Futures Soar After China’s Plunge Protection Team Props Up Markets

Sometime trading really is this easy. Literally minutes after we predicted last night that it was just a matter of time before central banks step in to halt the rout…

In theory a continued collapse in the QQQ will crash the S&P, DJIA, and everything else.

In practice, the Fed will never allow it. We are within 2-3% of the Fed’s red line for QQQs

— zerohedge (@zerohedge) March 9, 2021

… Beijing did just that when shortly after China’s markets reopened on Tuesday (a little after 9pm ET), Bloomberg reported that state-backed funds – i.e., China’s Plunge Protection Team – had intervened to shore up the market in morning trading. The funds, known as China’s “national team,” had stepped in order to ensure stability during the National People’s Congress in Beijing, Bloomberg reported citing “according to people familiar with the matter” with a Hong Kong-based trader saying entities linked to mainland funds were actively buying shares through stock links with Hong Kong Tuesday morning.

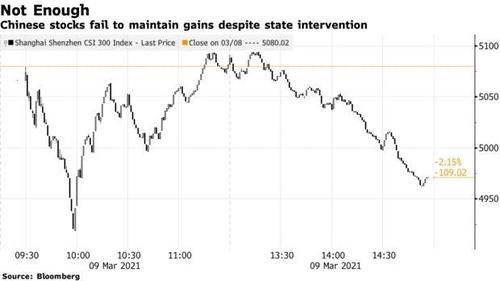

And just like that, moral hazard was baaack front and center…. yet it wasn’t enough. While the news helped Chinese stocks erase losses of as much as 3.2%, declines then resumed in the afternoon and China’s CSI 300 Index closed about 2.2% lower with Kweichow Moutai the stock that’s become an indicator of sentiment in China’s mutual fund industry, falling 1.2%…

… it halted Monday’s tech rout and sent S&P futures 1% higher.

At 7:25 a.m. ET, Dow E-minis were up 167 points, or 0.5%, S&P 500 E-minis were up 40 points, or 1.05% and Nasdaq 100 E-minis were up 279 points, or 2.3%. Tesla advanced about 4%, while Apple Inc, Amazon.com Inc, Facebook Inc and Microsoft Corp jumped about 2% each in early trading. It wasn’t just Tesla: all electric-vehicle firms rebounded Tuesday amid a slew of industry news that could impact their shares: Nikola +4.7%, Nio +4.7%, Li Auto +4.6%, Xpeng +6.4%, Workhorse +3.4%, Lordstown Motors +6.3%. Cathie Wood’s flagship exchange-traded fund Ark Innovation ETF, which has Tesla as its largest holding, gained 4.9%. Both are set to open higher after five straight days of declines.

Yield-sensitive Nasdaq 100 futures futures rebounded about 2% on Tuesday, a day after a steep selloff, as U.S. bond yields retreated and investors scooped up beaten-down technology stocks. Meme stock Gamestop was set to gain for the fifth consecutive session, up 16.4% at $226.47 premarket, building on Monday’s 41.2% gain after the company said it had tapped shareholder Ryan Cohen to lead a shift towards e-commerce.

China’s PPT intervention did as much to ease rising yields with the 10Y slumping 8bps overnight, dropping as low as 1.52% ahead of tomorrow’s CPI report and closely watched 10Y auction.

Signs that the $1.9 trillion coronavirus relief packaged was close to final approval sparked a spike in yields on Monday, pushing the tech-heavy Nasdaq to close in an official correction, down more than 10% below its Feb. 12 closing high. Higher yields weigh even more on high duration tech and growth stocks with lofty valuations, as they threaten to erode the value of their longer-term cash flows.

“The firesale in many big tech names has been driven by fears of how higher yields will damage the attractiveness of these high flyers,” said Chris Beauchamp, chief market analyst at IG in London. “But with many now much cheaper (compared to where they were) some will be eyeing up the sector, even if only for a quick rebound.”

Bizarrely, the Nasdaq rout took place even as the Dow Jones hit an intraday record high in the previous session as investors favored stocks primed to benefit from an economic reopening; such an gaping divergence had not been seen since 1993.

Europe’s (mostly value) stocks were a sea of green for the second day in a row with the Stoxx 600 Energy advancing 1.7% in early trading, tracking a recovery in oil prices and bucking a broad commodity rout. Royal Dutch Shell +2.1%, Vestas Wind +4.7%, BP +1.1%, Total +0.7%, Siemens Energy +4.2%, Eni +1%. Shell contributes the most to the index increase. Here are some of the biggest European movers today:

- Pandora shares jump as much as 7.8% after the Danish jeweler publishing a trading update for February. DNB said the month’s growth rates are better than feared, indicating strong online sales with store closures still at a high level.

- Siemens Energy shares gain as much as 5.8% as Jefferies says the company’s return potential is being materially underestimated by the market. The broker raised its price target.

- Orsted shares rise as much as 5.4% after HSBC upgrades the wind farm operator to buy with the recent selloff in its shares meaning future growth is being undervalued.

- JDE Peet’s shares plunge as much as 9.8% after the coffee company lowered its medium- to long-term outlook and reported disappointing 2020 growth.

- IWG shares drop as much as 8.6% with RBC saying the flexible office space provider’s FY results were weaker than expected and its outlook for FY21 cautious.

- Continental shares fall as much as 7.1% after the German tire and car parts maker released 4Q results and 2021 forecasts that Oddo said were “both significantly below expectations.”

The euro zone economy contracted more than previously estimated in the last three months of 2020 against the previous quarter, revised data showed on Tuesday, as household consumption plunged because of COVID-19 lockdowns. “The Q4 data is already quite old, but it might act as a reminder that the euro zone is going to be a laggard in terms of growth in 2021,” said ING rates strategist Antoine Bouvet. But he added not too much should be read into the data, because stocks are up and the rally could be as much led by U.S. Treasury yields. Major government bond yields around the world tend to track each other as many investors switch between them.

Earlier in the session, Asian stocks looked set to snap a three-day slide as shares of financial and industrial companies rallied. A measure of financial names was the top performer among subgauges on the MSCI Asia Pacific Index amid expectations that higher yields will boost earnings. AIA Group was the biggest contributor to the regional benchmark’s advance, followed by SoftBank Group and Toyota Motor. Equity gauges in Japan and Singapore rose more than 1% each to lead gains among national benchmarks in Asia, while those in South Korea and China dropped. The CSI 300 Index ended 2.2% lower despite evidence that China’s state-backed funds had intervened to shore up the market in morning trading.

Emerging-nation stocks and currencies swung between gains and losses as the dollar stumbled and traders weighed the potential impact of planned U.S. bond auctions on riskier assets. A gauge of developing-nation currencies trimmed losses of as much as 0.5% to trade little changed after three days of declines. The dollar fell for the first session in five. After weak U.S. auction demand last month rattled riskier assets, emerging-market investors will be taking their cues from $120 billion of bond sales due in the coming days. Developing currencies may struggle to recover after coming under pressure from the greenback’s four-day advance, while the premium demanded to hold emerging debt over U.S. treasuries widened by two basis points on Tuesday. “The dollar strengthening is also raising pressure on emerging-market currencies, which remain subject to large daily swings,” Unicredit economists and analysts including Edoardo Campanella wrote in a note. Speculation the Chinese central bank may be “biased against further monetary easing,” isn’t helping, they said.

As noted above, in rates it was all about China’s intervention: the 10Y Treasury bond yield eased to 1.53%, 6 basis points lower than its highest level this year with block trades in Treasury futures bolstering the flattening move. Euro zone government bond yields dipped across the board on Tuesday as revised data showed that the region’s economy ended 2020 worse than previously estimated, and with U.S. Treasury yields dropping before a key auction. Germany’s 10-year government bond yield dropped 4 basis points to -0.322%, moving further away from the one-year high of -0.203% in late February. Other euro zone bond yields were also down between 4 and 6 basis points across the board. Semi-core and peripheral spreads tightened to core with 10y BTP/bund ~2bps narrower near 101bps.

Investors will be closely watching Treasury sales in the coming days, with the U.S. planning three debt auctions totaling $120 billion centered around Wednesday’s 10Y TSY auction. The sales will test appetite for the safest debt after last month’s poorly bid auctions sent shockwaves throughout global markets and short bets climbed to a record.

In FX, the dollar weakened against all of its Group-of-10 peers with risk-sensitive Scandinavian currencies leading gains. Turkey’s lira was the best performer among peers, while South Africa’s rand advanced after better-than-forecast economic growth in the fourth quarter. The Norwegian krone rallied against a backdrop of better-than- forecast GDP data and more upbeat outlook for economic activity. The Australian dollar rebound amid a short squeeze, even as iron ore futures took a beating on concerns over Chinese demand. The pound rose for the first time in five days as the U.K.’s successful vaccine rollout and a weaker dollar buoyed sterling. The yen advanced versus the dollar for a first day in five after earlier falling to a nine-month low. According to Ueda Harlow manager Soichiro Mori, the dollar is poised to keep strengthening against the yen as Japan’s institutional investors appear to be holding back on their hedge sales. Institutional investors may be retaining dollars in their accounts and looking for opportunities to reinvest in overseas assets.

The yuan rebounded after Chinese state funds intervened in the stock market, and gains in regional equity indexes bolstered risk sentiment. The USD/CNY dropped 0.2% to 6.5155, swinging from an intraday high of 6.5445; USD/CNH falls 0.4% to 6.5231, snapping a five-day winning streak. The headline that China state funds intervened to alleviate the stock market declines during the National People’s Congress helped narrowed the renminbi loss, Ken Cheung, chief Asia currency strategist at Mizuho Bank Ltd, wrote in a note.

Bitcoin flirted with the $54,000 level and hit a two-week high Tuesday, aided by more signs of institutional interest in the largest cryptocurrency.

In commodities Brent crude climbed to $69, rebounding from a 1.6% drop Monday. Crude hit its highest since the start of the pandemic on Monday after Yemen’s Houthi forces fired drones and missiles at Saudi oil sites on Sunday. Saudi Arabia said it thwarted the strike and prices slipped as supply fears eased. Brent crude was up 89 cents, or 1.3%, at $69.13 by 1200 GMT, after trading as low as $67.61. It reached to $71.38 on Monday, its highest since Jan. 8, 2020. West Texas Intermediate added 82 cents to $65.87, after hitting its highest since October 2018 on Monday.

“Dips have been lately viewed as buying opportunities,” said Tamas Varga of broker PVM. “Last week’s OPEC+ meeting will ensure that the global oil balance will get tighter in the foreseeable future.”

Looking at today’s calendar, the main highlight will likely be the German export and trade balance data for January, the industrial production in Italy, also for January, as well as the eurozone export data and the final Q4 GDP reading. The OECD publishes its interim economic outlook. The US 3yr auction will also be a highlight.

Market Snapshot

- S&P 500 futures up 1% to 3,857.50

- MXAP up 0.4% to 203.51

- MXAPJ little changed at 677.78

- Nikkei up 1.0% to 29,027.94

- Topix up 1.3% to 1,917.68

- Hang Seng Index up 0.8% to 28,773.23

- Shanghai Composite down 1.8% to 3,359.29

- Sensex up 1.0% to 50,941.72

- Australia S&P/ASX 200 up 0.5% to 6,771.16

- Kospi down 0.7% to 2,976.12

- Brent futures up 1.2% to $69.06/bbl

- Gold spot up 1.1% to $1,702.80

- U.S. Dollar Index down 0.3% to 92.03

- SXXP Index up 0.4% to 418.87

- German 10Y yield down 3 bps to -0.31%

- Euro up 0.4% to $1.1897

Top Overnight News from Bloomberg

- Even with the recent spike that saw the 10-year rate top 1.6%, Treasury yields haven’t been this low relative to U.S. economic growth estimates since 1966. That suggests the climb in rates may still have room to run

- Treasuries traders are awaiting three U.S. debt auctions totaling $120 billion in coming days that have the potential to trigger another round of bond selling if demand starts to falter

- A U.S. recovery turbocharged by President Joe Biden’s stimulus package will help power a faster than expected global economic upswing that risks leaving Europe behind, according to OECD forecasts.

- One of the takeaways from the annual National People’s Congress under way in Beijing is a conservative growth goal, with a tighter fiscal-deficit target and restrained monetary settings. That’s a big contrast with Washington, where President Joe Biden is preparing a second major fiscal package after he gets final approval for his $1.9 trillion stimulus

- China’s CSI 300 Index closed about 2.2% lower despite evidence that state-backed funds had intervened to shore up the market in morning trading. The news earlier helped the gauge erase losses of as much as 3.2%, before declines resumed in the afternoon

- Shorting the dollar was a popular Wall Street call, but back-to-back monthly gains is proving painful. Net speculative short positions has dropped by almost $6 billion by one gauge based on data compiled from the Commodity Futures Trading Commission, leaving nearly $25 billion on the table

- The Bank of England is moving to tamp down talk about rising interest rates and inflation, focusing attention on risks to the U.K. economy as it struggles to emerge from lockdown. That includes unemployment that’s likely to rise and remain high for months to come, indicating little to push up the pace of consumer price gains

- The European Union is selling more social bonds, a test for the robustness of demand at a time when investors are turning away from government debt

- The Covid-19 vaccine from Pfizer Inc. and BioNTech SE showed a high ability to neutralize coronavirus strains first detected in Brazil, the U.K. and South Africa, according to a new study

A quick look at global markets courtesy of Newsquawk:

Asian equity markets traded choppy following the mixed lead from Wall St where the DJIA outperformed to post a fresh record high but its major counterparts were pressured especially the Nasdaq 100 which slumped by nearly 3% amid a heavy rotation out of tech and into value. ASX 200 (+0.5%) was supported by strength in cyclicals and with the largest weighted financials sector atoning for the losses in tech and mining names, while M&A prospects also provide a boost with Westpac underpinned after reports that Dai-Ichi Mutual Life Insurance is thought to be interested in its life insurance business and Vocus shares surged on news it is to be acquired by a consortium including Macquarie Infrastructure and Real Assets and Aware Super. Nikkei 225 (+1.0%) was choppy as participants digested soft data including a wider than expected contraction in Household Spending and downward revisions to Q4 GDP, although a weaker currency was the determining factor in keeping the index afloat. Hang Seng (+0.8%) and Shanghai Comp. (-1.8%) were varied with initial pressure due to continued tech woes as the Hang Seng Tech Index initially slumped by more the 4% shortly after the open before staging a full recovery which also inspired a turnaround in the city’s benchmark, while the mainland bourse dropped by around 2% before briefly rebounding on reports that China state funds were said to be purchasing domestic equities after a worsening of the plunge. Finally, 10yr JGBs were softer following the prior day’s late selling and comments from BoJ Deputy Governor Amamiya that the March review will discuss whether to increase the 10yr JGB yield target band and clarified that last week’s comments by Governor Kuroda was him voicing his personal view when he leant back from the idea of widening the band. Nonetheless, prices were off their lows but with the rebound limited by resistance at 151.00 and following weaker results at the 5yr JGB auction.

Top Asian News

- Worst-Performing Asia Stock Index Turns Winner on Value Love

- Top Glove Profit Blows Out Analyst Estimates as Sales Surge

- Korean Three-Year Bonds Slide as Markets Add to Rate-Hike Bets

- Investors Dump $2 Billion India Stock, Bond Funds After Budget

European stocks trade mostly higher but off best levels (Euro Stoxx 50 +0.3%) after recovering from modest opening losses following yesterday’s European rally and amid a mixed APAC handover. US equity futures meanwhile are higher across the board with outperformance seen in the NQ (+2.0%) after cash Nasdaq closed in technical correction territory yesterday amidst the rotation out of the highly-valued large tech firms and into value stocks – pushing the DJIA to fresh highs. Back to Europe, stocks see varying degrees of gains, with the SMI (-0.1%) in the red as heavyweight Novartis slumps (-1.2%) after its Phase III CANOPY-2 trial failed to meet its endpoint. Sectors in Europe now present a more pro-cyclical bias, compared with a somewhat directionless open with Tech outperforming, closely followed by Oil & Gas and Travel & Leisure; whilst the other side of the spectrum sees Banks and Basic Resources at the bottom amid pullbacks in yield and base metal prices. Over to individual movers, Continental (-6.8%) is pressured post-earnings after it did not declare a dividend for 2021, but looks to resume payments as soon as is possible. In terms of banking commentary, Citi suggests that all USD 9bln Euro Stoxx 50 futures shorts above 3,700 are in losses and “liable to unwind in a short squeeze that could support markets through the week”. The bank also sees futures positioning supportive for S&P 500 but would be on the lookout for a break below 3,750 which would increase downside risks.

Top European News

- Rolls-Royce’s Norway Asset Sale to TMH of Russia Hits Hurdle

- ITV Avoids Committing to Dividend Despite Advertising Bounce

- Russia Secures Sputnik Italy Production in European Vaccine Push

- ION Capital, GIC Offer to Buy Italy’s Cerved for $2.2 Billion

In FX, the DXY charts will say that the index breached a key Fib retracement level and crossed another semi-psychological barrier at 92.500, but the lack of follow-through buying suggests that bullish technical momentum was already fading, and the Dollar may have over-extended gains or simply rallied too far in short order. Whatever the reason, 92.506 appears to have been a turning point and the DXY is now testing 92.000 to the downside (91.949 low to be precise) amidst a broad Greenback retreat vs major peers, EM currencies and precious metals that were undermined by the post-US jobs data ratchet higher in yields.

- AUD/NZD/GBP – Aside from the Buck reversal, marked improvements in NAB business conditions and sentiment have boosted the Aussie before attention turns to remarks from RBA Governor Lowe, with Aud/Usd retesting 0.7700 from the low 0.7600 zone that has formed a base of late, while Aud/Nzd continues to pivot 1.0750 due to Kiwi underperformance following declines in ANZ business confidence and the activity outlook rather than a sharp slowdown in NZ manufacturing sales. However, Nzd/Usd has bounced firmly following several retreats towards last Friday’s trough just under 0.7100 to hover above 0.7150, and Sterling has also survived latest attempts to fill 1.3800 bids on the way back up to touching 1.3900 in the run up to comments from BoE’s Haldane.

- EUR/CAD – Also clawing back lost ground vs their US counterpart as bonds regroup and some consolidation sets in before this week’s headline events, like US CPI and the BoC tomorrow and then the ECB policy meeting on Thursday. The Euro is eyeing 1.1900 again and Loonie 1.2600 from nearer big figures below in both cases and the latter also gleaning some encouragement from a recovery of sorts in crude prices.

- CHF/JPY – The Franc has pared some losses from 0.9375 to clamber back over 0.9350 and the Yen from sub-109.00 in wake of a downgrade to Japanese Q4 GDP and significantly weaker than consensus household spending for the month of February through 108.60 at one stage.

In commodities, WTI and Brent front-month futures have recovered off the APAC lows with upside owing to Dollar weakness coupled by broader upside across equities, before the complex saw tailwind from the OECD forecasts. The complex saw losses overnight as Texas continues to recover from its recent deep-freeze, while some also question how long OPEC+ can cap output against the backdrop of mass vaccinations and reopening economies. Meanwhile, desks are also flagging the impact of a sustained underlying rally on inflation and headaches it may cause central banks during the recovery phase. Crude markets experienced a leg-higher after the OECD raised its Real GDP forecasts vs its December release – pointing to a faster than expected recovery and also addressing one of the worries highlighted by OPEC in recent months, in reference to a sluggish recovery the cartel voiced as a risk due to intermittent lockdowns. Elsewhere, the morning saw commentary from Libya’s NOC head who suggested the country’s output will be raised to 1.4mln BPD (from some 1.3mln BPD recently), although this did little to sway prices. Nonetheless, WTI April reclaimed a USD 65/bbl handle (vs low USD 64.34/bbl) whilst its Brent April counterpart resides around USD 69/bbl level (vs low USD 67.61/bbl). Elsewhere, spot gold and silver benefit from the broader Dollar softer as the yellow metal regains a footing above USD 1,700/oz (vs low 1680.30/oz), whilst silver gains further ground above USD 25.50/oz (vs low 25.04/oz). Over to base metals, LME copper remains subdued after relinquishing the USD 9,000/t mark, despite the risk appetite and softer Buck. Elsewhere, Dalian iron ore fell some 10% overnight after China’s largest steel-making city Tangshan announced anti-pollution restrictions.

US Event Calendar

- 6am: Feb. Small Business Optimism 95.8, est. 97.0, prior 95.0

DB’s Jim Reid concludes the overnight wrap

You are starting to see genuine rotation coming through now in markets. As I highlighted in my CoTD yesterday (link here), up until February 12th, pretty much everything had gone up in risk terms since the Pfizer/BioNTech vaccine efficacy numbers broke on November 9th. So rather than rotation I would say it was extra buying in some areas relative to others but everything was benefiting as inflows surged. Yesterday exaggerated the trend of the last 3-4 weeks with the S&P 500 closing down “just” -0.54%, compared to the far larger declines in the NASDAQ (-2.41%) and the NYFANG+ index (-5.19%). As a measure of the divergence the equal weight S&P 500 was up +0.66% and the old economy weighted DOW climbed +0.97%, highlighting that it was the huge mega-cap stocks that were mostly suffering. In fact, two-thirds of the companies in the S&P 500 actually rallied yesterday, despite the pullback. In terms of industries, 16 of the 24 S&P 500 level two sectors were higher on the day led by consumer durables (+1.86%) and banks (+1.79%), which rallied to its highest level since July 2007. The big laggard from an industry perspective were semiconductors, which fell -5.31% and erased all of its 2021 gains. Europe was up big (Stoxx 600 +2.10%) partly due to the heavier weighting towards cyclicals but also due to the S&P 500 climbing nearly +3% on Friday afternoon from the lows immediately after Europe closed.

Stepping back, the NASDAQ and NYFANG+ are now down -10.5% and -16.6% respectively from their mid-February peaks with Tesla seeing a -36.3% decline from its late January highs (-5.84% yesterday). Over the same mid-Feb to current period, US and European Energy are up +20.2% and +11.6% respectively with US/EU banks +12.6% and +13.9%. The S&P 500 and Stoxx 600 are down -2.88% and -0.53% over the same period but 59% and 57% of stocks in these indices are up, which reflects how challenging it is for the overall index to rise when the mega-cap (mostly US tech) stocks are struggling. For now though we can certainly call this rotation. It’ll be interesting to see whether fresh stimulus cheques can offset the impact of higher yields for this group which have been the darlings of the retail sector. Talking of retail, Gamestop is back in the limelight having rallied +41.2% yesterday to rise above $190/share for the first time since February 1. The stock is still down nearly -60% from its all-time intraday high, but it is now up +378% from its mid-February lows. So this story continues to linger in the background.

Market moves within fixed income were more subdued but it was another day of higher yields with 10yr US treasuries rising +2.5bps to 1.591%, their highest since mid-February of last year on the back of expectations that President Biden’s $1.9tn covid stimulus package will become law this week. The final stage is for the Democrat-controlled House of Representatives to give its consent today, following the successful vote in the Senate over the weekend.

The next hurdle for fixed income are this week’s auctions. The US treasury department is set to issue $120bn of new bonds over the course of the next few days, selling $58bn of 3-year notes (today), $38bn in 10-year debt (tomorrow) and $24bn at the 30-year mark (Thursday). These will be keenly watched for clues as to demand.

In Europe, sovereign bond yields rose as the ECB’s PEPP increased by just EU11.9bn – the slowest pace since early January. 10yr bund yields rose +2.5bps, and French 10yr OATs rose +1.7bps while UK gilts (-0.2bps) and Italian BTPs (+0.2bps) were largely unchanged. Elsewhere in fixed income, credit spreads have started to move slightly wider, especially in the US where US IG cash spreads widened +4.5bps to 101bps – the widest high-grade spreads have been since just before Christmas. US HY cash was +4.7bps wider, while Europe saw just +1bps and +2bps moves respectively.

Oil prices fell back sharply after the initial Asia Monday rise following the attack on Saudi Arabia’s energy facilities over the weekend. Saudi Arabia said that oil production in the Kingdom has not been affected and that the distribution from the Ras Tanura area had continued as of Monday evening. The attack that was claimed by Iran-backed Houthi fighters in Yemen sent Brent crude up to over $71/bbl briefly, before reverting course and settling down -1.61% on the day to $68.24/bbl, having closed at roughly 21-month highs on Friday.

Overnight in Asia markets are trading higher after reversing moves lower at the open. The Nikkei (+0.92%), Hang Seng (+1.04%) and Shanghai Comp (+0.07%) are all up as we type. An exception to this pattern is Kospi which is down -0.3%. The reversal in Chinese stocks came this morning after the country’s state backed funds intervened in the markets to alleviate declines in the stock market. This helped Chinese stocks to erase deep declines from the open with the CSI around -3% lower at one stage and Shanghai Comp around -2.5% earlier. Meanwhile, futures on the S&P 500 are up +0.77% while those on the Nasdaq are up +1.21%. 10yr treasury yields are just under -3bps lower overnight.

On a topic that straddles Asia, Europe, climate change, ESG and inflation, today the Deutsche Bank Mining team is hosting an expert call at 15:00 GMT to discuss climate policies in Europe and China and the implications for key metal markets (registration link here). With Europe expected to table a proposed carbon border tax in Q2 and China continuing to release new policy details, there could be major ramifications for basic materials, industrials and the end consumer. Developments this year will be a key test of whether governments can successfully convert climate ambition into effective policies. It may have inflationary implications too.

Staying with inflation there was a big bid-offer from BoE Governor Bailey yesterday who signalled renewed concern about the possibility of rising inflation as the UK recovers from the coronavirus crisis, saying that the risks are now “increasingly two-sided”. Speaking at a Resolution Foundation event, Bailey said the central bank was not about to raise interest rates in response to a rapid recovery and would need to see “clear evidence” that inflation would be sustainable at the 2% target before the central bank decided anything. But he highlighted that the BoE was undertaking work both on the preparations for negative rates if the recovery disappointed and on how best to tighten policy if rapid spending growth rose inflationary pressures. So all options are being considered! Secretary Treasury Yellen on the other hand shared her successor’s views on inflation. During a TV interview on the new Biden Stimulus package, Secretary Yellen said that the current package is unlikely to cause inflation, but that there are tools to deal with inflation if it were to arise.

Turning to the pandemic, yesterday we found out that Americans who have been vaccinated against covid can now visit the homes of other vaccinated people or even unvaccinated people who are at low risk of serious disease, according to new guidelines from the US public health authorities. And high school students in New York City will return to classrooms this month, Mayor Bill de Blasio announced. In Florida, the eligibility age for vaccines dropped to 60 from 65, with the government citing “softening demand” in the 65+ age bracket. In Europe, Italy has approved the use of AstraZeneca’s vaccine for the majority of those over the age of 65. Elsewhere the lockdown in the Netherlands has been extended to the end of March, but they will ease some restrictions, even as President Rutte signalled that some curbs will be in place for at least four more months as vaccinations continue. The curfew remains in place but some retail shopping will be allowed along with outdoor recreation with four or fewer people.

Looking at yesterday’s economic data, a report released by the US Commerce Department confirmed on Monday that wholesale inventories rose 1.3% month-on-month in January. In Europe, total industrial output in Germany, fell 2.5% month-on-month in January, having risen the month before, while Spanish industrial output declined by 0.7% in January.

To the day ahead now, and the main highlight will likely be the German export and trade balance data for January, the industrial production in Italy, also for January, as well as the eurozone export data and the final Q4 GDP reading. The OECD publishes its interim economic outlook. The US 3yr auction might also be a highlight.

Tyler Durden

Tue, 03/09/2021 – 07:51![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com