China Credit Impulse Set To Collapse As Beijing Orders Banks To Curtail Loan Growth For Rest Of 2021

One month after global markets underwent a brief hiccup after China’s top banking regulator said he’s “very worried” about risks emerging from bubbles in global financial markets, Beijing is now looking inward and as the FT and Bloomberg reported, China’s central bank has asked the nation’s major lenders – which are all at least partially state-owned which means it wasn’t ‘asked’ but rather ‘ordered’ – to “curtail loan growth for the rest of this year after a surge in the first two months stoked bubble risks.”

The report goes on to note that at a meeting with the People’s Bank of China on March 22, banks were told to keep new advances in 2021 at roughly the same level as last year. The directive targeted not only domestic lenders but also “some foreign banks” which were also urged to rein in additional lending through so-called window guidance after ramping up their balance sheets in 2020.

As Bloomberg adds, the comments give further detail to what the central bank stated publicly after the meeting, when it said it asked representatives of 24 major banks to keep loan growth stable and reasonable.

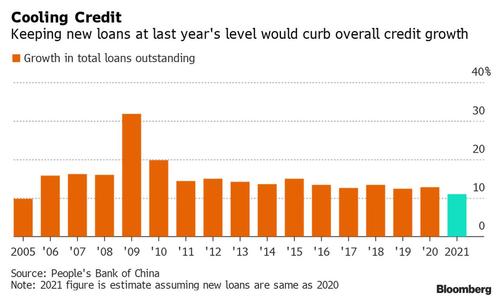

Some context: in 2020, the year when China’s economy slammed shut briefly before staging a remarkable debt-fueled comeback, banks issued a record 19.6 trillion yuan ($3 trillion) of credit, with about a fifth directed to inclusive financing such as small business loans. Lending the same amount this year would bring the outstanding balance to about 192 trillion yuan, an annual increase of about 11%, and the slowest pace in more than 15 years.

“On the one hand, there will be slowdown in loan growth, and on the other hand, the slowdown is quite moderate,” said Lu Ting, chief China economist at Nomura Holdings adding that the pace is line with the PBOC’s stance of making no sharp policy turns.

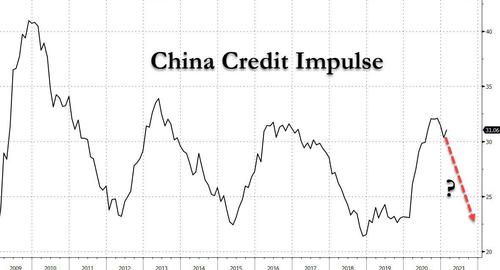

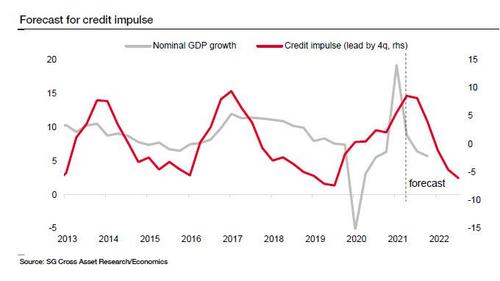

“Moderate” or not – and the slowest growth in 15 years is anything but moderate in our book – such a slowdown in credit creation would have dire consequences on China’s all-important credit impulse which, as we have profiled repeatedly in the past, is arguably the biggest driving force behind global reflation (or disinflation, as the case may be).

For regular readers this won’t be a surprise, as this credit slowdown is precisely what we warned about last December, when we said that “In Historic Reversal, China’s Credit Impulse Just Peaked.”

To be sure, China’s crusade to tame local credit is nothing new, and now that Beijing has contained the covid pandemic and the economy rebounding, Chinese policymakers have renewed their long-running campaign to curb risks, especially in the financial and real estate sectors.

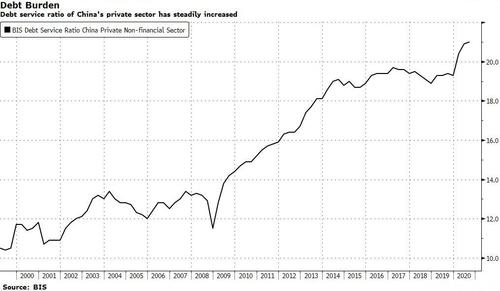

Meanwhile, even if credit growth eases, the prospect of higher interest rates and fewer soured assets may boost the profitability of banks, which saw earnings slump after they were enlisted to help borrowers obtain cheap financing during the pandemic. That said, with a record debt overhang and all time highs in the Chinese debt service ratio…

… Beijing is also limited in how much it can tighten financial conditions for a simple reason: China’s total debt increased 29% points last year to 315% of GDP, driven by companies and provincial governments borrowing during the pandemic, according to Citigroup. As such, the country can barely afford higher rates (as was discussed last week in “Record Leverage Means No Policy U-Turn For The PBOC.)”

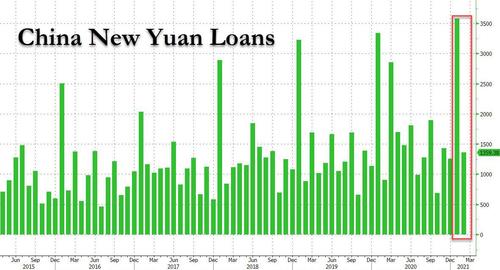

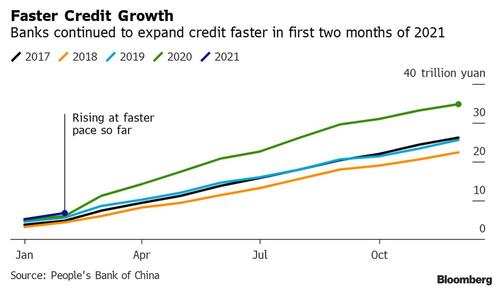

Meanwhile, it appears that local banks were unaware of Beijing’s desire to clamp down on record new loans, and in the first two months of the year, Chinese banks issued 4.9 trillion yuan of new loans in the first two months, 16% more than the same period last year….

… and at the fastest pace of the past five years.

This is even as the FT reported previously that the central bank told banks in February to keep new lending in the first quarter roughly at the same level as last year, if not lower.

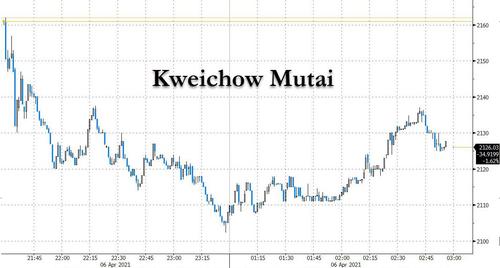

China’s renewed crusade to tame the leverage monster is hardly what Chinese investors want to hear: according to Ken Chen, a Shanghai-based analyst at KGI Securities. credit curbs will drain liquidity from the stock market and pressure sectors with high valuations. Indeed, Kweichow Moutai, the Chinese liquor giant, led a sell-off in blue-chip shares on Tuesday, falling as much as 2.8%. WuXi AppTec Co. slid as much as 5.4%.

Meanwhile, the central bank has made its desire where new capital should flow quite clear: while hoping to keep “zombie” firm capital to a minimu, the PBOC wants commercial banks to focus on lending to areas such as innovative technology and the manufacturing sector, it said at the March gathering. This took place shortly after Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission, warned about bubbles in the property and financial markets as noted above, fueling concerns policy makers will begin tightening monetary policy.

Here Bloomberg makes a laughable conclusion, noting that “China’s government is taking advantage of the economic recovery to deleverage, a long-standing goal shelved during the trade war with the U.S. and further delayed by the pandemic.” It’s “laughable” because every time Beijing pushes in earnest with its deleveraging plans either stocks – or housing – crash, or overnight fund rates explode into double (or triple) digits and the market quickly forces the PBOC to reverse its deleveraging intentions.

And while any earnest attempt at deleveraging is doomed to fail, that doesn’t mean that China won’t try again. It also means that SocGen’s forecast for sharply lower credit impulse in the coming years…

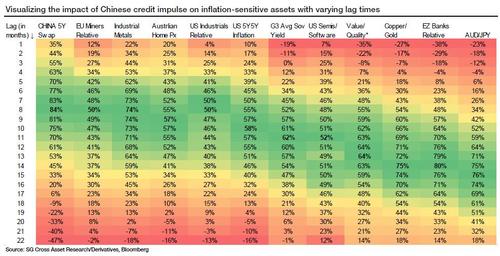

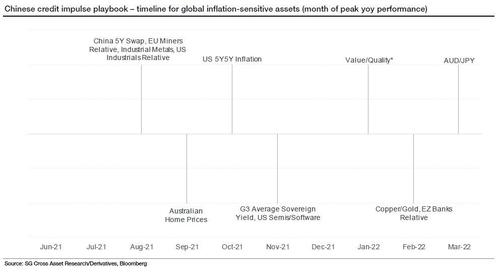

… will be validated. And as this all too critical metric fades, virtually every asset across the globe will be affected. As a reminder, the credit impulse first reaches assets that are driven primarily by the Chinese economy (Chinese bond yields and industrial metals). Next to be impacted are inflation breakevens and sovereign yields in Western economies. The peak correlation for other growth-sensitive assets such as eurozone banks and AUD/JPY arrives with bigger lag of around 4-5 quarters. This result, while logical, is quite significant, as it gives us a playbook for the ebb and flow in Chinese credit impulse.

The table above shows the correlation between different assets and Chinese credit impulse for varying lag times. The extent of the differences between lags in correlations is exemplified in the left-hand chart below. While peak correlation for Chinese interest rate swaps arrives with an eight-month lag, the peak correlation for eurozone banks manifests itself with a lag of 14 months (read more here “In Historic Reversal, China’s Credit Impulse Just Peaked: What This Means For Global Markets“).

Looking ahead, with high correlations and short lag times, Chinese interest rate swaps and industrial metals should be the first assets to be adversely impacted by the topping of the Chinese credit impulse. Australian house prices and US 5Y forward 5Y inflation will likely also be hit in this first group.

The mining and industrial sectors also have short lag times, but their correlation is slightly lower. The other highly correlated group of assets, including eurozone banks, also gets strongly affected by credit impulse, but the rather large lag time opens the door for other factors to influence the price action of these assets as well.

Low correlation with certain assets suggests that Chinese credit, while being one of the drivers, may not be the main driver of price performance for these assets (e.g. semis/software ratio, sovereign yields in the West and value/quality ratio).

In the chart below, SocGen provides a critical estimated timeline of the peak Y/Y performance for each of the assets it sees as impacted by China’s credit impulse slowdown. While these assets are influenced by multiple factors and therefore could easily diverge from expectations, the chart below does present a neat output from a lagged regression analysis and is a useful guideline for the balance of this year and next.

Tyler Durden

Tue, 04/06/2021 – 14:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com