Watch Out, Chinese Money May Start Trickling Away

By Ye Xie, macro commentator at Bloomberg Markets Live

Three things we learned last week:

1. Beijing is considering relaxing restrictions on capital outflows.

China will ease restrictions on investing abroad, including raising the QDII quota for institutions and studying the feasibility of allowing individuals to buy foreign securities within their annual limit, a State Administration of Foreign Exchange official said Friday. Currently, Chinese residents are allowed to purchase up to $50,000 a year of foreign currencies, but the funds can only be used for purposes such as traveling and studying, not for buying overseas property, securities or life insurance.

The authorities have already taken a slew of steps since late last year to encourage outflows and temper inflows in a bid to slow the yuan rally. To underscore the appreciation pressure, Friday’s data showed China’s current account surplus surged to $130 billion in the fourth quarter, the most since 2008.

The move also shows that PBOC is reluctant to directly intervene in the currency market, opting to let market flows determine exchange rates, according to Morgan Stanley.

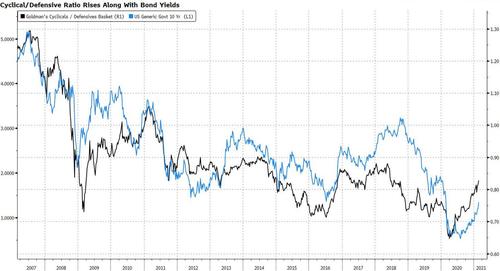

2. Rising real yields have yet to do much damage to markets.

Ten-year real yields rose 20 bps last week, the most since the U.S. lockdowns in March. While global equities fell from a record, cyclical sectors such as industrial stocks outperformed along with metals. Both signal that markets are upgrading the growth outlook with fiscal stimulus and vaccine rollouts, and higher yields can be digested.

3. Central banks are in no rush to withdraw stimulus.

Fed officials signaled massive bond purchases will continue for “some time.” Australia’s central bank expects “very significant” monetary support will be needed as it’ll take years to meet its inflation and unemployment goals, according to minutes of the February meeting. In China, the PBOC showed a steady hand last week, signaling the small liquidity drain it conducted shouldn’t be taken as a sign of tightening.

Tyler Durden

Sun, 02/21/2021 – 20:28![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com