Here’s Why Deutsche Bank Just Threw In The Towel On Its Dollar Short

Tyler Durden

Wed, 11/04/2020 – 10:40

And so the massive tide on the reflation trade begins to turn.

In the first of many reports to hit this morning, Deutsche Bank’s FX strategist became the first currency strategist to throw in the towel on his 2-month call for a weaker dollar which was based on expectations of a Blue Wave, and says that “with the US election outcome extremely uncertain” he is changing his view and turning neutral as he “no longer sees a compelling narrative of dollar weakness into year-end for three reasons.”

He lists his reasons below:

-

First, whoever wins the White House, the odds of a structural shift towards easier fiscal policy in the US have dramatically declined. Should the Democrats lose the Senate (the risk of this now appears high) and unified government becomes impossible, this would make agreement on sizeable fiscal expansion more difficult. Wider twin deficits and reflationary steepening in the US yield curve was an important driver behind our negative dollar view and this has been put on hold.

-

Second, the risks of a protracted contested election outcome appear significant. The market is likely to be most concerned by genuine uncertainty on the vote margin rather than political uncertainty relating to a refusal to concede. At the time of writing, the margins on numerous key states are very narrow (Georgia, Nevada, Wisconsin) or uncertain (Pennsylvania, Michigan), leading to a risk of protracted recount and litigation battles. This could last well into December.

-

Third, and beyond the election, the COVID winter wave has proven quicker and bigger than we thought. Europe is already on “soft” lockdown and the US numbers are likely to get worse. There is a significant risk that protracted election uncertainty leads to a politicization of COVID containment measures accompanied by an inability to provide fiscal support.

In all, the DB strategists sees the risks as “skewed towards a deterioration in COVID outcomes, an absence of fiscal support, persistent institutional uncertainty and broader negative growth surprises in the US in coming weeks.”

Usually, this environment would usually be associated with a weaker currency, however the dollar is unique in its behaviour as a safe haven and a counter-cyclical asset: it has weakened over the last six months as equities have rallied and the yield curve has priced reflation. It follows then, that deflation and risk-aversion, even if originating in the US, could be dollar positive according to the Deutsche Banker.

All in, Saravelos does not see good risk reward in shorting the dollar anymore, “especially against EM FX” adding that the JPY and gold may also be “one of the few” beneficiaries of a highly uncertain environment.

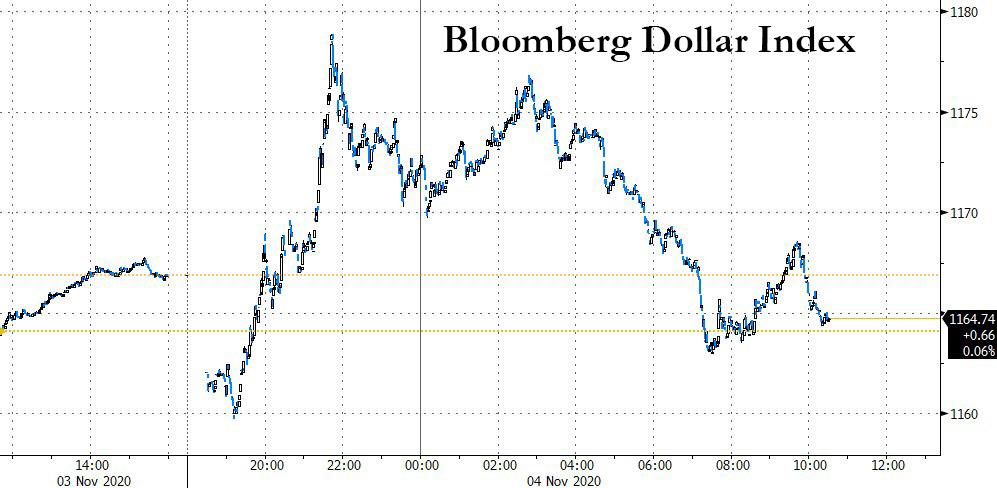

One look at the market shows that while traders agreed with Saravelos in the early hours after the election, the drift lower since then means that the net effect on the dollar from the “uncertainty”, and the collapse of the Blue Wave is, as of this moment… nothing at all.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com