Bitcoin Outperforms Nasdaq Over Last 12 Months, Bonds Bid As Dollar Skids

Tyler Durden

Tue, 10/27/2020 – 16:00

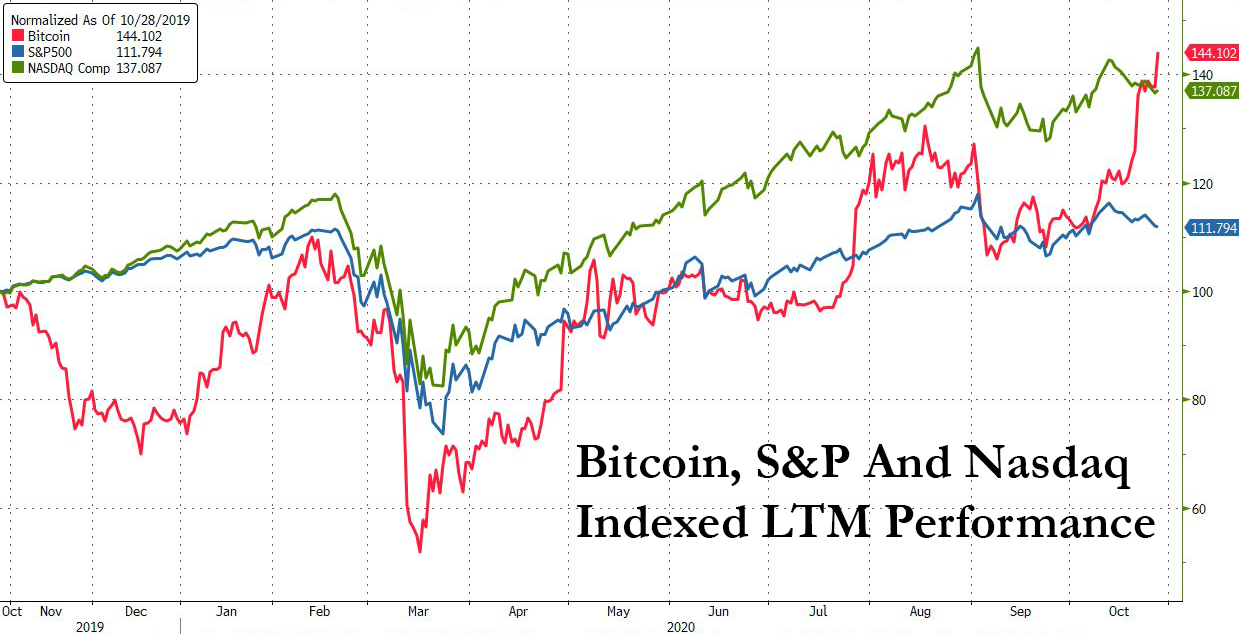

Mixed bag in stocks today (mega-tech bid, rest of market offered) but Bitcoin grabbed the headlines as it overtook Nasdaq’s performance in the last 12 months…

Source: Bloomberg

And longer-term, it’s not TSLA…

Source: Bloomberg

Nasdaq outperformed and the machines tried desperately to get the S&P green on the day. Small Caps and The Dow lagged…(NOTE, everything slid into the close after Trump said “Your 401(k)s, down the tubes. Look how great our stock market – – had a little blip yesterday because Nancy Pelosi will not approve stimulus, that’s all,”)…

Nasdaq manage to hold its bounce above the 50DMA but S&P and The Dow did not…

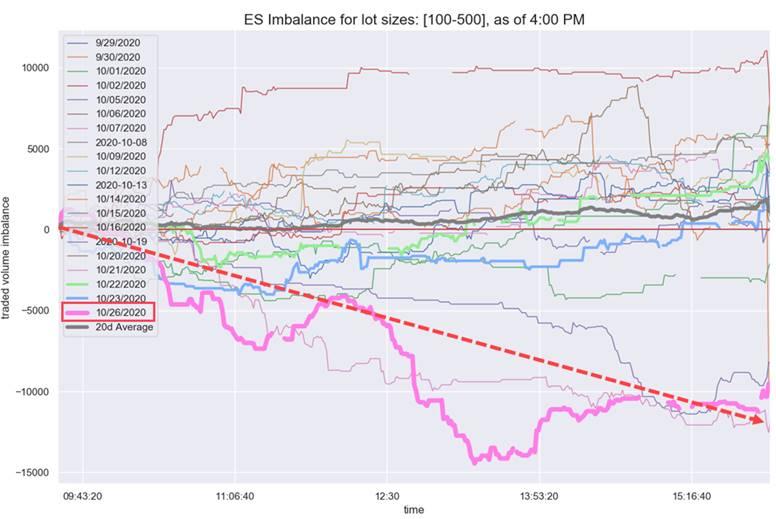

As we noted earlier, we have seen persistent “large lot” selling and “small lot” dip-buying…

Will everyone follow each other’s tracks down too?

Europe was ugly again today as lockdown threats escalated (no bounce)…

Source: Bloomberg

YTD, China (SHCOMP) still leads the US (Nasdaq is outperforming but S&P seems more appropriate) as Europe (DAX) dumps…

Source: Bloomberg

Nasdaq surged relative to Small Caps once again…

Momentum continued to rebound as Value lagged…

Source: Bloomberg

Some rotation today with value dumped as growth rebounded modestly…

Source: Bloomberg

Semis were marginally lower on the day after the AMD/XLNX deal…

Source: Bloomberg

Bank stocks sank again today…

Source: Bloomberg

FANG stocks erased yesterday’s losses…

Source: Bloomberg

Meanwhile, HOG had its best day ever as the machines ran the stops to the pre-COVID levels…

VIX was higher on the day, signaling more pain to come for stocks…

Source: Bloomberg

Bond yields fell for the 3rd day in a row with the curve flattening significantly (2Y -0.5bps, 30Y -11bps)…

Source: Bloomberg

With 10Y back to 76bps intraday…

Source: Bloomberg

Real Yields tumbled back in line with gold today…

Source: Bloomberg

The dollar leaked lower today…

Source: Bloomberg

Cryptos were mixed today with Bitcoin leading, now up over 20% in the last 10 days…

Source: Bloomberg

Bitcoin surged above $13,500, its highest close since Jan 2018…

Source: Bloomberg

Oil prices rebounded from yesterday’s weakness but WTI failed to get back to $40 ahead of tonight’s API inventory data…

Gold futures rallied off $1900…

Finally, we note that implied correlation is on the rise suggesting investors are piling into protective macro overlays ahead of the election (as opposed to individual stock hedging), expecting a systemic re-rating of stocks…

Source: Bloomberg

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com