December Class 8 Truck Orders Are The Fourth Highest In History

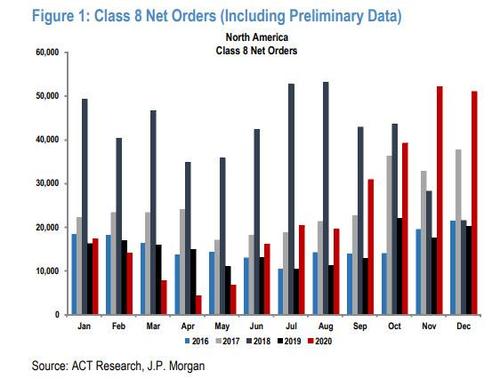

Class 8 truck net new orders in December were the fourth highest in history at 50,900 units, down 2% MoM but up 153% YoY. Seasonally adjusted orders in the month came in at 39,500 units (474,000 SAAR), down 18% MoM. Orders were up 139% YoY to 142,000 units in Q4 (the second best quarter on record) and up 54% to 278,400 units in 2020.

As Alan Adler at Freightwaves writes, the surge in bookings reflects continued demand for consumer goods, an awakening of the manufacturing sector and robust fleet profits from tight freight capacity. A driver shortage is worsened by closed driving schools. Other drivers are sidelined because they failed drug tests. All of these factor into higher per-mile freight rates.

“As we at ACT [Research] can often be heard saying, ‘When carriers make money, they buy trucks,’” ACT President and senior analyst Kenny Vieth told FreightWaves.

The order strength in the last four months of the year made up for a stagnant order book in April and May, when the first wave of the coronavirus shuttered truck manufacturing plants and disrupted supply chains. But a V-shaped recovery took hold in late summer and plants laid on overtime to make up for delayed orders.

“Looking to 2021, with freight-intensive economic sectors like manufacturing coming on strong, and driver recruitment continuing to lag, carrier profitability should continue to accelerate, which bodes well for new vehicle demand,” Vieth said.

In a Thursday note from JPMorgan, the largest US commercial bank said it expects production of ~250,000 units in 2021 (up 17% YoY) and ~258,000 units in 2022 (up 3% YoY).

Should the economy fall victim to the worsening impact of the pandemic, fleets can cancel or retime orders. Order placements assure carriers of being assigned a build slot for their new trucks. As production backlogs grow, so does the time between order and delivery.

“Although we believe the tailwinds of still-strong consumer buying, likely to be boosted further by new stimulus checks, and inventory restocking will remain powerful in 1H21, a successful vaccine rollout and reopening of economies is likely to drive an aggressive shift in consumer dollars back to services,” Evercore ISI said in an investor note Thursday.

That could occur just as new trucks being ordered now are ready for delivery.

“To get two back-to-back order months over 50,000 is a stellar accomplishment, after previously seeing orders crater to under 5,000 units in April,” said Don Ake, vice president of commercial vehicles at FTR Transportation Intelligence. “Now, 2021 has the potential to be an incredible recovery year.”

Orders for new dry vans and refrigerated trailers mirror the surge in the tractor orders that pull them. Flatbed orders are recovering more slowly. The September-November booking total amounted to the second-best three months in industry history. “The backlog is filled into Q4,” Dave Giesen, vice president of sales at Stoughton Trailers, told FreightWaves in December. “We will wait for the supply chain to catch up before we continue quoting as this is a long way out.”

Meanwhile, December demand for Class 5-7 trucks recorded its second-best ever volume at 35,100 units. Medium-duty orders rose 28% over November and 73% compared to last December.

“There is a symbiotic relationship between heavy-duty freight rates and medium-duty demand,” Vieth said. “Clearly, the shift in consumer spending from experiences to goods has been good for the providers of local trucking services as e-commerce has grown by leaps and bounds during the pandemic.”

Tyler Durden

Wed, 01/13/2021 – 05:35![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com