Corporate Margins Set To Tumble As Companies Freak Out About Surge In “Bad Inflation”

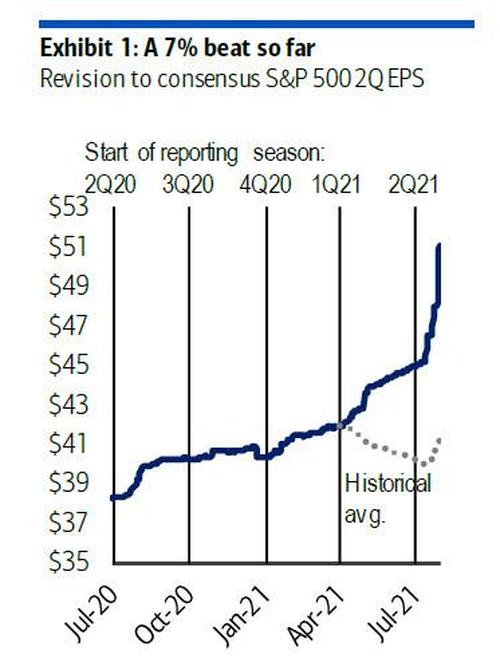

First the good news: according to Bank of America’s earnings tracker, Q2 earnings season is already one of the strongest in history (as one would expect following trillions in fiscal and monetary stimulus and comping off the catastrophic Q2 of 2020 when covid shut down the economy), and following the busiest earnings week of 2Q, 296 S&P 500 companies (76% of index earnings) have reported. 2Q EPS is now tracking a 13% beat or $51.12, topping BofA’s estimate of $50 or an 11% beat; and far above the historical average since the start of earnings season.

To avoid the skewed 2020 data and doing a two-year lookback, 2Q is now expected to be +83% YoY or +24% vs. 2Q19, vs. last quarter’s 25% 2-yr growth rate. Financials, Communication Services, and Consumer Discretionary led the EPS beat, while revenues are also coming in red hot and tracking a 3% beat, led by Energy.

More importantly, the proportion of beats also remained strong: 83%/85%/74% of companies beat on EPS/sales/both, representing the best proportion of beats in history (since 2011).

Looking at the top line, analysts now expect 2Q sales to rise 21% YoY, vs. 14% YoY last quarter. Energy is expected to lead (+102%), while Financials are forecast to be the biggest drag (-4%). Here, BofA estimates that FX tailwinds thanks to a weaker dollar added about 3% to YoY sales growth (Exhibit 4), representing the biggest benefit since 2011. Excluding FX/oil impacts, constant-currency sales growth for the S&P 500 ex. Fins. & Energy is expected to be +15% YoY (Exhibit 5), accelerating from the 13% growth last quarter.

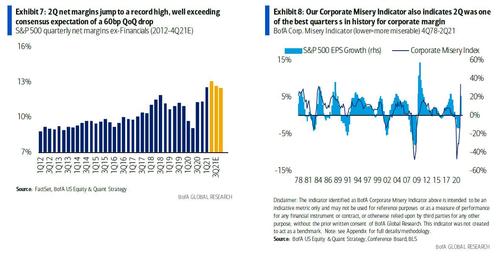

What is more surprising is that in a quarter when many predicted margins would be hit by surging input costs, not only was that not the case but companies once again posted skyhigh margins, with 2Q net margins (ex-Financials) jumping to a new high at 13.0%, topping last quarter’s 12.5%. This was consistent with BofA’s Corporate Misery Indicator, which rose to a record high (“least miserable”) in 2Q, indicating it was among the most favorable macro environment for corporate margins in history since 1978!

How is this possible in a time when numerous commodity prices have hit never before seen levels? Simple: companies have experienced virtually no pushback to rising prices as most Americans can easily absorb the rampant inflation. Indeed, as IHS Markit Chief Economist Chris Williamson commented in today this is “perhaps the strongest sellers’ market that we’ve seen since the survey began in 2007, with suppliers hiking prices for inputs into factories at the steepest rate yet recorded and manufacturers able to raise their selling prices to an unprecedented extent, as both suppliers and producers often encounter little price resistance from customers.” It remains to be seen just how long such a “seller’s market” will be the norm, although we expect it to reverse quite painfully once government handouts end.

In any case, that was the good news: now the bad and that was summarized best by BofA’s Savita Subramanian who wrote that “we are starting to see the good inflation environment turning into a bad inflation environment with many companies citing accelerating cost inflation, particularly around wages.”

Indeed, as shown in the chart above, consensus margin expectations for 2H reflect this risk, with margins forecast to moderate to 12.6 % in 3Q and 12.5% in 4Q. But if cost pressure continues to accelerate, we could see more downside risk in 2H margins.

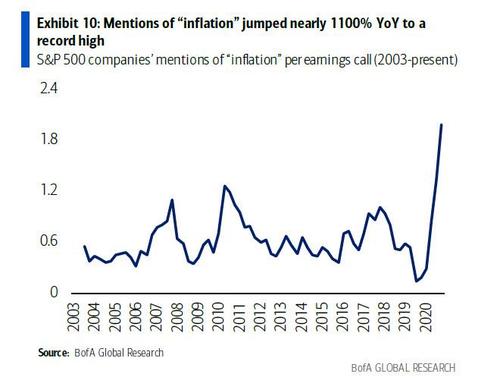

And nobody captures this risk better than companies themselves: according to word counts of corporate earnings transcripts by BofA’s Predictive Analytics team, mentions of “inflation” on 2Q earnings calls topped 1Q levels and jumped to a record high, based on BofA’s Predictive Analytics team’s analysis. On a YoY basis, inflation mentions rose nearly 1100% YoY, outpacing the 900% increase we saw last quarter.

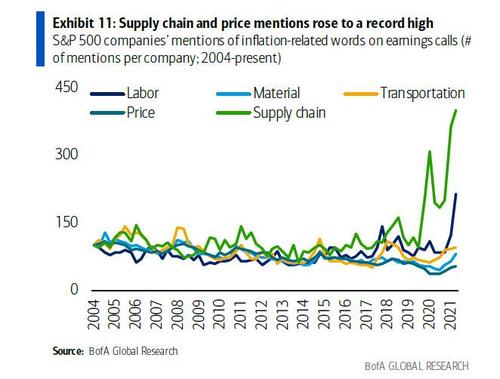

Notably, labor-related mentions – i.e., discussion of rising wages – rose the most among inflation categories BofA tracks in 2Q, up 155% YoY. This compares to last quarter when labor-related mentions rose the least (+12% YoY), pointing to soaring wage pressure, and is why BofA remains cautious on labor-intensive Consumer Discretionary and Industrials.

Meanwhile, supply-chain related mentions also more than doubled YoY (+106% vs. +17% YoY in 1Q). Both supply chain and labor related mentions rose to record highs in BofA data history since 2004.

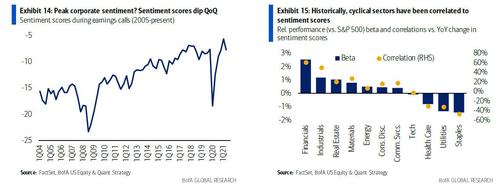

And before we dig through the actual earnings transcripts, we leave the most ominous finding for last: using earnings calls transcripts, BofA calculated sentiment for S&P500 companies that have reported this earnings season (it used Loughran McDonald’s financial dictionary to calculate sentiment scores.) Overall, BofA found that corporate sentiment dipped from a record high, indicating peak corporate sentiment amid inflation concerns and rising cases of the Delta variant.

Similarly, companies mentions of business condition (ratio of mentions of “better” or “stronger” vs. “worse” or “weaker”) indicate weaker business conditions vs. the peak level last quarter. Mentions of optimism also declined from the peak levels in the prior two quarters.

To summarize: yes, Q2 earnings were a huge beat and margins were a record high… but it’s all downhill from here as the “bad inflation” (to companies, and very good inflation to workers) is about to roll down the income statement, resulting in sharply lower margins and deteriorating earnings. And insiders know this well, which is why corporate sentiment has already rolled over and is down despite a true earnings bonanza, and is also why corporation optimism has moved sharply lower, a move which will accelerate to the downside as soon as margins are hit by surging wages and as soon companies can no longer pass through sharply higher input prices.

Finally, courtesy of BofA, here is a snapshot of what some of the most notable companies just said about inflation, bad or otherwise:

AMZN (Discretionary): “The other thing is wage pressure has become evident. We’ve talked about this a bit. The wage increase that we normally would do in October we pulled forward into May. We’re spending a lot of money on signing and incentives. And while we have very good staffing levels, it’s not without cost. It’s a very competitive labor market out there and certainly the biggest contributor to inflationary pressures that we’re seeing in the business.”

NWL (Discretionary): “We expect Q3 to be the peak quarter for inflation pressure, which will significantly weigh on the company’s margin performance.”

ITW (Industrials): “We continue to expect price/cost impact to be EPS-neutral or better for the year. […] We continue to experience raw material cost increases, particularly in categories such as steel, resins and chemicals and now project raw material cost inflation at around 7% for the full year which is almost 5 percentage points higher than what we anticipated as the year began. And just for some perspective, this is roughly 2x what we experienced in the 2018 inflation/tariff cycle.”

CHD (Staples): “We now expect full year gross margin to be down 75 basis points. This represents an incremental impact from our last guidance due to broad-based inflation on raw materials and transportation costs.”

IP (Materials): “We do expect further input cost inflation in the third quarter with substantial pressure on OCC and transportation costs.”

HSY (Consumer Discretionary): “In the second half of the year, we expect increased packaging and freight costs to continue. We also expect labor costs to remain elevated as higher levels of marketplace attrition contribute to more overtime and accelerated hiring to keep pace with demand. While we expect more price realization in the second half versus the first half, we also expect less sales volume benefits… And then in addition, I think labor rates in general and labor availability in general are a pressure point beyond just volume. The market for labor is challenging. And so just like everyone, we want to make sure we are staying ahead of the curve on hiring, making sure our value proposition at our plants is attractive. And packaging inflation similar, packaging inflation we touched on a little bit on the last call. It’s still a pressure point. I think we’re still optimistic we’re going to see that moderate as we go forward, but we haven’t seen it yet. And so, it is a combination of those transitory costs on the back of the higher volume and a few things that are a little bit [stickier] here as we look across the balance of the year.”

TFX (Health Care): “Any inflation that we saw, we saw it begin last year in transportation. So, that was already in our run rate. And we saw some modest inflation in some of our resins, but it was pretty – it’s very manageable, and we’re going to more than offset it with really positive pricing and building momentum in the quarter with that positive pricing.”

LKQ (Consumer Discretionary): “Across all of our segments, we are experiencing some level of supply chain shortages and disruptions. These disruptions are creating product scarcity and freight delays that are resulting in meaningful availability pressures in certain product lines. The supply chain challenges are also driving product inflation, which in turn, is generating the most robust pricing environment we’ve seen in years. Across all of our segments, we have been very effective in passing along these costs as witnessed by our margin performance. Alongside supply chain inflationary pressures, like many businesses across the globe, we are facing wage inflation and increased competition for labor.”

MAS (Industrials): “We continue to see escalating inflation across most of our cost basket, including freight, resins, TiO2 and packaging. Inbound freight container costs nearly tripled during the quarter. We now expect our all-in cost inflation to be in the high single-digit range for the full year for both our Plumbing and Decorative segments, with low double-digit inflation in the second half of the year.

Inflation in coatings will likely be in the mid-teens later in the fourth quarter. To mitigate this inflation, we have secured price increases across both segments and are taking further pricing action across our business to address these continued cost escalations. We are also working with our suppliers, customers and internal teams to implement further productivity measures to help offset these costs. Despite the increased inflation, we still expect to achieve price/cost neutrality by year-end. While cost inflation has clearly been an issue, material availability has also impacted our business.”

FBHS (Industrials): “While inflation headwinds were anticipated, they continued to strengthen throughout the quarter. As I mentioned earlier, we are taking incremental actions during the second half of the year to offset increased inflation. […]Through this combination of cost and thoughtful pricing actions, we plan to offset all inflationary headwinds this year and expect to deliver 2021 operating margin improvement.”

AVY (Materials): “Given the increasing inflationary pressures, we are redoubling our efforts on material re-engineering and again raising prices. We are targeting to close the inflation gap relative to mid last year by the fourth quarter.”

IEX (Industrials): “We anticipated rising inflation as the global economy recovered, but like many, did not imagine the sharp rate of increase. This narrowed our spread between price capture and material costs, although we remain positive overall. Our teams leveraged the systematic investments we made a few years ago in pricing management and aggressively deployed two, sometimes three pricing adjustments with precision. We are on track to expand our price/cost spread to typical levels as we travel to the back half of the year.”

ODFL (Industrials): “It’s a tighter labor market than certainly we’re used to. Of course, I’ve been here for a long time and I don’t ever remember the growth percentages in the past that we’ve got today. So, it’s definitely a bigger challenge than it’s ever been.”

MHK (Consumer Discretionary): “We anticipate material and freight challenges will continue to impact our business in the third quarter. To compensate for material inflation, we have increased prices and we expect further increases will be required as our costs continue to rise”

MDLZ (Staples): “As we said many times, inflation and commodity costs are higher than we originally anticipated at the start of 2021, but we continue to believe that they are manageable. In terms of pricing and inflation, I would say there is going to be more in the second part of the year. To start with, our pipeline of commodities and FX has been advantageous in the first part of the year, and we expect some commodities and FX impact to be relatively higher in the second part. So there will be some more pressure in Q3 specifically, but we will continue to be very disciplined in terms of costs and pricing.”

SBUX (Consumer Discretionary): “While we’re thrilled with our margin performance in Q3, we expect it to moderate slightly in Q4 primarily due to the growing impact of inflation coupled with incremental investments critical to our continued growth.”

“So in Q3 we had outstanding performance, but within that we covered headwinds in the Americas business of about 70 basis points. And we expect headwinds related to rising costs and inflationary pressures to continue into Q4 which is reflected in the guidance that we’ve given.”

SHW (Materials): “Our gross margins were under considerable pressure in the quarter given the sustained higher raw material costs. However, as we have demonstrated in past inflationary cycles, we are fully committed to offsetting these costs, and we announced additional pricing actions in the quarter, which will be realized as the year goes on.”… “We anticipate year-over-year inflation in the third quarter to be higher than it was in the second quarter with only slight improvement in the fourth quarter as demand remains high.”

WM (Industrials): “It’s no surprise to anyone who follows economic indicators that most businesses are experiencing inflation in their costs throughout 2021 and our business is no exception, particularly with regard to labor. We expect to overcome these pressures by increasing operating efficiencies and executing on our disciplined pricing programs.”

RSG (Industrials): “we’re seeing very modest inflation in this year’s economics; kind of do an annual increase and we give our people a fair increase every year. We expect that certainly to tick up next year, but to be more than offset by our ability to price through that. And so we think that inflation net-net will be margin expanding for us.”

LW (Staples): “As a result, we expect input cost inflation, especially for edible oils packaging and transportation to be a significant headwind for fiscal 2022. Our goal is to offset inflation using combination of levers including pricing. To that end, we just began implementing broad-based price increases in our Foodservice and Retail segments, and don’t expect to see the most of their benefit until our fiscal third quarter.”

IQV (Health Care): “it’s no secret that given the strength of the industry backdrop, there’s obviously strong competition for talent. […] Now does it cause a certain amount of anxiety in the industry? And yes, it’s true. And has it caused some level of wage inflation? Yes, that is true. There is also a little bit of an uptick in attrition levels as a consequence of all of that. All of that is true… But again, we feel confident. We do not anticipate this to cause any significant – there will be some level of headwind to our margins, but we have so many programs and productivity measures and process improvement measures in place that we are confident we will overwhelm.”

KMB (Staples): “Obviously, given that amount and given our outlook, we are covering a significant portion of that, but we can’t practically cover all of that this year […] And so, what I would say is, part one, our pricing implementation is largely on track and we expect to fully offset inflation over time. Not all this year, but over time.”

SWK (Industrials): “We continue to see elevated commodity prices and now expect $260 million of commodity inflation in the second half versus our prior assumption of $210 million. In particular, elevated steel pricing is largely driving the $50 million increase. We are now in the full implementation mode and believe we should be in a position to offset approximately 50% of the 2021 headwind, netting material inflation and better price realization is a neutral effect versus the prior guidance. The goal is to have our actions in place during the third quarter, so the 2022 carryover benefits of price and margin actions fully offset the carryover inflation”

PNR (Industrials): “Regarding the current inflationary environment, we have implemented further price increases and we expect the price cost gap to further narrow in the second half.”… “Consistent with our guidance, the second quarter did not see price fully offset inflation as we saw higher inflation that we have continued to implement price increases to help offset. The second half should see price costs start to even out. But an unprecedented amount of material and wage inflation coupled with robust demand has contributed to price reading out at a slower pace. Our forecast reflects our expectations that material shortages and inflation are not going away nor will they improve materially.”

FTV (Industrials): “Even though we are seeing a little bit of cost inflation, we’re still going to be net – significantly net in a good shape relative to material cost reductions for the year. So material cost reductions will still be a profit improver for the year, even though we’ve seen a little bit more inflation than typical, we still are in a very good shape relative to price cost, not only because of price, but also because we’ve done a nice job on the cost reduction side as well.”

CL (Staples): “We expect raw material costs to remain elevated throughout 2021, but we do expect some sequential lessening of inflation as we get into the fourth quarter.”

JCI (Industrials): “Although lead times and conversion cycles are stretching, we believe conditions will begin to improve over the next couple of quarters. We are successfully leveraging our pricing capabilities to offset inflation, and we still expect to remain price cost positive for the year.”

UPS (Industrials): “We know what happens in an inflationary environment, don’t we? Somebody pays for it. It’s usually the consumer, which means, right, that price increases get passed along all the way to the end to the consumer until the consumer says, ouch, I’m not going to buy any more. The consumer continues to buy. So there we are in the cycle, and this is a cycle, right. This is a cycle.”

PKG (Materials): “These items were partially offset by higher operating costs of $0.57, primarily due to inflation-related increases in the areas of labor infringes, repairs, materials and supplies, recycled fiber cost, as well as other indirect and fixed cost areas Inflation associated with most of the operating costs as well as freight and logistics expenses is expected to continue.”

GLW (Tech): “Now during the quarter, we continue to face supply chain disruptions and inflationary headwinds. Planning and increased output allowed us to reduce costly airfreight, but the sequential improvement was offset by increases in shipping rates and the cost of certain raw materials such as resin, a key component in our Optical and Life Sciences businesses. […] So right now, we’re clearly facing a lot of supply chain disruptions and inflationary pressure. And what we saw in the first quarter was, of course, a lot of that relative to freight and logistics. We had plans to mitigate that. We actually did those mitigations. But then there were other things that occurred, particularly around increased resin cost. So as we think about the guide, in particular the guide for the third quarter, we thought it was prudent to assume that, that 150 basis points drag that’s coming from those inflationary and supply chain logistics costs would continue.”

IR (Industrials): “Since the end of Q1 of 2021 of this year, we have seen inflation and we call inflation here direct material and logistics, continue to increase, which is the reason why we acted on additional pricing actions. I’ll say those pricing actions are offsetting the incremental inflation that we’re expecting to see in the second half.”

HIG (Financials): “As we listen to inflationary expectations, we expect some of those trends will be with us into the third quarter, fourth quarter. But I think that given our trends, our expectations to the year haven’t changed materially and we’re on top of our selections and I think we’re in good shape as we move into Q3.”

PHM (Consumer Discretionary): “As reflected in the increases in our sales prices and gross margin, we’ve been able to pass on the meaningful cost inflation we have incurred over the course of the year. At this point, we now expect house costs to be up between 9% and 11% for the full year with the peak of certain costs, driven by lumber flowing through in the third and fourth quarters. Even with the ongoing rise in build costs, we still see opportunity for gross margins to move higher over the remaining two quarters of the year.”

BSX (Health Care): “[We] expect slight improvements in second half gross margin compared to the first half, though still not at full year 2019 levels, as other headwinds remain, in particular, the lingering cost of running plants with COVID-specific measures, as well as some impact from inflation.”

HAS (Consumer Discretionary): “We talked earlier about ocean freight in some of our prepared remarks and we’re seeing those costs are over four times higher than what we had been experiencing earlier or last year even. So, we expect a lot of those costs to continue. But between cost of sales and that, we do expect our gross margin to be slightly down from a year ago, but we do expect the price increases that we’ve taken to offset our increased costs”

GE (Industrials): “Looking forward to the second half of 2021 and into 2022, although inflation pressure is likely to increase particularly in Aviation and Renewables, we expect the net inflation impact to be limited.”

OTIS (Industrials): “This high inflationary environment that we’re seeing should help us on Service pricing because most of our contracts in Europe and Americas have price escalators kind of built-in that are largely tied to labor inflation. And, historically, we’ve always had that lever but given low inflationary environment in the macro market, the prices don’t always stick. And now, with this inflationary environment, we should have a greater ability to stick those prices, so that should help next year.”

HON (Industrials): “so everywhere in our books of business that we can, we continue to pass through the inflation that’s being seen in the materials and also in the labor because in the projects businesses, labor is also important as well.”

SLB (Energy): “But I believe that the tool box we have and the professional and very experienced organization we have in our planning and supply chain and manufacturing organization that are used to manage some inflationary pressure has allowed us to mitigate and edged this inflationary pressure and contain cost inflation […] under our roofs.”

CE (Materials): “But we did raise price more than we saw our materials increasing. And I think that’s a question of mix. I mean what – we are in a very tight supply constrained situation. So we have been prioritizing our higher margin products and our higher market –higher margin region to really maximize the return that we get for the molecules thatwe have available to sell to the market.”

ADM (Materials): “In our scenario, margins normalize, we have inflation and then we are able to offset a lot of that through growth and through productivity.”

INTC (Tech): “Since April, we have seen supply chain inflation happening faster than we are electing to pass through to our customers, further impacting our second half gross margin outlook.”

LUV (Industrials): “We are mindful of the tight job market, as well as general inflationary pressures. We expect to have wage rate inflation beyond our normal annual wage rate increases, as we want to be competitive to retain and attract talent, including the decision to increase the minimum hourly wage to $15 per hour across all workgroups, we now estimate, $5 million to $10 million of additional salary, wages, and benefits cost pressure in third quarter and approximately $15 million in fourth quarter.”

GPC (Consumer Discretionary): “In the second quarter, there was significant pricing activity with our suppliers resulting in product cost inflation. We were positioned to pass these increases on to our customers and the impact of price inflation was neutral to gross margin. We estimate a 1.5% impact of inflation in automotive sales for the quarter and a 1% impact in industrial. Based on the current environment, we expect this to increase further through the second half of the year.”

NUE (Materials): “So we’ll see some price inflation that will cause working capital to go up further, but probably not at the same pace as we experienced in Q2.”

POOL (Consumer Discretionary): “Inflation, as we have previously mentioned, has been above average this year and is trending to 5% to 6% for the year in total. This has had no meaningful impact on demand and has passed through the channel as is typically the case.”

NEM (Materials): “The impacts of the pandemic are also driving cost inflation around the globe. We are now expecting cost escalation of around 3% to 5% for materials, energy and labor. And we expect these pressures to continue through until at least the end of next year.

FCX (Materials): “Everyone is focused on inflation around the world and the impact on mining companies. And as Kathleen said, we’ve had higher energy costs, higher grinding material cost, but Josh Olmsted and our Americas team has just done a great job in helping offset that.”

UNP (Industrials): “And as we experience a strong demand environment, our pricing actions continue to yield dollars in excess of inflation.”

DGX (Health Care): “So there’s nothing extraordinary in the back half of the year in terms of labor inflation.”

MMC (Financials): “The pace of price increases continued to moderate, but still remains high, reflecting elevated loss activity and concerns about inflation and low interest rates.”

ALLE (Industrials): “Allegion is not immune to inflation and the supply chain constraints impacting industrial markets. Allegion navigated well during Q2, but these industry-wide constraints will persist for the remainder of the year and put pressure on margins for the short-term.”

“We’ve seen an acceleration of inflation, predominantly in commodity costs, material components, freight, packaging, et cetera. It’s continued to be a headwind. As you know, we’re pretty aggressive moving on price and we’re taking similar actions in the back half of this year. We’ve went ahead and announced a price increase that will take effect at the beginning of Q4. So, there’s going to be some margin pressure, I would say, given the acceleration in inflation particularly in Q3.”

WHR (Consumer Discretionary): “Structural cost takeout actions, higher volumes and ongoing cost productivity initiatives delivered 550 basis points of net cost margin improvement. These margin benefits were partially offset by raw material inflation, particularly steel and resins, which resulted in an unfavorable impact of 400 basis points.”

CSX (Industrials): “The good news is we have secured adequate inventory and supply commitments for critical materials, and we’ve worked to lock in the vast majority of unit costs for 2021. Excluding locomotive fuel, expense inflation this quarter was just above 3% and we don’t expect that to move much going into the second half.”

NTRS (Financials): “Inflation is showing up in different areas. I mean every firm is dealing with talent issues and the pressure is there. We certainly see that and experience it and talking at management levels about how to address it. And the inflation we see across the business and different areas as well. And some of it is unit costs but some of it is just the increased cost of doing business. And we talked about the significant increase in technology oriented expenses that we’re having. In some ways that’s an inflation cost on the business. It’s not just a unit price inflation but it’s inflation in the overall cost of doing business. So, it’s showing up in different ways across the organization.”

BKR (Energy): “Although we have moved quickly to pass inflation on to our customers, there is a timing lag relative to the increase in costs.”

JNJ (Health Care): “We continue to expect in the back half of the year pressure in parts of our portfolio in terms of commodity inflation and distribution cost. We are prepared to absorb those.”

CMG (Consumer Discretionary): “We anticipate these commodity headwinds will negatively impact the quarter by an additional 60 basis points to 80 basis points, essentially offsetting the benefit of menu price increases. This will result in food costs for Q3 being at or slightly above the percentage we saw in Q2. Over the next few quarters, we’ll have greater visibility on how much of this inflation is permanent versus transitory, and we can take the appropriate actions as needed to help offset any lasting impacts.”

DOV (Industrials): “What we underestimated was the total cost impacts of a strained logistics system and tight labor market that shows no signs of abating. This has had two knock-on effects on our results. First, the absolute cost of inbound and outbound freight were materially higher; and second and more important, the costs associated with production line stoppages due to lack of labor and components caused by transit time uncertainty and overall supply chain tightness.”… “I think that there is an interesting argument, and I would agree with it that to the extent that labor inflation is durable and that supply chains, the issues that we’re having in supply chains will improve, but not dramatically. There’s an argument to be made that the returns on automation are going to be better than they’ve been over the last five to six years. And I would agree with that.”

KSU (Industrials): “Core pricing and contract renewals were essentially in line with the first quarter, but we are clearly seeing inflationary pressures that will need to be addressed going forward. As we look into the back half of 2021, we would expect the auto chip shortage to continue to negatively impact our growth, with a strong bounce-back late in the year and into 2022 as auto demand continues to be extremely high and dealer inventories at all-time lows.”… “We’ve now got to step up in inflation. So, we need to kind of deal with that going forward because our long-term strategy has always been to price above the cost of inflation. But an interesting dynamic and even the fed looking at their long-term projections around inflation would suggest inflation is going to come back down in 2022. So, there are interesting discussions with customers to have and we’re going to do our best to continue to make sure we cover cost increases in our business there.”

PPG (Materials): “Due to supply disruptions, we experienced unprecedented levels of raw material and transportation costs that continually elevated as the quarter progressed. This drove raw material inflation to be up a mid to high-teen percentage on a year-over-year basis versus our original estimate of a high single-digit percentage increase.”… “Clearly this inflation cycle is much higher than anyone anticipated, and we’re continuing on a business-by-business basis, working to secure further selling price increases. This includes executing additional pricing actions during the third quarter.”…“We now fully expect to offset raw material cost inflation in the fourth quarter on 2021 on a run rate basis.”…“But if we could get the overall base supply/demand (back in) balance, if you will, in our supply chain, I think prices would start to normalize somewhat. We don’t see that happening in 2021. So right now, we’re still anticipating significant inflation, when we said it’s 20% in Q3 and we’ll have a significant inflation in Q4. So for as far as we can currently look out, we’re still looking at a pretty inflationary cycle.”

FAST (Industrials): “Price actions to-date have largely matched cost increases. There’s a ton of inflation going on. There’s inflation because of disruption and shipping,”… “The marketplace is still receptive to price actions and the tools and processes we have developed have been effective. Even so, given the rate of inflation, maintaining price cost parity will be a bigger challenge in the third quarter.”

CAG (Staples): “We expect the negative impact of the cost inflation to hit our financials before the beneficial impact of our responsive actions, including our pricing. This timing mismatch is expected to be particularly impactful in (fiscal) H1 and, more specifically, in (fiscal) Q1. The resulting pressure on our first half margins impact our full year profit […] Although the substantial increase in inflation over the last few months has negatively impacted our profit guidance for the (fiscal) year, we remain confident in the underlying strength of the business. […] Importantly, we expect that the impact of our aggressive mitigating actions will cause second half adjusted EPS to rebound, to be in line with what was assumed for (fiscal) H2 within our prior guidance.”… “When we initially gave our fiscal 2022 targets at our Investor Day in April of 2019, our models assumed an annual inflation rate of around 3%. At the time of our third quarter call, in April of 2021, we expected fiscal 2022 inflation to come in at twice that level around 6% […] We now currently expect fiscal 2022 inflation to come in around 9%. The difference between the 6% we expected a few months ago and the 9% we expect today equates to approximately $255 million in additional costs during fiscal 2022.”

JPM (Financials): “In terms of inflation, I would say that we’re not seeing inflation in our actuals. But obviously, your guess is as good as mine in terms of the future. But it would be reasonable to assume that that’s going to be a little bit of a challenge… it won’t make any difference as long as you have that strong growth in consumer there. Jobs are plentiful; wages are going up. These are all good things. And so, obviously, inflation could be worse than people think. I think it’ll be a little bit worse than what the Fed thinks. I don’t think it’s all going to be temporary. But that doesn’t matter if we have very strong growth.”

MKC (Staples): “We’re seeing broad-based inflation across our various commodities, packaging materials and transportation costs. To offset rising costs, we are raising prices where appropriate, but usually there is a lag time associated with pricing, particularly with how quickly costs are escalating. And therefore, most of our actions won’t go into effect until late 2021.”

PEP (Staples): “We’re seeing inflation in our business across many of our raw ingredients and some of our inputs in labor and freight and everything else. So, we operate in the same context. We feel quite comfortable or confident that through a combination of net revenue management initiatives and increased productivity, we can navigate this.”

CTAS (Industrials): “While some inflationary pressures increased certain costs, these were more than offset by increased revenue from businesses reopening or increasing capacity as COVID-19 case counts fell and restrictions on businesses were reduced.”

ZION (Financials): “This outlook does not reflect a significant change in inflation from what we’ve observed over the past several years which we believe is an emerging and increasingly important risk to our outlook.”… “But there is no softening in the concerns about supply chain or concerns about inflation. Those concerns are real. They’re certainly remaining steady, if not building, in terms of the minds of business owners.”

SIVB (Financials): “If we do see inflation, I actually think it’s going to be modest, I don’t think it’s going to be something that would be a fundamental change that would cause the market to get overly spooked. But again, something to pay attention to, and that’s just my own opinion.”

WRB (Financials): “We continue to be very focused on inflation. From our perspective, inflation is very much here. There’re some people that talked about it being this transient that may be true. I’m not quite sure when people talk about transient, well, how long is transient, regardless the costs of things are up today. But even if you saw inflation return to a 2.5% or 3% level, we continue to believe that the 10-year at 130% or less doesn’t make a whole lot of sense for a long run.”

RHI (Industrials): “We’re passing through the wage inflation that we’re having and we’ve actually expanded our margin.”

Tyler Durden

Mon, 08/02/2021 – 19:20![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com