S&P Futures, Oil Jump On Vaccine Optimism; Bitcoin Hits $18,000

Tyler Durden

Wed, 11/18/2020 – 07:43

After yesterday’s modest selloff as covid optimism fizzled amid fresh daily record numbers of new cases, on Wednesday futures contracts on three major U.S. equities indexes rebounded sharply as vaccine optimism made a triumphal comeback after Pfizer Inc. said a final analysis of clinical-trial data showed its Covid-19 vaccine was 95% effective, paving the way for the company to apply for the first U.S. regulatory authorization for a coronavirus shot within days. The news propelled S&P 500 futures as much as 0.4% higher, erasing earlier decline of as much as 0.6% as the reflation trade appeared back in vogue, while futures on the Nasdaq 100 and Dow Jones rose 0.2% and 0.5%, respectively, as of 7am ET, while Russell 2000 index futures rose 0.6% as the small cap outperformance was set to continue.

Propping up the Dow was Boeing, which announced the crash-prone 737-MAX was cleared to returned to the skies as the FAA lifted its longest-ever US grounding.

The gains helped reverse Tuesday’s drop when US markets closed in the red after soft U.S. retail sales data, a rise in COVID-19 cases and uncertainty over fresh stimulus measures in the world’s largest economy had sapped sentiment. While the release of two successful coronavirus vaccine trial data over the last week had buoyed markets, the still-high infection rate globally had acted to trim gains, said Jane Shoemake, London-based fund manager at Janus Henderson.

“People can see light at the end of the tunnel now and the markets clearly responded to that, but it’s not going to go up in a straight line because we’ve still got to get through the winter… (and) that is going to continue to temper some of the exuberance people feel”, Shoemake said.

Cormac Weldon, Head of U.S. Equities at UK asset manager Artemis said while the overall picture for investors was brighter, the recovery was likely to be uneven. “Low inventories and the need to manufacture and distribute goods are likely to be the first drivers of the recovery, with the re-emergence of consumer demand adding a powerful second phase.”

The MSCI World index was up 0.1% at 1013 GMT, just shy of the previous session’s record high. After opening lower, European shares crawled back into the black tracking overnight gains in Asia where China stimulus hopes helped MSCI’s broadest regional gauge rise 0.7%, with the STOXX 600 index rising as much as 0.5% to an intraday high following the Pfizer news.

Earlier in the session, Asian stocks gained, led by the finance and IT sectors. Most markets in the region were up, with Taiwan’s Taiex advancing 1.3% and Australia’s S&P/ASX 200 rising 0.5%, while Japan’s Topix slid 0.8%. Trading volume for MSCI Asia Pacific Index members was 13% above the monthly average for this time of the day. The Topix lost 0.8%, with Toyota and Sony contributing the most to the move. The Nikkei 225 Stock Average lost 1.1% after Tokyo reported a record number of new Covid-19 infections. The Shanghai Composite Index rose 0.2%, driven by China Life and Industrial Bank.

Strong corporate earnings in the third quarter have also underpinned the positive stock market sentiment, said analysts at Barclays, with firms “confident on the outlook and in control of costs”, they said in a note to clients.

“This reinforces the case for a strong earnings rebound and pick-up in corporate activity in 2021, as the cyclical recovery unfolds.”

As risk sentiment returned, risk havens sold off and Treasuries dipped to session lows in early U.S. trading after Pfizer Inc.’s final analysis of clinical-trial data previewed last week showed its Covid-19 vaccine was 95% effective. Yields flipped to slightly cheaper on the day across belly, remaining within a basis point of Tuesday’s close across the curve. Treasury’s 20-year new-issue bond auction is ahead. 10-year yields, just above 0.86%, were slightly cheaper on the day vs bunds and gilts. On today’s calendar we have a sale of $27BN in 20Y Treasurys at 1pm which is $2b larger than previous new issue; the 20Y WI is trading around 1.397%, above all six previous 20-year stops and ~2.7bp cheaper than last month’s. In Europe’s debt markets, Germany saw its benchmark 10-year government bond yield fall to its lowest since Pfizer announced its COVID-19 vaccine update a week and a half ago.

“Yields continue to grind lower as more warning signs flash about the near-term outlook,” said Benjamin Schroeder, senior rates strategist at ING. “Euro zone spreads appear to have eyes only for QE (quantitative easing), shrugging off volatility and EU setbacks,” he said, referring to news this week that Hungary and Poland have blocked the adoption of the 2021-2027 budget and recovery fund by European Union governments.

The yield on China’s 10-year sovereign debt rose by 5.2bps to a new high for 2020 at 3.33% (the 2019 high yield is in the vicinity of 3.45%). The price response in onshore rates stands in contrast to the move in US debt with a similar maturity profile (-3.3bps in yield week-to-date).

In FX, the USD declined 0.2% in BBDXY terms, with the Index trading further below the 1,150 mark and on the verge of hitting a new low for 2020. Advisors from the incoming US administration have shied away from a national lockdown in early-2021, which has helped lift risk appetite alongside positive vaccine news. The dollar declined against all Group-of-10 currencies as it continued to be sold amid a more optimistic vaccine outlook and after Fed Chair Jerome Powell said the U.S. economy still has a “long way to go” before it fully recovers from the pandemic. The Bloomberg Dollar Spot Index fell as much as 0.3% in early trading, nearing the multi-year low recorded on Nov. 9, to take losses into a fourth day, before recovering some losses following the Pfizer news.

The Turkish lira extended a drop to as much as 1.1% after President Recep Tayyip Erdogan spoke against higher interest rates one day before central bank’s key rates meeting, sparking confusion whether the CBRT would hike rates by as much as 500 bps tomorrow as some banks now expect. Erdogan said high interest rates render production impossible, prevent improvement in exports: “We will solve our problems in line with free market economy practices” he said adding that “Turkey will accomplish price and financial stability, we are targeting lower inflation as soon as possible.” The Lira was trading 0.4% lower at 7.7076 per USD after dropping as low as 7.80; The Borsa Istanbul Banks Index pared gains of as much as 5.3% after Erdogan’s comments and was trading 2% higher.

In other markets, the Norway krone led G-10 advances; USD/NOK down 0.6% 9.017, as oil rose toward $42 a barrel in New York, as signs of a robust demand recovery in Asia offset a jump in U.S. crude stockpiles. USD/JPY fell 0.4% to 103.83, its lowest since Nov. 9. Cross is down a fifth day, the longest run in two months. AUD/USD rose 0.2% to 0.7318 as broad dollar weakness reverses an earlier decline. GBP/USD continued to be supported, rising as much as 0.4% to 1.3297. U.K. and European Union could strike a deal on their future trading and security relationship early next week. Media reports “suggesting a deal next week and the departure from government of high profile Brexit hardliners seems to have inspired fresh confidence in a deal and thus in sterling,” Sean Callow, senior currency strategist at Westpac Banking Corp.

With stocks still well supported, other risk markets also took heart, with U.S. crude futures and Brent crude futures both up just over 1%, bolstered by hopes OPEC will delay a planned increase in production.

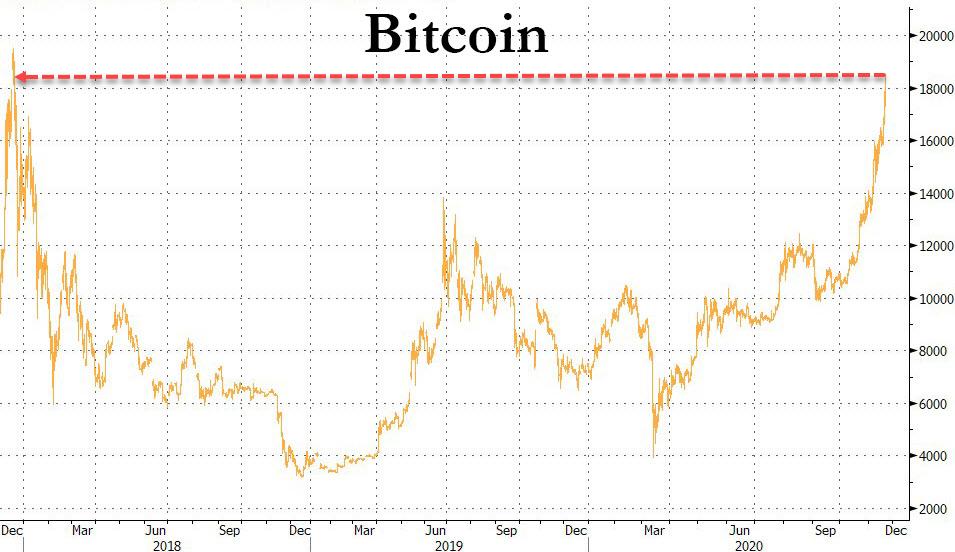

But nowhere was the move more pronounced than in Bitcoin, where the cryptocurrency briefly traded above $18,000 for the first time since Dec 2017, extending its blistering 2020 rally driven by demand for its perceived quality as an inflation hedge and expectations of mainstream acceptance. The original and biggest cryptocurrency jumped as high as $18,483 and was last up 2%. It has soared about 160% this year and has jumped 17% in the last three days alone.

Bitcoin is now close to its all-time high of just under $20,000, which it touched at the peak of its retail investor-fuelled 2017 bubble. “It is not out of the question for the crypto to hit its all-time high of $20,000 this side of Christmas,” said Simon Peters, analyst at investment platform eToro.

“The crypto industry has consolidated, matured and is seeing real traction with institutional investors. Investors are using bitcoin as an inflationary hedge to combat the prospect of continued government stimulus.”

Meanwhile that “old school” bitcoin, gold, was weaker, trading $20 lower at $1871.

Looking at the day ahead now, data highlights include the UK CPI reading for October, along with new car registrations in the EU27 for that month. From the US, we’ll also get October’s housing starts and building permits. Central bank speakers include the Fed’s Williams, Bullard and Kaplan, along with BoE Chief Economist Haldane.

Market Snapshot

- S&P 500 futures up 0.4% to 3,621

- STOXX Europe 600 up 0.05% to 389.00

- MXAP up 0.2% to 188.36

- MXAPJ up 0.6% to 623.94

- Nikkei down 1.1% to 25,728.14

- Topix down 0.8% to 1,720.65

- Hang Seng Index up 0.5% to 26,544.29

- Shanghai Composite up 0.2% to 3,347.30

- Sensex up 0.4% to 44,142.57

- Australia S&P/ASX 200 up 0.5% to 6,531.10

- Kospi up 0.3% to 2,545.64

- Brent Futures up 1.3% to $44.70/bbl

- Gold spot down 0.3% to $1,870.39

- U.S. Dollar Index down 0.2% to 92.28

- German 10Y yield fell 0.2 bps to -0.565%

- Euro up 0.2% to $1.1880

- Brent Futures up 0.9% to $44.12/bbl

- Italian 10Y yield fell 1.3 bps to 0.528%

- Spanish 10Y yield unchanged at 0.075%

Top Overnight News from Bloomberg

- European Central Bank policy makers are trying to persuade investors not to focus too much on the size of their next dose of monetary stimulus, hoping they will instead look at its design

- After a couple of big crashes that destroyed billions in value, the digital currency has rebounded to its highest value since January 2018, crossing $18,000 this week. The cause: a flurry of developments that suggest Bitcoin has taken some big steps toward going mainstream

- Italy’s banks could face higher costs to sell bad loans as the government is set to scrap tax relief measures in next year’s budget. The government decided not to extend into 2021 a tax benefit introduced earlier this year to facilitate the disposal of non-performing loans held on the balance sheets of Italian banks. Lenders and customers have been severely hit by the pandemic crisis

- U.K. Prime Minister Boris Johnson announced a 12 billion-pound ($15.9 billion) plan to boost green industries and tackle climate change, in a blueprint he says will create or support as many as 250,000 jobs

- The U.K.’s entry to Europe’s booming green sovereign bond scene could prove a catalyst for broader corporate issuance, helping London’s ambitions of becoming the continent’s ethical investing hub

- Investors in Europe are getting their once-a-year opportunity to snap up Chinese sovereign debt in volume as the nation returns with a euro bond sale that stands to benefit from ultra-low borrowing costs there

- New Zealand’s central bank said it accidentally disclosed sensitive information from its latest Monetary Policy Statement to a group of financial services firms before the official publication time last week

Quick look at global markets courtesy of NewsSquawk

Asian equity markets traded mostly higher as the region attempted to pick up from the weak handover from Wall Street where all major indices finished a choppy session in the red amid mixed data and as the recent vaccine euphoria wore off. ASX 200 (+0.5%) was positive with the index underpinned by outperformance in its largest weighted financials sector but with upside limited in the broader market by softness in commodity-related stocks, while Nikkei 225 (-1.1%) lagged its peers on recent currency inflows and virus concerns with Tokyo preparing to shift to the highest virus alert level. Hang Seng (+0.5%) and Shanghai Comp. (+0.2%) were kept afloat despite a slow start as participants remained cautious following another liquidity drain by the PBoC and amid further tension-related headlines after US bombers entered China’s air defence identification zone on Tuesday and with US regulators drafting plans to require Chinese companies listed in the US, to use auditors overseen by US regulators or risk being removed from exchanges. Finally, 10yr JGBs eked mild gains amid recent upside in T-notes and underperformance in Tokyo stocks, but with upside capped by mixed results at the 20yr JGB auction.

Top Asian News

- Copper Roars, Zinc Rallies as Chinese Demand, Dollar Spur Rally

- China’s Credit Jitters Deepen a Selloff in Government Bonds

- Bank of Thailand Shifts Focus to Baht Rally, Holds on Rates

- Sharp to Return to Japan’s Blue Chip Index, Replacing Docomo

European equities trade modestly firmer after a softer start to the session (Eurostoxx 50 +0.1%) as prices continue to consolidate around recent levels in the absence of any further incremental newsflow. The picture remains the same for the region as optimism around the efficacy of COVID-19 vaccines is somewhat tempered by the nearer-term outlook which is one of mounting COVID cases, lockdown restrictions and ongoing disputes over the passage of the European recovery fund. Sectoral performance is relatively mixed with mild outperformance in the tech sector, something which recently has often been a sign of rotation in/out of growth momentum names and out/into value/cyclicals. However, the performance of the latter is relatively mixed, suggesting that this morning is not in-fitting with this theme. Additionally, the magnitude of moves thus far are relatively minor and as such there is the risk that any such discrepancies between groups could be subject to over-interpretation. The highlight of this morning’s earnings reports was Danish shipping giant Maersk (-2.1%) with the Co.’s report often viewed as a bellwether for global economic activity, on which, the Co. noted that it has recovered faster than initially anticipated as it benefits from firmer retail sales in the US. Elsewhere, RSA (+3.9%) are firmer on the session after the Co. accepted a GBP 7.2bln takeover approach from Intact and Tryg. Other deal activity has seen Deutsche Boerse (+3.4%) agree to acquire an 80% stake in Institutional Shareholder Services with an enterprise value of USD 2.3bln. To the downside, Air France-KLM (-3.3%) are lower on the session with reports noting the Co. are said to be in discussions over a EUR 6bln capital raise. Hargreaves Landsown (-1.5%) are another laggard for the session amid reports that Stephen Lansdown, the Co.’s founder has sold 6.7mln shares at a discount.

Top European News

- Spain Raises Hurdle for Foreign Investments in Strategic Firms

- Pimco Said to Take Office Space in Dublin in Boost to Market

- British Land Hikes Asset Sales as Values Drop $1.1 Billion

- Ubisoft Jumps on Positive Update for New Assassin’s Creed Game

In FX, the Dollar and index look increasingly destined to decline further as sellers continue to pounce on rebounds and the technical backdrop/momentum turns more bearish to the benefit of its major and EM counterparts. In fact, the Buck’s downfall may be due to relative strength elsewhere as much as negative US specifics, albeit the ongoing rise in COVID-19 infections and fatalities has dampened some vaccine optimism as stimulus remains gridlocked in the still uncertain Presidential Election aftermath. The DXY has faded after another tame and short-lived recovery petered out just above 92.500 and is just off 92.200 having fallen to 92.207 vs last week’s 92.129 trough ahead of housing data and another round of Fed speak.

- NZD/GBP/AUD – In contrast to the Greenback, latest Kiwi and Aussie revivals appear more solid on the respective 0.6900 and 0.7300 handles following mixed NZ PPI data and appreciation in the YUAN from another higher PBoC Cny midpoint fix. Meanwhile, the Pound is inching closer to 1.3300 and back through 0.8950 against the Euro ahead of a potentially key update from EU chief Brexit negotiator Barnier on Friday and in wake of reports that France may have ‘accepted’ that there will less water to fish in post-UK transition. However, market contacts suggest there could be big offers into the next big figure in Cable and price action supports that theory, while Aud/Usd may be capped around 0.7350 in the run up to Aussie employment overnight.

- JPY/CAD/EUR/CHF – The Yen has breached 104.00 again irrespective of somewhat conflicting Japanese trade impulses, as the surplus smashed consensus, but only by virtue of the fact that exports hardly fell and imports plunged much more than expected. Elsewhere, the Loonie is back above 1.3100 against the backdrop of firmer oil prices in advance of Canadian CPI again, while the Euro is still on track to test 1.1900 and in bullish mode above the 50 HMA (1.1856) given no big upside option expiry interest to hamper the pair today, unlike Usd/Cad that should be cushioned by a hefty 1.1 bn at the 1.3000 strike. In similar vein, the Franc is finding 0.9100 tough to overcome, and perhaps wary of more verbal intervention to compliment direct action via SNB’s Maechler who is scheduled to talk at some point.

- SCANDI/EM – Choppy trade for the Sek and Nok due to fluctuations in risk sentiment, but the Try is bucking the overall trend of gains vs the Usd after yesterday’s brief interlude as the clock ticks down to Thursday’s eagerly anticipated CBRT policy meeting that comes with an aggressive median forecast of +475 bp in comparison to unchanged SARB expectations.

In commodities, WTI and Brent have continued to grind higher throughout the morning aided by the gradual pick-up in equity performance as well as tail-winds from the USD’s underperformance thus far. Fundamentally, little new has occurred since yesterday’s JMMC gathering and attention has now firmly turned to the full OPEC/OPEC+ gathering at month-end for further updates prior to the next JMMC on December 17th. Currently, the benchmarks are posting gains of around 1.0% and reside in relative proximity to session highs. For reference, last night’s private inventories printed a larger than expected build of 4.2mln vs. Exp. 1.7mln and did prompt some crude downside although this was relatively short-lived. Later today the EIA will release their inventory report with the headline expected at a build of 1.65mln. Moving to metals, spot gold is overall flat this morning but has been erring slightly lower in-spite of the USD’s downside with some desks attributing the mild pressure to Fed nominee Shelton’s nomination being blocked yesterday, though this does retain the scope for a re-vote at a later date; in the context of Shelton’s previously expressed interest in hard-money regimes.

US Event Calendar

- 7am: MBA Mortgage Applications -0.3%, prior -0.5%

- 8:30am: Housing Starts, est. 1.46m, prior 1.42m

- 8:30am: Housing Starts MoM, est. 3.18%, prior 1.9%

- 8:30am: Building Permits, est. 1.57m, prior 1.55m

- 8:30am: Building Permits MoM, est. 1.43%, prior 5.2%

DB’s Jim Reid concludes the overnight wrap

The rally in risk assets paused for breath yesterday as markets shifted their focus from Monday’s positive vaccine news to the near-term challenges of rising case growth and tighter restrictions. By the close, both the S&P 500 (-0.48%) and the Dow Jones (-0.56%) had fallen back from their record highs. 18 of the 24 industry groups in the S&P fell yesterday, led by defensives such as Utilities (-2.01%), Food & Staples (-1.49%) and Healthcare Equipment (-1.42%). However, the NASDAQ fell a lesser -0.21% thanks in part to a +8.21% advance for Tesla, which came on the back of the news that it’ll join the S&P 500. It added c.$31.8bn market cap on the day, which is around the same size as Yum! Brands ($31.4bn), Freeport-McMoRan Inc ($30.6bn) and notably near Ford ($34.8bn). As we mentioned yesterday, it will comfortably enter the top 10 of the S&P 500 when it arrives in December.

In other “is it a bubble or not news?” Bitcoin (+5.59%) traded back above $17,000 for the first time since 21 December 2017 – a level it has only closed above for 5 other days in history. It even briefly soared through $18,000 in Asia trading. This is even as gold (-0.45%) continues to slip, so the two have decoupled a bit of late. The precious metal is now down -8.88% from its early-August highs. The two have been correlated recently mostly due to their negative relationship to the dollar, which was down -0.24% yesterday and closed only +0.30% higher than its pandemic closing lows.

As we go to print Asian markets are taking a sudden dip lower as Japanese broadcaster FNN announced that Tokyo saw a record 493 Covid-19 cases. This follows earlier news from the Nikkei that the Tokyo Metropolitan Government is making final arrangements to raise its alert on the infection status to the highest of 4 levels. The Nikkei is down -1.13% as we type. Futures on the S&P 500 are down -0.34%. Elsewhere, markets are trying to hang onto earlier gains with the Hang Seng (+0.14%), Shanghai Comp (+0.34%), Kospi (+0.22%) and ASX (+0.51%) all still up.

Fed Chair Powell spoke yesterday at an online event hosted by the Bay Area Council and said that the economic recovery in the US would likely continue at a “solid” pace though he called rising coronavirus infection rates a “significant” downside risk “especially in the near term.” While Powell indicated that the recent spate of vaccine news is good for the medium-term outlook of the economy, a full recovery is a still a long way off and that the Fed “will stay here and be strongly committed to using all our tools.” He went on to indicate that he leaned towards keeping the Fed’s emergency lending facilities operation as is, given that the “recovery is incomplete” – this comes as all but one of those facilities are scheduled to expire at year-end. Regardless of the Fed’s position on the matter, the Treasury Secretary Mnuchin would have to agree to keep the facilities open and he has not yet made a decision. Elsewhere, Judy Shelton’s confirmation to the Federal Reserve Board was blocked yesterday in 47-50 vote after two Republican senators were unable to attend due to quarantining. Senate Majority leader McConnell voted no in order to be able to bring the vote back up once the two missing senators were again available. Given Democratic Senator-elect Mark Kelly is set to join the chamber as early as the first week of December, the schedule of the GOP to get Shelton confirmed is tightening.

On the Vaccine front, Pfizer’s CEO said overnight that a key safety milestone had been reached in the study of its vaccine, and the drug maker is now preparing to seek an emergency-use authorisation. Elsewhere, the Indonesian government is planning to kick-starts its vaccine inoculation program next month with an initial 3mn doses likely to be from China’s Sinovac. The country will prioritise health workers, police, military and public servants.

Back to markets and over in Europe it was a similar story to the US, as the STOXX 600 (-0.24%) and bourses across the continent also lost ground. The STOXX Travel & Leisure index (-1.06%) suffered in particular amidst fears of continued restrictions heading through the winter months, while Healthcare (-1.32%) was the worst-performing sector in Europe. Other cyclicals such as Energy (+0.71%) and Autos (+0.72%) continued to edge higher as the vaccine news kept them afloat.

With investors rotating out of risk assets, yesterday saw a strong performance in sovereign bond markets, where a number of new records were set. For example, yields on 10yr Italian BTPs fell -1.3bps to an all-time low of 0.639%. Meanwhile in Greece, the spread of 10yr yields over bunds fell another -3.0bps to 1.233%, which is their tightest level in over a decade. Core sovereign bonds also gained ground, with yields on 10yr Treasuries falling -4.9bps to 0.857%, as those on 10yr bunds (-1.8bps), gilts (-2.5bps) and OATs (-2.3bps) also fell.

Another asset that performed well yesterday was sterling, which strengthened +0.36% (up a further +0.13% overnight) against the US dollar thanks to headlines that suggested the Brexit negotiators could manage to agree a deal early next week, potentially as soon as Monday. Nevertheless, the same set of headlines also had officials cautioning that the talks could still fall apart, while a statement from Prime Minister Johnson’s office said that “it is far from certain that an agreement will prove possible”. It’s not clear when we’ll get any further news, but the Guardian’s Brexit correspondent, Lisa O’Carroll tweeted that UK government sources weren’t expecting a breakthrough this week and were looking to next week instead for a deal. If these reports are right, that means that a deal won’t have been reached in time for tomorrow’s video conference of EU leaders, in which they would have had the opportunity to discuss the issue.

In terms of the latest developments on the virus, in New York City, the 7-day average positivity rate was at 2.74%, which is below the important 3% threshold that would lead to school closures. Ohio’s Governor imposed a 10pm to 5am curfew for the next 21 days, though he has maintained that he is trying to keep businesses open outside of those hours as much as possible. In Scotland, a number of areas including Glasgow faced tougher Level 4 restrictions, which includes the closure of non-essential shops, along with pubs and restaurants. Elsewhere in Europe, the Netherlands extended their partial lockdown measures while also lifting some restrictions imposed two weeks ago. Libraries, theaters, cinemas, museums and swimming pools can reopen while bars and restaurants remain shut. Similarly in France, Prime Minister Castex announced that the country will not end the full lockdown but that some measures may be lifted. It is starting to look like late-spring again with the virus getting worse in the US as it plateaus in parts of Europe. Across the other side of world where the virus has been spreading less aggressively, South Australia announced a 6-day lockdown that would see even schools and universities close to help contain a growing cluster of Covid-19 infections in the state capital Adelaide. South Korea also reported the highest number of daily infections in almost 12 weeks.

Yesterday’s data saw a weaker-than-expected reading on US retail sales, which rose by just +0.3% in October (vs. +0.5% expected), while the previous month’s growth was also revised down to 1.6% (vs. 1.9% previously). That +0.3% growth is the slowest pace of growth since the sharp contractions when the pandemic first hit, and the soft reading will add to concerns with the coronavirus case numbers surging once again. One caveat is that YoY US retail sales are up a fairly remarkable +5.7%, which shows how much government and central bank stimulus has propped up spending.

In more positive real time data, industrial production rose +1.1% in October (vs. +1.0% expected), and September’s decline was revised to show a smaller contraction than expected. Lastly, the NAHB’s housing market index rose to a record 90 (vs. 85 expected).

To the day ahead now, and data highlights include the UK CPI reading for October, along with new car registrations in the EU27 for that month. From the US, we’ll also get October’s housing starts and building permits. Central bank speakers include the Fed’s Williams, Bullard and Kaplan, along with BoE Chief Economist Haldane.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com