Morgan Stanley Expects US To Grow Faster Than China In 2021

Last Friday, at the start of its latest Five-Year Plenum, aka National People’s Congress, China’s government surprised markets when it announced a paltry 6% growth target for 2021 (which however did not stop if from also revealing a five-year plan and vision for 2035 that aims to expand China’s global footprint as a major technology power).

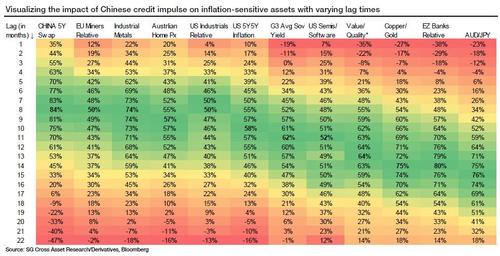

That number is a big problem for several reasons, first and foremost of because as Michael Every explained this morning, it means that China’s credit impulse is about to collapse.Overnight, China’s central bank – the PBOC – announced it would keep growth of both money supply and aggregate financing broadly in line with that of nominal GDP. This, as the Rabo strategist said “is **STAGGERINGLY** contractionary given the last 12-month rolling aggregate financing figure was 35% y/y, the series average back to 2004 is 15%, and the most optimistic nominal GDP print one could expect would be 9% – and even that only for 2021, with something far lower further out.”

As Every concluded, paraphrasing what we warned back in December, “it seems there is going to be an aggressive crackdown on leverage – and growth will follow. And then so will global growth with a lag. And so will the likes of AUD, etc.” This is another way of saying what we showed in December – namely the upcoming rapid slump in China’s credit impulse – also pointing out that virtually every asset in the world will be impacted the slowdown in China’a credit impulse with a lag anywhere from 1 month to 2 years.

But there is another, even more bizarre, consequence of China’s 6% GDP target: according to the latest, just released US economic forecast from Morgan Stanley, the US will – for the first time ever – grow faster than China in 2021: according to MS chief economist Ellen Zentner, the US “reopening is progressing, the rate of vaccinations is ramping up, and the labor market is gaining momentum.”

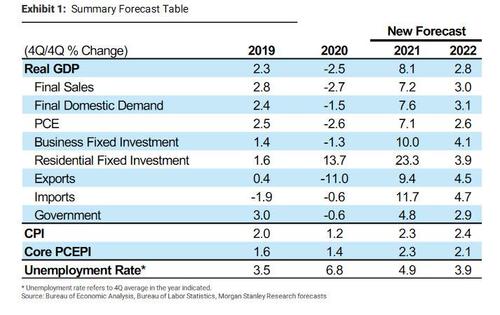

As a result, the investment bank is taking up its 2021 GDP forecast by 0.5% to 8.1% 4Q/4Q (+0.8pp to 7.3%Y). And while the US may indeed grow faster than China in 2021 as a result of the massive fiscal and monetary stimilus injections, all this will reverse in 2022, when Morgan Stanley lowered its forecast by 0.1% to 2.8% 4Q/4Q (-0.3pp to 4.7% Y).

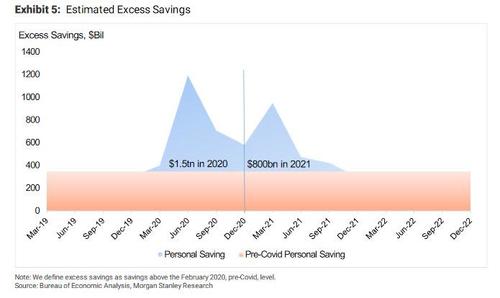

As Zentner notes, US GDP “is now on track to reach its pre-Covid level by the end of the current quarter, with a positive output gap of 2.7% in 4Q21, and 3.6% in 4Q22.” If one incorporates the bank’s updated expectations for spending and income this year, Zentner expect excess savings in Q1 21 to total $600bn and a further $130bn in Q2 21.This would be added on top of the estimated excess savings of $1.5Tn accumulated in 2020.

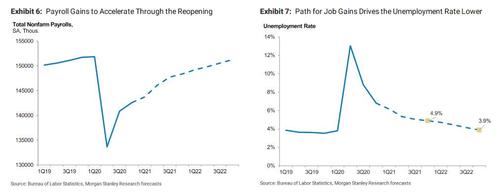

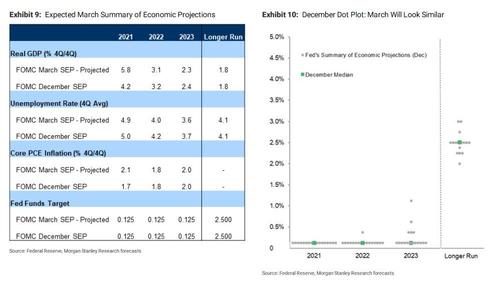

Meanwhile, on the labor front, Morgan Stanley expects that a more robust return to work will be offset somewhat by rising labor force participation, “but economic activity is strong enough to still generate a sharp decline in the unemployment rate throughout our forecast horizon.” As a result, the bank expects the unemployment rate to average 4.9% in 4Q21 (vs 5.1%, previously), falling further to 3.9% in 4Q22 (4.0% previously). . On an annual basis, MS sees the underlying unemployment rate falling from 10.5% in December 2020 to 6.1% by December 2021, showing a more substantial improvement, then falling to around 4.0% as it closes in on the as-reported unemployment rate by the end of 2022.

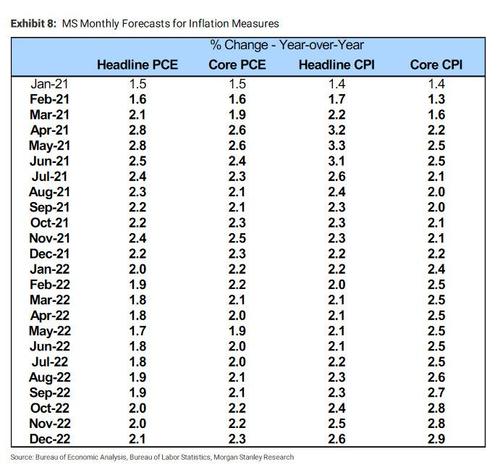

So between blistering economic growth and tumbling unemployment, what does that mean for inflation? According to Zentner, now that the US is set to surpass China as the world’s fastest growing economy if only for a few quarters, the bank expects significant price adjustments to come this year that sends core PCE to a near-term peak of 2.6%Y in April/May, before backing off to end the year at 2.3%Y (bringing a 2.3% quarterly average).

Where MS differs from the Fed which sees no cyclical inflation anywhere, the bank expects a more sustainable inflationary impulse to start taking shape in 2021 “led by shelter inflation, healthcare services, and a multi-quarter pass through of dollar weakness into goods.” The sustainable inflation impulse intensifies in 2022 as cyclically sensitive inflation components start to dominate – based on a tightening labor market and still robust levels of demand. Ultimately, the bank sees core PCE ending 2022 at an overheating 2.3%, well above the Fed’s inflation target of 2.0% (which is precisely why the Fed made sure to give itself buffer not to hike with its new average inflation targeting policy).

What is remarkable is that despite clearly admitting the US is set to overheat if only for one year, Morgan Stanley says that “there is nothing in the outlook that changes the Fed’s message of patience on the back of a dismissal of inflationary pressures as transient, and the improvement in the labor market and rising inflation expectations being a good start.”

So in a world where the US grows faster than China yet where the Fed sees this as perfectly normal, all eyes now turn to the March FOMC were MS expects policymakers “will show an updated Summary of Economic Projections (SEP) with the majority of dots still firmly anchored at the zero lower bound through the end of 2023, alongside higher growth as FOMC participants onboard the stimulus package, and even some acknowledgment of emerging upside risks for near-term inflation. Policymakers will use this new dot plot to double down on dovish guidance, indicating that even after incorporating more fiscal stimulus, vaccine progress, and the latest inflation outlook,policymakers still see interest rates on hold for the foreseeable future.”

What happens next?

Well, unless the Fed wants to really teach China’s who’s boss and have the US economy literally explode in a hyperinflationay civil war in a couple of years when the S&P is at 1 trillion, it will have to tighten eventually. First, it will taper, then it will hike rates:

Tapering: After the March FOMC the Fed’s job this year does not get any easier. As Zentener correctly writes “a sharper turn upward in the data as we move further into the spring coupled with a fresh round of stimulus means financial markets are likely to constantly test the Fed’s patience.” But that won’t happen for a while.

Outlined in the FOMC statement, the Fed “will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability Morgan Stanley assumes the Fed will see this substantial further progress over the course of this year, and expects that by the middle of the year the cloud of Covid will have thinned and the recovery will have picked up meaningfully enough that the Fed will see it as appropriate to begin taking its foot off the gas pedal and Chair Powell will indicate tapering could be on the horizon.

We would take such a message – likely delivered atthe June FOMC meeting – to indicate the start of tapering in January 2022 by reducing the pace of the Fed’s asset purchases by $10 billion Treasury/$5 billion MBS per meeting.

Translation, brace for a bond market crash some time in the second half as we replay the Taper Tantrum on steroids.

Rate Hikes: While tapering may be about a year off, liftoff remains a long, long way off – some time in Q3 2023 according to Morgan Stanley – which continues to expect a very gradual pace of policy normalization that is indicative of the general dovish shift in the Fed’s reaction function. Look for the June FOMC dot plot to first show a median of one Fed hike before the end of 2023, but it is the September FOMC meeting this year, when the Fed first publishes its 2024 forecasts that it can use the dot plot to redefine gradual in this cycle.

* * *

For all those wondering what China will be doing during this self-imposed slowdown when its credit impulse plunges and turns negative, sending its economy on the verge of a recession, stay tuned for a subsequent post in which we analyze what it means for the US to be growing near double digits which China approaches a hard landing.

Tyler Durden

Tue, 03/09/2021 – 18:25![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com