Soaring Inflation Will Not Peak Before January 2022: Here’s How To Trade It

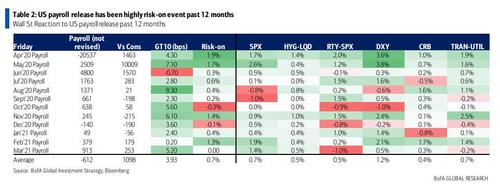

In his latest weekly Flow Show note, BofA’s CIO Michael Hartnett looked at the historical record and correctly predicted that today’s job print would be a “highly risk-on event” as the past 12 reports, 10 have seen the S&P jump on average 1% on day of release.

Perhaps more importantly, Hartnett predicts that going forward, wages will be more important than payrolls in the coming months and that Average Hourly Earnings monthly prints of more than 0.3% MoM will likely provoke fresh upgrades to 2022 inflation forecast.

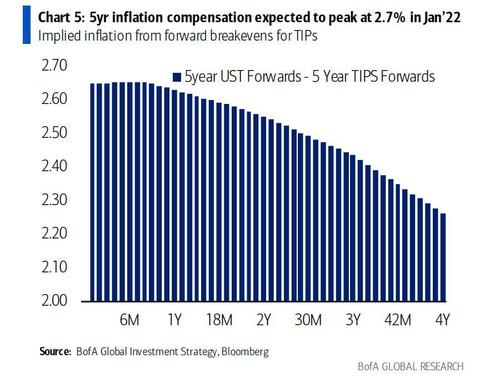

Which would be troubling: according to rates markets, using the 5-year forward breakeven curve, we find that 5-year inflation is expected to peak at 2.7% in Jan’22 (up from 2.0% just 6 months ago), and this number is likely to only go up.

So how should one trade this surge in inflation over the next 8 months? According to Hartnett, there are two ways:

- The Secular, or 1-2 year view: higher inflation = higher yields = real > financial assets, commodities > bonds, RoW stocks > US, small>large cap, value>growth.

- Tactical, or 1-2 quarter view: peak Positioning, Policy, Profits (“3Ps”) + rising Rates, Regulation, Redistribution (“3Rs”) = low/negative stock/credit returns next 3-6 months…optimal barbell = long inflation & long quality.

Focusing on the “peak liquidity” aspect first, Hartnett points to the recent crash in new economy stocks relative to old economy (e.g. AARK vs BRK) which he says “is reminiscent of the 2000/01 post-bubble price action.”

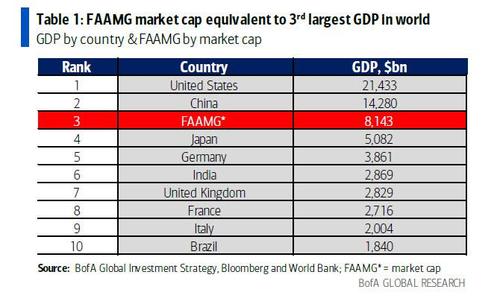

On the other end of the tech spectrum, FAAMG stock upside has been impeded by positioning & valuation (market cap of FAAMG = 3rd largest country by GDP)

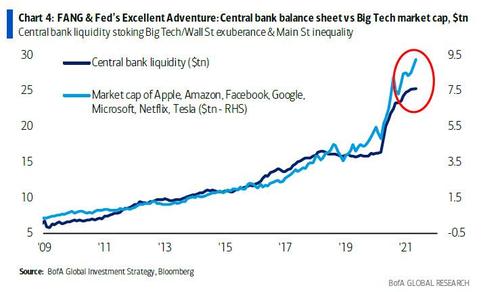

The good news is that the Fed is determined to stoke Wall Street exuberance & Main St inequality – as shown in the chart below Fed has been tech’s best friend for past 10 years…

… and ignore future systemic risk consequences;

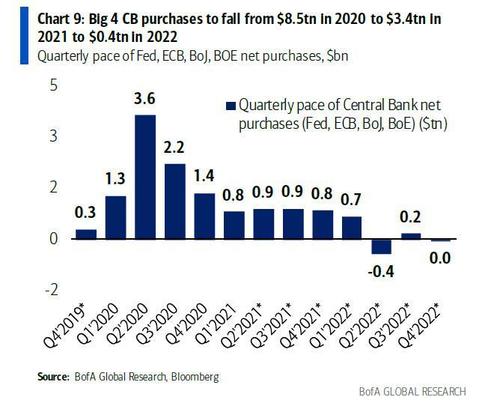

However, the bad news is global tapering has begun as big 4 central banks’ QE is set to fall from $8.5tn in ‘20 to $3.4tn in ‘21 to just $0.4tn in ’22, and in Q2/Q3 “the stronger the macro the quicker & bigger the taper.”

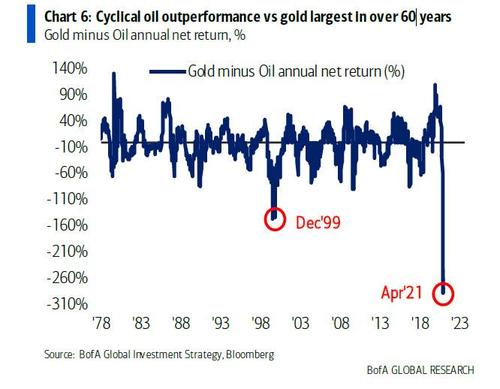

Hartnett then looks at “peak profits” noting that China bonds are outperforming stocks YTD, while in in Q2 30-year Treasurys are outperforming Nasdaq (after a disastrous Q1 for bonds). At the same time, the cyclical oil outperformance vs gold largest in over 60 years.

But the clearest indication of the coming topping in profits comes from BofA’s Global EPS model which says peak global EPS growth ≈ 36% in April…

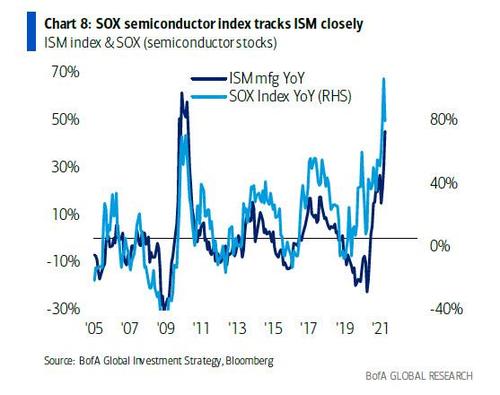

… and the SOX semiconductor index, which tracks ISM closely, and has failed to hit a new high, i.e. >3300…

… will then shift to markets via peak OMX, DAX, Nikkei, KOSPI in coming months as global reopening = peak EPS revisions.

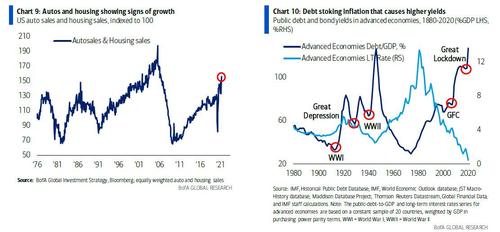

One final point from Hartnett on debt and yields: the IMF chart showing public debt as share of GDP since 1880 and bond yields in developed economies is a timely reminder to the CIO that big increases in yields driven not by debt per se (see Japan) but rather the success of debt in facilitating strong economic growth & inflation.

In other words, if the trillions in debt-funded stimulus injected by Biden do in fact translate into a non-transitory boost to GDP growth, then all bets are off. Said otherwise, it will be extremely ironic if the Biden stimulus plan works… and the US economy implodes as yields soar.

Tyler Durden

Fri, 05/07/2021 – 13:33![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com