After All That, 139% Of Gamestop’s Float Is STILL Short

Two weeks ago, we first pointed out something which we thought was remarkable: a whopping 144% of the company’s float was short…

is this right pic.twitter.com/mVfitVff5b

— zerohedge (@zerohedge) January 14, 2021

… as short had piled on to never before seen levels in recent weeks.

It was some variant of this observation that prompted retail daytraders to ramp up the stock and force a massive short squeeze, and judging by today’s $159.18 record stock price, which briefly pushed the market cap of the video game retailer above $10 billion, they succeeded. Since then, however, the price slumped, and at one point turned red sliding $100 from its intraday highs, as the furious ramp fizzled, perhaps on the expectation that most of the shorts had covered and there was little forced buying left.

But is that true?

According to financial analytics firm S3 Partners, despite the punishing two weeks and historic ramp that forced countless margin calls, GameStop haters are showing no signs of surrender which is perhaps to be expected since every surge higher invites a new round of shorts to bet on the move lower (and who are forced to cover when that does not happen).

According to Bloomberg, which quotes S3, the latest data shows that shorts equal to 139% of its float has been borrowed and sold short. Shockingly, that figure is little changed since last Thursday’s 141% short-interest reading, even though GameStop shares have surged roughly 130% in the past two days alone.

The still-high level of bearishness indicates that even though shorts are being squeezed out of their positions, new traders looking to bet against GameStop are rushing in, according to Ihor Dusaniwsky, S3’s managing director of predictive analytics. That’s occurring even as the cost-to-borrow shares for the purpose of selling them short spikes — the stock borrow fee is currently 23.6%, S3 data show.

“We are seeing a short-squeeze on older shorts who have incurred massive mark-to-market losses on their positions, but are seeing new shorts coming in and using any stock borrows that become available to initiate new short positions in hopes of an eventual pullback from this stratospheric stock price move,” Dusaniwsky wrote in an email.

It means that as countless legacy GME shorts covered, almost all of them were replaced by new shorts, who in addition to the risk of another bull raid, are forced to pay exorbitant borrow fees of 23.6%, which means that unless the stock plunges – and fast – all those millions on shorts will lose money even if the stock goes nowhere.

Meanwhile, the pile up into the most shorted name continues. A Goldman Sachs basket of the most heavily shorted stocks rose as much as 11% in New York Monday. That brought its month-to-date return above 38%, the most since at least 2008, as far back as data for the index goes. Of course, regular readers handsomely profited from the move. As we said last November when presenting the most heavily shorted hedge fund names “as usual, our advice is to go long the most hated names and short the most popular ones – a strategy that has generated alpha without fail for the past 7 years, ever since we first recommended it back in 2013.”

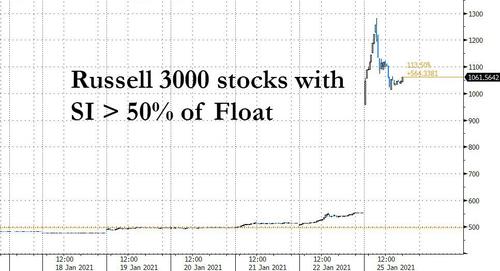

Meanwhile, our basket of the most shorted Russell 3000 stocks (those whose Short Interest is more than 50% of float) is up more than 100% today alone.

There was some good news for battered shorts: Bloomberg notes that according to Susquehanna International, the pace of bearish put-contract buying outpaced that of call purchases on Monday, with roughly 500,000 puts purchases versus 275,000 calls. That follows a similar dynamic on Friday, after six consecutive weeks of call volume clocking in higher than put buying.

“The GME rally is unlikely to last forever, and investors looking for a sign we are closer to the end could look at the 6 week streak of call volume outpacing put volume finally being broken,” wrote Susquehanna co-head of derivatives strategy Chris Murphy in a note Monday.

Perhaps, but once daytraders realize that after the tremendous move higher in the stock, it still has the same number of shorts as it did a few weeks ago, the next ramp is sure to follow and test just how stubborn the new “generation” of shorts will be.

Tyler Durden

Mon, 01/25/2021 – 14:15![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com