Futures Start Second Half Hovering At All Time Highs As Oil Jumps

S&P futures were flat, hovering near all time highs, after earlier briefly rising above 4,300 – Goldman’s year-end price target – before dipping back to the unchanged line as European stocks faded gains of as much as 1% as gains in cyclical shares offset declines in technology firms. Asian shares dipped as Covid-19 flareups threaten to hamper the recovery there. Dow e-minis were up 20 points, or 0.06%, S&P 500 e-minis were up 1 point, or 0.03%, and Nasdaq 100 e-minis were down 25.5 points, or 0.28%. The dollar rose while Treasuries dipped.

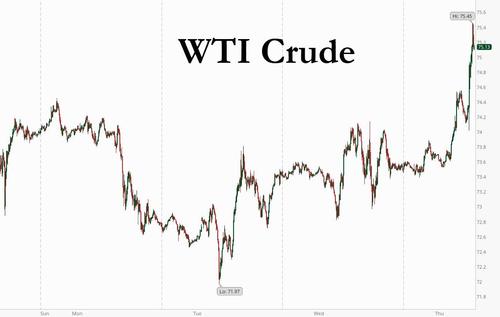

WTI crude surged almost 3%, rising above $75 a barrel, for the first time since 2018, as the market awaited a decision from OPEC+ on production levels for the coming months. OPEC+’s de facto leaders, Saudi Arabia and Russia, have a tentative agreement to increase output gradually, but are still negotiating a deal, delegates said as ministers gathered online on Thursday. The proposal under discussion would add about 2 million barrels a day to the cartel’s output between August and December, they said.

In premarket trading, Micron slipped 2.9% even as it beat estimates for quarterly profit and forecast fourth-quarter revenue above expectations. Didi jumped 8.5%, a day after its shares ended their first day of U.S. trading slightly over their initial public offering price of $14, and dropping more than 10% from the break price. Here are some of the other big premarket movers today:

- Borqs Technologies (BRQS) falls in U.S. premarket trading and Exela Technologies (XELA) fluctuates after Reddit-fueled jumps for both stocks recently.

- CureVac shares (CVAC) sink as much as 14% in U.S. premarket trading after its Covid-19 vaccine demonstrated overall efficacy of 48%, trailing other vaccines currently in use.

- ADRs of Chinese ride-hailing giant Didi (DIDI) rise in U.S. premarket trading, a day after its debut.

- Chinese hip-hop promoter Pop Culture Group (CPOP) falls in U.S. premarket trading after it surged 405% in debut.

- Spero Therapeutics (SPRO) surges in U.S. premarket trading after the company said Pfizer made a $40m equity investment and entered a licensing agreement.

With the S&P 500 and the Nasdaq hitting a series of record highs last month, investors are razor-focused on Friday’s nonfarm payrolls report, where a strong reading could force the U.S. Federal Reserve to rethink its accommodative stance. Focus also shifts to the second-quarter earnings season, beginning July, to gauge whether the first-half momentum could continue further for the remaining year.

Risk assets started the second half in an uncertain mood, as they also face challenges from Covid-19 variants and the prospect of diminishing monetary policy support amid inflation pressures. That’s leading to predictions of a pickup in volatility and stirring questions about whether bets tied to economic reopening — such as on cyclical stocks and higher longer-term Treasury yields — will prosper.

“What we’re seeing at the moment is markets coming to the realization that they have to discount the risk — the high probability I really should say — that the Covid-19 virus will be with us for the foreseeable future,” Kyle Rodda, an analyst at IG Markets, said on Bloomberg Television. He added investors will reward countries with adequate vaccine capacity, helping to explain some of the strength of U.S. and European stocks relative to Asian equities.

In Europe, the Stoxx 600 faded gains of as much as a 1.1% as energy firms and banks led while technology shares drifted lower. Travel shares got a lift from a report that the U.K. plans to ease tourism rules. The Stoxx Europe 600 Basic Resources Index rises as much as 2%, as cyclical stocks including banks, travel and energy bounce, while iron ore gains provide a boost to miners. Diversified miners rise; BHP +1.8%, Glencore +2%, Anglo American +2.1%, Rio Tinto +1.2%. Steelmakers also rise: ArcelorMittal +2.8%, Evraz +2.9%, Voestalpine +1.6%. European bank stocks advanced, with the Stoxx 600 Banks Index among the best sectors in the region, after ECB President Christine Lagarde said restrictions on dividends could be lifted in September. Here are some of the biggest European movers today:

- AB Foods shares jumped as much as 5.4%, most since Feb. 15, after the company raised its financial outlook for the year. Analysts noted the positive impact of its Primark budget clothing chain and see consensus profit expectations increasing following Thursday’s update.

- Orsted shares rose as much as 5.2% after the group was awarded a contract for an offshore wind-farm project in New Jersey.

- All members of the index are in the green, with Societe Generale +3.3%, BBVA +3.5%, Banco Santander +2.9%

- Grafton shares climbed as much as 4.4%. The sale of its traditional merchanting arm has been done at an “impressive multiple,” Liberum writes in a note.

- JD Sports shares gained as much as 4.4% after the sportswear retailer increased its FY adjusted pretax profit guidance to at least GBP550m. The update showed a good start to the fiscal year, according to Peel Hunt, which increased its estimates “handsomely” as a result.

- Solutions 30 shares jump as much as 17% after CEO Gianbeppi Fortis says the Luxembourg-based technology-services company has “beautiful years of growth” ahead, with the search for a reference shareholder about to start.

- European travel stocks rise after a Times of London report saying the U.K. government is aiming to introduce quarantine- free travel for double-vaccinated holidaymakers by July 26, the first full week of school holidays in Britain. Shares of EasyJet as much as +4.7%, British Airways-owner IAG +4.2%, Ryanair +3.3%, Lufthansa +3.4%, TUI +3.6%, WHSmith +4.6%

- H&M shares dropped as much as 4.9%, the most since Jan. 29, with analysts noting a slowdown in 3Q momentum for the fast fashion retailer. The Swedish company is the worst performer in Europe’s Stoxx 600 Retail Index on Thursday.

- Nordex shares fell as much as 12%, the most intraday in four months, after the German wind-turbine maker launched a rights offering to raise EU584.6m.

- Meyer Burger Technology shares slumped as much as 15%, the most since late July 2020, after the company raised CHF80m in a private placement.

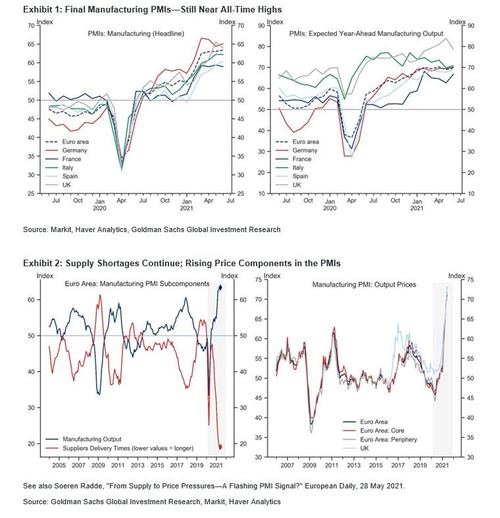

European bourses were not impressed by the latest Euro zone manufacturing data which expanded at its fastest pace on record in June, according to Thursday’s PMI survey which also showed factories faced the steepest rise in raw materials costs in well over two decades. IHS Markit’s final manufacturing Purchasing Managers’ Index (PMI) rose to 63.4 in June from May’s 63.1, above an initial 63.1 “flash” estimate and the highest reading since the survey began in June 1997.

- Euro Area Manufacturing PMI (Final, June): 63.4, flash 63.1, previous 63.1

- Germany Manufacturing PMI (Final, June): 65.1, flash 64.9, previous 64.4

- France Manufacturing PMI (Final, June): 59.0, flash 58.6, previous 59.4

- Italy Manufacturing PMI (June): 62.2, GS 62.1, consensus 62.2, previous 62.3

- Spain Manufacturing PMI (June): 60.4, GS 59.3, consensus 59.6, previous 59.4

- UK Manufacturing PMI (Final, June): 63.9, flash 64.2, previous 65.6

“Euro zone manufacturing continued to grow at a rate unbeaten in almost 24 years of survey history in June as demand surged with the further relaxation of COVID-19 containment measures,” said Chris Williamson, chief business economist at IHS Markit. “However, the sheer speed of the recent upsurge in demand has led to a sellers’ market as capacity and transportation constraints limit the availability of inputs to factories, which have in turn driven industrial prices higher at a rate not previously witnessed by the survey.”

The mood was also downbeat in Asia where equities fell, on track for a third-straight daily loss amid concerns over the impact of the delta variant and stubbornly high Covid-19 infection rates on the global economic recovery. Technology stocks were the biggest drag on the MSCI Asia Pacific Index, as all industry groups declined. The three-day drop comes on the heels of a five-day gain. The recent dip in Asia contrasts markedly with the U.S., where the S&P 500 has gained for five straight sessions to a series of new record highs. MSCI’s Asian Pacific gauge underperformed a measure of global peers in April-June by the most since the third quarter of 2015, marred by relatively lower vaccination rates and stricter lockdowns. “If the world is in a race to open up then it’s clear that those with higher vaccine take-ups are winning, with the U.S.A., U.K., Europe well ahead,” Simon Powell, a Hong Kong-based equity strategist at Jefferies, wrote in a note. “Variants are currently causing concern due to higher transmissibility, but there is some data to suggest lethality could be lower.” Stocks dropped in Japan on Thursday after Tokyo reported the highest number of confirmed coronavirus cases in more than a month. The Philippines led gains around the region, with its benchmark closing 0.9% higher. Hong Kong markets were closed for a holiday.

Japanese stocks fell after Tokyo reported the highest number of confirmed coronavirus cases in more than a month on Wednesday, damping investor demand for riskier assets. The Topix fell for the third day, dropping 0.2% to 1,939.21 in Tokyo, while the Nikkei 225 closed at 28,707.04, down 0.3%. Mitsubishi Electric Corp. contributed the most to the Topix’s decline, decreasing 6.1%. Today, 1,295 of 2,187 shares fell, while 764 rose; 21 of 33 sectors were lower, led by information and communication stocks. “Japanese stocks are falling behind due to the infection outbreak — cases are rebounding in Tokyo earlier than expected,” said Takashi Ito, an equity market strategist at Nomura Securities. “Even though the vaccine rollout is proceeding, given the delta variant, the outbreak situation is still serious in Japan.” Terminal users can read more in our markets live blog. U.S. index futures rose during Asia trading hours. The S&P 500 closed slightly higher on Wednesday, notching its longest streak of quarterly gains since 2017, as solid economic data tempered concern about elevated valuations and the spread of a more contagious coronavirus variant. “Japanese stocks are stuck in a range,” said Hajime Sakai, the chief fund manager at Mito Securities Co. “They could try testing to break out in an upward trend, once uncertainties surrounding the Olympics go away and vaccinations catch up. The trend remains upward, investors just have to wait.”

Indian shares fell for a fourth session amid a lack of local triggers as investors booked profit following the benchmark index’s longest run of quarterly gains since 2015. The S&P BSE Sensex dropped 0.3% to 52,318.60 in Mumbai after completing five straight positive quarters Wednesday. The NSE Nifty 50 Index declined by a similar magnitude, with Infosys and HDFC Bank weighing on both measures. Fourteen of the 19 sector sub-indexes compiled by BSE Ltd. retreated, led by a gauge of power companies. “The markets look stretched at index level,” Mohit Nigam, a portfolio manager with Hem Securities Ltd., said by phone. He attributed the latest market weakness to concerns over valuations as the Nifty continues to trade at more than 20 times its 12-month forward earnings estimates. Investors should focus on individual stocks from sectors such as pharma and technology that have largely remained unaffected by the pandemic, Nigam said. Industrial activity in India has been gathering pace, with key industries’ output increasing 16.8% in May. India’s steady pace of vaccination and dropping number of Covid-19 cases has helped states ease curbs on the movement of people. Auto companies, led by carmaker Maruti Suzuki and motorcycle manufacturer Bajaj Auto, posted higher sales for June

In rates, Treasuries were slightly cheaper with the curve steeper as month-end bid leaves the market; bunds underperform, helping drag Treasuries lower on haven unwinds and ahead of French debt sales. Treasuries cheaper by nearly 1.5bp across long-end of the curve, steepening 5s30s by ~1bp; 10-year yield at 1.478% is higher by 1bp, with corresponding bunds and gilts lagging by ~1.5bp. Manufacturing data is in focus during U.S. session with June PMI and ISM readings due, while Fed’s Bostic is slated to speak.

In FX, the dollar climbed to a one-week high as traders assessed US data to see if the economy is strong enough for the Federal Reserve to start withdrawing its monetary stimulus. The U.S. currency strengthened against all except one of its Group-of-10 peers after an ADP Research Institute report on Wednesday showed private payrolls rose more last month than economists predicted. Investors are awaiting June manufacturing data due Thursday, and nonfarm payrolls on Friday. The pound extended its drop after posting the worst month in June since September, with Bailey re-emphasising that the rise in inflation was due to one-off factors that should not last. New Zealand’s dollar outperformed G-10 peers, while the yen consolidated after falling to weakest level since March 2020 in early Asian trading.

In commodities, as noted above oil jumped above $75 a barrel as the market awaited a decision from OPEC+ on production levels for the coming months. Base metals mixed in London: Copper +0.4%, aluminum -0.6%, nickel -0.5%, zinc +0.2%; iron ore +1% in Singapore, +1.7% in China

The Labor Department’s weekly jobless claim report, due at 8:30 a.m. ET, is expected to show the number of Americans filing for unemployment benefits fell for the week ended June 26, albeit at a slower pace amid labor shortages. Separately, data on U.S. factory activity and construction spending is scheduled at 10 a.m. ET.

Market Snapshot

- S&P 500 futures up 0.3% to 4,300.00

- STOXX Europe 600 up 0.7% to 455.94

- MXAP down 0.4% to 207.11

- MXAPJ down 0.4% to 698.32

- Nikkei down 0.3% to 28,707.04

- Topix down 0.2% to 1,939.21

- Hang Seng Index down 0.6% to 28,827.95

- Shanghai Composite little changed at 3,588.78

- Sensex down 0.2% to 52,394.58

- Australia S&P/ASX 200 down 0.6% to 7,265.57

- Kospi down 0.4% to 3,282.06

- German 10Y yield rose 1.6 bps to -0.191%

- Euro down 0.1% to $1.1844

- Brent Futures up 1.3% to $75.60/bbl

- Gold spot up 0.3% to $1,775.01

- U.S. Dollar Index little changed at 92.50

Top Overnight News from Bloomberg

- Bank of England Governor Andrew Bailey pushed back on speculation that he’ll soon move to tighten monetary policy

- The end of one of the best first halves since 1998 for U.S. stocks was marked by small moves and slow trading

- Chancellor of the Exchequer Rishi Sunak will promise to bolster the U.K. finance industry’s competitive edge for decades to come on Thursday, the latest move by the U.K government to champion a sector that it largely ignored during Brexit

- The Trump Organization and Chief Financial Officer Allen Weisselberg were charged by a grand jury in Manhattan Wednesday, in the first cases to emerge from a multiyear investigation of the former president’s company, a person familiar with the matter said

Quick look at global markets courtesy of Newsquawk

Asian equity markets began H2 subdued following the mixed performance of Wall St counterparts and as participants digested a slew of soft data releases including the BoJ Tankan survey which missed expectations and Chinese Caixin Manufacturing PMI also printed short of estimates. ASX 200 (-0.7%) traded negatively with underperformance in consumer stocks and the largest-weighted financials sector but with downside stemmed as data showed the domestic manufacturing industry and the latest exports gathered pace. Nikkei 225 (-0.3%) was pressured after a disappointing BoJ Tankan Survey in which most components of the release missed forecasts despite the headline Large Manufacturing Index increasing to its highest level since December 2018 and Large Non-Manufacturers Index turning positive for the first time in more than a year, while the KOSPI (-0.4%) was also constrained with a continued surge in exports doing little to spur risk appetite. Shanghai Comp. (-0.1%) was lacklustre after Chinese Caixin Manufacturing PMI missed forecasts and amid the absence of Hong Kong participants, as well as Stock Connect trade on the anniversary of the city’s handover from the UK, while there were also hawkish reports concerning Taiwan including comments from Chinese President Xi that they want to resolve the Taiwan problem to achieve complete reunification of the nation and with the US and Japan said to have been conducting war games and joint military exercises in the event of a conflict with China over Taiwan. Finally, 10yr JGBs edged mild gains amid the uninspired risk tone and following stronger results at today’s 10yr JGB auction in which the b/c and accepted prices increased from the previous month.

Top Asian News

- BOK’s Lee to Meet Korea’s Finance Chief Amid Policy Questions

- Didi Gains 1% After Second-Biggest U.S. IPO by Chinese Firm (2)

- Xi Warns China’s Foes Will Break Against ‘Steel Great Wall’

- U.K. ‘Golden Visa’ Firm Files for Insolvency Following FCA Ban

Equities in Europe kicked the new HY off on the front foot as European sentiment improved following the lacklustre APAC handover, with major bourses initially extending the modest gain seen at the open, albeit cash and futures have trimmed all of these initial gains, at the time of writing (Euro Stoxx 50 +0.1%). This sentiment also initially seeped into the major US futures, but the contracts have been waning off best levels in recent trade, with the NQ (-0.2%) narrowly lagging vs the YM (+0.2%), RTY (+0.3%), and ES (U/C) as yields also clamber off lows. Back to Europe, sectors are all in the green with cyclicals faring better than defensives. Travel & Leisure outpace peers with some positive omens emanating from reports that UK Ministers are reportedly targeting quarantine-free travel for double-vaccinated holidaymakers by July 26th. The Oil & Gas sector also resides towards the top of the pack as the sector reaps rewards from the rise in oil prices in the run-up to the OPEC meetings; supported further on the recent source reports (see commodities). Banks are on a firmer footing amid the higher yield environment and with ECB’s Supervisory Board Member Enria stating that the ECB plans to repeal the dividend recommendation as of end-Q3 2021. Basic Resources names also see some reprieve as base metal prices stabilise. On the downside, Healthcare resides as the laggard – in turn, pressuring the pharma-heavy SMI (-0.1%). Turning to individual movers, AB Foods (+4.1%) trades at the top of the Stoxx 600 following a rosy trading update which sees higher-than-expected Primark sales. GSK (+0.5%) is off best levels with the initial upside in light of a letter from activist investor Elliott which noted that the Co. has substantial value creation opportunity with superior execution, as much as 45% upside in share price, but the management and board need to be reassessed. Finally, H&M (-1.8%) resides towards the foot of the pan-European index after noting that sales are still affected by reduced footfall.

Top European News

- ECB’s Lagarde Says Bank Payout Cap Could Be Lifted End September

- H&M Shares Slump as Post-Lockdown Sales Rebound Loses Steam

- Travel Stocks Gain on Report U.K. Eyes Rule Change by Holidays

- Danske Bank Sells Its Private Banking Activities in Luxembourg

In FX, The index has now scaled 92.500 and breached Fib resistance just above the half round number after a very narrow miss at first time of asking as the broad Buck short squeeze continues into the new month, Q3 and H2. However, the Dollar and DXY face a busy macro agenda before the main event of the week and perhaps the whole of July in the form of NFP tomorrow, with more proxies for the official BLS report via Challenger layoffs and the employment components of the final Markit manufacturing PMI and ISM, while jobless claims provide an even more timely snapshot of the labour market and Bostic represents the Fed on the speakers front yet again. Back to the index, 92.547 is the new cycle and multi-month or multi-year high vs 92.356 intraday low.

- SEK – In contrast to the Dollar’s ongoing ascent, the Swedish Crown has lost momentum following its rebalancing rally on the final trading day of June, and the retreat was already underway prior to the Riksbank maintaining rates and its QE remit with a taper to ensure that the Sek 700 bn envelope will be fully utilised by the end of the year in wake of a slowdown in Sweden’s manufacturing PMI and downward back month tweak. The Riksbank did change guidance on inflation to state that less expansionary monetary policy may be justified if inflation threatens to overshoot target significantly and persistently, but left the repo path unchanged at 0% for the entire forecast period (out to the 3rd quarter of 2024 this time) and retained the caveat that the Executive Board may cut the repo rate or loosen policy by other means should inflation prospects weaken. Hence, Eur/Sek is back up near 10.1600 and the Krona has ongoing political instability and uncertainty to contend with given reports that Moderate Party Leader Kristersson has abandoned attempts to form a new government.

- GBP/JPY/CHF/AUD/CAD – It remains an overarching, if not quite all consuming Greenback story, but the Pound’s failure to retain grasp of 1.3800 and decline through stops said to be waiting for a break of 1.3787 may also attributed in part to a small downgrade to the final UK manufacturing PMI. Meanwhile, comments from BoE Governor Bailey via text for the Mansion House dinner highlighted at least three reasons why the MPC believes higher inflation will be transitory, but also underlined that the Bank is willing to act if that is not the case – see 9.00BST post on the Headline Feed for details and link to the full speech. Elsewhere, the Yen has tanked after a disappointing Tankan survey on balance overnight, and failed to stop the rot at 111.50, with a current high around 111.62 having fallen through interim chart support at 111.30 to a fresh y-t-d trough, while the Franc is under 0.9250 and hardly assisted by slightly softer than forecast Swiss inflation data or a slowdown in retail sales and the manufacturing PMI. Similarly, the Aussie is losing sight of 0.7500 and partially on specific factors, as the trade surplus came in short of consensus, albeit fractionally and China’s Caixin manufacturing PMI also underwhelmed.

In commodities, WTI and Brent front-month futures have been grinding higher, in part due to the constructive sentiment across Europe, but the complex eyes a string of OPEC meetings and corresponding sources throughout the session. The complex saw a bout of upside as sources suggested that the OPEC+ deal will likely include a monthly oil output increase of less than 500k BPD vs the median expectations of 500k in August – with reports adding that an ease of around 2mln BPD is being discussed between August and December. Price action is likely to be dictated by OPEC developments today in the absence of any macro shocks. WTI and Brent now reside at session highs just off USD 75/bbl (73.39-74.94/bbl range) and USD 76/bbl (74.55-76.03 range) respectively at the time of writing. As a reminder, the OPEC, JMMC, and OPEC+ meetings are all slated for Thursday at 12:00BST/07:00EDT, 15:30BST/10:30EDT and 17:00BST/12:00EDT respectively, although delays can be expected. Elsewhere, spot gold and silver drift higher but remain within recent ranges awaiting the US labour market report tomorrow, with the former on either side of USD 1,775 (1,765-79 range) whilst spot silver inches higher above USD 26/oz. Turning to base metals, LME copper has clambered off worst levels in tandem with the risk tone, but in the grander scheme, prices remain around recent lows. Meanwhile, Chinese steel futures notched a seventh straight session of gains with traders citing supply woes and increased demand for manufacturing.

US Event Calendar

- 8:30am: Initial Jobless Claims, est. 388,000, prior 411,000; June Continuing Claims, est. 3.34m, prior 3.39m;

- 9:45am: June Markit US Manufacturing PMI, est. 62.6, prior 62.6

- 10am: May Construction Spending MoM, est. 0.4%, prior 0.2%

- 10am: June ISM Manufacturing, est. 60.9, prior 61.2; Employment, prior 50.9; New Orders, est. 65.0, prior 67.0; Prices Paid, est. 87.0, prior 88.0

Tyler Durden

Thu, 07/01/2021 – 07:55![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com