Key Events In A Very Busy Week: Inflation, Surveys And Fed Speakers Galore

It is a very big week for macro data as we close-out May (the following Monday is a holiday) with the usual end-of-month barrage of data. Most importantly, Goldman reminds us, the April PCE report is due on Friday (this is the inflation measure most closely watched by the Fed because it chronically underperforms ). We also get a series of business sentiment surveys including the Richmond, KC, and Chicago Fed releases and the Chicago PMI. On the consumer front, we get fresh consumer sentiment surveys from the Conference Board and the University of Michigan and ‘stale’ home price reports from way back in March.

This week also features some more Retail earnings (April quarter-end) with results expected from AZO, BBY, COST, DLTR, DG, GPS, and ULTA. Tech stocks are also slatedto report, including ADSK, CRM, INTU, NVDA, and HPQ.

Taking a closer look at this week’s events, DB’s Jim Reid notes that we have a gathering of EU leaders meeting in Brussels today and tomorrow for a special European Council meeting. The items on the agenda include the Covid-19 response, climate change, a strategic debate on Russia, and discussions on the EU’s relations with the UK. They’re also expected to discuss the weekend news that Belarus ordered a Ryanair flight moving through its airspace to land before arresting a journalist on board.

Otherwise, data releases this week include the German Ifo tomorrow and final Q1 GDP alongside the US Conference Board’s consumer confidence. The other main releases are noted at the end in our day by day guide.

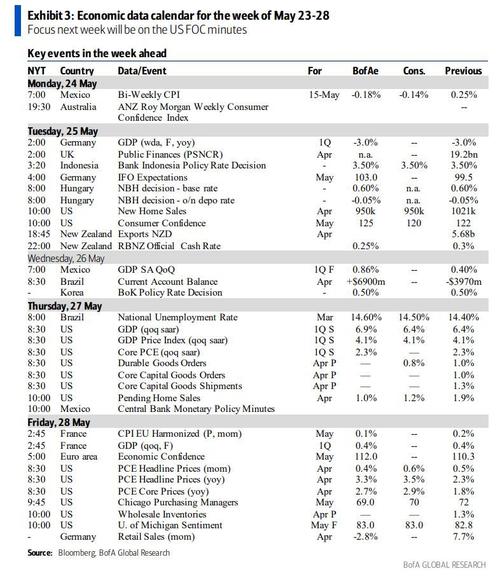

The global economic data calendar is shown below:

On the central bank side, the 2 decisions from G20 central banks next week are from Bank Indonesia tomorrow and the Bank of Korea on Thursday. In terms of what to expect, our economists think that Bank Indonesia will keep its policy rate steady at 3.5%, as it continues to prioritise the rupiah’s stability. Meanwhile the Bank of Korea is also likely to keep its policy rate steady at 0.5%, and the market will be closely watching for forecasts revisions for clues to its policy bias. Otherwise there are only a few speakers from the Fed and the ECB, including Fed Vice Chair Quarles who’ll be making multiple appearances, including a speech on the Economic Outlook.

For earnings, the season is really winding down to the end now, with just 15 companies each from the S&P 500 and the STOXX 600 reporting. Among the highlights are Intuit tomorrow, Nvidia on Wednesday, before Thursday sees reports from Salesforce, Medtronic, Costco, HP, Royal Bank of Canada and Dell Technologies.

Here is a breakdown of key events day by day, courtesy of DB:

Day-by-day calendar of events

Monday May 24

- Data: April Chicago Fed National activity index

- Central Banks: Fed’s Brainard, Mester, Bostic and George speak

- Politics: European Council meeting begins

Tuesday May 25

- Data: Germany final Q1 GDP, May Ifo business climate indicator, UK April public sector net borrowing, US April new home sales, May Conference Board consumer confidence, Richmond Fed manufacturing index

- Central Banks: Bank Indonesia monetary policy decision, Fed’s Quarles, ECB’s Villeroy and BoE’s Tenreyro speak

- Earnings: Intuit

- Politics: European Council meeting concludes

Wednesday May 26

- Data: Japan final March leading index, France May consumer confidence

- Central Banks: Fed’s Quarles and ECB’s Villeroy speak

- Earnings: Nvidia

Thursday May 27

- Data: China April industrial profits, Germany June GfK consumer confidence, Italy May consumer confidence index, US preliminary April durable goods orders, nondefence capital goods orders ex air, second Q1 GDP estimate, weekly initial jobless claims, April pending home sales, May Kansas City Fed manufacturing activity

- Central Banks: Bank of Korea monetary policy decision, BoE’s Vlieghe speaks

- Earnings: Salesforce, Medtronic, Costco, HP, Royal Bank of Canada, Dell Technologies

Friday May 28

- Data: Japan April jobless rate, France preliminary May CPI, final Q1 GDP, Euro Area final May consumer confidence, US preliminary April wholesale inventories, April personal income, personal spending, May MNI Chicago PMI, final May University of Michigan consumer sentiment index

- Central Banks: ECB’s Villeroy speaks

Finally, here is Goldman’s focus on US data only, noting that the key economic data releases this week are the durable goods report and Q1 GDP revision on Thursday and core PCE inflation on Friday. There are several speaking engagements from Fed officials this week.

Monday, May 24

- There are no major economic data releases scheduled.

- 09:00 AM Fed Governor Brainard (FOMC voter) speaks: Fed Governor Brainard will speak at the Consensus 2021 cryptocurrency conference. Prepared text and moderated Q&A are expected.

- 11:00 AM Cleveland Fed President Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will make opening remarks to a panel discussion on diversity and central bank communication.

- 12:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will discuss the public policy response to Covid-19 in a virtual event hosted by the Homer Hoyt Institute’s Weimer School of Advanced Studies in Real Estate and Land Economics. Prepared text is not expected.

- 05:30 PM Kansas City Fed President George (FOMC non-voter) speaks: Kansas City Fed President Esther George will speak at an agricultural symposium hosted by the Kansas City Fed.

Tuesday, May 25

- 07:30 AM Chicago Fed President Evans (FOMC voter) speaks: Chicago Fed President Evans will discuss the economy during a virtual presentation hosted by the Bank of Japan. Prepared text is expected.

- 08:00 AM Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Thomas Barkin will take part in a virtual discussion hosted by the Wilmington, North Carolina Chamber of Commerce.

- 09:00 AM FHFA house price index, March (consensus +1.3%, last +0.9%)

- 09:00 AM S&P/Case-Shiller 20-city home price index, March (GS +1.3%, consensus +1.33%, last +1.17%): We estimate the S&P/Case-Shiller 20-city home price index rose by 1.3% in March, following a 1.17% increase in February.

- 10:00 AM New home sales, April (GS -7.3%, consensus -7.0%, last +20.7%): We estimate that new home sales declined by 7.3% in April, reflecting a slowdown in starts and mortgage applications.

- 10:00 AM Conference Board consumer confidence, May (GS 116.0 consensus 118.9, last 121.7): We estimate that the Conference Board consumer confidence index decreased by 5.7pt to 116.0 in May. Our forecast reflects weaker signals from other consumer confidence measures.

- 10:00 AM Richmond Fed manufacturing index, May (consensus +19, last +17)

- 10:00 AM Fed Vice Chair for Supervision Quarles (FOMC voter) speaks: Fed Vice Chair for Supervision Randal Quarles will give a semi-annual testimony before the Senate Banking Committee. Prepared text is expected.

Wednesday, May 26

- There are no major economic data releases scheduled.

- 10:00 AM Fed Vice Chair for Supervision Quarles (FOMC voter) speaks: Fed Vice Chair for Supervision Randal Quarles will give virtual remarks on insurance regulation to the National Association of Insurance Commissioners. Prepared text is expected; Q&A is not expected.

- 03:00 PM Fed Vice Chair for Supervision Quarles (FOMC voter) speaks: Fed Vice Chair for Supervision Randal Quarles will discuss the economic outlook at the Brookings Institution’s Hutchins Center on Fiscal and Monetary Policy. Prepared text and moderated Q&A are expected.

Thursday, May 27

- 08:30 AM Durable goods orders, April preliminary (GS +2.0%, consensus +2.0%, last +0.8%); Durable goods orders ex-transportation, April preliminary (GS +1.0%, consensus +0.7%, last +1.9%); Core capital goods orders, April preliminary (GS +1.0%, consensus +1.0%, last +1.2%); Core capital goods shipments, April preliminary (GS +1.0%, consensus +0.5%, last +1.6%): We estimate durable goods orders rose 2.0% in the preliminary April report, reflecting a rebound in Boeing orders. We estimate a 1.0% increase in durable goods orders ex-transportation, core capital goods orders, and core capital goods shipments, reflecting continued industrial-sector resilience.

- 08:30 AM GDP, Q1 second (GS +6.8%, consensus +6.5%, last +6.4%); Personal consumption, Q1 second (GS +11.2%, consensus +10.9%, last +10.7%): We estimate a four-tenths upward revision to Q1 GDP growth to +6.8% (qoq ar). Our forecast reflects firmer-than-expected services consumption details in the Census QSS survey.

- 08:30 AM Initial jobless claims, week ended May 22 (GS 435k, consensus 425k, last 444k); Continuing jobless claims, week ended May 15 (consensus n.a., last 3,751k): We estimate initial jobless claims decreased to 435k in the week ended May 22.

- 10:00 AM Pending home sales, April (GS -2.0%, consensus +0.5%, last +1.9%): We estimate that pending home sales declined by 2.0% in April.

- 11:00 AM Kansas City Fed manufacturing index, May (consensus +28, last +31)

- 10:30 AM Dallas Fed manufacturing index, May (consensus 30.0, last 28.9)

Friday, May 28

- 08:30 AM Advance goods trade balance, April (GS -$93.0bn, consensus -$92.5bn, last -$90.6bn): We estimate that the goods trade deficit increased by $2.4bn to $93.0bn in April compared to the final March report, reflecting stimulus-driven import strength partially offset by firming seaborne exports.

- 08:30 AM Wholesale inventories, April preliminary (consensus +1.1%, last +1.3%): Retail inventories, April (consensus n.a., last -1.4%)

- 08:30 AM Personal income, April (GS -13.5%, consensus -14.8%, last +21.1%); Personal spending, April (GS +0.6% consensus +0.5%, last +4.2%); PCE price index, April (GS +0.49%, consensus +0.6%, last +0.52%); Core PCE price index, April (GS +0.52%, consensus +0.6%, last +0.36%); PCE price index (yoy), April (GS +3.38%, consensus +3.5%, last +2.32%); Core PCE price index (yoy), April (GS +2.81%, consensus +2.9%, last +1.83%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE price index rose by 0.52% month-over-month in April, corresponding to a 2.81% increase from a year earlier. Additionally, we expect that the headline PCE price index increased by 0.49% in April, corresponding to a 3.38% increase from a year earlier. We expect a 13.5% decrease in personal income after the American Rescue Plan stimulus checks were primarily paid out in March, and a 0.6% increase in personal spending in April.

- 09:45 AM Chicago PMI, May (GS 67.5, consensus 69.0, last 72.1): We estimate that the Chicago PMI pulled back by 4.6pt to 67.5 in May, reflecting sequential normalization in other manufacturing surveys.

- 10:00 AM University of Michigan consumer sentiment, May final (GS 82.8, consensus 83.0, last 82.8): We expect the University of Michigan consumer sentiment index was unchanged at 82.8 in the final May reading, reflecting weaker signals from other consumer sentiment measures.

Source: DB, Goldman, BofA

Tyler Durden

Mon, 05/24/2021 – 09:14![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com