“Oops: What If He Does It Again”: Here Is The Best Hedge Trade For A “Surprise” Trump Victory

Tyler Durden

Tue, 11/03/2020 – 12:10

If one goes by the official polls, one would conclude that a Biden victory is in the bag: according to RCP, Biden is a 7 point favorite, while Nate Silver has Biden’s winning odds at 89.2%. Of course, as 2016 showed, the polling process has become completely discredited and served more to reflect the biases of the poll creator than anything else.

So while Trump’s path to victory looks narrow, SocGen’s FX strategist Jason Daw asks “what if the unthinkable happens and he pulls it off again?” and suggests a trade to hedge said “unthinkable” event.

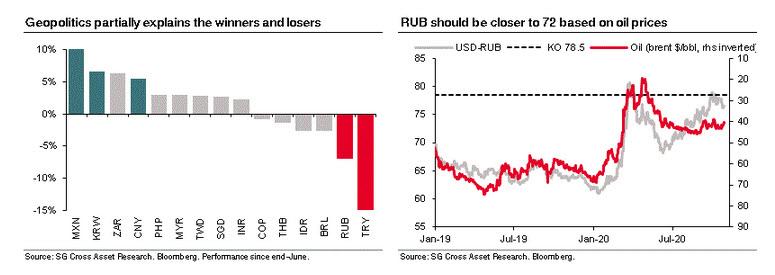

According to Daw, while there is still confusion within equities, “the currency market has nearly fully priced in a Biden win.” Specifically, as Biden has maintained a sizeable lead in the national polls over past four months, the Russian ruble has been one of the weakest currencies in EM, while the Mexican peso and North Asian currency bloc are amongst the strongest, with Daw suggesting that “geopolitical undertones are at least partially responsible for this price action” to wit:

The conventional wisdom is that under Biden, the US administration is likely to mend relationships with traditional allies, be harder on Russia than the Republicans, but take a more traditional and diplomatic approach to China even though the acrimonious core of the trade and tech disputes will remain intact.

Well, if the ruble and peso have fully priced in a Biden victory, obviously the trade here is to do the opposite, and as the SocGen strategist writes, “short MXN-RUB, short CNH-RUB, and short USD-RUB are potential candidates to reverse recent price action.” He adds that in response to the election results, there could be a clear asymmetry in how these currencies behave: “a surprise Trump win could see a sharp reversal of recent trends, whereas there would probably be a muted response in a Biden win (even in a Democrat sweep).”

A look at fundamentals also bolsters this trade reco: as Daw explains, short USD-RUB offers attractive risk-reward. Based on relative macro considerations (Mexico’s elevated inflation and market reducing rate cut expectations; China growth resilience and strong portfolio flows), short USD-RUB could offer the best risk-reward in a Trump victory. Finally, “solild” Russian fundamentals when coupled with the removal of geopolitical risk premium would suggest at the current oil prices USD-RUB should be trading closer to 72.

Finally, how to put the trade on to reap the most benefits from a favorable outcome?

While one can simply put on a short USDRUB trade in the spot market, SocGen’s preferred trade is a knock out option in the form of a 3m USD-RUB put strike ATMS, KO at 78.5. Here are the details:

- Volatility, skew, and convexity are near the upper end of the three-year range (aside from the period surrounding COVID-induced market stress).

- With the set-up in volatility, a constructive stance on oil ($50/bbl a year from now ) and Russian currency fundamentals , an up-and-out put option (indicative price (Bloomberg): 1.68%) is an attractive risk-constrained and cost effective structure to position for a lower USD-RUB.

- Adding a topside knock-out feature at 78.5 reduces the cost by 40% compared to a vanilla 3m USD-RUB put strike ATMS.

- Maximum loss on the trade limited to the premium paid.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com