Goldman Does The SLR Math, Stumbles On An Huge, $2 Trillion Problem

Last week, ahead of Jerome Powell’s Thursday zoomconference with the WSJ, we wrote why “The SLR Is All That Matters For Markets Right Now.” Unfortunately, neither Jerome nor his hapless WSJ interviewer addressed this $64 trillion elephant in the room, but that doesn’t mean it has gone away and on the contrary, as Goldman’s banking analyst Richard Ramsden writes today, “investor focus on the implications of SLRs approaching minimum requirements and avenues of potential relief has intensified” in light of:

- FDIC Chair McWilliams’ statement that banks do not need further SLR relief at the bank sub level, and

- Senators Brown and Warren’s letter to the Fed requesting no further relief.

Echoing our view, Ramsden then says that he continues to see the SLR as the most important balance sheet constraint for banks, and one which could require the largest banks to:

- issue preferred equity;

- turn away deposits or otherwise optimize balance sheets; and

- downstream capital to bank subs, reducing the amount of excess capital that can be distributed to shareholders.

Ramsden then calculates balance sheet caps across US banks, and finds that while Morgan Stanley could offset much of the pressure by downstreaming capital and meet dividend and buyback forecasts, “absent mitigation, BAC, C, and JPM would end 2021 below SLR minimum requirements (plus a 25bps management buffer) and would have to either slow balance sheet growth, issue pref., or some combination of both.“

In English, what this means is that absent a Fed extension of the SLR exemption, banks will need to aggressively deleverage as soon as April 1 – and perhaps in the days ahead of it if no relief seems likely – such deleveraging would take place while the Fed continues to flood the financial system with $120 billion in reserves every single month until such time as it announces its tapering plans and crashes the bond market.

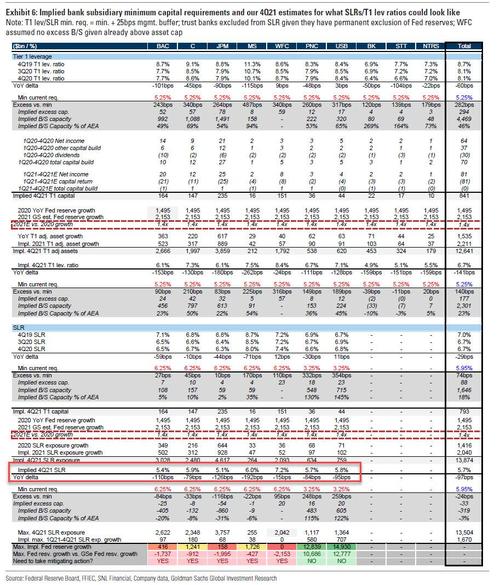

Now this is a problem because as Ramsden calculates based on Goldman’s assumptions for $2.2tn in Fed reserves growth driving $2.0 tn in SLR exposure growth (which is roughly equivalent to deposit growth) “we estimate that, absent mitigation and any further regulatory relief, JPM’s bank sub SLR would end 2021 at 5.1%, BAC at 5.4%, C at 5.9%, and MS at 6.0%”

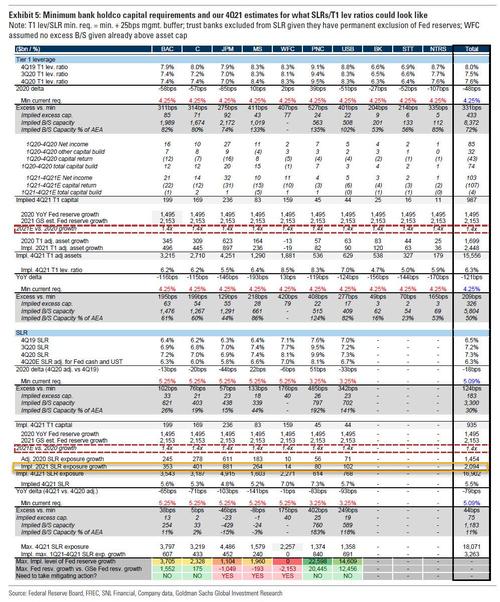

There is some good news: simply downstreaming capital would reduce excess capital for these banks, but also appears to be a feasible form of mitigation. Even if these banks chose to partially offset their SLR issues to the extent possible by downstreaming equity, rather than other mitigation strategies, Ramsden says that “they would not cross any of the double leverage bright lines that regulators examine when assessing the riskiness of a bank, which in our mind also suggests limited impact on investor perception.”

A bank holdco is considered to have double leverage when this ratio exceeds 100%, and double leverage above 120% could prompt additional regulatory scrutiny. On our math, the large banks are 37pp below the 120% level, and even if they downstreamed the maximum estimated amount of capital from the holdco to the bank subs above holdco/bank sub SLR mins., they remain 36pp below the 120% limit.

Alas, the bigger problem is that based based on Goldman’s analysis, the bank does not believe that JPM, BAC, and C could resolve SLR issues at their bank subs solely by downstreaming capital as the amount of capital shortfall at the bank sub is greater than the amount of excess that could be downstreamed from the holdco.

As a result, Goldman believes that the largest US banks will need to mitigate the SLR pressure in ways that have a “greater market and profitability impact” (i.e. dump risk assets), specifically:

- issuing preferred equity;

- “optimizing” the balance sheet through turning away deposits or shrinking short term financing (the former is more likely); and

- reducing capital return in the form of buybacks.

Ramsden believes that option (3) remains least likely, given that new issue pref. is significantly less expensive than the common equity that they are repurchasing (3.5-4% yield vs. ~10% implied cost of common equity).

Consequently, the Goldman analysts expects that JPM, BAC and C will focus on a combination of 1) and 2).

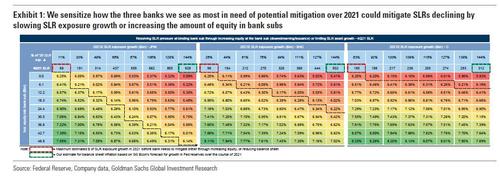

Stepping back to look at the bigger picture reveals something even more troubling: Goldman estimates that BAC, C, and JPM could add only a fraction of our forecasted SLR exposure growth, consistent with the bank’s forecasts for 2021 growth in Fed reserves before needing to mitigate:

- Goldman’s current model assumes more than $900bn of deposit growth at JPM, $500bn at BAC and more than $300bn at C

- However, the bank estimates that JPM/BAC/C could see only ~$70bn/~$100bn/$180bn of bank sub SLR exposure growth before approaching the minimum SLR requirement (including a 25bps management buffer).

For context, JPM’s paltry $70BN of capacity compares to a massive $644BN of growth over the course of 2020 and an even more massive $928bn in growth forecast for 2021. In fact, Goldman calculates that these banks could see this level of growth within the next couple of months alone. Worse, Citi could fall below regulatory minimums if one includes a 25bps management buffer in the requirement.

This means that in order to be able to soak up the reserve tsunami that is still coming, banks will need to issue more equity all else equal.

To calculate how much, Goldman notes that to fully mitigate further expected pressure on SLR, JPM, BAC and C could have to issue pref., in combination with significantly slower growth in their deposit base relative to our estimates: “We note that in the past, JPM has been able to significantly optimize its B/S due to regulatory constraints. They reduced deposits in 2015 by >$250bn in light of the then new G-SIB constraint.”

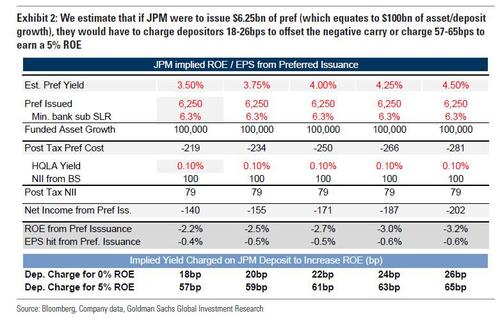

So given the 6% minimum SLR at the bank sub (and a 25bps management buffer), each $100bn of deposit growth equates to $6.25bn of pref. issuance (Exhibit 1).

Assuming that the bank wished to offset the cost of carrying the pref., Goldman estimates that each $6.25bn of pref issuance would require charging 18-26bps on deposits. Alternatively, if the company were to earn a 5% ROTCE on levering up its pref (which is well below the banks’ ~10% cost of common equity), they would have to charge 57bps-65bps on deposits.

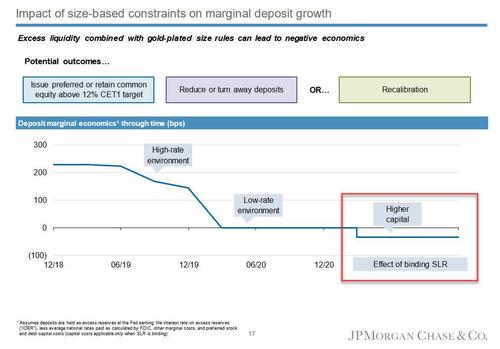

Yes, this means that banks would have to quickly shift to negative deposit rates, something which JPM already hinted in its Q4 earnings presentation it may have to do in a world of higher capital and where the SLR is not extended.

Finally, Ramsden says that banks could simply shift deposits off the balance sheet and into UST money market funds instead.

But wait, it gets worse. According to the Goldman strategist, further exacerbating this pressure across the group is WFC’s inability to expand its balance sheet at all — recall that WFC is at its Fed-mandated B/S cap and already conducted significant mitigation in 2020 to reduce deposits and repo to keep its B/S below the cap. While there have been recent press reports around positive steps for WFC towards eventual lifting of the asset cap, the timeline for further developments remains uncertain, and it could be at least a number of months if not quarters, until resolution.

Finally, Goldman cautions that a number of other leverage constraints limit bank balance sheet growth capacity and would require additional regulatory and legislative changes to fix — specifically the explicit Tier 1 leverage ratio requirement and the implicit leverage capital requirement in the form of the G-SIB buffer. These requirements, Ramsden warns, “could become binding and require mitigation from trust banks over the course of 2021.”

But the biggest challenges is that given that Fed reserve growth leads most directly to growth in trust deposits – meaning unless banks are able to soak up trillions in deposits the Fed will have a tough time with extending QE simply due to clogged plumbing – once BAC and JPM reach their maximum deposit growth levels, much of Goldman’s forecasted deposit growth would likely occur at the trust banks (BK, NTRS and STT), which have permanent exemption of Fed reserves from their SLRs and temporary exemption of UST.

However, even here we run into a problem as there is a limit to the amount of excess deposit capacity that trust banks could absorb, as they are subject to another set of leverage ratios (the GAAP, or T1 leverage ratios) that do not exempt Fed cash or USTs. In fact, based on Goldman forecasts, trust banks’ excess balance sheet capacity could fall from ~$200bn as of 4Q20 to a ~$35bn shortfall as of 4Q21E absent mitigation.

To amend this constraint too, legislative action would be required. In addition, the banks remain subject to the implicit leverage requirement through the G-SIB buffer, which uses the SLR denominator in its calculation. Unless the same exemption of central bank cash and US Treasuries that we saw in the Fed’s SLR rule is applied to the G-SIB buffer, this would be another constraint limiting banks’ willingness to expand their balance sheets.

Summarized: Goldman’s calculations raise several major concerns in the event that the SLR exemption which expires in March 31 is not extended. Such a legislative fiasco could lead banks to be limited to how much deposits they can accept (which in turn is a binding constraint on how much QE the Fed can do), and unless banks deleverage and/or issue tens of billions in stocks – either preferred or common – while halting all stock buybacks, there is simply no capacity to maintain the Fed’s current monetary policy. One final option banks have to turn back the tidal wave of deposits and force these to be parked elsewhere: launch negative deposits rates, something which JPM already hinted could be coming.

Bottom line: we have three weeks until a potentially calamitous event takes place and unless the Fed steamrolls political opposition from both the FDIC and progressive Senators Brown and Warren, the US banking sector will suddenly find itself with a $2 trillion capacity shortfall making it virtually impossible to continue the Fed’s monetary policy, and forcing QE to grind to a halt.

Tyler Durden

Tue, 03/09/2021 – 13:29![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com