Facebook Tumbles On Disappointing DAUs, Warning Revenue Growth Will “Decelerate Sigificantly”

After yesterday’s tech bonanza which saw Google surge, Apple fall and Microsoft swing when the 3 gigacaps reported more than $57 billion in net income, we now get the 4th FAAMG – Facebook – before Amazon closes the books on the 5 companies that account for more than 20% of the S&P’s market cap.

A quick look at sellside reports reveals that consensus expectations are for revenue of $27.86 billion for the quarter, which would be 49% growth (last year during this quarter, sales jumped just 11% given the advertising pullback surrounding the pandemic so there will be a sizable base effect). Analysts also expect user growth of around 7%, anticipating just under 2.9 billion monthly users for Facebook’s core social network. Facebook also reports a “Family” metric that encompasses users for all of its services. On that front, analysts expect 3.49 billion monthly users.

Some context: the ad industry is solid, with Twitter and Snap both reported strong second quarter earnings and Google ad sales rising 69% when it reported earnings yesterday. That explains why Facebook stock is already up 30% YTD.

So with that in mind here are Facebook’s Q2 results:

- Revenues $29.08BN, up 56% Y/Y, and beating exp. $27.86BN

- Advertising rev. $28.58 billion, +56% y/y, estimate $27.13 billion

- Other revenue $497 million

- EPS $3.61, beating exp. $3.02

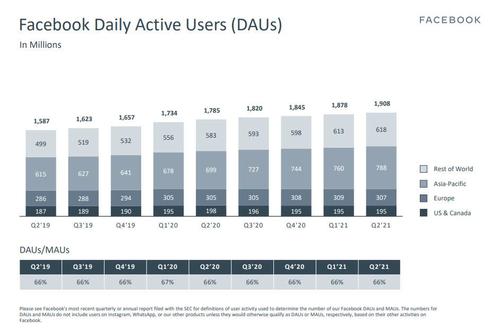

- Daily Active Users 1.91B, Est. 1.91B

- Monthly Active Users 2.90B, Est $2.9BN

- Oper Margin 43%, Est. 37.6%

- Average Family service users per day 2.76 billion, +1.5% q/q, estimate 2.72 billion

- Average Family service users per month 3.51 billion, +1.7% q/q, estimate 3.49 billion

A visual snapshot of the company’s MAUs:

So far, so good and as expected for a company that hasn’t missed on sales in six years. And if that was it the stock would be soaring in the after hours. Yet one look shows that it is tumbling, and the reason for that was in the company’s outlook where we find this surprising confession:

In the third and fourth quarters of 2021, we expect year-over-year total revenue growth rates to decelerate significantly on a sequential basis as we lap periods of increasingly strong growth. When viewing growth on a two-year basis to exclude the impacts from lapping the COVID-19 recovery, we expect year-over-two-year total revenue growth to decelerate modestly in the second half of 2021 compared to the second quarter growth rate

In other words, growth will slow even if one ignores the outlier covid year.

Additionally, Facebook continues to expect “increased ad targeting headwinds in 2021 from regulatory and platform changes, notably the recent iOS updates, which we expect to have a greater impact in the third quarter compared to the second quarter.”

Furthermore, looking a the company’s DAUs were find that not only has the US not grown in 5 quarters having peaked in Q2 2020, but European DAUs continue to slide.

Some other details from the guidance:

- Expects 2021 Total Expenses to Be in Range of $70-73B

- Expects Year 2021 Tax Rate to Be in High-Teens

- Sees FY Capex $19B to $21B, Est. $20.14B

Needless to say, despite the impressive Q2 numbers, investors were not happy with the guidance, and the stock is sharply lower after hours.

As Bloomberg’s Kriti Gupta notes, Facebook’s earnings results highlight just how high the bar is when it comes to impressing investors. Shares are down afterhours despite sales and revenue beats. But the key may lie in monthly active users, which were in line with estimates at 2.9 billion.

Tyler Durden

Wed, 07/28/2021 – 16:21![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com