When IBM Was The Center Of Gravity

By Byrne Hobart of The Diff substack

When IBM Was The Center Of Gravity

Learning about IBM in the context of the early history of the computer industry has the same shock value as watching Star Wars: A New Hope for the first time: “That’s no moon. It’s a space station.”

Consider:

-

In 1953, UNIVAC was basically the only company selling computers commercially. By 1956, IBM’s market share in computers was 85%.

-

In the late 70s and early 80s, after several industry transitions, the entry of smaller and more agile competitors like DEC and Control Data as well as larger and more resourceful ones like GE and Exxon, IBM’s market share was still 70%.

-

IBM “bet the company” on one product in the 1960s, with a total budget that exceeded twice the cost of the Manhattan Project. In this time, they didn’t report a loss, and they didn’t even report a sequential decline in annual earnings.

-

In fact, IBM reported positive annual earnings growth every year from 1952 through 1979.

In “Adam Smith”‘s wonderful book, The Money Game, the concept of a growth stock is illustrated with a five-year table of some high growth companies’ earnings per share; IBM is at the top of the list. More interesting is an earlier section on investor psychology, which has a bit called “IBM as Religion: Don’t Touch, Don’t Touch.” It’s a story about someone who invests in IBM’s predecessor, Computing-Tabulating-Recording Company, and holds the stock for his entire life. His $20,000 becomes millions of dollars, and he insists that his heirs never sell the stock. They don’t, and they make the same stipulation to their heirs. One reason for the company’s marvelous performance is, of course, that it retains most of its earnings and pays low dividends. When he dies, the stock is split up between his heirs, who also hold and never sell, and who also end up as millionaires, as do their heirs. But the dividends remain modest:

In short, for three generations the Smiths have worked as hard as their friends who had no money at all, and they have lived just as if they had no money at all, even though the various branches of the Smith family all put together are very wealthy indeed. And the IBM is there, nursed and watered and fed, the Genii of the House, growing away in the early hours of the morning when everyone is asleep.. It is a parable of pure capitalism, never jam today and a case of jam tomorrow; but as any of the Smiths will tell you, anyone who has ever sold IBM has regretted it.

How did IBM get so dominant? How did “Nobody ever got fired for buying IBM,” become a catchphrase among corporate IT buyers and investors? And what changed?

Origins: Promoters and Punch-cards

In 2021’s SPAC-saturated financial universe (and in light of the last few weeks’ SPAC drawdowns), it’s interesting to note that IBM was born as an act of financial engineering. In the early 1900s, the market was enamored by trusts, and promoters realized that merging a few semi-related companies together could create a combined entity that was a) big enough to issue stock, and b) could tell a plausible story that it would monopolize its industry. (Monopolies were technically illegal, but in practice weren’t heavily prosecuted. The existence of the Sherman Antitrust Act told investors that a monopolist could charge exploitative prices; its lax enforcement told them that it wouldn’t be shut down for this reason.)

Charles Flint was one of many stock promoters who merged together small companies and took them public. In 1911, he cobbled together a new firm called Computing-Tabulating-Recording Company. CTR was an odd mix, including an industrial scale manufacturer, a company that made timecards for hourly workers, and The Tabulating Machine Company. The last was a quirky niche product: founded by a German inventor, Herman Hollerith, it built mechanical devices that could tabulate information if it was encoded on punched cards. The company had only a handful of customers; railroads, for example, could save money and better track their business using punched cards. The company’s most important client was the US Census, but one big contract every ten years did not indicate much business potential.

As it turns out, the company made one other key acquisition: hiring Thomas J. Watson as President. Watson had a somewhat mixed reputation: he’d worked for National Cash Register, a company that was famous for rapid growth, technical sophistication, and an excellent sales organization. On the other hand, he’d been recently convicted of antitrust violations for some of his work at NCR, and faced jail time. Flint, perhaps operating on the assumption that he’d sell out of the stock before the case was fully resolved, hired Watson anyway.

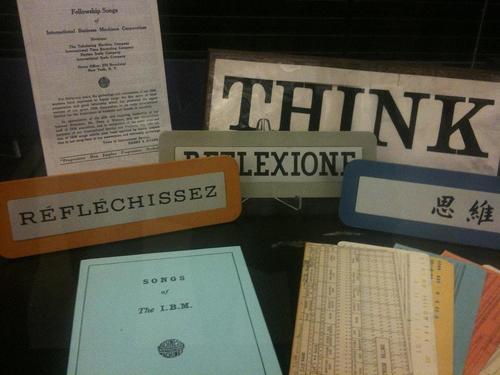

Watson had a natural flair for sales and strategy, and had developed his sales technique at NCR. NCR deployed armies of salespeople, held them all to strict personal standards (good grooming, no alcohol consumption whatsoever), and used this standardized approach to scale fast. Watson’s CTR adopted the same model, and even borrowed some of the same mottos:

One realization Watson came to was that CTR was a clunky name, and, as trusts went out of fashion, was sending the wrong signal to the market (and to the FTC). So, in 1924, he renamed the company International Business Machines. Watson also insisted on reinvesting in the business, even though other executives like board chairman George W. Fairchild were more concerned with maintaining dividends.

He came to another important realization about one of those business machines in particular: Hollerith’s punched-card tabulators were more exciting than they looked, especially for an organization that specialized in sales. The machines themselves had unimpressive margins, but making stacks of perforated cardboard and selling them to a captive market was a very high-margin business indeed. And this sticky, high-margin revenue source grew with usage, not just the unit volume of tabulators. If IBM could embed its salespeople in companies, and have them relentlessly THINK about ways to replace clerks with cards (or about new functions that could be economically performed by cards but that wouldn’t be worth an employee’s time), they could continuously grow sales.

By the 1930s, cards routinely represented a third of sales, and presumably a much larger share of profits. IBM’s sales were flat early in the depression, as cuts in corporate spending were offset by growth in government use. During the Second World War, IBM continued to grow its top line—profits were compressed by higher taxes—but it also reinforced a virtuous cycle. More tabulated data meant more legible data; the Social Security Administration was a big client, but also a client whose existence gave every American a unique numerical identifier, and whose implementation meant that their employers had to track who them employed and how much each one was paid. Heavy war spending required more data tracking, and this meant that manufacturers also needed to invest in business machines to meet their end of the bargain.

Even later, when IBM was less dependent on cards, it liked the model of having a long tail of revenue. As IBM evolved, it preferred to lease its products rather than sell them, and to offer peripherals that would increase revenue per customer. Even after cards were irrelevant, a card-like model was a core part of IBM: each year, they started with a baseline of high-margin recurring revenue from existing clients. New sales would just add to that sum.

Dominance

IBM was not the first company to build computers, although Thomas Watson Jr., who took over from his father in 1952, was certainly interested in them. Sperry-Rand’s subsidiary UNIVAC (which survives today as Unisys) introduced the first commercially successful computers in the early 50s.

IBM had the largest R&D department of the business machines industry in the 40s and 50s, and Watson had read Norbert Wiener’s Cybernetics. IBM quickly caught up, and had dominant market share in computers by the late 1950s. Some of this was because of their research—they were able to introduce cost-competitive computers a few years after UNIVAC. And a lot of it was because of their sales organization: IBM sales reps didn’t have to introduce themselves to potential corporate customers, who had been buying other IBM products for years or possibly decades.

IBM added another tactic around this time, which would be called “paper machines” then and “vaporware” today: if a competitor’s product was selling well because it reached a price or market segment that IBM didn’t touch, the company wouldn’t hesitate to announce a competing product (and start taking orders for it) long before it was available. Meanwhile, IBM kept news about upgrades to its existing products well-hidden.

This sort of behavior led to one of what would be a long series of unpleasant interactions with the Justice Department, leading to a decree in 1956 that required IBM to divest some of its punched-card business and start selling as well as leasing computers. This is an early case study of a common phenomenon: antitrust cases take so long—in part because the companies being sued are not especially cooperative—that by the time they’re resolved, the industry has changed, and the remedies don’t have much of an impact. IBM had to divest a rapidly-shrinking segment that was quickly being rendered obsolete by the company’s other products.

It’s hard to overstate how powerful IBM was in the computer industry by this time. A big order from IBM revived Texas Instruments’ fortunes in the late 50s, for example, and every computer company worried that if their product worked too well for too long, it was only a matter of time before an army in a uniform of starched white shirts, blue suits, clean shaves, and high quotas was marching on their customers and offering a more expensive, but much more defensible, choice.

Both IBM and its competitors acknowledged that the company excelled at sales. As the CEO of UNIVAC’s parent company put it:

It doesn’t do much good to build a better mousetrap if the other guy selling mousetraps had five times as many salesmen.

And in a revealing comment from Watson, Jr., he once explained that the company’s release cadence was dictated in part by the needs of its sales team:

You have to keep feeding them new things to keep their morale up.

One of the biggest New Things IBM fed to its salesmen in the 60s was the 360. This product, announced in 1964 and first sold the next year, was IBM’s most intensive development project in history, costing, according to one estimate, twice as much as the Manhattan Project. The 360 was a series of machines that had compatible code, so customers could easily upgrade from one to the next as they scaled without needing to rewrite their software. It was, in other words, another way for IBM to replicate the negative dollar churn model of the punched card business. IBM needed the 360 in part because its sales team was entirely too good: the people responsible for selling IBM’s low-end machines were cannibalizing the sales of high-end ones by convincing buyers that the more affordable option could handle all of their needs. While the 360 represented a technological advance, it was partly an organizational one—a way to give the company a strict hierarchy of products and use cases so it could charge what the market would bear. IBM had to repeatedly turn to the capital markets to fund this, although the company kept reporting growing profits throughout the development process.

The launch of the 360 represents Peak IBM in terms of influence and ability to shape markets, although their financial peak was a long way off. IBM’s computers were so successful that they spawned two separate ecosystems: the first “IBM compatible” devices were produced in the 1950s, when smaller manufacturers sold peripherals that functioned alongside IBM machines.

More worrisome for the company was the trend of computer leasing companies, whose business model was straightforward: IBM depreciated its computers over five years, and priced them accordingly. Leasing companies depreciated computers over ten years, and were able to undercut IBM and report (accounting) profits doing it. These leasing companies would have slightly worse cash flows than IBM, since their higher reported profits entailed a higher tax burden. But they were able to show good profits, and as long as they grew fast enough, any misguided optimism about the useful life of a computer would be hidden. (If a leasing company grows its assets 50% each year, and the IBM depreciation number is correct, then the computers they start to write down in year six are just a fifth of assets, and they’ve had five years of profitable growth before then.) Paradoxically, the leasing companies (some of which were much hotter stocks than IBM in the 60s) were a bet on growth but against technology. An investor buying IBM instead of Leasco was betting that the 360 was not the last word in computing (and that whatever the last word was, it would be spoken in the vicinity of Armonk, New York). A buyer of Leasco was implicitly claiming that the computer trend had been an interesting one, and had fully run its course by the mid-60s, with deployment rather than new technology as the main source of growth.

In a sense, the company painted itself into a corner: by creating a new standard, and ensuring that future releases would be backwards-compatible, IBM plausibly did increase the useful life of its computers. The company could either cut leasing rates (which would cut into revenue) or accept that its model was shifting from leasing computers to customers over to selling them to middlemen.

IBM did adjust its pricing, but this entailed still more problems.

Decline

In 1968, Control Data accused IBM of assorted antitrust violations, which the US government followed up on the next year. IBM spent over a decade in litigation, hiring armies of lawyers and producing millions of documents. (The joke at the time was that the real winner of the case was Xerox.) The case ran on long enough that IBM could accurately argue that more than half of the companies that accused it of anticompetitive behavior had been founded after the original lawsuit was filed. Some companies bet their future on IBM in yet another way; the CEO of one company, Calcomp, joked that his company’s most valuable asset wasn’t patents, equipment, or employees, but their ongoing lawsuit against IBM.

The suit was ultimately dropped, but IBM’s defense was all too accurate: the computer business was getting too competitive, and other companies were adapting faster than IBM itself was. Over the course of the 70s, IBM’s annual profits still tripled, but by the end of the decade, the stock hadn’t gone up at all.

The story of IBM’s long-term collapse was not the result of any one decision; if there was one bad decision, it was the way they structured their MS-DOS deal, which allowed Microsoft to license it to other PC manufacturers. But that choice was more symptomatic. IBM’s sales centric approach naturally assumed a slower industry cadence than the one that developed in the 80s. Rapid growth in low-end computers reduced the relevance of their competitive advantage in large-scale, long-term deals, and as those computers got more powerful, software started to matter more. A pure software company has higher margins, and thus more ability to take risky bets, than a software-and-hardware company, particularly one that’s constantly adjusting its overhead in light of lower and lower market share.

IBM was the most profitable company in America in 1985, but by the early 90s, IBM was losing money. It reported what was then a record annual loss for any US corporation in 1992. The company eventually stabilized, by divesting some money-losing businesses and focusing more on corporate clients. (It also started to focus more on buybacks, even though an early buyback program in the 80s was one reason IBM was somewhat capital-constrained at the dawn of the PC era.)

It’s exceptionally hard for a company to adjust to no longer dominating its industry. That’s especially difficult when the nature of the industry changes; caring about PCs was low-status relative to worrying about mainframes until the growth of the PC market was impossible to ignore.

Relative to the other stories of compounders-gone-bad, IBM ends up being the most impressive of the lot. It had an incredible stretch of nonstop growth, and that stretch started after the company pivoted from one sector it was influential in, punched-card machines, to a completely new one it had to catch up in. IBM’s ability to keep growing while disrupting itself, and juggling antitrust restrictions, is simply astounding. While it’s not nearly as influential as it once was, there was indeed a good reason that, for a very long time, nobody got fired for buying IBM.

Tyler Durden

Sat, 03/06/2021 – 22:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com