Biggest Winners From Biden’s Stimulus: Middle-Class Family Of 4 Will Qualify For $12,800 Over Next 15 Months

While markets wait to see what the final size and scope of the proposed $1.9 trillion Biden stimulus will be, what we know currently about the key support components is the following:

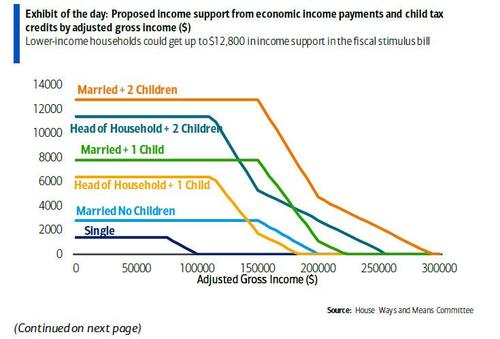

- “Economic Impact Payments” of $1,400 per person plus an additional $1,400 per dependent phasing out starting at $75,000 for single, $112,500 for head of households and $150,000 for married (fully phased out at $100,000 for single,$150,000 for head of households and $200,000 for married)

- Temporary enhanced Child Tax Credit: Fully refundable $3600 per child age under 6 and $3000 per child age 6-17 with gradual phase out of $50 for each $1000 over the threshold of $75,000 for single, $112,500 for head of households, and $150,000 for married. Credits are paid out monthly in even increments starting July 2021 through June 2022 (e.g. $300 for age under 6, or $250 for age 6-17 per month per child).

What does that mean in practical terms?

As BofA economist Joseph Song explains, the big winners of the proposal will be be low to middle-income households with young children. As shown by the orange line below, a family of 4 making less than $150,000 a year could qualify for $12,800 in federal income support over the next 15 months.

To be sure, not all of the child tax credit will be new money as the current tax code provides a $2000 tax credit per child, but the new provision is more generous in two ways:

- it is released monthly rather than all at once, allowing families to smooth over spending (bad news for anyone hoping to bet it all on a pennystock)

- the credit is fully refundable (i.e. refund is allowed even if credits exceed taxes owed) allowing low income households to gain the full benefit of the provision.

There is of course a cost: the Joint Committee on Taxation has scored the Economic Impact Payments and the Child Tax Credits to cost around $530bn ($422bn + $109bn) which, if fully spent, would equate to roughly 2.8% of real GDP. That said, not all of the income support will be spent in the economy and reasonable fiscal multipliers would suggest a GDP boost in the range of 0.5-1.5%. Still, as BofA quipts “that’s a lot of diapers and toys.”

Expect to get more details in coming days as House Committees mark up the bill. News reports suggest that the House will aim to vote on the full legislation the week of February 22nd and then the Senate will get its turn. In any case, if these provisions survive to reach the final version of the bill – and they probably will – “the consumer will be well supported in 2021 and beyond” according to BofA.

Tyler Durden

Thu, 02/11/2021 – 16:50![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com