Nasdaq Futures Plunge As Bond Rout Sends 10Y Treasury To 1.75%

It started off well enough, with futures initially continuing their post-FOMC ascent and lifting global markets.

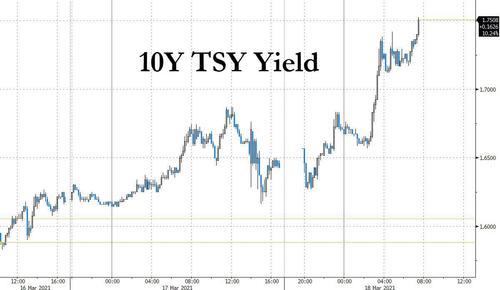

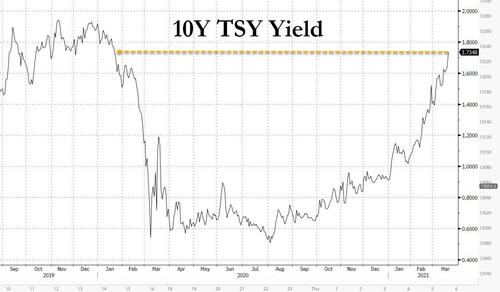

However, It all reversed sharply during the Asian session driven by a sharp spike in the 10Y TSY, which initially jumped following a Nikkei report that the BOJ readied to adjust monetary policy and will look at measures that will allow long-term interest rates to move in “a slightly larger range of about 0.25%, versus 0.2% now” in order to make life easier for financial institutions. The news, which came during the Japanese trading break forced local traders to sell US paper instead. The selloff then accelerated sharply when Europe opened, and pushed the 10Y as high as 1.75%, a level which BofA two weeks ago said was the “tipping point” for bonds…

… the highest level since Jan 2020, while the 30-year topped 2.5% a level that hasn’t been seen since August 2019

The algos took one look at the fresh surge in yields and dumped risk assets with a focus on high duration “bathwater” tech names, slamming Nasdaq 100 futures 1.7% lower….

… while Emini S&P futs were set to fade the entire post-FOMC move.

While big U.S. banks, that are sensitive to economic outlook, including JPMorgan, Bank of America, Citigroup and Goldman Sachs were among the top gainers in early premarket trade, momentum and growth darling Tesla slumped again in pre-market trading. Other yield-sensitive tech stocks such as the FAAMGs all dropped between 0.8% and 1.7% in premarket trading. Meme stock GME rallied as much as 5% before settling around $216 premarket.

The Dow on Wednesday surpassed 33,000 points for the first time after the Fed projected strongest growth in nearly 40 years as the COVID-19 crisis winds down while forecasting no rate hikes through 2023. While inflation is expected to exceed the Fed’s 2.0% target to 2.4% this year, Fed Chair Jerome Powell views it as a temporary surge that will not change the central bank’s stance. The Federal Reserve’s apparent willingness to keep pumping support into the economy and let it run hotter has spurred betson faster growth and inflation, sending market expectations of price pressures to multi-year highs.

“Rising real rates have created a hostile environment for longer-duration growth factors,” Jonathan White, head of investment strategy at AXA IM Rosenberg Equities, wrote in a note. “Looking ahead we continue to believe the environment should favor value stocks over growth stocks” White added echoing what has now become consensus sentiment across trading desks.

Despite the slump in futures, global stock markets edged higher on Thursday after the U.S. Federal Reserve promised to keep its support in place.

MSCI’s 50-country world index was near record highs after the Fed had lifted Wall Street and Asia overnight and Europe opened with Germany’s DAX at a record high. European automakers, banks and other cyclical stocks led gains. The Stoxx Europe 600 was up 0.3% to 426.37. Here are some of the biggest European movers today:

- Volkswagen common shares, preference shares and the stock of majority holder Porsche SE all continue the week’s rally, with analysts at Barclays and Bernstein pointing out a growing valuation discrepancy between VW’s common stock and its largest holder, Porsche SE, making the latter an attractive investment.

- Sartorius Stedim shares rise as much as 9.1% and Sartorius AG jumps as much as 13% after the medical and lab- equipment companies raised their 2021 forecasts, citing increased demand due to the coronavirus pandemic.

- BMW shares gain as much as 3.9% with Bernstein highlighting the carmaker’s potential to deliver “exciting and scalable e-mobility,” while giving its PT on the stock a big boost.

- Holmen shares rise as much as 6.3% after Danske Bank upgraded the stock to buy from hold, seeing potential for upside in the share price in the coming year.

- The Stoxx Europe 600 Media Index jumps as much as 1% to reach its highest intraday level since Feb. 6 2020, recouping all of its pandemic losses. The sector gauge is set for its highest closing level since 2015.

- Zur Rose shares slumps as much as 9.3% with Barclays saying the online pharmacy firm reported “disappointing margins,” though long-term commentary is “encouraging.”

Asian stocks climbed toward a two-week high while Japan’s Topix jumped past the 2,000 mark for the first time since 1991, becoming the region’s top-performing major equity index this year. Internet stocks, which were previously hammered by a spike in U.S. Treasury yields, contributed the most to the MSCI Asia Pacific Index’s gain on Thursday. Reflation trades abated, with Commonwealth Bank of Australia and India’s Reliance Industries Ltd. among the heaviest drags on the region’s benchmark. Hong Kong’s Hang Seng Index led advances in Asia, with the gauge up 1.3%, extending its longest streak of gains in a month. Japan’s Nikkei 225 Stock Average pared gains, trading near its highest level in three decades. Key equity gauges in Indonesia and Vietnam rose more than 1%. India stocks extended declines for a fifth day, dragged down by Infosys Ltd.

The U.S. central bank sees the economy growing 6.5% this year, which would be the largest jump since 1984. Inflation is expected to exceed its preferred level of 2% to 2.4%, although it is expected to drop back in subsequent years.

“I don’t know what the Fed can do to stop a rise in yields that is based on stronger fundamentals,” said BCA chief global fixed income strategist Rob Robis, pointing to the $1.9 trillion U.S. stimulus package that will drive growth. “The path of least resistance is still towards higher yields,” he said. “The U.S. Treasury market leads the world and every bond market responds.”

As noted above, the move in rates was the highlight of the session with Treasuries extending the bear-steepening move unleashed by Wednesday’s FOMC decision during London morning; intermediate sectors led losses, sending 10-year yields above 1.70% for the first time since January 2020 after Fed policy makers increased their inflation forecast without anticipating a rate increase by 2023, greenlighting a steeper Treasuries curve.

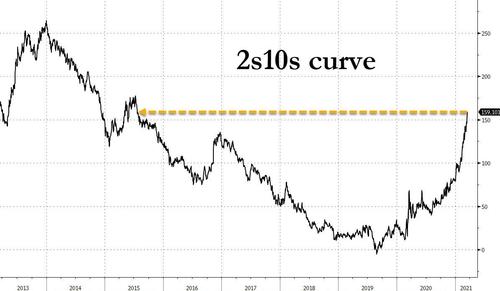

Yields traded near session highs are cheaper by 1.5bp to 9bp across the curve with 10s leading the move, lifting 5s10s30s fly above 10bp for the first time since 2014; 10-year yields topped at 1.742% while 30-year yields approached 2.51%. Treasury 2s10s slope, higher by ~8bp near 160bp, is steepest since 2015, while the 2s10s rose as high as 159bps.

Treasuries underperformed bunds by 6bp, gilts by 3bp in 10-year sector. After the Fed meeting Barclays strategists took profit recommendation to be long the 3-year Treasury while Morgan Stanley positioned for a Treasury 5s30s steepener.

In FX, the Bloomberg Dollar Spot Index swung to a gain and the dollar climbed versus most of its Group-of-10 peers as yields on the benchmark 10-year bond climbed as much as 10 basis points to 1.74%. A 25 basis-point hike by the first quarter in 2023 is still reflected in Eurodollar futures, which are priced off Libor and are a decent proxy for future borrowing costs, suggesting traders haven’t exactly brought their views on the timing that much closer to the central bank’s guidance. The euro retreated from a one-week high of $1.1989 while Norway’s krone rallied to a more than a one- year high of 10.0215 per euro after Norges Bank brought forward the timing of what will probably be the rich world’s first interest rate increase since the pandemic broke out. The pound was steady before a Bank of England policy announcement in which it’s likely to emphasize its high bar for tightening monetary policy, a move to tamp down speculation that a quick recovery will force policy makers to push U.K. borrowing costs higher; U.K. government bonds fell, underperforming bunds.

The Australian dollar rose to a two-week high of $0.7849 after data showed the nation’s economy created more than twice as many jobs as expected in February.. Its New Zealand counterpart lost momentum, however, after the country posted a surprise contraction in fourth-quarter GDP.

Elsewhere, oil slipped after U.S. crude stockpiles topped half a billion barrels and the International Energy Agency said global supplies are plentiful. Bitcoin traded around $59,000. The dollar ticked higher. Gold dipped 0.3% to $1,737 per ounce.

Another day of central bank action was in store too. The Bank of Japan and Bank of England are both meeting, Norway signalled a possible hike this year and in emerging markets Turkey’s central bank unexpectedly hiked by 200bps after a torrid month for the lira. The dollar index, which measures the greenback against a basket of its peers, rose as much as 0.4% to 91.671. It had dropped to 91.300 after Wednesday’s Fed meeting.

“Similar to what we’ve seen from the Fed, the Bank of England will talk up their prospects of the economy relative to where we’ve been, but at the same time emphasize that we’re still a long way from full recovery,” said Rodrigo Catril, senior currency strategist at National Australia Bank in Sydney.

Looking at To the day ahead, and the main highlight will be the Bank of England’s monetary policy decision, along with remarks from ECB President Lagarde and Fed Chair Powell. Other speakers today include ECB Vice President de Guindos and the Executive Board’s Schnabel and Elderson, along with BoE Deputy Governor Cunliffe and Chief Economist Haldane. Finally, data releases from the US include the weekly initial jobless claims, February’s leading index, and March’s Philadelphia Fed business outlook.

Market Snapshot

- S&P 500 futures down 0.3% to 3,960.50

- STOXX Europe 600 up 0.3% to 426.22

- MXAP up 0.8% to 209.99

- MXAPJ up 0.5% to 696.18

- Nikkei up 1.0% to 30,216.75

- Topix up 1.2% to 2,008.51

- Hang Seng Index up 1.3% to 29,405.72

- Shanghai Composite up 0.5% to 3,463.07

- Sensex down 1.2% to 49,219.15

- Australia S&P/ASX 200 down 0.7% to 6,745.91

- Kospi up 0.6% to 3,066.01

- Brent futures down 1.2% to $67.19/bbl

- Gold spot down 0.4% to $1,737.55

- U.S. Dollar Index up 0.2% to 91.63

- German 10Y yield up 2 bps to -0.27%

- Euro down 0.3% to $1.1948

Top Overnight News from Bloomberg

- The next round of ultra-cheap loans from the ECB could boost the allure of Italian and Spanish debt. The record levels of spare cash in the euro-area system are set to grow by as much as 300 billion euros ($357 billion) as banks seek funds with extended sweetener terms at Thursday’s ECB liquidity operation, according to Banco Santander SA. That would push overall excess liquidity toward 4 trillion euros

- The EU is bracing for a decision by its health regulator on whether AstraZeneca Plc’s Covid-19 vaccine is safe to use, a key step in the bloc’s efforts to move past a messy suspension by several countries. The European Medicines Agency, which has consistently backed the shot even amid concerns about the risk of blood clotting, will issue updated guidance on Thursday

- Beijing is seeking a meeting between Joe Biden and Xi Jinpingnext month if the first high-level U.S.- China talks in Alaska starting Thursday are productive, according to people familiar with the situation

A quick look at global markets courtesy of Newsquawk

The FOMC spurred the S&P 500 and DJIA to fresh record highs and provided a constructive backdrop for the Asia-Pac region. That said, the ASX 200 (-0.7%) failed to take advantage of this with the index dragged amid weakness across tech, financials, healthcare and property, while a blockbuster jobs report did little to spur the risk appetite in Australia. Nikkei 225 (+1.0%) reclaimed the 30k status amid favourable currency flows and as Japan makes final preparations to end the Tokyo state of emergency on Sunday, although the index then pared some of its gains after reports suggesting the BoJ is to widen the yield target band to +/- 25bps and scrap its JPY 6tln target for ETF purchases. Hang Seng (+1.3%) and Shanghai Comp. (+0.5%) were both positive but with gains in the mainland somewhat limited after China lowered the bar on expectations ahead of the US-China meeting in Alaska and stated it will not compromise with the US on sovereignty. It was also reported that the US Commerce Department served subpoenas on multiple Chinese companies that provide information and communications technology or services in the US and the FCC voted to adopt procedures to determine whether to revoke China Unicom’s authority to conduct wireless operations in the US. Finally, 10yr JGBs were initially stable as participants looked ahead to tomorrow’s BoJ conclusion, but then saw a bout of pressure on reopen from the lunch break following the source reports that the BoJ is to widen the yield target band and drop its ETF target which saw prices move lower by around 30 ticks before paring a majority of the losses.

Top Asian News

- Edelweiss Denies Probe Allegations at Unit After Shares Plunge

- China Takes Aim at a Booming $7 Billion Market for Dirty Oil

- Pressure Mounts on Toshiba CEO After Defeat in Landmark Vote

- Turkey Prosecutor Seeks to Shut Kurdish Party, Draws U.S. Rebuke

European equities opened the session with modest gains across the board (Euro Stoxx 50 +0.4%) and continue to inch higher, following on from APAC’s predominately firmer lead. APAC took its lead from Wall Street after the S&P 500 and DJIA reached fresh record highs following the FOMC’s rate decision and Fed Chair Powell’s press conference. Moreover, US yields saw considerable upside in early European trade, and at the time of writing, sit over 1.73% having had eclipsed 1.7450% at best. Thus, US equity futures have been giving back some of the aforementioned gains and currently all reside softer, with the tech-heavy NQ (-1.1%) the underperformer. Back to Europe, sectors opened mostly in the green with the underperformance in Food & Beverage (-0.4%) persisting throughout early European trade. Banks (+1.2%) are faring well due to the clearly favourable yield environment but they have since pared back a touch. Moreover, the Autos sector (+1.8%) is the clear outperformer which could be in part down to Porsche’s (+5.1%) and Volkswagen’s (+0.4%) earlier upside, with the latter’s Audi division also planning a disruptive entry into the EV market with some 20 EV models set for release by 2025. Note, BaFin said it is keeping an eye on Volkswagen share prices. Leading on from this, in-fitting with the upside seen in these Cos. the DAX (+1.3%) is the notable leading index on the day. Other notable gainers include Sartorious (+9.4%), which is led by the Co. raising its forecasts for FY 2021 and now sees revenue growth of around 35% against the prior forecast of 19-25%. The leading bank this morning is Deutsche Bank (+3.7%), as aside from the favourable economic environment, Board member Campelli stated the Cos. momentum has continued strongly into Q1 and revenues are up 20%. Lastly on the morning’s gainers, Adidas (+0.8%) are firmer after it was announced they are working with Peloton on an exclusive apparel line. Onto the downside, Elekta (-1.4%) are softer after influential bank JP Morgan downgraded the Co. to underweight in a broker move. National Grid (-0.1%) are also residing in the red which could be factored down to the Co. proposing the acquisition of Western Power Distribution for GBP 7.8bln, which would see an outflow of funds.

Top European News

- Casino Is Said to Weigh Paris IPO for Renewable Arm GreenYellow

- Danske Bank Faces Long Road Back as Fine Seen Hitting $1 Billion

- Norges Bank Proves Its Hawk Status as Rate Hike Moves Closer

- BT Says New Fiber Rules Are Green Light to ‘Build Like Fury’

In FX, the Buck has bounced firmly on the back of the latest rout in bonds that has shunted benchmark Treasury yields up towards and beyond levels that many are flagging as potentially pivotal for overall risk sentiment, and in context of repercussions for other asset classes, like equities. Specifically, the 10 year cash rate is now approaching 1.75% and 30 year briefly breached 2.5% to widen spreads between USTs and global counterparts even further, such as T-note/Bund out to 200 bp. Hence, the DXY has reclaimed 91.500+ status from a 91.300 low, and the Euro is one of the major casualties given its prominent weighting in the index. However, the Greenback still has some way to go before retrieving all its losses in wake of ‘dovish’ Fed dot plots ahead of IJC, the Philly Fed and February’s leading index.

- NOK/AUD – In stark contrast to unchanged rate guidance from the FOMC (albeit a few more policy-setters leaning towards an earlier start to normalisation), latest projections from the Norges Bank indicate that lift-off may now come at the end of this year compared to mid-2022 previously and the path going forward has been tilted accordingly – see 9.00GMT post on the Headline Feed for more details and links to the March policy statement and MPR. In response, Eur/Nok is back below 10.0500 and has been under 10.0200, but still not quite close enough to test the symbolic 10.0000 mark. Elsewhere, the Aussie is also a G10 outperformer and managing to stay above 0.7800 vs its US rival following a pretty resounding labour report in terms of the key metrics that smashed consensus forecasts, and with the impressive headline payrolls beat all down to full time jobs.

- CHF/EUR/NZD/JPY – Little independent impetus for the Franc via mixed Swiss trade and producer/import price data as Usd/Chf pivots 0.9250 and Eur/Chf straddles 1.1050 even though the Euro continues to hit technical resistance ahead of 1.2000 vs the US Dollar amidst pandemic waves and vaccine shortages. Moreover, heavy option expiry interest at the 1.2000 strike (1.3 bn) looks almost as overbearing as those at 1.1900 (1.6 bn) that could underpin Eur/Usd. Back down under, the Kiwi has been undermined by much weaker than expected NZ Q4 GDP, leaving Nzd/Usd nearer the base of a 0.7217-69 range and lifting Aud/Nzd through 1.0800.

- JPY/SEK – The Yen has been volatile between 108.62-109.32 parameters against the Buck post-Fed and pre-BoJ eyeing US-Japanese yield differentials that were diverging further until a Nikkei report hit screens claiming that a new 10 year band for the 10 year JGB could be set at +/- 25 bp. However, Usd/Jpy has returned to the 109.00 axis that has been the focal point for trade of late and is close to the 200 WMA, in keeping with Eur/Sek around 10.1500 after somewhat conflicting Swedish jobs data and findings from a Riksbank survey of large businesses.

- GBP – Sterling has had another look at key or significant peaks vs the Greenback and Euro circa 1.4000 and 0.8541 respectively, but its fate from a UK standpoint could lie in the hands of the BoE at midday – checkout our preview via the Research Suite or Headline Feed.

In commodities, WTI and Brent front month futures were initially subdued in early European trade as an early spike in yields prompted downside in stocks and a firmer Buck, albeit crude-specific news flow has remained light throughout the session thus far. From a more fundamental standpoint, eyes continue to remain on the OECD inoculation, namely in some of the larger Eurozone countries, amid the temporary halt of the rollout of the AstraZeneca jab due to reports of blood clots, thus providing some headwind to the recovery momentum of the continent. Focus will reside in the European Medicines Agency’s (EMA) report on the matter, slated for around 1500GMT/1100EDT. The EMA could indicate potential groups at risk from the AstraZeneca COVID-19 vaccine, according to the Italian Medicines Agency. Aside from that and barring any major macro headlines, prices are likely to follow the overall risk tone and the Dollar. That being said, energy contracts nursed those earlier losses as US participants entered the fray, with no direct newsflow to influence the rise. WTI May now trades on above of USD 64.50/bbl (vs low USD 63.79/bbl) while its Brent counterpart meanders around USD 68/bbl (vs low 67.07/bbl). Elsewhere, spot gold and silver track the post-FOMC revival of the Dollar, with the former back below USD 1,750/oz (vs high USD 1,755.50/oz), whilst silver holds its head just above USD 26/oz (vs high 26.631/oz). Elsewhere, Chinese ferrous metals were bolstered by the post-FOMC risk sentiment, whereby Dalian iron ore saw a firm performance alongside coking coal, steel rebar, hot rolled coil and shanghai stainless steel futures. However, the base metal complex has been feeling the weight of the yield-related jittery sentiment, with LME copper trading just off session lows after briefly dipping below USD 9,000/t.

US Event Calendar

- 8:30am: March Initial Jobless Claims, est. 700,000, prior 712,000

- 8:30am: March Continuing Claims, est. 4.03m, prior 4.14m

- 8:30am: March Philadelphia Fed Business Outl, est. 23.2, prior 23.1

- 9:45am: March Langer Consumer Comfort, prior 49.4

- 10am: Feb. Leading Index, est. 0.3%, prior 0.5%

DB’s Jim Reid concludes the overnight wrap

The FOMC was the week’s big event and seemed to deliver on the dovish-goldilocks scenario that markets were hoping for. The heavily-watched dot plot showed the FOMC leaned toward keeping rates unchanged through 2023 despite their upgrades to the economic outlook, with the median dot still showing rates on hold at end-2023, in spite of anticipation that they might show liftoff by that point. Their forecasts now show unemployment failing to 4.5% by the end of this year and 3.5% in 2023, while GDP is expected to expand by +6.5% in 2021, well ahead of December’s estimate of +4.2%. In the ensuing press conference Chair Powell said that “The strong bulk of the committee is not showing a rate increase during this forecast period” – specifically until after 2023, and he added that it was “not yet” the time for them to discuss reducing asset purchases. On the topic of inflation, the FOMC’s forecast saw their preferred measure of inflation spiking to 2.4% in 2021, before slowing to 2% next year. Our US economists have more details on the outcome here, and in response they’ve pushed back their expectations of the first rate hike from Q3 2023 to mid-2024.

The meeting was a small step towards trying to be credible on its average inflation targeting message that Fed officials have been embracing since Jackson Hole. At the moment this is all fine if the Fed’s assumption that any inflation is transitory is proved correct. However if the market doubts the transitory nature of inflation at any point that’s when the fun and games start. We’re not there at the moment however.

Proving this point, risk assets finished the day higher and bond yields fell after a sharp sovereign sell-off prior to the meeting. Starting with equities, the S&P 500 was down -0.57% just ahead of the Fed announcement before rising to flat nearly immediately following the statement’s release. The index then finished up +0.29% at yet another record high, after the press conference went without any hitches. Tech saw an even bigger turnaround as the NASDAQ was down more than -1.4% early in the US session before finishing up +0.40%. The heavily concentrated NYFANG index rose +1.50% on the day and climbed along with US banks (+0.89%) as the majority of the US equity market found a reason to rally. And on top of all this, the VIX index of volatility fell -0.56pts to a fresh 1-year low of 19.23pts.

US Treasuries witnessed a strong bear-steepening before the Fed’s decision with yields on 10yr Treasuries up +6.9bps to a 13-month high of 1.687% ahead of the announcement. They then rallied after the announcement before coming back up slightly to finish +2.5bps higher on the day at 1.643%, though this morning they’re up a further +2.6bps to 1.669%. Real yields drove the bulk of the increase yesterday, with 10yr breakevens up just +0.5bps. US 2yr note yields were flat ahead of the meeting, but ended up -1.4bps lower afterwards as markets reappraised the odds of rate hikes by the end of 2023. That said, even with the median dot showing rates on hold through end-2023, markets are still pricing in a more rapid liftoff than the FOMC are currently indicating, with two hikes priced in by the end of 2023. The decline in 2yr yields saw the 2s10s curve steepen further (+4.4bps) to levels (150.9bps) not seen since August 2015, while the dollar saw a steep drop, falling -0.67% from just prior to the FOMC to end -0.46% lower – the greenback’s worst day since early February.

Overnight in Asia, markets are following Wall Street’s lead with the Nikkei (+0.66%), Hang Seng (+1.51%), Shanghai Comp (+0.55%) and Kospi (+0.83%) all moving higher. Futures on the S&P 500 are trading broadly flat while those on Nasdaq are down -0.07%. Meanwhile, sovereign yields have inched higher with those on Japanese 10y up +1bp following a report from the Nikkei newspaper that the BoJ are likely to widen the trading range around its 10-year bond yield target to 0.25% either side of zero, up from 0.2% at the moment. The news also led to the Nikkei index paring some of its gains and comes ahead of tomorrow’s BoJ policy meeting where the central bank is due to announce the outcome of its policy review. Elsewhere, Australia’s 10yr is up +6.7bps as the country reported a strong February employment report with unemployment rate dropping to 5.8% (vs. 6.3% expected) as the previous month’s figure was also revised down a tenth to 6.3%.

In other news, the Wall Street Journal reported that China would seek a meeting between US President Biden and Chinese President Xi next month if the high-level talks between the two countries that start today in Alaska are productive. The report said that this could be organised around Earth Day on April 22, to indicate the leaders’ commitment to combating climate change.

In advance of the Fed, European equities were fairly steady yesterday but the STOXX 600 fell back -0.45% from its post-pandemic high the previous day. A big out-performer was Volkswagen (+11.04%) which was the strongest performer in the STOXX 600 as it overtook SAP as Germany’s most valuable public company. The moves have come after VW announced their plan to become the world’s leader in electric vehicles earlier this week. Over in rates meanwhile, sovereign bonds sold off across the continent, and by the close of trade, yields on 10yr bunds (+4.5bps), OATs (+4.9bps) and BTPs (+7.1bps) had all risen. This was before the Fed meeting conclusion though.

Bitcoin was up +2.42% yesterday to $57,751, its first daily gain since Saturday when it broke through $60,000 for the first time. On this topic Marion on my team has released the latest in her Future of Payments series yesterday, with the latest edition looking at Bitcoin. The cryptocurrency’s market cap of $1 trillion is making it too important to ignore, and prices could continue to rise as long as asset managers and companies continue to enter the market. Nevertheless, bitcoin transactions and tradability are still limited, and the real debate is whether rising valuations alone will be reason enough for bitcoin to evolve into an asset class, or whether its illiquidity is an obstacle. Click here to read more.

Looking forward now, today marks the much-anticipated verdict from the European Medicines Agency on their review of the AstraZeneca vaccine, following reports of blood clots that have led a number of European countries to suspend the jab. As we mentioned yesterday, it would be a big surprise if they were to withhold approval given the various statements since the start of the week, and the EMA’s statement on Monday said that their view remained that the benefits of the vaccine outweighed the risks.

Staying on the pandemic, there was yet another escalation of tensions between the EU and the UK yesterday after European Commission President von der Leyen refused to rule out using Article 122. If invoked, this would in theory allow the EU to take control of the production and distribution of vaccines, potentially placing export controls on vaccines that had been destined for the UK. The only time it’s previously been used was during the 1970s oil crisis, but von der Leyen said that “I am not ruling out anything for now because we have to make sure that Europeans are vaccinated as soon as possible.”

Speaking of the UK, today will also see the Bank of England’s latest policy decision, which is being announced at 12:00 London time. According to our UK economists (link here), the MPC will likely stick to last month’s script, keeping the policy rate on hold and the pace of asset purchases steady. However, similarly to the Fed, markets have brought forward their expectations for the next BoE rate hike since the last meeting, and now expect an initial hike within the next 2 years. And in another parallel, inflation expectations have also risen, with 10yr UK breakevens at their highest level since September 2008 yesterday, at 3.488%. Recent MPC speak has endorsed market pricing, but our economists expect them to walk a tightrope between talking up the recovery whilst avoiding too hawkish a message that would see an unwarranted tightening in financial conditions.

In the Netherlands, exit polls show that incumbent Prime Minister Rutte was set to return for a fourth term following the general election, with an Ipsos poll indicating his VVD party are set to gain 3 seats to 36 in the new parliament. In second place were the pro-European D66, while Geert Wilders’ PVV fell into third.

Looking at yesterday’s data, US housing starts and building permits fell by more than expected in February as the severe weather affected the data. Housing starts fell to an annualised rate of 1.421m (vs. 1.560m expected), and building permits were down to 1.682m (vs. 1.750m expected), though in both cases they were also coming off their highest rates since 2006 the previous month. Meanwhile in the Euro Area, the final CPI and core CPI readings for February were in line with the earlier flash estimates, at +0.9% and +1.1% respectively.

To the day ahead now, and the main highlight will be the Bank of England’s monetary policy decision, along with remarks from ECB President Lagarde and Fed Chair Powell. Other speakers today include ECB Vice President de Guindos and the Executive Board’s Schnabel and Elderson, along with BoE Deputy Governor Cunliffe and Chief Economist Haldane. Finally, data releases from the US include the weekly initial jobless claims, February’s leading index, and March’s Philadelphia Fed business outlook.

Tyler Durden

Thu, 03/18/2021 – 07:44![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com