China Halts Banks From Selling Commodity-Linked Investment Products To Retail Traders

Now that the inflation narrative has been paralyzed with Bloomberg picking up on what we said last week about China’s tumbling credit impulse… China’s top banking regulator has directed banks to stop selling commodity-linked investments to mom-and-pop buyers, three sources with knowledge of the matter told Reuters. They said China is cracking down on the commodity boom and is attempting to curb future investment losses.

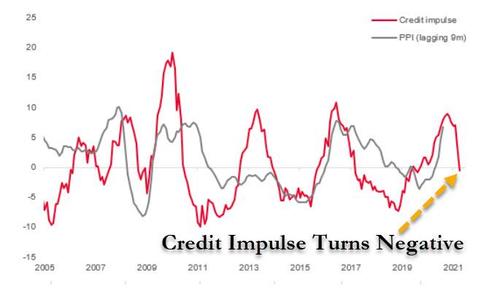

The China Banking and Insurance Regulatory Commission (CBIRC) requested banks to unwind existing books of commodity-linked products. This comes, as we noted above, China’s credit impulse is plunging and has crossed into negative territory, which will limit upside in global commodity prices.

The commodity boom began in the spring of 2020, driven by unprecedented monetary support from global central banks and fiscal support from governments, resulting in soaring prices from iron ore to copper to soybeans to wheat to crude to gasoline to almost every commodity. And, of course, Chinese retail traders went wild during the boom, sort of like Chinese farmers who invested their life savings in 2015 only to lose it all when everything crashed.

“The risk contained in banks’ commodity-linked investments cannot be easily spotted by ordinary investors, neither can they bear it,” one of the sources said. “Banks also don’t have enough expertise to run such products properly.”

CBIRC is moving to curb commodity speculation among retail as state planners and exchanges in recent weeks said they would implement price-control measures for commodities.

Last weekend, the National Development and Reform Commission (NDRC) cracked down on commodity speculation, threatening top metal firms with severe punishment for price manipulation to excessive speculation to spreading fake news.

After a year-long vertical rampage, iron-ore futures have hit a sudden air pocket in the last week amid chatter from Chinese regulators. There’s a “zero tolerance” for monopoly behavior and hoarding, the NDRC top execs Sunday.

“With policy risk-shifting toward government intervention, prices will surely be affected by market sentiment,” said Li Ye, an analyst at Shenyin Wanguo Futures Co. in Shanghai, who Bloomberg quoted. “The rapid surge in commodity prices has badly affected manufacturers and market orders, leading to losses and defaults.”

Over the past few years, we have vehemently explained that ‘as goes China’s credit impulse, so goes the world’, and it would appear, once again, that is occurring.

With China’s credit impulse negative, mom-and-pop investors who leveraged up in commodity-linked investments could get wiped out again as liquidity eases.

Sources said some banks are shifting their commodity-linked investments and clients to affiliated brokerages, but this would require permission from the securities regulator.

The Chinese government also warned that it would monitor and effectively ‘manage’ a rapid increase in commodity prices, without specifying how.

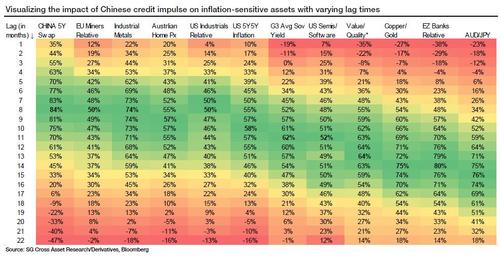

One final reminder: the credit impulse first reaches assets driven primarily by the Chinese economy (Chinese bond yields and industrial metals). Next to be impacted are inflation breakevens and sovereign yields in Western economies. The peak correlation for other growth-sensitive assets such as eurozone banks and AUD/JPY arrives with a bigger lag of around 4-5 quarters. This result, while logical, is quite significant, as it gives us a playbook for the ebb and flow in Chinese credit impulse.

… and it’s possible China is killing the commodity craze.

Tyler Durden

Wed, 05/26/2021 – 09:14![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com