“Full Throttle Correction” – Tumbling Nickel Prices Lead Sudden Industrial Metals Slump

Industrial metal prices have soared over the last year to highs not seen in over a decade as bets on economic recovery from the pandemic push up the prospects for “pent-up demand” due to a cleaner and greener future. Though industrial metal prices are stumbling in the last five sessions, that has set off alarm bells with some commodity analysts.

S&P GSCI Industrial Metals index tagged a near-decade high last week after an 11-month rip roar rally of 75% from pandemic lows. Base metals are essential inputs for batteries and home electronics as post-crisis consumption and supply chain disruptions have led to price increases. The prospects of a greener future with government and companies globally announcing net-zero emissions have unleashed momentum and speculative traders into these metals.

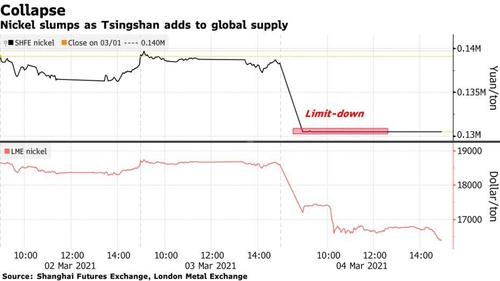

But over the last five sessions, something spooked the industrial metals market. On Thursday, nickel prices plunged more than 4%, dragging down copper by almost 5% at one point.

Saxo Bank commodity analyst Ole Hansen told Reuters that the massive influx of speculative money flowing into industrial metals over the last year was bound to burst. He said, “It’s been a long time coming.”

Hansen said the latest plunge in nickel prices was the “trigger” and “now we see correction at full throttle.”

Commodity analysts at Citi told clients that more supply from Tsingshan Holding Group Co., the world’s top stainless steel producer, in China, and Tesla’s efforts to reduce the nickel in its batteries threatens the industrial metal price outlook.

“We are very concerned the impact this will have on speculative positioning at a time the market also goes into a large physical surplus,” Citi analysts wrote.

A little more than two months ago, we told our Premium subs that Chinese credit impulse “just peaked” – and since it impacts virtually every aspect of the global economy – it is a proxy of global economic growth.

JPMorgan’s Mislav Matejka explained last month China’s credit impulse is in the process of “peaking.” The change in the growth rate of aggregate credit as a percentage of gross domestic product in the country has a tremendous impact on the global economy’s future. Saxo Bank once said the credit impulse leads the global economy by 9 to 12 months.

Putting this all together – could a downturn in industrial metals as China’s credit impulse tops, suggest global economic growth is set to stumble later this year?

Tyler Durden

Thu, 03/04/2021 – 18:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com