Fed Vice Chair: Not Enough Progress To Start Taper Talk

Not that it will come as a surprise to anyone, but on Monday morning Fed Vice Chair Richard Clarida said during a Q&A after his speech at the Annual Financial Markets Conference, sponsored by the Atlanta Fed’s Center for Financial Innovation and Stability, that the weaker-than-expected April payroll report shows “we have not made substantial further progress” on the central bank’s goals for employment and inflation laid out as thresholds to begin scaling back the central bank’s massive monthly bond purchases.

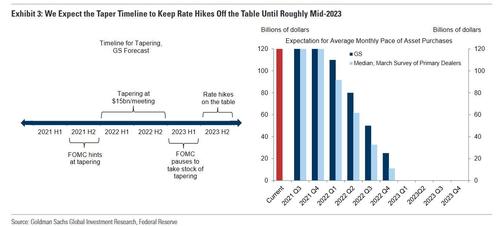

Seeking to comfort markets on edge over the recent inflationary spike, Clarida said that “we will certainly give advanced warning before scaling back those purchases.” Putting this in context, last week Morgan Stanley chief US economist Ellen Zentner said she expects the Fed to signal its intention to taper asset purchases at the September FOMC meeting, to announce it in March 2022 and to start tapering from April 2022. Morgan Stanley also expects that rate hikes will begin in 3Q23, after inflation remains at or above 2%Y for some time and the labor market reaches maximum employment. Goldman’s own stylized tapering/liftoff forecast is shown below.

There were also no surprises in Clarida’s pick up of the familiar party line saying there that upward pressures on inflation are likely to be transitory due to mismatches between supply and demand as economy reopens from pandemic lockdown; he added that the Fed will have to be “attuned and attentive” to incoming data, although it’s unclear how since the Fed continues to dismiss any upside inflation as one-off events.

Still, should inflation hit what Kaplan last week hinted as the Fed’s new and improved redline of 4%, Clarida said that he has “no doubt we would use our tools to address that situation” if inflation expectations got unanchored.

Tyler Durden

Mon, 05/17/2021 – 12:15![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com