Futures Spooked By Hottest Chinese Factory Inflation Since 2018

US equity future struggled for direction after hitting an all time high of 4,102 as investors assessed economic growth prospects against renewed inflation concerns after Beijing reported that in March China experienced the fastest factory inflation since 2018, which weighed on Asian stocks, and dragged contracts on the duration-heavy Nasdaq 100 lower, despite Fed Chair Jerome Powell reiterating late on Thursday that inflation was not a worry. Emini futures were steady after the S&P 500 rose 0.42% to a record high on Thursday when the Nasdaq Composite added 1.03%. Treasury yields rose, as did the dollar, while oil was flat and the VIX dropped to its lowest level since Feb 2020 at 16.55.

“U.S. equities are holding on to recent highs with U.S. interest rates remaining stable and the economic outlook improving,” Steen Jakobsen, chief investment officer at Saxo Bank A/S, said in a client note. “We do not expect wild things in today’s trading session as everyone is waiting for the first-quarter earnings season to start next week.”

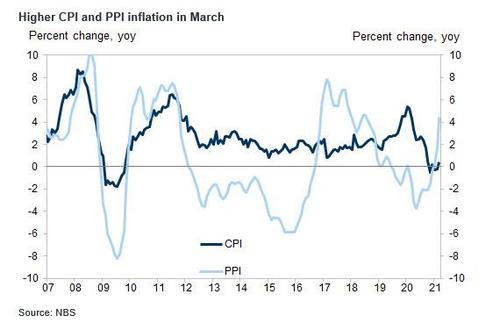

The big overnight event was the latest Chinese CPI and PPI prints, which both came in hot for March, as China’s CPI inflation picked up to +0.4% yoy in March after two months of deflation, primarily on higher fuel costs; in month-on-month terms, headline CPI prices increased 3.0%.In year-on-year terms, food inflation moderated to -0.7% yoy in March from -0.2% yoy in February, primarily on lower inflation in vegetable and pork prices. Deflation in pork prices widened to -18.4% yoy in March from -14.9% yoy in February primarily on a sequential decline, and inflation in fresh vegetables moderated to +0.2% yoy in March from +3.3% yoy in February. In contrast, non-food CPI inflation picked up to +0.7% yoy in March from -0.2% yoy in February, primarily on a significant rebound in fuel costs. Fuel costs increased notably by 11.5% yoy in March, from -5.2% yoy in February. Core CPI inflation (headline CPI excluding food and energy) increased mildly as well to +0.3% yoy in March from 0% yoy in February.

But most of the attention was on China’s PPI inflation, which picked up notably to 4.4% yoy in March from +1.7% yoy in February, the highest since July 2018. PPI inflation in producer goods increased to 5.8% yoy in March from 2.3% yoy in February, while PPI inflation in consumer goods, which matters more for CPI inflation, inched up to +0.1% yoy in March from several months of deflation. Among major sectors, inflation in the petroleum industry picked up the most, followed by the metal sectors and chemistry sector. Goldman expects PPI inflation to continue to accelerate with limited spillover to CPI.

Elsewhere, Powell signaled at an IMF event that the central bank was nowhere near reducing support for the U.S. economy, saying that while economic reopening could result in higher prices temporarily, it will not constitute inflation. Deutsche Bank analysts said the comments “offered fresh reassurance to investors who’d begun to price in earlier rate increases on the back of some very strong economic data in recent weeks”.

Looking at global markets, MSCI’s broadest gauge of world stocks set a record high in Asian trading, though it was down 0.1% at 0755 GMT. The index has gained more than 1.5% this week.

“As long as monetary stimulus is easy, as long as fiscal policy is easy, any hiccups in stocks are probably only going to find buyers,” said Giles Coghlan, chief currency analyst at HYCM.

Europe’s Stoxx 600 index edged higher, led by consumer-focused firms and construction and on course for a sixth straight week of gains, the longest run since November 2019 even though Germany and France, the euro area’s two largest economies, both saw unexpected declines in industrial production in February, suggesting that coronavirus restrictions are increasingly harming parts of the economy that have proved resilient so far. Germany has doubled its pace of Covid-19 vaccinations after a sluggish start, while Italy is set to ease lockdown curbs. Britain’s FTSE 100 hit its highest in more than a year, bringing gains for the week to nearly 3%, helped by the country’s speedy vaccine rollout. Here are some of the biggest European movers today:

- Fuchs Petrolub shares jump as much as 5.7% after Baader Helvea upgraded the company to add, citing higher-than-anticipated demand for lubricants used in the automotive industry.

- Puma shares surge as much as 4.6% to a record high, as UBS increased the price target on the sportswear brand, predicting a “strong start to the year” despite U.S. port congestions and recent issues in China.

- Lonza shares rise as much as 3.1% as Tages- Anzeiger reported Swiss Interior Minister Alain Berset and company President Albert Baehny had a telephone conversation. Both parties are interested in intensifying cooperation, newspaper cites government spokesman Peter Lauener as saying.

- JD Sports shares gain as much as 3.2% after Berenberg raised its price target to a joint Street-high, saying the impact of “sneakerheads” should not be underestimated. Surprisingly, while it has been perceived as a lockdown winner, JD Sports has not traded like one — or as a vaccine beneficiary, the broker said in note.

- TUI shares drop as much as 7.9% after the company kicked off a EU350m sale of senior unsecured convertible bonds. Jefferies said the move is “a very short-term and insufficient liquidity fix.”

Earlier in the session, Asian stocks fell as benchmark gauges in China led declines, with investors spooked by the fastest Chinese inflation prints. Japan’s Topix gained 0.6% and Australian stocks hovered near a 13-month high, with technology stocks providing the biggest boost after the Federal Reserve played down inflationary risks. South Korea’s Kospi touched the highest intraday level since mid-February.

Chinese shares, however, slid 1.5%, as robust domestic inflation data raised worries over policy tightening. Factory gate prices rose at their fastest annual pace since July 2018 in March. The Chinext index of Chinese small caps and the CSI 300 index each retreated more than 1%. SF Holding was the biggest decliner on the CSI 300 after reporting downbeat earnings. China Great Wall Technology and Shenzhen Inovance Technology also slumped. Tokyo’s Mothers index for startups outperformed, climbing more than 1%. Sector-wise for the region, information-technology firms contributed the most to the MSCI Asia Pacific Index’s slide, while telecommunications companies rose, providing support.

Australia’s S&P/ASX 200 index dipped 0.05% to close at 6,995.20, cooling off after five straight days of gains that capped its longest winning streak since Dec. 9. The benchmark added 2.4% over the holiday-shortened week, its best since Feb. 5. Lynas Rare Earths Ltd. was the worst performer on Friday, falling the most since March 24. Gold miners were among the top performers as the metal headed for the first weekly advance in three. In New Zealand, the S&P/NZX 50 index fell 0.5% to 12,574.35

Treasuries were lower, unwinding Thursday’s gains which were capped by NY Fed’s Lori Logan hinting the Fed could purchase more 20Y TSYs, as next several trading days bring key economic data and auction cycle beginning Monday. 10-year Treasury yields rebounded from Thursday’s two-week trough near 1.6%, to print at 1.6674% following the hot Chinese inflation data. As Bloomberg reports, most of the declines occurred during London session, with swap spreads widening into the move higher in yields; earlier, stronger-than-forecast Chinese PPI numbers were digested; selling is broadly consistent with profit-taking ahead of next week’s CPI report and front-loaded Treasury auction cycle starting with 3- and 10-year notes Monday and including 30-year bond Tuesday. 10Y yields had surged to the highest since Jan 2020 at 1.776% at the end of March as a string of strong U.S. economic data stoked fears of a spike in inflation that could force the Federal Reserve to raise interest rates sooner than policymakers had so far signalled.

Bond yields across the euro region also rose. Italy’s 10-year yield jumped the most since February after Bloomberg reported Prime Minister Mario Draghi is bringing forward plans for as much as 40 billion euros ($48 billion) in new borrowing. German 10-year bond yields rose 2 basis points, moving away from the previous session’s 10-day lows.

In FX, the U.S. dollar index gained 0.2% but was set for its worst week of the year, weighed down by lower Treasury yields. The euro dipped 0.2% after hitting two-week highs in the previous session. The Bloomberg Dollar Spot Index advanced after China said March PPI climbed the most since July 2018; the greenback gained versus all of its Group-of-10 peers, with commodity currencies such as the Norwegian krone and Australian dollar leading losses. The euro fell below $1.19 after reaching a more than a two-week high Thursday. Australia’s dollar slid by as much as 0.9% against the greenback, driven in part by iron ore which fell for the first day in the last seven.

In commodities, oil prices edged down as investors weighed rising supplies from major producers and the impact on fuel demand from the COVID-19 pandemic. WTI fell 0.35% to $59.38 a barrel, while Brent lost 0.5% to $62.87 a barrel. Spot gold fell 0.5% to $1,747 an ounce after jumping to a more than one-month peak of $1,758 on Thursday.

Looking at the day ahead now, we’ll get the PPI reading for March. In addition, central bank speakers include ECB Vice President de Guindos and Dallas Fed President Kaplan.

Market Snapshot

- S&P 500 futures little changed at 4,091.50

- STOXX Europe 600 up 0.1% to 437.30

- MXAP down 0.4% to 206.69

- MXAPJ down 0.7% to 688.48

- Nikkei up 0.2% to 29,768.06

- Topix up 0.4% to 1,959.47

- Hang Seng Index down 1.1% to 28,698.80

- Shanghai Composite down 0.9% to 3,450.68

- Sensex down 0.5% to 49,518.79

- Australia S&P/ASX 200 little changed at 6,995.17

- Kospi down 0.4% to 3,131.88

- Brent Futures down 0.4% to $62.96/bbl

- Gold spot down 0.5% to $1,746.45

- U.S. Dollar Index up 0.24% to 92.28

- German 10Y yield rose 2.2 bps to -0.313%

- Euro down 0.2% to $1.1891

Top Overnight News from Bloomberg

- The U.K. said it will decide by early next month whether Britons can resume taking international holidays on May 17, while implementing coronavirus testing rules that airlines criticized as too costly

- U.K. house prices rose at the strongest pace in six months as buyers eyed a path out of lockdown and the government extended a temporary tax break on purchases, mortgage lender Halifax said

- Italy is set to ease lockdown restrictions, lifting some curbs that have been weighing on the economy in the region surrounding Milan and across the country as the latest virus resurgence slows, officials said

- Germany and France both saw unexpected declines in industrial production in February, suggesting that coronavirus restrictions are increasingly harming parts of the economy that have proved resilient so far

- France’s budget deficit won’t fall below 3% of gross domestic product until 2027, the finance ministry said. While progress could have been faster, targeting a drop below 3% in 2025, that would have involved major spending cuts and tax increases, an official at the ministry said

- Italy is bringing forward plans for as much as 40 billion euros in new borrowing as the cost of keeping the economy afloat drains the state’s coffers and street protests heap pressure on the government

A quick look at global markets courtesy of Newsquawk

Asia-Pac markets end the week with a cautious tone as regional bourses failed to sustain the early momentum from the tech-led gains in the US where sentiment was underpinned as yields eased and Fed Chair Powell stuck to the dovish script. US equity futures thereafter pulled back from session highs after the E-mini S&P briefly breached the 4,100 level for the first time. ASX 200 (-0.5%) was lacklustre with strength in tech, telecoms and gold miners offset by a subdued broader market amid concerns that the vaccination programme could be hindered after Australia recommended to halt the use of the AstraZeneca (AZN LN) vaccine for people under the age of 50 which also placed doubts on local partner CSL that has a contract to produce 50mln doses of the AstraZeneca vaccine. Nikkei 225 (+0.2%) was positive after an attempt to reclaim the 30k level although has partially retraced the advances with the government and expert panel set to discuss COVID-19 measures for Tokyo today. There were also mixed earnings from retailers as Seven & I posted a decline in its full year net and although Fast Retailing reported improved results, its shares were subdued with the Co. said to be facing pressure from the US to take a clear stand against the human rights abuses in Xinjiang. Hang Seng (-1.0%) and Shanghai Comp. (-1.0%) weakened amid continued US-China tensions after the US Commerce Department added 7 Chinese supercomputing bodies onto its entity list for alleged support to the Chinese military and with the US Senate’s legislation draft stating that the US must encourage allies to do more in balancing and checking China’s aggressive behaviour, while the latest Chinese inflation data was mixed as CPI and PPI topped estimates Y/Y with factory gate prices at its highest in more than 2 years amid rising commodity prices, but CPI M/M was at a wider than anticipated contraction. Finally, 10yr JGBs were flat as they took a breather from the prior day’s gains with demand subdued as Japanese stocks remained afloat and amid the absence of the BoJ purchases in the market today, while Australian yields were relatively unmoved following the 2025 Aussie government bond auction. PBoC injected CNY 10bln via 7-day reverse repos with the rate at 2.20% for a net neutral daily position. (Newswires)

Top Asian News

- Didi Chuxing Plans to File for New York IPO in April: Reuters

- For the Rich, Living in Asia Is Costlier Than Anywhere Else

- Tencent- Backed Linklogis Rises 9.9% in Hong Kong Debut

- TSMC Quarterly Sales Rise 17% After Surge in Chip Deman

Bourses in Europe trade mixed and continue to lack a firm direction (Euro Stoxx 50 -0.1%), with ranges of the price action also relatively narrow and contained following a directionless and uninspiring cash open. US equity futures meanwhile are similarly mixed/contained with modest underperformance experienced in the NQ (-0.1%) amid headwinds from rising yields and following the tech sector’s outperformance on Wall Street yesterday. Back to Europe, Spain’s IBEX (-0.2%) narrowly underperforms amid pressure from its financials exposure – with the banking sector among the laggards. Conversely, Switzerland’s SMI (+0.3%) gleans support from its vast healthcare exposure as the sector resides as the top performer. Overall, sectors are mixed with no clear theme nor risk biases. The tech sector is firmer with potential tailwinds from TSMC reported a third straight quarter of record sales, with revenue narrowly ahead of forecasts reporting a third straight quarter of record sales, revenue narrowly ahead of forecasts. In terms of individual movers, Credit Suisse (-1.3%) is pressured after the bank tightened financing terms it offers hedge funds following the Archegos situation, with the bank moving from static margining to dynamic margining which could reduce profitably for traders and force them to post more collateral. On the flip side, Tui (-5.3%) trades at the foot of the Stoxx 600 after it commenced a convertible bond offering of EUR 350mln which can be extended to EUR 400mln – with the proceeds to be used to improve its liquidity position.

Top European News

- U.S. Tax Proposal Is ‘Very Interesting’, EU’s Breton says

- U.K.’s Sunak Under Pressure Over Handling of Greensill Aid Bid

- ECB’s Visco: EU Recovery Fund, Faster Vaccinations Are Crucial

- Italy Set to Ease Lockdown Restrictions in Most of the Country

In FX, nothing new from Fed chair Powell to augment FOMC minutes or fresh catalyst for a rebound in US Treasury yields amidst relatively mild re-steepening, but enough it seems for the Dollar to regain some composure as the week draws to a close. Indeed, the index has rebounded from Thursday’s 91.995 low to probe above 92.300, with the ripples reaching all DXY components and spreading beyond to other Greenback counterparts as several psychological and key technical levels are being breached or rigorously tested. However, the Buck still has a long way to go before getting back on track, and the nearest hurdles come in the form of 200 and 21 DMAs at 92.330 and 92.363, then recent highs and 92.500 before the index even considers staging an attempt to revisit Monday’s 93.000+ peak. Turning to fundamentals, PPI data is due and could provide a guide for CPI next week.

- AUD/NZD – The Aussie is underperforming across the board, with Aud/Usd struggling to retain grasp of the 0.7600 handle and Aud/Nzd fading below 1.0850 as the Kiwi maintains 0.7000+ status against its US rival ahead of the RNBZ next week. Hence, at this stage hefty option expiry interest in Nzd/Usd at the 0.6950 strike (1.2 bn) does not appear influential in contrast to expiries between 0.7600-20 (almost 1 bn) that could keep Aud/Usd capped amidst a suspension of AZN vaccinations in the state of NSW.

- JPY – Having touched, but failing to pierce 109.00 vs the Dollar yesterday, the Yen has subsequently retreated through 109.50 on the aforementioned resumption of UST bear steepening that leaves JGBs with some catching up to do. However, 110.00 may continue to keep Usd/Jpy firmly in retracement mode after 2 consecutive rejections of the round number on Tuesday and Wednesday.

- GBP/CHF/EUR/CAD – All conceding ground to the mini Greenback revival, as Sterling strives to pare declines from a deeper reversal to circa 1.3670 and under the 100 DMA at one stage (1.3687), but the Pound looks destined to give up more 2021 gains against the Euro as the cross approaches 0.8700 following a bullish close over 0.8670. Nevertheless, the single currency remains locked in its own battle vs the Buck around 1.1900 and the 200 DMA that comes in at 1.1896 today, while the Franc is pivoting 0.9250 and 1.1000 against the Dollar and Euro respectively in wake of lower than expected Swiss jobless rates. On that note, the Loonie is eyeing Canada’s labour report for independent direction between 1.2611-1.2555 parameters vs its US peer, and is also mindful that 1.2 bn option expiry interest at 1.2600 will be withdrawn barring execution at the NY cut.

- SCANDI/EM – A bit of a double whammy for the Norwegian Krona as softer crude prices on balance compound considerably weaker than forecast headline CPI to leave Eur/Nok hovering near new wtd highs around 10.1270 compared to sub-10.0250 lows and Nok/Sek unwinding gains as the Swedish Crown holds above 10.2000 in Euro cross terms. Elsewhere, broad weakness vs the Usd and the Zar having to contend with Russia surmising that its Sputnik V vaccine is not as effective against SA’s COVID-19 strain, while the Cnh weighs up mixed Chinese data and Try digests latest CBRT survey findings revealing higher year-end projections for inflation and the 1-week repo rate, but significant Lira depreciation – see 8.00BST post on the headline feed for details.

In commodities, WTI and Brent front-month futures traded with modest losses in early European hours as the indecisive risk tone and firmer Dollar keep prices subdued but somewhat contained. At the time of writing, WTI resides around USD 59.50/bbl (vs 59.13-95 range) whilst its Brent counterpart trades near USD 63/bbl (vs 62.57-63.49 range). Futures saw a similar bout of pre-US-entrance choppiness as had been experienced throughout the week, with no specific fundamental catalyst at the time of the move. The narrative remains little changed as participants eye any demand impacts from the rising COVID cases among key consumers, prompting more stringent lockdown measures – with the German Health Minister today stating that nationwide measures are needed to break the latest wave. On the flip side, France has announced that the first AstraZeneca dose should be followed by a second dose of an mRNA-based vaccine for those under 55 years of age. Although this announcement may have been a function of the rare blood clots, this may provide more flexibility when it comes to the vaccination drive as the EU has secured more orders of the latter. On the supply front, Chinese oil giant CNOOC said today a fire that broke out on an offshore platform Monday was extinguished on Tuesday. The incident may affect its production by up to 600k barrels, or 0.1% of the annual total. Aside from the above, oil-specific news flow has remained on the lighter side. Elsewhere, spot gold and silver are subdued as they track the firmer Buck, with the former back below USD 1,750/oz (vs high 1,757/oz) and the latter still holding its head above USD 25/oz (vs high 25.49/oz). In terms of base metals, LME copper remains softer whilst Shanghai copper and Dalian iron prices were pressured overnight by the firmer Dollar, indecisive risk tone – with some also citing fears over potential Chinese policy tightening following the inflation figures.

US Event Calendar

- 8:30am: March PPI Final Demand YoY, est. 3.8%, prior 2.8%, MoM, est. 0.5%, prior 0.5%

- 8:30am: March PPI Ex Food, Energy, Trade YoY, est. 2.7%, prior 2.2%; MoM, est. 0.2%, prior 0.2%

- 8:30am: March PPI Ex Food and Energy YoY, est. 2.7%, prior 2.5%, MoM, est. 0.2%, prior 0.2%

- 10am: Feb. Wholesale Trade Sales MoM, prior 4.9%; Wholesale Inventories MoM, est. 0.5%, prior 0.5%

DB’s Henry Allen concludes the overnight wrap

It was yet another buoyant day for financial markets yesterday as remarks from Fed Chair Powell helped to sustain the ongoing strength in risk assets, whilst also putting downward pressure on Treasury yields. Although Powell’s comments stuck to his dovish messaging of late, they offered fresh reassurance to investors who’d begun to price in earlier rate increases on the back of some very strong economic data in recent weeks, not least with last week’s jobs report. In response to this, equity indices hit fresh highs across multiple regions, with the S&P 500 (+0.42%), the STOXX 600 (+0.58%) and the MSCI World index (+0.50%) all climbing to new records. That marked the 7th successive advance for the MSCI World Index, whilst the VIX index of volatility (-0.21pts) closed beneath 17pts for the first time since the pandemic began last year.

Looking at Powell’s remarks in more depth, he reiterated the extent of the damage to the economy and the labour market relative to its pre-Covid state, saying how eight and a half million people were still out of work, and that the “burden is still falling on lower income workers, the unemployment rate in the bottom quartile is still 20 per cent.” He also noted that the country’s disparate vaccination rates could pose a risk to the recovery, which “remains uneven and incomplete.” Notably, he said that the Fed wanted to see a succession of strong monthly jobs growth like the one in March, saying that “we want to see a string of ones like that so we can really begin to show progress toward our goals”. So the jobs reports over the coming months will be under intense focus from investors to see if they meet this criteria. In response to Powell, yields on 10yr Treasuries extended their decline, ending the day -5.5bps lower at 1.619%, though this morning they’re up +1.6bps. That level at the close yesterday was actually their lowest closing level in more than two weeks, and even with this morning’s increase, the decline in Treasury yields over the week so far (-8.7bps) puts them on track for their biggest weekly move lower since last June, which marks a reversal of fortunes from Q1 when 10yr Treasury yields saw their third biggest increase so far this century, having moved up by +83bps.

With yields continuing to move lower yesterday, this offered further support for tech stocks, which led the outperformance in US equities once again, as the NASDAQ rose +1.03% and the NYSE FANG+ index (+1.39%) recorded its 9th consecutive daily advance. Technology hardware (+1.64%), Software (+1.47%), and Semiconductors (+1.01%) were the leading industries in the S&P at the expense of cyclicals such as Energy (-1.36%) and Banks (-0.23%) which were strong outperformers in the first quarter when oil and rates rose sharply. Meanwhile financial conditions continued to ease, with Bloomberg’s index for the US moving to its most accommodative level since late-2018. And although we did get some worse-than-expected data on the weekly initial jobless claims, which came in at 744k in the week through April 3 (vs. 680k expected), if anything this just bolstered the view that the Fed will remain on hold for longer. Furthermore, the decline in the US dollar yesterday (-0.43%) has put the greenback on track for its worst weekly performance so far this year.

Overnight in Asia markets are mostly trading lower with the Shanghai Comp (-0.74%), Hang Seng (-0.72%), Kospi (-0.13%) and Asx (-0.45%) all losing ground. The main exception to this pattern this morning is the Nikkei (+0.38%), which has moved higher even as the Japanese government appear set to impose tougher restrictions in a few areas, with Economy Minister Yasutoshi Nishimura saying that they would seek to introduce them in Tokyo, Kyoto and Okinawa. Separately in South Korea, the country said that social distancing measures would stay in place for another 3 weeks, which includes a limit on gatherings of more than 5 people. In terms of economic data, the Chinese inflation release has showed that PPI inflation rose to +4.4% yoy in March (vs. +3.6% expected), which is the fastest pace of price growth since July 2018. Meanwhile CPI also printed higher at +0.4% yoy (vs. +0.3% expected). Outside of Asia, equity futures are pointing higher once again in both the US and Europe, with those on the S&P 500 up +0.14% this morning, suggesting yet another rise from the index’s latest record high.

Looking at yesterday’s other moves, European equities were similarly buoyant as mentioned with the STOXX 600 at a fresh record, though they’d closed for the day by the time Powell started speaking. A number of new milestones were reached, with the CAC 40 (+0.57%) at a post-GFC high, whilst the FTSE 100 (+0.83%) reached a post-pandemic high. For sovereign bonds it was a strong day once again as well, with yields on 10yr bunds (-1.2bps), OATs (-0.8bps) and BTPs (-3.0bps) all moving lower.

In terms of the latest on the pandemic, vaccination numbers have continue to improve around the world. France met its target of vaccinating 10 million residents with a first shot one week ahead of schedule as the country is in the midst of its third national lockdown. Separately, Bloomberg reported new numbers on the number of Covid-19 vaccinations that have been exported from the EU, with over 80 million vials having been sent abroad –of which nearly 40% have gone to the UK and Japan. By comparison, 112 million shots have been delivered to EU member states through April 5th, and although various EU leaders have called for slowing vaccine exports, there has yet to be a meaningful change in policy. Over in the US, the 7-day average of vaccinations doses rose to 3.04 million per day, which comes as eligibility for the shot has increased to include almost all US adults. Even as the vaccination program continues at pace however, cases are increasing in spots all across the country – Florida saw its most cases since early February, Ohio rose by its most in nearly a month, and Wisconsin saw the most new cases in nearly two months. The latter two were driven primarily by new variants.

Back to Europe, and yesterday saw the release of the minutes from the ECB’s March meeting, which showed that all of the Governing Council supported the move to use the flexibility built into PEPP to increase the pace of bond purchases, provided that the size of the overall PEPP envelope was not on the table. Our chief European economist Mark Wall has a write up of the minutes (link here), and he notes that the hawks are stretching their wings by making this the price of their support. On the question of reviewing the pace of purchases, the minutes showed that the Governing Council “would undertake a quarterly joint assessment of financing conditions and the inflation outlook in order to determine the pace of purchases”, but it also said that there should be flexibility applied in the intervening period to determine the pace according to market conditions. Against this backdrop, 5y5y forward inflation swaps for the Euro Area hit their highest level since early 2019 yesterday, rising another +0.5bps to 1.565%.

Wrapping up with yesterday’s data, German factory orders rose by +1.2% in March as expected, though the previous month figures was revised down to show +0.8% growth (vs. +1.4% previously). Staying on Germany, the March construction PMI rose to 47.5, its highest level since August, while the UK’s construction PMI rose to 61.7 (vs. 55.0 expected), which was its highest level since September 2014. Finally, the Euro Area PPI reading for February rose to +1.5% year-on-year (vs. +1.3% expected), which is the fastest pace since May 2019.

To the day ahead now, and data highlights include German and French industrial production for February, as well as Italian retail sales for that month. Meanwhile in the US, we’ll get the PPI reading for March. In addition, central bank speakers include ECB.

Tyler Durden

Fri, 04/09/2021 – 08:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com