Mexico’s 3rd Richest Man Puts 10% Of Net Worth In Bitcoin

Tyler Durden

Wed, 11/18/2020 – 12:20

With Bitcoin set to take out its December 2017 all time highs around $20,000 in the near future, attention is finally turning back to this asset which so many “experts” left for dead after its plunge in 2018.

As noted earlier, following a 150% advance YTD, and with fintech such as Paypal wholeheartedly embracing cryptocurrencies, institutions can no longer afford to stay out of what has emerged as the most powerful momentum rally of the year and which, unlike momentum stocks which just suffered a 15-sigma crash last week, has actually seen its volatility decline.

Indeed, as Bloomberg’s James Batty writes bitcoin’s volatility is now close to a three-year low while sporting a low correlation with the S&P 500 – making it an ideal diversification away from the bubble in stocks – and the growing open interest in the futures contract point to a rally that may be on firmer foundations than the one in 2017, one which was largely driven by retail investors as opposed to the surging institutional participation now.

Additionally, there have been a number of fund launches with bitcoin in their description this year as investors get more avenues to the cryptocurrency, which means adoption will only increase.

But the real driver of additional crypto upside will be continued transfer out of fiat and into bitcoin and other alternative currencies, whether it is Chinese depositors who once again attempt to flee the Chinese capital account “firewall” or ultra wealthy individuals becoming bitcoin advocates as they shift their net worth into crypto.

An example of just that is billionaire Ricardo Salinas Pliego, Mexico’s third-richest person, who said in a Twitter post Tuesday he’s invested a substantial portion of his liquid assets in the world’s biggest cryptocurrency, becoming one of Bitcoin wealthiest backers yet.

“Many people ask me if I have bitcoins,” said Salinas, who has a $11.8 billion fortune through his stakes in retail, banking and broadcast businesses, according to the Bloomberg Billionaires Index. “YES. I have 10% of my liquid portfolio invested it” he tweeted.

Hoy les recomiendo EL PATRÓN BITCOIN, este libro es el mejor y más importante para entender #Bitcoin.

El Bitcoin protege al ciudadano de la expropiación gubernamental.

Muchas personas me preguntan si tengo bitcoins, SÍ. Tengo el 10% de mi portafolio líquido invertido en el 😌💵 pic.twitter.com/6LtFVCXvuA

— Ricardo Salinas Pliego (@RicardoBSalinas) November 17, 2020

While Salinas may be a new entrant to the bitcoin faithful, cryptocurrency pioneer Mike Novogratz has continued to beat the drum and earlier this morning on CNBC he said that bitcoin could rise as high as a $60,000 next year as it continues to replace gold…

Bitcoin is surging this week. It is now at its highest point since the crypto boom in 2017. Mike Novogratz says Bitcoin “has found its lane” in both the crypto realm and with big banks, which have recently expressed confidence in the cryptocurrency. https://t.co/dZBpCwdaL7 pic.twitter.com/5jgDYY9yuN

— CNBC (@CNBC) November 18, 2020

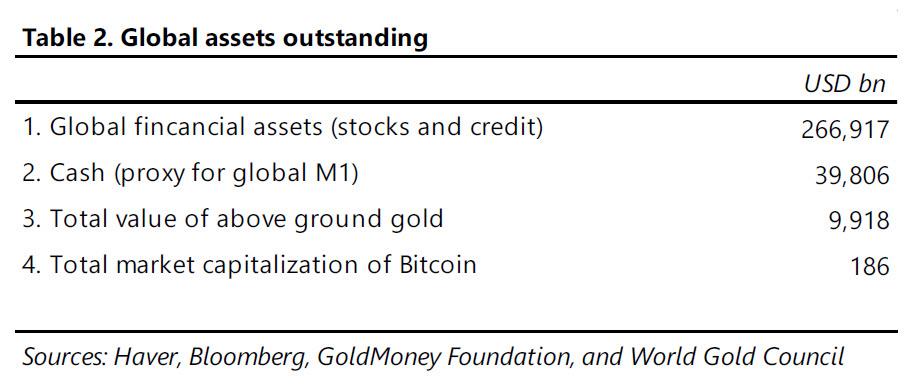

…. a thesis which Paul Tudor Jones discussed earlier this year, when he saw bitcoin total market cap rising steadily and eventually catching up with gold (it was $186BN back then, and is almost double at $326BN today).

Even better news for bitcoin is that deep skepticism remains. As discussed earlier, in a series of tweets on Tuesday, Bridgewater’s founder Ray Dalio questioned the cryptocurrency’s utility as a storehold of wealth, but added: “I might be missing something about Bitcoin, so I’d love to be corrected.” Yes, Ray, you are.

Someone else who may be missing something is Jamie Dimon, who famously mocked bitcoin in 2017, calling it a fraud, warning any JPM trader who was trading it would be fired, and mocked his own daughter for buying bitcoin (a few months later he reversed and said he regretted calling bitcoin a fraud). Taking a far more conciliatory tone today, Dimon spoke at the Dealbook conference, where he said that he is “not interested in Bitcoin,” but “I’ve always supported blockchain” adding that he believes there will be regulation coming. He concluded that Bitcoin’s “just not my cup of tea,” clearly unwilling to discuss the topic further.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com