The Creator Of The Bond VIX Pens An Open Letter To The Fed

Submitted by Harley Bassman, creator of the bond VIX and author of the Convexity Maven blog

Open Letter To The Fed (pdf link)

In 1986 Herbert Stein, a University of Chicago economist and onetime Chairman of the President’s Council of Economic Advisors, modestly proposed Stein’s Law: “If something cannot go on forever, it will stop.”

As such, with similar modestly, let me propose a few ways for the Federal Reserve Bank (FED) to “trim the sails” of their monetary support programs before another “Chuck Prince moment” arrives with a deafening silence.As a reminder, we have a massive debt problem in the US, both public and private; and there are only two paths out of such a situation, either default or inflate, where inflation is simply a slow-motion default.Thus, the FED’s program of Quantitative Easing (QE) was well-intentioned, and in fact it did create inflation; such a pity this inflation occurred in asset prices instead of Service (Labor) wages as intended.

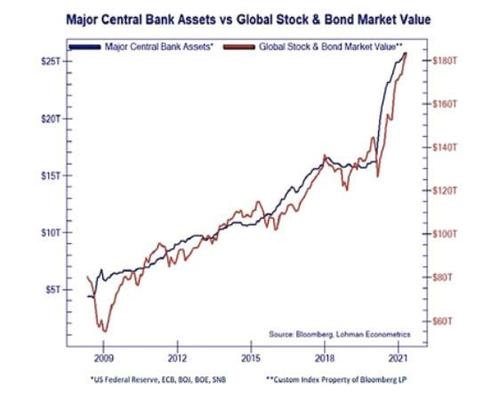

Clever quants will say that a statistically significant mathematical correlation does not exist between money creation and financial asset prices;but who are you going to believe, them or your lying eyes? Below the blue line is the balance sheet assets of the major Western Central Banks, while the red line is the value of theirGlobal financial market.

Perhaps on a week-to-week basis asset prices do not move synchronously with the production of fiat currency, but $20 Trillion of money must reside someplace, and with the magic of financial leverage it is quite clear where.

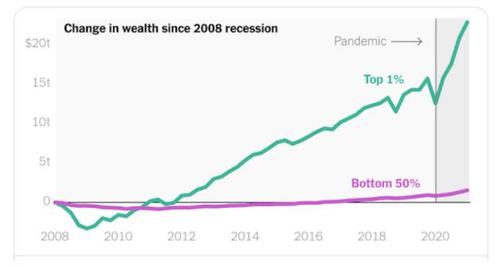

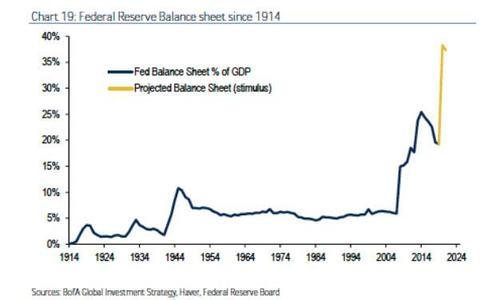

Similarly, while I cannot show a formula that links concentrated wealth creation to significant political unrest, once again I will let your lying eyes consider the green line and the purple line on the prior chart. The yellow line below was a projection for the growth of the FED’s balance sheet relative to US GDP; hat tip to Bank of America as the balance sheet presently tops out at $8.24Tn versus a GDP of $22.79Tn, or 35.2%.

At some point,simple common sense must be a viable consideration. After all, if it were possible for the Sovereign to create the coin of the realm (fiat currency) at a pace faster than the growth of the economy, wouldn’t there be a record of that happening successfully before? Why should there be poor people if it is possible to create wealth and offer it to all citizens? It must stop eventually.

For better or worse, financial markets are now tightly linked to FED policies, and specifically balance sheet growth that:

- Funds non-investment Fiscal policies

- Controls interest rates

- Suppresses both realized and implied Volatility

Consequently, the notion of a cold turkey reduction of financial support would likely cause a disruption, which while perhaps beneficial over the long-term, would cause too much suffering for both our citizens and policymakers. As such, let me offer a few ways to improve FED policies without inducing an opioid-like withdrawal. [Did I just compare the FED to the Sacklers?]

Reduce Mortgage-backed Security (MBS) purchases

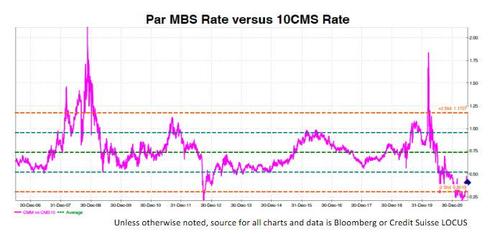

Presently the FED targets buying $120bn a month in bonds; $80bn in US Treasuries and $40bn in MBS. This MBS purchase is too large relative to the size of the market and the appetite for such securities from private investors. The best single measure of MBS value is the yield spread between the par Constant Maturity Mortgage rate (CMM) and the Constant Maturity 10yr Swap rate (10CMS).

The “forever” average is about 72bps; compare this the current 41bps.

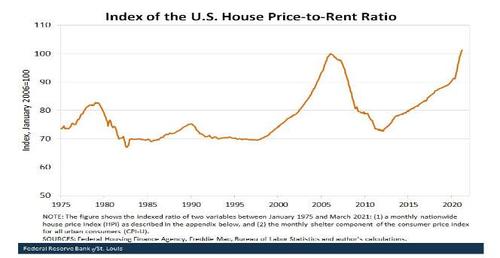

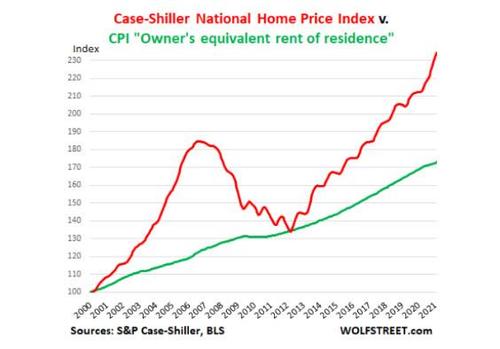

Contraction of this spread implicitly leads to lower mortgage rates, which seems like a nice idea, until it is not. It was reported that the year-over-year median national home price has risen by 23.4%; this has pushed home prices out of reach for many current renters.

The reality is that nobody “buys a house”, rather they agree to a thirty-year payment stream that is within their budget. If someone can afford to pay $1800 per month for a home loan, the size of the mortgage they can take out is then limited by the interest rate on that loan.

Pencil to paper, if a Millennial couple can afford a median priced home at $363,300 when mortgage rates are at 2.50%, they could only afford a $319,600 home if mortgage rates rose to 3.50%.

MBS rates have declined by over 150bps since 2017/18, this has likely been the primary driver of the recent increase in home prices.As the Millennial demographic enters the household formation sweet spot, artificially elevating home prices is not a public policy benefit. In fact, it is a public policy dyspeptic that only adds to wealth disparity.

Reduce the purchase of TIPs

Long time readers know I have never been a fan of US Treasury Inflation Protected securities, if only because I believe CPI is an manufactured number that is constructed to bias reported inflation to a lower level.

There are a few sneaky metrics employed, perhaps the most impactful is the use of “owner’s equivalent rent” instead of actual home prices to conjure up the cost of housing, the largest input into CPI.

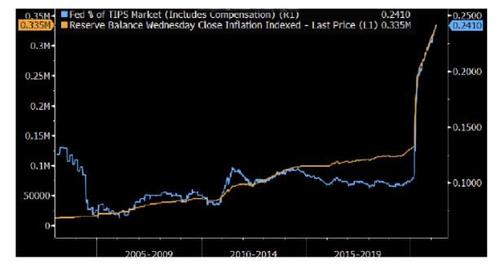

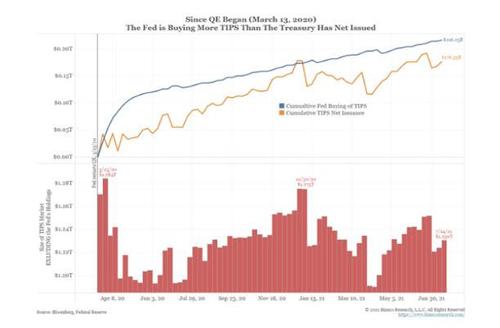

While the FED cannot resolve that issue, they can redirect their purchase of TIPS to shorter-term UST bills and notes. For reasons that are unclear, the FED altered their purchase metrics such that their ownership of TIPS has increased from10% to nearly 25%.

In fact, the FED is now purchasing more TIPs than are being net issued.

The harm here is clearly not to the owners of TIPs, who have benefited greatly;and in fact, not much harm has been done to anyone except the FED that owns a nominally negative yielding security.

Rather the problem is the distortion of information, both to the policy makers and investors. The TIPs market is totally dysfunctional as their market price offers little useful information about market sentiment for distant inflation.

While I shed few tears for speculative Hedge Funds, exactly how can the FED make policy when they have no useful feedback on inflationary expectations?

Buy fewer long-term securities

The single best indicator for a recession has always been the shape of the Yield Curve, often measured as the difference in yield between the three-month rate and the ten-year rate.To the extent the FED is holding down long-term rates via excessive purchases of long-term bonds, this important information is being withheld from, or worse distorted to,both investors and policy makers.

Over the past few months, the Yield Curve has flattened by nearly 50bps; the quandary is whether this is due to FED purchases, or market concerns that the COVID Delta variant might send the economy back into a recession.Once upon a time there was the notion of “facts”, another concept the FED cannot fix. However, to the extent FED policy disfigures the market, nobody can have confidence in the financial facts offered by market prices.

Encourage a steeper Yield Curve

I will not offer yet another chart that describes how the US has migrated from a manufacturing economy to one supported by financial activity; but rather note the plumbing of this system is managed by our Too Big To Fail (TBTF) banks.

This is the raison d’etre for Dodd-Frank; while retribution for the Great Financial Crisis (GFC) may feel good, in fact we need to keep theseplumbers solvent to prevent an even greater catastrophe. [Those of a certain age will recall the somewhat bothersome story of Werner von Braun;we swallowed hard since Plan B would have been a lot worse.]

A steeper Yield Curve supports the plumbing of our financial system. While increasing profits for TBTF banks will garner few cheers, increased revenue for the overall banking system builds a capital cushion to expand lending and reduce systemic risk.Moreover, a stronger capital base will enable banks to keep functioning when the QE money spigot is eventually shut.Higher long-term interest rates improve the health of our pension and insurance systems, both public and private.

The first quarter rate rise helped close the “funding gap” for the 100 largest Corporate Defined Benefit plans by nearly 8 percentage points.

Just as important is the financial health of our insurance industry. To the extent insurance products become unaffordable, the Government will have to pick up the tab. It is a public policy benefit for private citizens to purchase long-term health care from a private insurance company rather that rely upon Medicare.

The market is well-aware of the relationship between long-term interest rates and the profitability of large insurance companies. Below, the blue line is the UST 30yr rate while the green line is the price of AIG stock.

The FED’s policy of low interest rates has transferred money from savers (civilians) to borrowers (corporations). A steeper curve will rejigger this profile; and be especially helpful to the expanding retirement demographic. It is a public policy benefit for corporate borrowers to enhance retirement income via higher interest rates, and thus reduce the need for Government assistance.

Shorten “Forward Guidance” to reduce Moral Hazzard

While a bit hyperbolic, there is a reason the VIX is known as the “Fear Index”. What is anomalous is its current reading near 17, well under it’s long-term average. While my summer in Quogue is indeed rather peaceful, how can one not be twitching with CPI printing a 5%-handle, COVID running rampant, and our political class is unsupervised while playing with sharp tools.

The MOVE Index of Implied Volatility for interest rates is low relative to the shape of the Yield Curve, as well as relative to history.

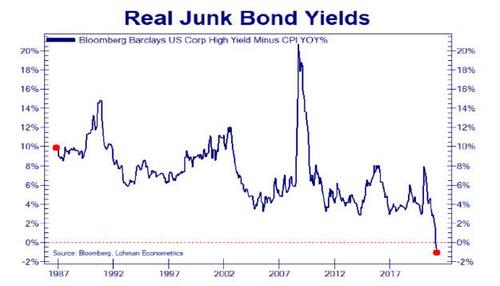

Similarly, either driven by a desperate need for income, or an over reliance upon the so called “Powell Put”, bonds at the bottom of the capital structure do not even return a positive real yield (the return after inflation).

The FED’s “forward guidance”,extrapolated by a speculative “Dot Plot”, is offering investors unsupported confidence in the economic future. As such, investors and financial managers are exhibiting classic Moral Hazzard by taking on a risk profile much greater than their true comfort level.

Closing…

I am loath to use the word “always”, but over the course of my professional career, there always seems to be a concentration of short Convexity positioning at the core of extreme market turbulence.

If you own any bond asset that is not a US Treasury, you are short Convexity. Moreover, via bond math I will not detail here, the lower the level of Implied Volatility, the greater the mathematical Convexity (gamma). Similarly, the lower the Yield of such assets, the greater the (negative) Convexity.

The FED has motives for reducing interest rates and suppressing Volatility, but let’s be clear, they are also increasing the Convexity risk. This is what underpins the notion that the FED is creating a coiled spring that will eventually be a trap. I am not predicting a crash, nor the immediate end of civilization, I will let the bloviating talking heads earn their salaries.

Rather I think the current $120bn a month is fine for now, but a swift rejiggering of that mix would do a lot to signal investors to moderatetheir risk profiles. Remember: For most investments, sizing is more important than entry level.

Tyler Durden

Tue, 07/27/2021 – 11:49![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com