Berkshire Trims General Motors And Pharma Stakes, Dumps Biogen, Opens New Position In Organon

Unlike last quarter, when there were a flurry of changes in the world’s most closely watched 13F, when Berkshire Hathaway liquidated almost its entire stake in Wells, sold half of its Chevron shares, added a new position in Aon PLC and trimmed its holdings in 11 positions, Warren Buffett’s just filed 13F for the quarter ended June 30 was a bit of a snoozer which had three highlights: i) the trimming of Berkshire’s holdings in GM, ii) a new position in pharma company Organon offset by the full liquidation of holdings in Biogen, and iii) the shrinkage of stakes in pharma names Merck, Bristol-Myers and Abbvie.

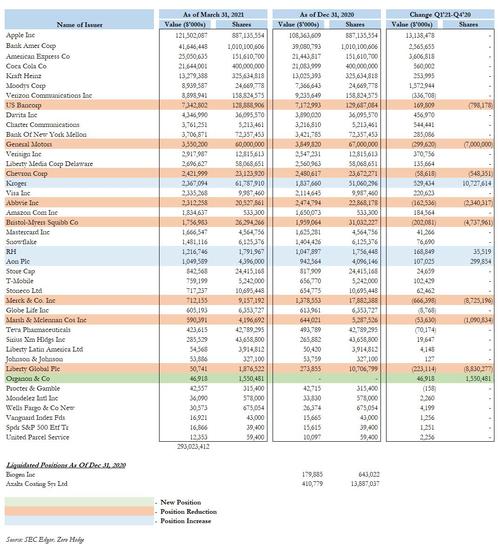

As shown in the table below, Buffett’s latest 13F which had a disclosed value of just over $293 billion with Apple still the largest position at 887 million shares, had no changes among the top 7 positions, and while Buffett trimmed his holdings in US Bancorp by a token 798K shares (perhaps to remain within regulatory limits) the most notable move going down the list was the 10% reduction in Berkshire’s GM stake which was cut by 7 million shares from 67 million to 60 million.

In addition to GM, a total of 8 stakes were cut in Q2 including Berkshire’s holdings in Abbvie (10% cut to 20.5 million shares), Bristol-Myers (15% cut to 26.3 million shares), as well as Merck which was cut by 48% to 9.2 million shares while liquidating its entire stake in Biogen. The company also slashed its holdings in Liberty Global, which shrank by 82%, and Chevron which saw a modest, 2% decline.

Berksire had had recently disclosed new bets on two insurance brokers, Aon and Marsh McLennan. But it took those bets in different directions during the second quarter, with the Marsh McLennan stake dropping by 20%, while the Aon position increased by 7%.

Berkshire also unveiled a new, if modest, position in Organon at 1.55 million shares accounting for $46.9 million as of Q2, while liquidating its entire position in Biogen (643K shares) as noted above, as well as a somewhat largest stake in Axalta, which was $410MM as of Q1. Finally, the conglomerate added 21% to its Kroger stake, where it now owns 61.8 million shares, up 10.8 million from last quarter.

Overall, while there were some notable moves, this was nowhere near as exciting as some of the rotation observed in recent, post-covid quarters.

The full 13F summary is below (SEC link here).

Tyler Durden

Mon, 08/16/2021 – 17:23![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com