PIMCO Rings The Alarm Over China’s Sliding Credit Impulse

Three months after Zero Hedge subscribers were first made aware of the biggest risk for the global economy, Pimco has finally caught up and is ringing the alarm as noted in the latest observations from Bloomberg macro commentator Ye Xie titled “Pimco Warns of Risks From Beijing’s Credit Curtail.”

1. Beijing sounds less sanguine about 2021.

The government set the growth target this year at “above 6%,” well below economists’ forecasts of 8%. A 6% year-on-year GDP expansion implies zero growth from Q4 2020. Meanwhile, the budget deficit is pegged at 3.2% of GDP, lower than the record 3.6% last year, but higher than the 3% consensus. Taken together, the government seems less upbeat than most economists.

Granted, 6% is the floor, not the ceiling for growth. Beijing may have intentionally set a low bar this year so that it could target a similar growth rate in 2022 to project the image of stability. The economy may turn out to be stronger.

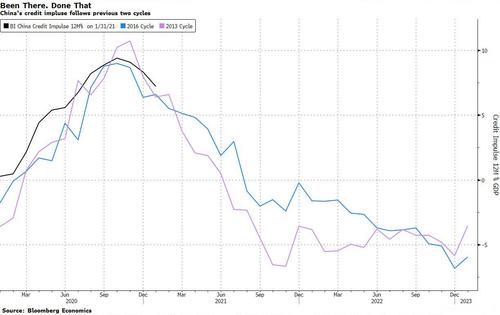

In any case, even if the government ensures it won’t yank stimulus abruptly, gradual tapering in credit growth is already well under way. As first discussed in December in “In Historic Reversal, China’s Credit Impulse Just Peaked: What This Means For Global Markets“, China’s credit impulse, or the change of new credit as a percentage of GDP, peaked in October and is following the similar downward path of the previous two credit cycles in 2013 and 2016. At this rate, the gauge could turn negative in the second half of the year.

In a note on Friday, Pimco estimated that the credit impulse will fall to -3.5% of GDP by year-end, from a peak above 9% in 2020. All else equal, it may slow China’s economy to below-trend levels by late 2022, the firm’s Gene Frieda and Carol Liao wrote.

What does this mean? Tighter liquidity is likely to lead to stress in China’s corporate debt market, they wrote (echoing what Zero Hedge wrote in December). While a soft-landing is achievable and the yuan remains attractive, the drag from China’s economy next year suggests that “developed economies may require stimulus for longer than currently appreciated.”

2. The path of least resistance is for bond yields to move higher.

Jerome Powell reiterated that the Fed is in no rush to reduce stimulus, but declined to say that rising bond yields are inconsistent with the central bank’s objective. That essentially gives the market a free rein to push yields higher, keeping Treasuries as the potential source of volatility for other markets.

Chinese bonds remain insulated from the global bond rout, given they have largely priced in economic normalization.

3. The trade-weighted yuan rose amid a stronger dollar.

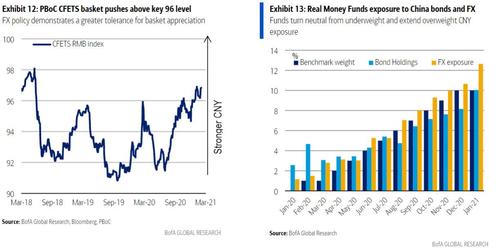

While rising yields lifted the dollar, the yuan managed to outperform other currencies, sending the trade-weighted yuan close to the highest since 2018. The foreign bond inflows continue to be supportive. “Real money” investors, such as pension funds, have boosted their overweight on the yuan to the highest level since JPMorgan included Chinese bond in its benchmarks in February 2020, according to Bank of America.

Tyler Durden

Sun, 03/07/2021 – 21:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com