Is Hyperinflation Really A Threat?

Authored by Lance Roberts via RealInvestmentAdvice.com,

Is hyperinflation a threat? While I was on vacation this past week, I got into a discussion on the issue.

This is how capitalism will end in the US

Same way it ended in Germany. pic.twitter.com/m3imOQJGDz

— HousePriceMania (@HousePriceMania) March 18, 2021

While the discussion ebbed between a broken financial system and capitalism’s failure, the gist was hyperinflation was coming. The measure of money in the system, known as M2, is skyrocketing, which certainly supports his concern. Now, with the Biden administration adding another $1.9 trillion into the economy, those concerns have risen.

In a recent Bloomberg interview, Larry Summers stated:

“There is a chance that macroeconomic stimulus on a scale closer to World War II levels will set off inflationary pressures of a kind not seen in a generation. I worry that containing an inflationary outbreak without triggering a recession could be even more difficult now than in the past.”

Are those concerns valid? Should we worry about a hyperinflationary surge like we saw in the late 70s? Or, are the deflationary pressures on the economy still present?

The Difference Between Inflation & Hyper-Inflation

Let’s start by defining the difference between an inflationary increase and hyperinflation.

Could repeated stimulus into the economy that exceeds the current output gap lead to a rise in inflationary pressures? Absolutely.

However, “hyperinflation” is not a threat. At least not yet.

“Hyper-inflation comes from a complete loss of faith in a currency from the threat of losing a war (Weimer Republic), an economic collapse, or some other catastrophic event. The U.S., even with all of our economic ills and woes, is still the safest place, in terms of liquidity, depth, and strength, to store excess reserves. The near historic low yield on government treasuries tells the story here.” – Real Investment Show

What is important is whether or not inflationary pressures, regardless of where they come from, have reached levels that could impact economic growth. While we see commodity-based inflation, primarily in food and energy, is that alone enough to offset the deflationary pressures we see economically from wages, debts, deficits, and rising dependency on social welfare?

Inflation is a function of three primary components:

-

The velocity of money,

-

Wages, and

-

Commodity prices.

The Velocity of Money

As I discussed in “2021 – A Disappointment Of Growth & Inflation,” monetary velocity is defined as:

“The velocity of money is important for measuring the rate at which money in circulation is used for purchasing goods and services. Velocity is useful in gauging the health and vitality of the economy. High money velocity is usually associated with a healthy, expanding economy. Low money velocity is usually associated with recessions and contractions.”

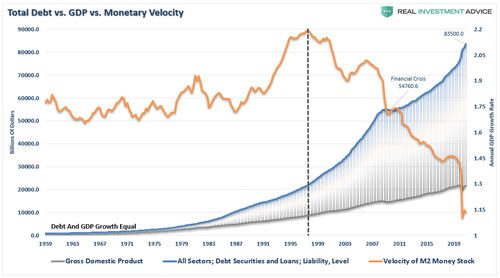

The chart shows what we have known for quite some time: money is not flowing through the system.

While there are many criticisms over this measure’s validity, it is a simplistic representation of demand. For prices across the entire spectrum to rise, there has to be more demand than supply. If the velocity of money is increasing, then “demand” in the system is growing. That increase in demand allows producers to raise prices and pass on costs to consumers.

Currently, companies are absorbing those costs, which eats into profit margins. To offset that increase, we have seen companies continuing to scale back employment, increase automation, and reduce CapEx. The decline in “activity” has worsened post-pandemic.

Wage Inflation

Secondly, to have “sustainable” levels of inflation, wages must be increasing.

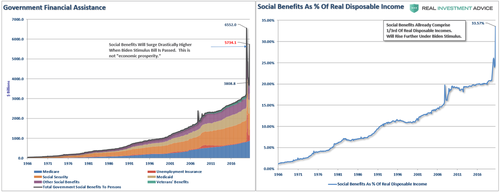

As wages rise, individuals can consume more, increasing aggregate demand, which, as noted above, leads to higher prices. Unfortunately, wage and salary disbursements, on a year over year basis, have been on the decline since 1980. Such remains commensurate with the weaker economic growth and declining monetary velocity.

While wages have turned up post the recessionary lows, they are still sharply lower than at the turn of the century. That deterioration in wages, combined with credit constraints, has continued to put pressure on producers’ ability to raise prices. As a consequence, we continue to see more reliance on discounting to move inventories.

Commodity Prices

Finally, commodity prices are the headline event that everyone notices. Rising costs of milk, bread, gasoline, and the essentials of survival slap them in the face daily. While deflationary pressures exist in everything from apparel to iPads – these items are not consumed daily, and the psychological impact gets felt far less. Nonetheless, commodity prices are essential in consideration of inflation due to the effect on personal incomes.

Since consumption is roughly 70% of the economic calculation, higher commodity prices, particularly food and energy costs, can have a “psychological” impact on consumers. Such is especially an issue if it occurs quickly. Consumers can adjust to higher prices over time as long as wages rise at a proportional rate; however, that is not the case currently. The increase in commodity prices has been such a focal point with the average “American.”

So, what is the risk of surging inflation?

The High-Inflation Index

None of these items, individually or collectively, point to hyper-inflation. However, to measure these components’ impact on the overall economy, I created a composite index of wages, commodity prices, and velocity. The index clearly shows the inflationary pressures of the late ’70s, which gives us a confidence level in the assumptions’ validity. The dashed line is the average level of the index since 1959.

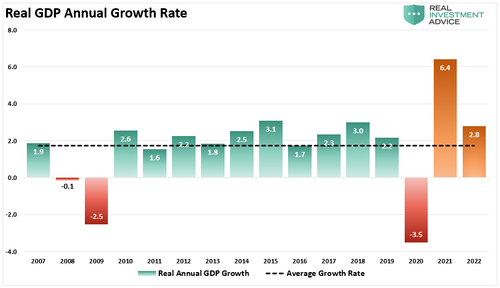

Importantly, there is a high correlation between the rise and fall of the index and overall real GDP growth. When the index has risen above its average level, the economy has begun to weaken or receded into recession. Currently, the inflation index is at 1.12, which well below the long-term average of 4.94.

The reading suggests what we already know. That since 2007, the average economic growth rate has been feeble at just 1.3%, or 1.7%, if we use estimates for 2021.

Secondly, while inflationary pressures are indeed rising short-term, we tend to agree with Jerome Powell’s assessment they could be “transient.”

There are three reasons for that statement:

-

Current inflationary pressures are a function of the stimulus flooding into the system, which is “transient.”

-

The economy is dependent on zero interest rates and $120 billion in monthly bond purchases, which suggests there is little if any, organic economic growth; and,

-

The enormous burden of debt continuing to depress economic growth, and notably, monetary velocity.

Conclusion

The threat of hyperinflation remains an outlier due to the economic detractors mounting over the last 40-years.

-

A decline in organic savings that depletes productive investments

-

An aging demographic that is top-heavy and drawing on social benefits at an advancing rate.

-

A heavily indebted economy with debt/GDP ratios above 100%.

-

The decline in exports continues due to a weak global economic environment.

-

Slowing domestic economic growth rates.

-

An underemployed younger demographic.

-

An inelastic supply-demand curve

-

Weak industrial production

-

Dependence on productivity increases to offset reduced employment

While the U.S. economy certainly has its share of problems, the U.S. is still the “cleanest shirt in a pile of filthy laundry.” With the Treasury still the safest source to store foreign currency reserves, at the moment, the likelihood of a complete economic meltdown is minimal.

Furthermore, due to the deflationary pressures that currently exist due to weak wage growth, automation, and mounting debts, it is unlikely that inflation can rise much before it triggers an economic contraction. Since interest rates adjust for inflation, a rise in inflationary pressures is a “double whammy” on consumption.

However, while the fears of a hyperinflationary event are overblown, other factors could be equally devastating to individuals and the economy.

The debt problem remains a massive risk to monetary and fiscal policy. If rates rise, the negative impact on an indebted economy quickly depresses activity. More importantly, the decline in monetary velocity clearly shows that deflation remains a persistent threat.

Tyler Durden

Sat, 03/20/2021 – 10:35![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com