Q3 Bank CRE Loan Performance: Delinquencies Spike For Big Retail And Small Hotel Sectors

By commercial-real estate experts Trepp

Summary: The overall credit performance of commercial real estate (CRE) loans in bank portfolios continues to show signs of pandemic related stress with increasing delinquency rates and charge-offs and downward migration of risk ratings. While anecdotal feedback from lenders indicates that relief granted through deferrals and forbearance early in the pandemic has kept delinquency rates from spiking further, several market sectors are clearly in distress.

Unsurprisingly, the delinquency rate for loans on hotels more than doubled, jumping from 1.3% in Q2 to 3.2% in Q3. Delinquency rates for loans on retail properties, while down slightly from Q2, are also significantly elevated and currently stand at 1.44%. The decrease in the retail delinquency rate in Q3 was in part driven by many loan charge-offs that effectively reduced the delinquent balance.

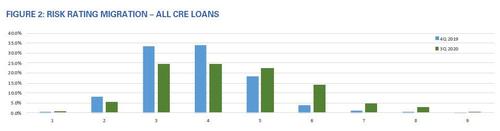

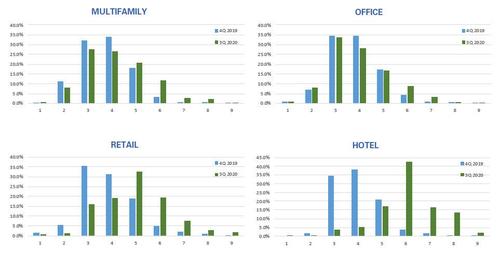

Risk Ratings, which are both reflective of current loan performance and expectations for future performance, have shifted significantly downward from pre-pandemic levels. On Trepp’s Standard Rating scale, a 1 to 9 risk rating scale that normalizes the risk ratings for all T-ALLR participants, the percent of loan balance rates 1 to 3 dropped from 42% to 31% while loans rated 6-9 jumped from 6% to 22%. As with delinquency rates, performance has been uneven across property types with loans on hotel and retail properties showing the greatest decline in Standard Rating. For hotel loans, the balance rated 1 to 3 dropped from 36% to 3.6% while loans rated 6 to 9 spiked from 5.1% to 74%.

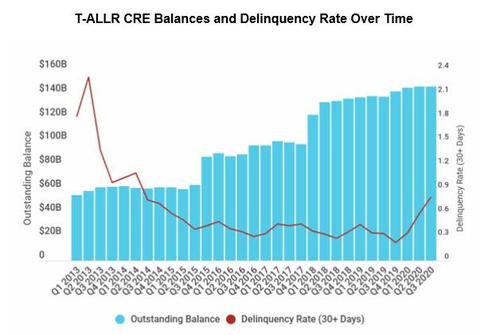

Background: Trepp’s Anonymized Loan Level Repository (T-ALLR) bank loan data consortia captures detailed loan characteristics, activity, and performance on all CRE and commercial and industrial (C&I) loans held on the balance sheet of participating banks. As of Q3 2020, the outstanding balance of active loans in the T-ALLR CRE portfolio stood at $146 billion for CRE loans and $34 billion for Construction loans, an overall increase of $1 billion from Q2 2020.

Delinquency Rates: At the portfolio level, delinquency rates for CRE loans started reaching levels not observed since the recovery period following the last recession. Delinquencies continue to occur unevenly across property types, have not occurred evenly across the portfolio, and continue to be reflective of the sectors of the economy that have been hardest hit by the economic shutdown. When viewed by property type, retail and lodging show delinquencies that are much higher than other property types while industrial, office, and multifamily properties are generally performing in line with where they were performing in the 2-3 years pre-pandemic.

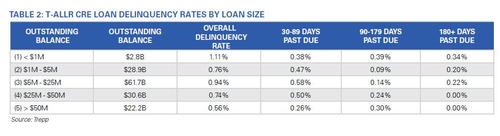

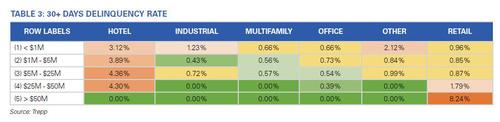

Delinquency rates for loans below $1 million in outstanding balance are outpacing the delinquency rates for larger loans, but much of this difference can be attributed to the historic overall lower performance of loans in this cohort relative to larger loans. Measuring the percentage increase in delinquencies the quarter end prior to the pandemic (Q4 2019), the delinquency rate for sub $1 million loans is up 27%. For loans between $1 million – $5 million the increase is 66% and for loans between $5 million – $25 million the increase is over 235%. The increase, in percentage terms, cannot be calculated for loans above $25 million because there were no loans delinquent in these cohorts in Q4 2019, despite them representing more than a third of the total portfolio outstanding balance at $52 billion.

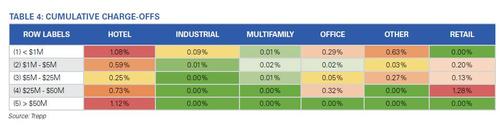

Cutting the more than 30-day delinquency rates by loan size and property type provides a clearer picture of where the areas of distress live. The worst performing segments are hotel loans in the middle loan size cohorts and large retail loans.

This trend is represented in the cumulative charge-off rates where it appears that lenders are being a bit more aggressive in writing off losses on larger balance loans.

Risk Ratings:

When compared with Q4 2019, the quarter prior to the beginning of the pandemic, Risk Ratings have migrated down significantly with the largest increases in both percentage and dollar terms being in the ratings that align with Special Mention, Substandard, Doubtful, and Loss (6-9 respectively). Anecdotal feedback from participants indicates that in most cases when a deferral or forbearance was granted, the risk rating was automatically dropped to 6 (Special Mention) at a minimum. This is reflected in a large jump in the outstanding balance rated as 6 in the prior two quarters.

When viewed by property type, the same trends as in the delinquency data are clearly visible with the risk ratings for loans on Retail and Hotel properties shifting down significantly more than for loans on other property types. Loans on Hotel properties reflect a very negative outlook for the property type with nearly 75% of the current outstanding balance rated as 6 or worse.

Summary: Delinquency rate and risk rating migration trends are signaling that we have yet to reach peak levels of delinquencies, defaults, and charge-offs. This is supported by anecdotal feedback from lenders and the continued slowdown in the hardest-hit sectors of the economy. Without targeted relief from Washington, credit performance for loans on retail and hotel properties will continue to deteriorate. While losses on these loans could impact bank earnings in the coming quarters, retail and hotel loans collectively represent less than 25% of the overall outstanding balance while multifamily, office, and industrial, which continue to perform well, represent more than two thirds of the outstanding balance in the T-ALLR portfolio.

Tyler Durden

Wed, 12/23/2020 – 15:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com