Mapping The Global Lockdown: Where Air Travel Is Partially Open And Where It’s Fully Closed

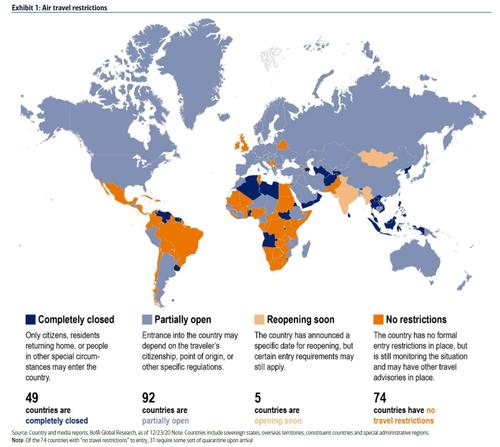

In a world gripped by partial (or full) lockdowns, the map below from Bank of America provides real-time data on the current state of air travel restrictions. It shows that 92 countries are currently partially open, 74 countries have no travel restrictions (having a list of these will come in handy during the next crisis), 50 countries are completely closed and 6 are reopening soon.

A quick look at North America reveals that the US, Canada, and Mexico extended their shared border restrictions through 21 January. This is the ninth extension since the restriction was first imposed on 18 March. “Essential” cross-border workers, immediate family members continue to be excluded from the restrictions. Additionally, on 8 October, the Canadian government announced it would allow extended family members cross-border privileges for those in an exclusive dating relationship for over a year and “have spent time in the physical presence of that person at some point during the relationship”.

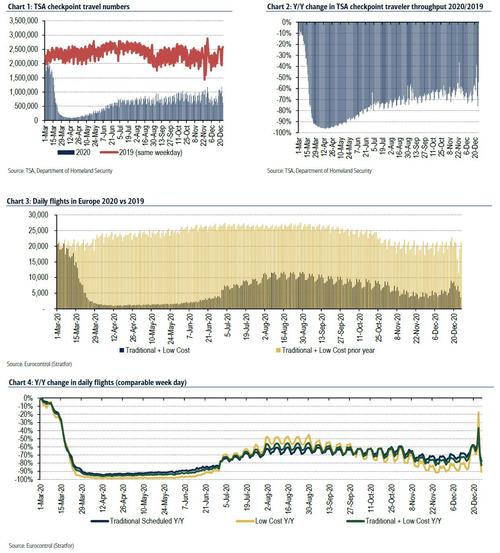

Meanwhile, as a result of the ongoing partial or full lockdowns, air travel remains sharply lower than 2019. According to the Transportation Security Administration (TSA), checkpoint traveler throughput numbers over the last week were 67% (on average) below what they were in 2019, which while an improvement off early and mid-April lows, which were 96% below what they were in 2019 according to BofA is a deterioration from the 56% decline observed at the start of December.

Chart 1 below shows raw number data for TSA checkpoint traveler throughput, Chart 2 depicts the year over year change in traveler throughput 2020 vs 2019.

There is no quick recovery in sight: on 9/29, the International Air Transport Association (IATA) revised its 2020 forecast to a 66% Y/Y declined in air traffic demand as measured by revenue passenger kilometers (RPK). Previously IATA forecasted a 63% Y/Y decline. The forecast was updated to reflect a weaker outlook following 2020’s “dismal end to the summer travel season.”

On 7/28, IATA said the pandemic is expected to delay the recovery of air traffic demand to pre-COVID-19 levels till 2024, as measured by revenue passenger kilometers (RPK) (vs. previous forecasted recovery in late 2022/ early 2023). At the time, IATA also revised its forecast to reflect a 63% Y/Y decline in air traffic demand (RPK) in 2020, and a 75% recovery in 2021 (still 36% below 2019 levels). Prior to that, IATA had estimated the pandemic’s impact in 2020 would be a 55% Y/Y decline with a 55% recovery in 2021(but still remaining 29% below 2019 levels).

The result of this global collapse in air travel has been a tsunami of defaults, bankruptcies and bailouts. The list below courtesy of BofA tracks the most prominent airline bankruptcies and bailouts of the past year.

- Virgin Atlantic (Chapter 15 Bankruptcy filing 8/4): On 8/4, Virgin Atlantic (UK-based) filed for chapter 15 bankruptcy protection in the US, amidst increasingCOVID-19 pandemic pressures. According to Reuters, the US chapter 15 bankruptcy code allows “a foreign debtor to shield assets in this country.”

- Grupo Aeromexico (Bankrupt 6/30): On 6/30, Aeromexico announced that it has filed for Chapter 11 bankruptcy in the US. The airline will continue to operate through the legal process. According to Cirium, Aeromexico’s fleet consists of 19787 Dreamliners, 6 737 MAX, 44 737 NG, 47 E190s, and nine E170s.

- LATAM Airlines (Bankrupt 5/26): On 5/26, LATAM Airlines and its Chile, Peru,Colombia, Ecuador and US affiliates filed for Chapter 11 bankruptcy protection inthe US. LATAM Brazil, Argentina and Paraguay are negotiating support with the government of Brazil. LATAM and all of its affiliates will continue to operate as it works to reorganize.

- Lufthansa (Bailout 5/25): On 5/25, Lufthansa confirmed that the Economic Stabilization Fund (WSF) of Germany had approved a $9.8bn aid package for theairline. The terms include a 20% government stake in Lufthansa which could increase to 25% and one share in the event of a takeover attempt. Lufthansa’s acceptance of the package is pending the approval of its Management and Supervisory boards (which is expected to happen shortly) and the European Commission’s regulatory approval.

- Avianca Airlines (Bankrupt 5/12): On 5/12 Colombian airline Avianca filed for bankruptcy. According to media reports the filing identified the impact of theCOVID-19 pandemic on the airline as the reason for its filing. Avianca is the third largest airline in Latin America. According to its website, Avianca’s fleet consists of13 Boeing 787s, 8 Airbus A330s, 15 A321s, 67 A320s, 25 A319s, 15 ATR-72s and 6A330F Cargo aircraft.

- Air France-KLM (Bailout 4/24): On 4/24, Air France-KLM secured $7.6bn in funding from the French and Dutch governments. The loans include some “greenties” or environmental commitments ie. Reducing its CO2 emissions by 50% overthe next 10 years.

- Virgin Australia (voluntary administration): On 4/20, Virgin Australia Holdings Limited announced it has “entered voluntary administration to recapitalise the business and help ensure it emerges in a stronger financial position on the other side of the COVID-19 crisis.” Virgin Australia Holdings includes Virgin Australia,Virgin Australia Regional, Virgin Australia International and Tigerair Australia(lowcost carrier). According to Cirium, the total fleet consists of 148 aircraft: 85 737NG, five 777s, 15 A320s, six A330s, 12 ATR 72s, 19 Fokker 100s and two Fokker70s.

- Air New Zealand (Bailout): New Zealand offered its flag carrier Air New Zealand aNZ$900mn ($513mn USD) loan over the next two years, separate from the NZ$600mn ($342mn USD) aviation industry support package New Zealand announced on 3/17. Air New Zealand had previously cut its long haul flights by 80%and its government owns a majority stake of the airline (52%). The airline agreed to not pay dividends to shareholders over the duration of the loan.

- Finnair (Bailout): On 3/20 media reports indicated Finland was preparing to grant its flag carrier airline, Finnair, 600mn euro in support through the COVID-19pandemic. The airline had previously cancelled ~90% of its flights. The airline is~56% owned by the state.

- Norwegian Air (Bailout): On 3/19, the Norwegian government offered NOK 6bn(~$535mn USD) in credit guarantees for its airline industry. Half of the amount(~$267mn) will be made available to Norwegian Air, with conditions.

- Alitalia (Bailout): Italy has earmarked 500mn euro for its airline sector. A large portion of that funding is intended for its flag carrier airline Alitalia.

- FlyBe (Bankrupt: 3/5): UK regional airline that had 2,000+ employees and serviced over 8mn people per year. According to media reports, Flybe operated ~40% of UK domestic flights.

- Air Italy (Bankrupt: 2/25): Formerly known as Meridiana, Air Italy was Italy’s second largest airline after Alitalia. Air Italy ceased flight operations on 25 February2020.

Other smaller bankruptcies include Atlasglobal (Turkey), Trans States Airlines (US), and Nantucket Express (US).

Tyler Durden

Fri, 01/01/2021 – 08:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com