Futures Flat As Traders Wait For Next Green Light From Fed

S&P 500 futures erased earlier gains, and after rising as much as 0.3% when they traded at all time highs, Eminis were last seen down 4 points or 0.1% to 4,232, as European stocks also struggled to gain momentum on Wednesday despite reassurances from U.S. Federal Reserve Chair Jerome Powell that the Fed is not rushing to hike rates contrary to the market’s post-FOMC freakout last week. Treasuries fell, the dollar was flat and bitcoin soared after tumbling on Tuesday.

On Tuesday, Powell sought to reassure investors on Tuesday, saying that the central bank will watch a broad set of job market data to assess the economic recovery from COVID-19, rather than rush to raise rates on the basis of fear of inflation. New York Fed President John Williams echoed Powell, saying that a discussion about raising interest rates is still “way off in the future.”

“The market’s still digesting the Fed news,” said Mo Kazmi, portfolio manager and macro strategist at UBP. “I think a lot of that move was exacerbated by stretched positioning and now what we’re seeing is perhaps reflation trades being put back on and the market normalising to some extent, realising that for now it’s just a subtle shift from the Fed.”

At 7:30 a.m. ET, Dow e-minis were down 8 points, or 0.02%, S&P 500 e-minis were down 4 points, or 0.1%, and Nasdaq 100 e-minis were down 21.25 points, or 0.10%. In early trading, energy stocks Occidental Petroleum, ConocoPhillips and Exxon Mobil gained about 1% as oil prices jumped to a more than two-year high. Among meme stocks, software firm Alfi Inc dropped 10.1% after more than doubling in value in the prior session, while Torchlight Energy Resources dropped in U.S. premarket trading, extending losses from Tuesday triggered by the Reddit-hyped oil explorer’s sale of $100 million in new shares. Stock declines as much as 13% after Tuesday’s 29% plunge. Xpeng ADRs climbed in U.S. premarket trading after the electric-vehicle maker is said to have received the green light from the Hong Kong stock exchange to list in the city. Cryptocurrency-exposed stocks also edged higher as Bitcoin recovered bigly after dipping below the $30,000 level in the prior session, and was currently trading around $34,100. Here are some of the biggest U.S. movers today:

- Cryptocurrency-exposed stocks edge higher in premarket trading following a volatile day for digital assets on Tuesday. Riot Blockchain (RIOT) climbs 2.4% and Marathon Digital (MARA) rises 2.3%, while Bit Digital (BTBT) gains 3.1%.

- Gemini Therapeutics (GMTX) slumps 30%, extending postmarket losses, after the company announced initial data from its Phase 2a ReGAtta study of GEM103 in patients with geographic atrophy (GA) secondary to dry age-related macular degeneration. Jefferies said the stock was oversold in postmarket trading and the data was “encouraging but early.”

- Xpeng ADRs (XPEV) rise 4.7% after the electric-vehicle maker is said to have received the green light from the Hong Kong stock exchange to list in the city. Peer Li Auto (LI) rises 2.4%, while Nio (NIO) gains 2.1%.

The MSCI world equity index was up 0.1% on the day at 1101 GMT, having recovered from the one-month low it hit in the aftermath of the Fed’s meeting.

In Europe, the Stoxx 600 Index fell as much as 0.5% to a session low, with travel and leisure and retail shares underperforming the most. All sectors in the red except energy and mining shares. Luxury shares are down after analyst downgrades. Here are some of the biggest European movers today:

- Pernod Ricard shares jump as much as 4.3% to a record high after the French distiller upgraded its full-year Ebit growth guidance more than anticipated, according to Jefferies. Peers also advance: Diageo gains as much as 2%, Remy Cointreau +1.5% and Campari +1.2%

- Abivax climbs as much as 15% to the highest since Feb. 16 following positive data from clinical trials of its rheumatoid arthritis drug.

- Bank of Ireland drops as much as 6.4% to the lowest since April 21 after the Irish government said it will sell part of its stake in the lender.

- Kering slips as much as 3.1% after HSBC downgraded luxury- goods stocks and said investors may “take a break” from names trading close to record valuations. Peers also fall: Hermes drops as much as 2.5%, LVMH -1.8%, Richemont -2.2%, Burberry -2.3%

- Shop Apotheke Europe drops as much as 5.1% after Metzler downgraded the stock to hold from buy, with analyst Tom Diedrich saying the latest news flow on e-prescriptions could dampen market optimism. Zur Rose Group falls as much as 5.8%

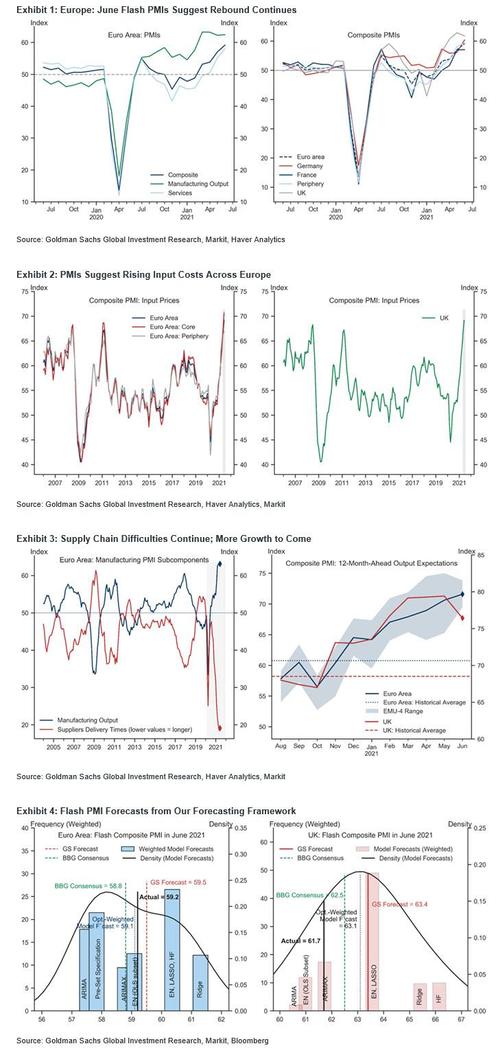

Early European PMI data showed that euro zone business growth accelerated at its fastest pace in 15 years in June as the easing of more lockdown measures and the unleashing of pent-up demand drove a boom in the bloc’s dominant services industry. The Euro area composite flash PMI increased by 2.1pt to 59.2 in June, continuing to beat consensus expectations. In a reversal of the cross-country pattern from May, the area-wide improvement was led by Germany, with a softer-than-expected PMI in France but further gains in the periphery. In the UK, the composite PMI declined by more than expected but remained close to its all-time high from May.

- Euro Area Composite PMI (June, Flash): 59.2, consensus 58.8, last 57.1.

- Euro Area Manufacturing PMI (June, Flash): 63.1, consensus 62.3, last 63.1.

- Euro Area Services PMI (June, Flash): 58.0, consensus 58.0, last 55.2.

- Germany Composite PMI (June, Flash): 60.4, consensus 57.6, last 56.2.

- France Composite PMI (June, Flash): 57.1, consensus 59.0, last 57.0.

- UK Composite PMI (June, Flash): 61.7, consensus 62.5, last 62.9.

Germany’s private sector growth was also lifted to its highest level in more than a decade in June, the PMI survey showed. In France, business activity edged higher, but not as much as expected. In Britain, growth in the private sector cooled slightly from the all-time high hit in May, but inflation pressures faced by firms hit record levels. The Bank of England meets on Thursday.

Berenberg economists Holger Schmieding and Kallum Pickering wrote in a note to clients that the euro zone economy is likely to recover to its pre-pandemic level of GDP in Q4 2021, while for Britain it will be Q1 2022.

UBP’s Kazmi said that he is positioned for higher yields in Europe, as it overtakes the United States in terms of vaccinations, lockdown easing and economic recovery from COVID-19.

“It will be interesting to see if the German Bund can follow the U.S. rate move with yields moving higher in Europe – it is something that we think could happen,” he said. “The fact that the Fed has moved more hawkishly will allow the ECB to be more comfortable perhaps in moving more hawkish, or less dovish, over time.”

Earlier in the session, Asian equities posted a modest advance, led by Hong Kong and Taiwan. The MSCI Asia Pacific Index was up 0.3%, set for a second straight day of gains. Property and IT shares climbed, offsetting a decline in consumer staples and industrial stocks. Hong Kong’s Hang Seng Index rose by the most in more than two months while Taiwan’s benchmark also jumped, driven by an advance in tech shares including Meituan, TSMC and MediaTek. The Asian measure’s mild move on Wednesday lies in contrast to its outsized swings in the past few sessions following the Fed’s hawkish pivot last week. Fed officials moved to clarify their stance this week, with Powell on Tuesday saying authorities would be patient in waiting to lift borrowing costs. “Powell is trying to calm the markets, and I think that should be a positive turn of pace through Asia,” said Gary Dugan, chief executive officer at Global CIO Office in Singapore. The current valuations of Asian stocks are “cheap,” he added. Japan stocks steadied after a wild two-day ride that saw the Nikkei 225 slump 3.3% on Monday and then recoup almost all those losses in the following session. Indonesia’s Jakarta Composite Index was the worst performer among major national benchmarks as the country struggles to contain the coronavirus outbreak.

Japan’s Topix declined as the market attempted to settle following a dramatic swing over the past two days. Electronics and auto makers were the biggest drags on the benchmark, which fell 0.5%. The Nikkei 225 closed little changed, with Fast Retailing the largest support while Eisai dropped. The Topix slid 2.4% on Monday before rebounding 3.2% on Tuesday, as investors reassessed the rally in cyclical-heavy Japan since late 2020 amid concerns over inflation and the timing of interest-rake hikes. The blue-chip Nikkei 225 is currently hovering around 29,000, in the middle of the 2,000-point range in which it has traded for most of the year. “It’s likely for investors to be inclined to take profits whenever the Nikkei 225 tops the 29,000 mark,” said Shingo Ide, chief equity strategist at NLI Research Institute. “Still, local corporate earnings are likely to improve, meaning more companies will likely revise up their forecasts, so the downside will be firmly supported with people kicking in to buy when the Nikkei 225 falls below 29,000.”

India’s benchmark equity index declined the most in two weeks, dragged by Reliance Industries after struggling for direction during the day. Out of 30 shares in the Sensex index, 8 rose, while 22 fell. Sixteen of the 19 sector indexes compiled by BSE Ltd. tumbled, with a measure of oil and gas companies leading the losers. Stocks swung between gains and losses several times through the session against the backdrop of a steady ramp up in coronavirus vaccinations and the reassurance of policy support from the U.S Federal Reserve. The S&P BSE Sensex closed down 0.5%, with the NSE Nifty 50 Index falling by a similar magnitude. “Nifty continues to witness selling pressure at higher levels,” Manish Hathiramani, technical analyst at Deen Dayal Investments said in a note. “A buy-on-dips approach would be the most prudent way to trade this market.” Reliance Industries Ltd. was the biggest drag on both indexes, falling 0.9%. The nation’s largest company by market capitalization will hold its annual general meeting on Thursday.

In rates, Treasuries were slightly cheaper and the yield curve is steeper, with 10-year yields at around 1.477%, cheaper by 1bp. The long end steepened the 5s30s curve by more than 1bp, although the spread at close to 124.2bp it remains inside Tuesday’s range. The Asian session saw light volumes and low activity, while open interest points to a continued unwinding of positions into the ongoing Treasuries bear steepening move. Treasury auctions continue Wednesday with a $61b 5-year note sale at 1pm ET; offering follows a soft 2-year sale on Tuesday. In Europe, Bund futures are just off session highs having traded at -0.176%. Peripheral spreads tighten to core, 10y Bund/BTP spread narrows ~2bps.

In FX, the Bloomberg Dollar Spot Index hovered around its 200-day moving average as it gave up an earlier advance when the euro erased losses following better-than-forecast PMIs out of Germany and the euro-zone. The greenback was mixed versus its Group-of-10 peers though most currencies traded in more confined ranges compared to moves over the past week. The krone advanced as oil prices rose after an industry report pointed to another decline in U.S. crude stockpiles. The pound swung between modest losses and gains against the dollar, as investors positioned for a potentially more hawkish tone from the Bank of England at its Thursday decision. Options show the pound may stay above recent lows even if the BOE makes a case for selling pressure. Australian and New Zealand dollars reversed an Asia-session loss, even as Covid-19 restrictions were tightened in both nations. The yen fell toward its lowest level in more than a year as sentiment got a boost after Federal Reserve officials said interest rates are unlikely to rise anytime soon.

In commodities, Brent crude oil futures rose above $75 a barrel, their highest in more than two years, after an industry report pointed to another decline in U.S. crude stockpiles.

Elsewhere, bitcoin was up around 5% on the day, above the $34,000 mark. The cryptocurrency dropped to as low as $28,600 on Tuesday – its lowest since January. Ether was trading around $2,000.

The U.S. is set to report new home sales in May on Wednesday. The data “is unlikely to offer any major surprises,” Kaia Parv, head of investment research at FXPRIMUS, wrote in emailed comments. “These figures should mimic the trend of rolling off as we saw with existing home sales earlier this week.”

To the day ahead now, data releases include US new home sales for May, while from central banks, we’ll hear from ECB President Lagarde, Vice President de Guindos, and the Fed’s Bowman, Bostic and Rosengren.

Market Snapshot

- S&P 500 futures up 0.1% to 4,240.50

- STOXX Europe 600 down 0.1% to 455.92

- MXAP up 0.4% to 206.75

- MXAPJ up 0.9% to 693.70

- Nikkei little changed at 28,874.89

- Topix down 0.5% to 1,949.14

- Hang Seng Index up 1.8% to 28,817.07

- Shanghai Composite up 0.2% to 3,566.22

- Sensex little changed at 52,613.89

- Australia S&P/ASX 200 down 0.6% to 7,298.45

- Kospi up 0.4% to 3,276.19

- Brent Futures up 0.9% to $75.50/bbl

- Gold spot up 0.3% to $1,783.78

- U.S. Dollar Index little changed at 91.71

- German 10Y yield fell 0.4 bps to -0.167%

- Euro little changed at $1.1941

Top Overnight News from Bloomberg

- Chancellor Angela Merkel’s cabinet approved plans to increase borrowing by 99.7 billion euros ($119 billion) next year to help finance Germany’s pandemic response

- IHS Markit said its key index of activity in the U.K. was only slightly below the record posted in May, with firms responding to rising workloads by taking on staff at the fastest pace since it began collecting data in 1998; output-price inflation hit a new record as firms passed on higher costs to customers

- “In the second quarter of the year as well as in the second half of the year, we expect very significant growth in the euro-area,” ECB Vice President Luis de Guindos said in online event

- Treasury moves have been large post- Fed, but changes in curvature have been historically extreme. The past four sessions have seen futures open interest collapse, with the equivalent of $37 billion in 10-year bond positions being wiped out

- Morgan Stanley plans to bar employees who aren’t vaccinated against Covid-19 from entering its offices in the New York area, as a growing number of major Wall Street firms delay the return of staff who aren’t protected against the deadly virus

- Poland should shrug off inflationary fears and keep its key interest rate near zero until its economy fully bounces back, central banker Jerzy Zyzynski said

- The Czech Republic will probably follow regional neighbor Hungary by starting a campaign to lift borrowing costs to eliminate the risk of inflation spiraling out of control

Quick look at global markets courtesy of Newsquawk

Asia-Pac equities saw mixed trade and failed to fully benefit from the firmer performance seen on Wall Street, where the Nasdaq Composite closed at an all-time high as Microsoft joined Apple in the USD 2trl club, whilst the S&P 500 was just short of a new closing record. US equity futures held a mild upside bias – the NQ (+0.2%), ES (+0.1%), RTY (+0.1%), and YM (+0.1%) all saw modest broad-based gains ahead of the next raft of Fed speakers. ASX 200 (-0.4%) was pressured as the gains across its mining, telecoms, and tech stocks failed to offset the losses in the Financials and Healthcare sectors. The Nikkei 225 (Unch) briefly topped 29k as the softer currency underpinned the exporter-heavy index. The KOSPI (+0.4%) remained cautious as tensions between Washington and Pyongyang simmered in the background. The Hang Seng (+1.6%) was bolstered by gains across its large-cap oil and financial stocks, whilst the Shanghai Comp (+0.5%) was contained, with friction reported in the Taiwanese Strait after a US destroyer sailed through the waters in what was seen as a sign of provocation in Beijing. Finally, JGB futures are relatively flat as it tracks price action across UST futures.

Top Asian News

- Apple Daily to Shut Down at Midnight After Hong Kong Arrests

- China, U.S. May Hold Diplomatic Talks Next Week, FT Reports

- Australian Law Could Force Facebook, Google to Strip Content

- Monthly Bargain Days Boost Southeast Asia’s Online Spending

European equities (Stoxx 600 -0.5%) painted a relatively mixed picture at the start of the session with initial pressure seemingly stemming from misses across the board on French flash PMIs for June. A better-than-expected report from Germany and the Eurozone was unable to help revive sentiment with the Stoxx 600 unable to surmount the index’s record high of 460.5 posted on June 14th. As the morning progressed the initial equity pressure has picked up with fresh catalysts slim though cash bourses remain somewhat mixed as the FTSE 100, for instance, benefits from mining strength. Separately, analysts at JP Morgan note that Europe is currently experiencing a faster pace of upgrades than any other region and still has room to continue its uptrend vs. the US. Stateside, futures trade largely unchanged ahead of the US entrance to market with no real bias towards growth/value. From a sectoral standpoint, Oil & Gas names sit at the top of the leaderboard with Brent crude rising to its best level since October 2018. Basic Resources are also performing well with BHP (+0.8%) a notable gainer in the sector after being upgraded to overweight from equal weight at Morgan Stanley. While Pernod Ricard (+2.4%) is currently the biggest gainer in the Stoxx 600 after raising guidance amid a stronger than expected recovery from the pandemic. At the other end of the spectrum, Luxury names have been in focus after a slew of broker moves at HSBC which has sent the likes of Kering (-3.0%), Hermes (-1.9%) and Burberry (-0.2%) lower.

Top European News

- U.K. Poised to Ease Travel Curbs as Airlines Step Up Demands

- London Looks Past Brexit to Eclipse Rivals in Emerging Markets

- Private Equity Faces Off Hedge Fund Shorts in Bid for U.K. Plc

- Londoners Snap Up Luxury Homes as Rich Foreigners Are Locked Out

In FX, a stellar start to Wednesday’s session for Sterling amidst reports of optimism on both sides of the NI protocol divide that a stop-gap solution can be found to the trade spat, while the Pound also scaled several chart and psychological hurdles vs the Dollar and Euro respectively that have been capping upside momentum. Specifically, the 100 DMA at 1.3944 and yesterday’s 1.3963 high that aligns with a Fib retracement (38.2% of the retreat from 1.4250 peak on June 1st to this Monday’s 1.3787 low) were all breached to expose 1.4000 in Cable, and Eur/Gbp crossed 0.8550 to the downside on the way to a circa 0.8530 multi-month low before bouncing in wake of somewhat contrasting flash UK PMIs. Conversely, the Yen’s fortunes are going from bad to worse it seems as Usd/Jpy has now surpassed 111.00 inching beyond prior YTD peaks and now eyeing 111.10, with reports that the Japanese Government is thinking about tightening regulations regarding foreign investment in important tech firms hardly helping.

- USD – Aside from Yen underperformance and a fragile Franc (latter still straddling 0.9200), the Greenback is gradually losing more of its post-FOMC vigour vs G10 peers and EM counterparts. Indeed, the DXY is slipping further from 92.000 having already retreated into another lower range from last week’s peak (92.408), and in tech terms closing below a Fib support level for the 2nd consecutive day following a round of Fed speak offering a less hawkish/more dovish spin compared to Monday. However, the index is holding just above yesterday’s 91.643 trough, for now, within a 91.900-682 band awaiting more US housing data, Markit’s prelim PMIs and the next batch of Fed officials, including Bowman, Bostic and Rosengren.

- NZD/AUD – The Kiwi and Aussie have both recovered well from overnight lows just under 0.7000 and sub-0.7550 against their US rival irrespective of latest COVID-19 outbreaks in Wellington and NSW that prompted NZ to lift the capital’s alert status to level 2 and the state premier to announce new restrictions for hotspots including Sydney. Nzd/Usd is back up near 0.7050 and Aud/Usd is eyeing 0.7575 having cleared the 200 DMA (0.7560) with some belated assistance perhaps via the CBA revising its RBA outlook markedly (the bank now anticipates a hike in November 2022 vs 2024 previously).

- CAD/EUR – Another and firmer rebound in oil prices has helped the Loonie pare more of its recent losses to probe resistance offers through 1.2300 in the run up to Canadian retail sales, while mostly better than expected Eurozone flash PMIs (after an initial French scare) are contributing to the Euro’s efforts to stay comfortably afloat of 1.1900.

- SCANDI/EM – Brent’s bounce beyond Usd 75/brl alongside WTI on the back of bullish private crude inventory data is boosting the Nok, Rub and Mxn, while the Sek is deriving some underlying support from a sharp upgrade to this year’s GDP estimate from the Swedish Finance Ministry and the Try is taking remarks from the CBRT about protecting the Lira at face value. Elsewhere, the Zar has shrugged off slightly weaker than forecast SA core CPI against the backdrop of relative stability in Gold, but the Cnh and Cny remain on a weaker footing in line with PBoC fixings.

In commodities, a slower session for the crude complex in terms of newsflow updates after yesterday’s multiple source reports relating to OPEC+ potentially considering increasing production and the benchmarks are now back at prices near/above yesterday’s best levels. Specifically, WTI and Brent August’21 contracts post gains of ~1.0% on the session at the top end of a USD 1/bbl range for Brent which is now trading in the mid USD 75.50/bbl region. Focus this morning has been on yesterday’s bullish private inventory report, particularly referencing the headline crude figure which posted a draw of -7.2mln vs exp. -3.9mln, ahead of the EIA release due later today. Elsewhere, geopolitical development has seen outgoing Iranian President Rouhani’s Chief of Staff announced that parties in Vienna have agreed to lift economic sanctions on Iran; however, Rouhani is the outgoing President so it remains to be seen how relations will transfer and develop when Raisi, who has already refused a President Biden meeting, takes over. Subsequently, Germany’s Foreign Minister says that there are still some issues but acknowledges progress has been made on the nuclear talks. Moving to metals, spot gold and silver have been very contained throughout the morning though modestly firmer on the session taking advantage of USD pressure. For base metals attention remains firmly on the action of China whose State Planner has sent teams to begin investigation commodity pricing and supply. Nonetheless, the likes of platinum, palladium and LME copper remain firmer on the session.

US Event Calendar

- 8:30am: 1Q Current Account Balance, est. -$206.2b, prior -$188.5b

- 9:45am: June Markit US Services PMI, est. 70.0, prior 70.4

- 9:45am: June Markit US Manufacturing PMI, est. 61.5, prior 62.1

- 10am: May New Home Sales, est. 865,000, prior 863,000; MoM, est. 0.2%, prior -5.9%;

DB’s Jim Reid concludes the overnight wrap

5 years ago today we saw the U.K. vote for Brexit. Since this day, Sterling is -6.24% vs the Dollar and +4.87% vs the Euro, 10yr gilts have rallied -59bps (10yr Treasuries and Bunds have rallied -28bps and -26bps for context) and the FTSE is +11.9% (S&P 500 + 100.9% and Stoxx 600 +31.8%). Those who believe it was a bad idea continue to feel as strongly as ever and those who believe it was a good idea also share the same convictions. My only comment is that I can’t believe how quickly five years has gone.

I wonder what we’ll be saying about the Fed actions in recent weeks in five years time? For now calming remarks from Fed officials meant that risk assets have now regained their poise after last week’s FOMC wobble. Before the numerous Fed speakers, even 10yr US yields briefly traded higher than their pre-FOMC levels (European bonds closed above). However a steady but notable bond rally started with the Fed commentary which in turn helped equity markets power ahead.

The early speakers indeed helped set the tone with New York Fed President Williams reassuring markets that rates hikes were “still way off in the future”, while Cleveland Fed President Mester (a non-voter this year) said that they weren’t at a point to dial back accommodation, but that it may come under consideration this Autumn.

Fed Chair Powell later testified before the House of Representatives’ Select Subcommittee on the Coronavirus Crisis. The Chair received numerous questions on inflation and the Fed’s role and ability to curtail it. Chair Powell stuck to the script that, “a pretty substantial part, or perhaps all of the overshoot in inflation comes from categories that are directly affected by the re-opening of the economy such as used cars and trucks.” However as he mentioned last week, that view requires some level of humility and he acknowledged that those price “effects have been larger than we expected and they may turn out to be more persistent than we expected.” Powell also noted that the FOMC “will wait for actual evidence of actual inflation or other imbalances” before moving rates higher and not react to projections. The S&P 500 rose about 0.35% during the testimony before moderating a bit into the close, while US 10yr treasury yields fell another -1.5bps having rallied with the earlier Fed speak.

Running through the moves in response, US equities continued to advance as the S&P 500 (+0.51%) moved to within just quarter of a per cent of last week’s all-time closing high, whilst the VIX index of volatility fell a further -1.2pts as it subsided from its own recent high on Friday. New records were also set, with the NASDAQ (+0.79%) hitting a new record as tech stocks continued to power ahead, though small-cap stocks fared less well with the Russell 2000 closing up +0.43%. The US equity rally was fairly broad based with 18 of 24 industry groups gaining with a mix of technology and cyclicals stocks amongst the best performers. In fact the only two industries that fell over -0.25% yesterday were the defensive, bond-proxies real estate (-0.44%) and utilities (-0.68%). There were similar advances in Europe too, where the STOXX 600 (+0.26%), the FTSE 100 (+0.39%) and the DAX (+0.21%) all moved higher on the day.

For US Treasuries, yesterday saw a further steepening in the yield curve, albeit small, with the 2s10s (+0.1bps) and the 5s30s (+0.9bps) both moving higher. That was driven by a rally at the front end, with 2yr yields moving down -2.6bps on the day to 0.228%, whereas 30yr yields were down -2.4bps to 2.09%. We also saw a 2nd day running of higher inflation expectations, with the 10yr breakeven up +4.2bps to 2.32%, which brings its rise over the last 2 sessions to +8.2bps, although lower real yields helped the 10yr Treasury yield to move -2.5bps lower on the day, closing at 1.463%. At the day’s highs (1.507%) 10yr yields were actually +2.3bps higher that just before the FOMC announcement and 30yr yields (2.147%) were just -3bps lower than their pre-FOMC levels. At those intraday highs, the respective bonds were +15.5bps and +22.1bps higher than their Monday morning Asian yields lows. So a wild swing but markets are slowly getting acclimatised to the fact that the Fed didn’t say anything that outlandish last week. They just caught up closer to reality. For Europe it was a slightly different picture however, as 10yr yields on bunds (+0.7bps), OATs (+0.3bps) an BTPs (+2.2bps) all rose on the day.

Asian markets are largely posting gains this morning with the Nikkei (+0.07%), Hang Seng (+1.46%), Shanghai Comp (+0.46%) and Kospi (+0.38%) all up. Futures on the S&P 500 are also up +0.14% while the dollar index is up +0.11% in early trade today. Elsewhere, commodity prices are mostly trading up with DCE iron ore (+4.17%), Copper (+1.00%), SHF steel rebar (+2.12%) and oil prices (c. 0.50%) all higher. Treasury yields are broadly flat.

Looking ahead, the main highlight today will be the release of the flash PMIs for June. Back in May, the final numbers showed that growth was still maintaining decent momentum, with the Euro Area composite PMI coming in at 57.1, the strongest in over 3 years, while the US composite PMI was at 68.7, which is the strongest since the data goes back to in October 2009. Price pressures will be scrutinised and it’s possible the recent commodity dip will ease input prices even if supply chain issues still remain. Overnight, we’ve already had the numbers in from Japan and Australia, which showed Japan’s preliminary manufacturing PMI softening to 51.5 from 53.0 last month while the services reading improved to 47.2 from 46.5. Australia’s manufacturing PMI also softened to 58.4 (vs. 60.4 last month), the same trend as the Services PMI which came in at 56.0 (vs. 58.0 last month).

While Bitcoin ended the session up +0.98% at $32,903, at one point the cryptocurrency fell beneath $30,000 in trading for the first time since late January. The cryptocurrency is on track for its 3rd successive monthly decline now, and given it started the year at $28,996 it’s not too far away from having erased its entire YTD gains (it did intra-day), after peaking at an intra-day high of $64,870 back on April 14. So in spite of being all the rage during its ascent in Q1, you’d actually have better YTD returns right now from the mast majority of traditional assets in our monthly performance review suite.

In terms of the latest on the pandemic, there were signs that border restrictions could still be around in 2022 after Dow Jones reported that China would keep its pandemic border restrictions for at least another year, according to those familiar with the matter. Separately in the UK there was continued concern about the spread of the delta variant, as yesterday saw the 7-day average of new cases surpass 10,000 for the first time since February. That said, the one good piece of news is that the latest wave has seen the age distribution of cases shift substantially lower relative to previous waves, and younger groups are much less likely to be severely affected by the virus relative to older groups.

Concerns around the spread of the delta variant has also led to Wellington, capital city of New Zealand, raising its alert level to 2, a step below a lockdown while in Australia, Sydney has decided to impose new restrictions, including compulsory mask-wearing at all indoor venues such as workplaces and shops to control the outbreak. Taiwan has also decided to extend its soft lockdown by another two weeks to June 28. Elsewhere, the White House noted that the US is unlikely to reach 70% of adults with at least one shot by July 4th, however they are likely to get to 70% of all those over the age of 27 by the holiday.

Looking at yesterday’s data, US existing home sales fell to an annualised rate of 5.80m in May (vs. 5.73m expected), marking the 4th consecutive monthly decline. Separately, the Richmond Fed’s manufacturing survey for June saw the composite index rise to 22 (vs. 18 expected). And over in Europe, the European Commission’s advance consumer confidence reading for the Euro Area in June rose to -3.3 (vs. -3.1 expected), which is its highest level since January 2018.

To the day ahead now, and the aforementioned flash PMIs for June will likely be the main highlight. Otherwise, data releases include US new home sales for May, while from central banks, we’ll hear from ECB President Lagarde, Vice President de Guindos, and the Fed’s Bowman, Bostic and Rosengren.

Tyler Durden

Wed, 06/23/2021 – 08:08![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com