Taper Tantrums In A Time Of Implicit Yield Curve Control

By Guneet Dhingra, rate strategist at Morgan Stanley

Rates in Times of Implicit Yield Curve Control

I often wonder whether investors implicitly believe there is yield curve control, even when the Fed hasn’t officially articulated a policy of keeping yields below a certain number – the textbook definition of yield curve control. Last November, when we published our forecast that 10-year yields would reach ~1.5% by the end of 2021, the most common response was “Surely that’s too high.” The nearly universal rationale has been that the Fed will keep yields from rising above some number between 1.1% to 1.3% (the consensus forecast was and remains around 1.2%).

Has the Fed managed to have its cake and eat it too? Welcome to the world of implicit yield curve control. Anchoring our above-consensus view on rates is a belief that the Fed is focused on the conditions under which yields rise, not a specific level. Arguably, the Fed’s biggest challenge in 2021 is preventing a 2013-style taper tantrum.

Two pillars support our forecast. First, our economic forecasts, particularly on inflation, are above consensus. Second, we believe that higher yields are acceptable and even desirable to the Fed, under three conditions: (1) yields rise gradually; (2) rising inflation expectations (i.e., breakevens) account for the lion’s share of the rise in yields, while real yields lag; and (3) the rise comes with a recovery in growth, or at least positive catalysts.

The 60bp increase in 10-year yields over the last six months shows how they can rise without damaging financial conditions and alarming the Fed. The rise has been gradual, led by breakevens and accompanied by positive catalysts like the vaccine and the Democratic sweep. As yields approached 1.15% after the blue sweep, Fed Vice Chair Clarida said that he was not “concerned by yields a touch above 1%”. This aligns with our understanding of the Fed’s implicit yield curve control.

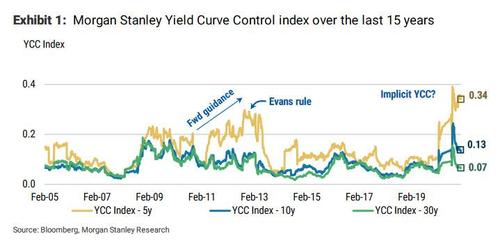

From here on, real yields will contribute more to a rise in nominal yields. We capture the degree of yield curve control via our Morgan Stanley Yield Curve Control index, which tracks the contribution of real yields to nominal yields.

The recent decline in the index is an important signal for what lies ahead. We can decompose that 60bp rise in yields into 55bp breakevens and 5bp real yields – a mix we think is unsustainable, given the V-shaped recovery and the upcoming fiscal stimulus. We therefore expect real yields to inflect from these all-time lows and play a larger role in the rise in Treasury yields.

A gradual rise, particularly in real yields, may mitigate the risk of another taper tantrum in 2021. One reason why yields rose sharply in the so-called taper tantrum of 2013 was that they were too low relative to improving economic fundamentals. A gradual rise in yields ensures that they don’t lag too far behind fundamentals and reduces the chances of a sharp move higher. Fed communications, starting with the January FOMC meeting, will be paramount in ensuring that the real yield move does not get out of hand.

We think that the Fed will succeed in avoiding a tantrum, for three reasons. First, the Fed’s high degree of optionality on the size and composition of quantitative easing reduces the risk of a spike in yields. Second, the December FOMC minutes indicate that the Fed plans a long lead time between communicating its intentions and actually tapering. This contrasts with 2013, where the plan to taper came as a surprise and its implementation seemed imminent.

Finally, the market differentiates tapering from tightening, which limits the risk of another tantrum. In 2013, the Fed was unable to separate tapering and tightening (via higher rates). Rate expectations (which capture the pricing of rate hikes) and term premiums (which capture the pricing of QE) were positively correlated from 2009 to 2013, suggesting that the market had been conditioned to treat rate hikes and QE as two sides of the same coin. In contrast, rate expectations and term premiums have completely decoupled in the past nine months, suggesting that the market won’t make the same mistake this time.

Tyler Durden

Sun, 01/17/2021 – 12:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com