Here Are All Of Melvin Capital’s Crushed Put Positions

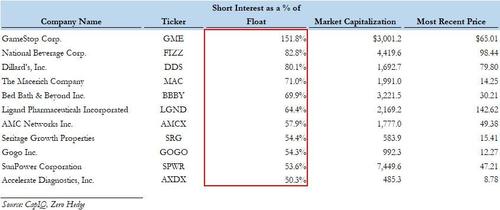

Last Friday, in the aftermath of the Gamespot’s historic eruption which sent the stock from $40 to the mid-70s (before it doubled again on Monday rising as high as $158), we had a feeling which way the wind was blowing and laid out all the Russell 3000 stocks that had the highest Short Interest (50%> of float).

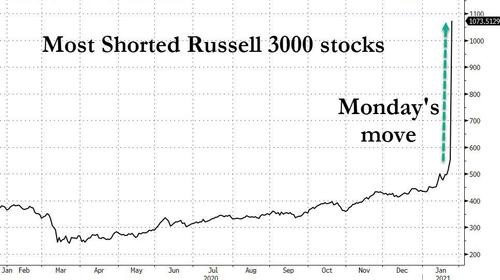

Also on Friday, we put together an equal weighted basket of the companies listed above which on Monday… well… exploded, in light with our expectations that WallStreetBets/Robinhood traders would go down the list and systematically ramp up each and every one of these most shorted names, sending them in the stratosphere.

That’s exactly what happened.

And yet, while the market reaction was as we expected, one thing we did not anticipate was the “fracture point” which as we now know was Gabe Plotkin’s Melvin Capital, which effectively blew up today and suffered a multi-billion margin call on its shorts (as reported earlier), and only a $2.75 billion bailout from Citadel and Point72 (both prior investors in the fund) avoided a far greater disaster (had the $12 billion Melvin Capital been forced to start liquidating its longs to pay its margin calls, all bets would have been off).

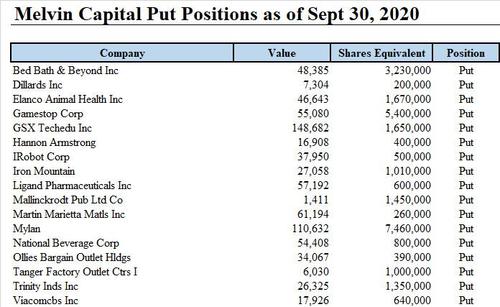

What is most remarkable, however, is that a quick look at Melvin’s put positions – which had attracted the ire of WallStreetBets investors who were long the names that Plotkin was short – shows that most of them were amazingly the same as the most shorted names shown above! One wonders how many idea dinners Plotkin attended to pitch his positions to his hapless peers who followed him right into the Big Short Squeeze abyss, and how many other hedge funds had been caught in the conflagration. Incidentally the reason why the WallStreetBets vendetta was targeted at Plotkin is because unlike traditional shorts, it had to disclose its puts in its quarterly 13F. Ironically, had Melvin merely kept its bearish bets in the form of regular shorts – which hedge funds have no obligation to report – all of this could have been avoided.

And so, without further ado, here are Melvin Capital’s puts.

Why do we care? Because as S3 Partners founder Bob Sloan told Bloomberg in a TV interview today, GameStop could rise even further after surging 95% over the past week: “Get prepared for another round of short squeeze. You’re going to see GameStop go way higher.”

The reason: while the negative hit from Plotkin’s shorts and/or puts may have been neutralized, especially with the help of the nearly $3 billion in excess funding from Steve Cohen and Ken Griffin, which removes his incentive to cover shorts at all costs, earlier today we learned that as the hobbled hedge fund cralwed through the finish line, suffering massive P&L losses, countless other hedge funds took its place shorting Gamestop et al. In fact, GME’s short interest as a percent of float declined from 142% two weeks ago to… 139% today.

Bottom line: brace for even more fireworks as WallStreetbets reignites the squeeze, only this time it won’t be Melvin but some other hedge fund that will be crushed under the collective weight of a few thousand Robinhood bulls. Which, incidentally, would be great news for Ken Griffin. Not only does he know which stocks will be ramped by Robinhood before anyone else – after all Citadel is the biggest buyer of RH orderflow – but once the short hedge fund on the other side blows up, Griffen can just pull another Melvin, and swoop in with another “bailout loan-for-revenue” scheme – i.e., an offer that simply can not be refused – and forcibly takes an equity stake in another distressed hedge fund… and another… and another, and so on, all with the help of a few thousand stimmychecked Gen-Zers.

Tyler Durden

Mon, 01/25/2021 – 23:03![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com