Stocks Soar To Record Highs As Dollar Dumps After Dismal Data

Tyler Durden

Fri, 12/04/2020 – 16:01

Before we start, let’s get one thing straight… the US economy is going south fast as the labor market nears its weakest of the year, retail is tumbling, and even ‘soft’ survey hope is rolling over… those are the ‘sciency facts’…

Source: Bloomberg

But, as always, bad news is the best news as it merely forces the hands of our benevolent central planners to do more sooner… and so stocks soared…

“It’s a weaker report than expected,” Jeffrey Rosenberg, BlackRock Inc. senior portfolio manager, said in an interview on Bloomberg Ratio and Television. “The market reaction has been looking through this to the policy response. This week we have a lot of acceleration in terms of movement on that and this is the kind of news the market is interpreting as pushing them over the finish line.”

The early week relative strength of Nasdaq was erased as Small Caps ripped back to end the week…

It’s a mad world alright…

And as the hope of moar free money soars, ‘Most Shorted’ stocks soared for the 5th week in a row as the short-squeeze is accelerating…

Source: Bloomberg

Energy stocks soared on the week (thanks to a huge spike today), outperforming its peers once again as Utes lagged…

Source: Bloomberg

“The market is betting that we’ll get a relief package soon,” said Matt Maley, chief market strategist at Miller Tabak + Co. “If anything, this weaker report will get them to agree on a package sooner rather than later.”

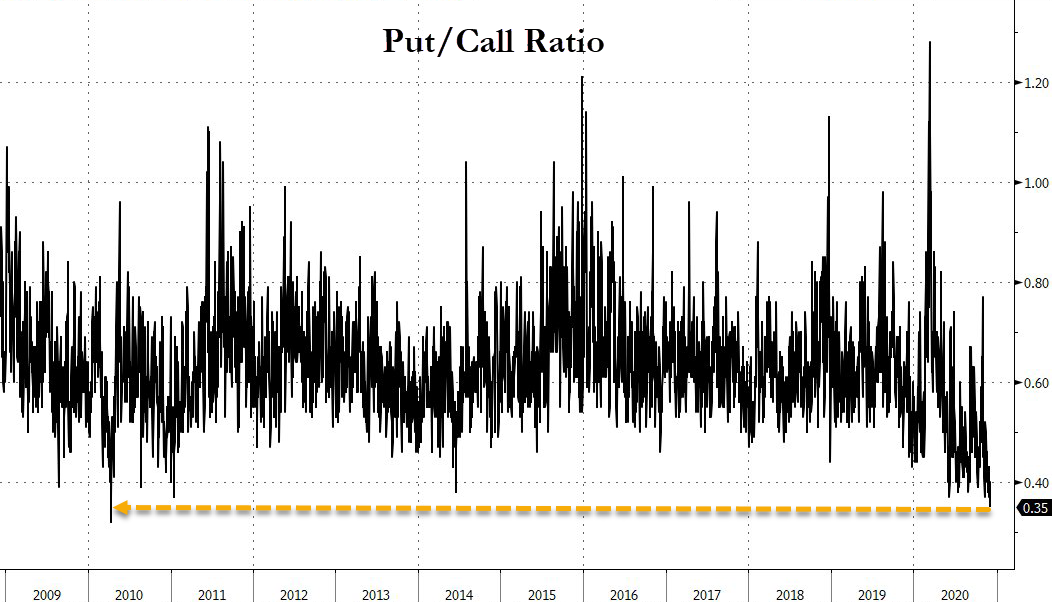

And that is nowhere more evident than the collapse in demand for protection, with the Put-Call ratio plunged to a decade lows (the indicator’s five-day moving average has hit its lowest level in 20 years)…

Source: Bloomberg

And as Bear Traps Report highlights, one of our Lehman 21 Systemic Risk Indicators, the spread between the 2 and 8 month VIX futures contract is back in negative territory.

Source: Bloomberg

This shows the volatility futures curve is back in its usual Contango state (back months higher than front months). Deep contango (under -2.50) means money managers don’t feel the need to pay for upside vol in the near-term. For now, we remain in our ‘danger zone’. Even with the put/call ratio at decade lows, managers are paying-up for near-term equity protection (2 months vol) relative to long-term protection.

The Virus Fear Trade signals that all ‘fear’ is almost gone, accelerating lower post-vaccine. Which is a little odd given that over 20 million Americans remain on unemployment benefits…

Source: Bloomberg

And as stocks rallied, credit spreads have collapsed to the point where the compensation for risk has been crushed to record lows…

Source: Bloomberg

The bond market was battered this week with the long-end up over 16bps (2Y unch)…

Source: Bloomberg

With 10Y pushing to its highest yield (98.4bps) since March (but notably a key resistance level)…

Source: Bloomberg

Remember, at 1.02%, all hell breaks loose in CTA-land.

30Y Yields also reached up to significant resistance at 1.75% (election and vaccine spike highs) before rolling over today…

Source: Bloomberg

And if the cyclical stock surge is to be believed, 10Y yields should be around 2.75%… which would break the world!

Source: Bloomberg

The yield curve (2s30s) steepened by the most since August this week, to its steepest since May 2017…

Source: Bloomberg

The dollar continued its collapse this week (down 4 of the last 5 weeks)…

Source: Bloomberg

As the euro soars…

Source: Bloomberg

The Loonie surged to its strongest since May 2018…

Source: Bloomberg

And offshore yuan is at its strongest since June 2018…

Source: Bloomberg

Cryptos were all higher on the week…

Source: Bloomberg

Bitcoin managed to hold $19k after reaching record highs earlier in the week…

Source: Bloomberg

Oil had a choppy week, but ended positive…

…with WTI trading above $46 – its highest since early March…

Source: Bloomberg

Gold futs bounced back notably off intraweek lows, back above $1800 and its 200DMA (after 3 down weeks in a row)…

Silver was the week’s big winner (after 3 straight losing weeks), rebounding strongly off a brief dip to a $21 handle…

Copper’s recent massive outperformance over gold has decoupled commodities from bonds…

Source: Bloomberg

And finally, by Yale professor Robert Shiller’s cyclically adjusted price-to-earnings ratio, U.S. stock valuations are back above their peak seen in 1929, just before the Great Depression…

And those who are hoping to find more greater fools to hand their ‘winners’ off to better hope for more and more deflation as multiples won’t hold up well if the ‘hopes’ of inflation come to fruition…

Be careful what you wish for!

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com