Predatory Lenders Charging Up To 589% Interest Posted Record Profits In 2020 Thanks To “Stimulus”

“I can’t even think about how much money I just paid in interest,” 44 year old Jamie Johnson said, thinking back to a payday loan he took out in April 2020.

His $5,000 loan – which eventually accrued interest at a clip of up to 589% annualized – was the topic of a new Bloomberg article on payday and predatory lending.

“It was just a big mess,” Johnson said, telling Bloomberg he used pandemic-relief unemployment insurance checks of $965 each week to hurriedly help pay back the debt for fear of being trapped in a neverending cycle of compounding interest and fees.

It’s stories like his that are the driving force behind payday and other high interest loan companies “emerging from the pandemic stronger than perhaps ever before”. The lenders raked in record earnings while Americans suffered during the pandemic.

Lauren Saunders, associate director at the National Consumer Law Center, a non-profit that advocates for low-income borrowers, said: “Debt collectors had a big year, and so did predatory lenders. The idea that any company could keep charging 100% or 200% interest or more during this time of crisis is really outrageous.”

Additionally, studies have shown these types of loans are disproportionately targeted to black and Latino communities. In Michigan, where Johnson is from, “areas that are more than a quarter Black and Latino have 7.6 payday stores for every 100,000 people, or about 50% more than elsewhere,” the report notes.

The irony is that it was the trillions in government stimulus that allowed these predatory companies to prosper. As we noted throughout 2020, many consumers used their stimulus to save and pay down debt. The New York Fed estimates about 33% of all cash received from stimulus checks was used to pay down debt. This equates directly to a boon for companies like Enova International Inc. and Elevate Credit Inc., who engage in these types of loans.

Moshe Orenbuch, an analyst at Credit Suisse Group AG, said: “Earnings were definitely higher than we would have expected because they benefited from an improvement in the credit environment. Consumers tended to pay back debt with funds they were given by the government.”

Kimberly Richardson found herself in an equally ugly scenario: she fell into a debt trap that caused her to go from borrowing $1,500 to bankruptcy. Interest on her $1,500 loan was accumulating at a rate of 276% and she was prompted by her loan provider to take additional borrowings under her credit line. She paid CashNetUSA more than $10,000 on the $1,500 loan and then filed for bankruptcy.

Elevate told Bloomberg “it is committed to serving those with non-prime credit scores who are locked out of traditional financial products.” Enova told Bloomberg “its policy is to provide customers with flexibility and to help them be successful with their loan.”

The kicker is that the National Consumer Law Center had urged Congress to cap these types of rates after Covid-19 was declared a pandemic. But just the opposite happened: in July 2020, the Consumer Financial Protection Bureau “repealed substantial portions of a 2017 rule that would have required lenders to determine consumers’ ability to repay loans.”

This rule could have wiped out as much as 68% of the industry’s revenue from payday loans.

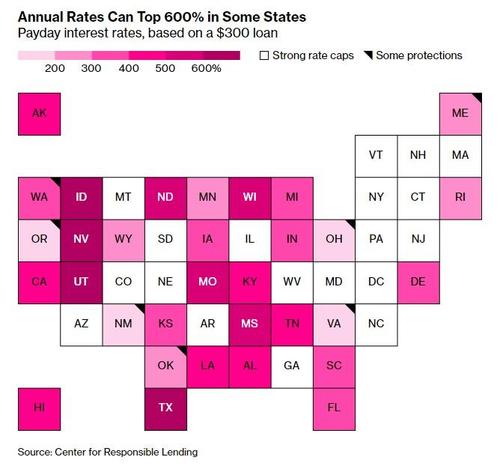

Now, more than 12 states have caps limiting payday loans to 36% or less. Michigan and Tennessee remain excluded from this list, however.

And while there are some indications that the Biden administration may try to reverse course and regulate these loans further, the reality is that companies like Enova are once again licking their chops at a post-Covid boom.

Enova Chief Executive Officer David Fisher said on an April conference call: “As the economy opens back up, we believe that consumers will raise their spending potentially to elevated levels due to increased activity and pent-up demand. We saw the same dynamic following the financial crisis, which led to strong origination growth in 2010 and 2011.”

Tyler Durden

Tue, 05/18/2021 – 19:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com