Entering The Worst Seasonal Period Of The Year… Which Ends With Jackson Hole

One week ago we showed readers some troubling seasonal patterns: having just emerged from the strongest two-week period of the year which is between July 1 and July 15, markets are about to enter the worst seasonal phase of the year: the month of August.

As Goldman trader Scott Rubner showed, seasonals trend lower all of August, for the 4th worst two-week seasonal period of the year…. before culminating with the Jackson hole central bank symposium when the Fed is widely expected to announce tapering. Furthermore, since 1950, there have been 19 times in 72 years that the S&P was up at least >10% through the first half of the year – like now – and the median return for August specifically, following a strong 1H is typically down -51bps.

The topic of August being the cruelest month for stocks was also the the inspiration behind today’s Chart of the Day by Jim Reid.

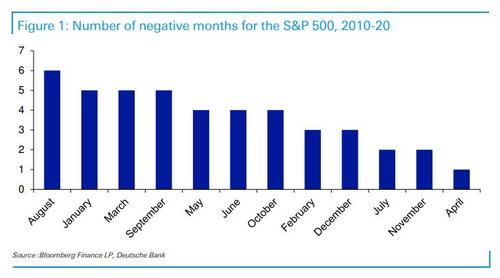

The DB strategist first recaps the good news, namely absent a dramatic rout today, the S&P 500 will close out with its 6th successive monthly gain, the longest run since 2018. However, echoing the above observations, Reid points out that since 2010 August has been the worst month for markets in terms of the number of declines with 6 out of 11 being negative.

Still, the credit strategist notes that this is not a pattern that has been seen through longer history “so is it random or has something changed?” Well, yeah, something has changed and one look at the Fed’s balance sheet should explain it. The Fed’s takeover of capital markets meant that markets have become more illiquid since the launch of QE and, as Reid speculates, “perhaps holidays in August exacerbate this so that any negative news that takes place is amplified.”

The two most memorable (and largest declines) took place in 2011 and 2015:

- The first of those coincided with the row in the US over the debt ceiling. Although that was actually resolved early in the month, the US credit rating was then downgraded by S&P from AAA to AA+. Meanwhile, in the backdrop, concerns over the European sovereign crisis continued to fester.

- Then in 2015, there was major turbulence in Chinese markets amidst concerns about their growth prospects and the surprise devaluation, which in turn spread to other regions including the US and Europe.

A notable addition was August 2019 when we saw the 2s10s yield curve invert for the first time in the cycle which alongside an escalation in the US/China trade war, encouraged declines as well.

So, what could this August bring, the strategist asks, and observes that according to the bank’s June monthly survey, more people are planning to take holidays this (northern hemisphere) summer than in a normal year so liquidity will likely be even lower than usual.

In terms of events, the August focus will be on Jackson Hole, China’s ongoing regulatory crackdown, and the Delta variant amongst all the usual macro variables, especially inflation.

His advice to traders: “enjoy your holidays if you’re off but keep half an eye open for any surprises in what are likely to be thin markets.”

Tyler Durden

Fri, 07/30/2021 – 13:10![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com