JPMorgan: Clients Are “Increasingly Nervous”, Fear “A Market Pullback In May Or June”

Much to the delight of bulls everywhere, the past month has been a relentless meltup in stocks, commodities, cryptos, and – paradoxically over the past week when we have been bombarded with stellar economic data – Treasurys as well.

After dumping at the end of March to a low of 3,843, spoos have seen an almost flat-line diagonal move higher over the past three weeks, hitting an all time high of 4,183 on Friday (trading a little softer over the weekend following the crypto rout) following one blockbuster economic data point after another, and a solid start to earnings season to boot.

If one looks purely at technicals (i.e., lines drawn on a chart which somehow predict stuff), the latest ramp was to be expected, but appears to be reaching an exhaustion point with just 10 points to go until resistance is hit.

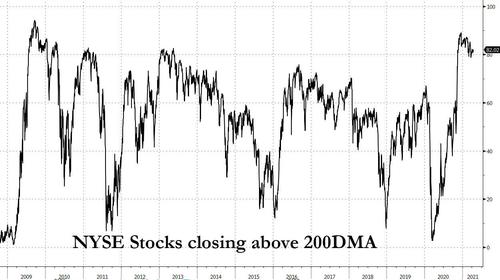

There is another technical reason (we’ll ignore fundamentals because when the Fed continues to inject $120BN per month and when the joke cryptocurrency Dogecoin goes exponentially higher “just because”, it’s clear that fundamentals don’t matter), the rally may be coming to an end: as of this moment a near record 96% of S&P stocks are trading above their 200DMA, which is the highest in more than 20 years, and the last time it happened – in Sept of 2009…

… the S&P was 5% lower in 2 weeks, and unchanged a year later. Then again, the current period – when central banks are openly PPTing everything and will defend stocks at any and all cost – can’t really be compared to any other period in the past. Offsetting the negative charts is the well-known fact that April is historically the strongest month for stocks, green 89% of the time over the past 10 years and 75% of the time over the past 20.

Another factor will be earnings season why by all counts will be stellar… but probably not stellar enough as absolute perfection is already priced in as recent bank earnings demonstrated.

Which may explain why in his Friday Market Intelligence note, JPMorgan’s Andrew Tyler writes that while the “bull case remains intact” he warns to “keep an eye” on growing divergence in the sleep VIX relative to the spiky MOVE Index (which would imply a VIX in the mid-30s)…

… as well as the CBOE’s put/call ratio…

… as “the combination seems to suggest an increasing nervousness among investors.”

As Tyler adds, “this dovetails with client conversations that, while expecting a robust earnings season, increasingly worry about potential market pullback in May/June” and urges his readers to recall that last week none other than JPM’s resident in house Marko Kolanovic recommended staying long risk but adding hedges.

Tyler Durden

Sun, 04/18/2021 – 20:49![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com