Key Events This Week: Retail Sales, Powell Speaks, Fed Chatter

Looking at the coming week, the events calendar is relatively quiet over the week ahead as markets await the Jackson Hole symposium next week and Fed Chair Powell’s speech there for any signs on how the Fed might begin to taper their asset purchases. However, as DB’s Henry Allen notes, we will get the release of the FOMC minutes from their meeting in late July, which economists expect will provide more insights into the technical discussions around tapering strategies, and potentially some further clues as to which data releases officials will be focusing on as they assess progress towards their goals. It comes after a report on Monday morning from the WSJ that the Fed is weighing ending the taper by mid-2022 although there was no mention in the note that Powell is on board, and that’s all that matters. We’ll also hear from Chair Powell in a virtual town hall with educators and students tomorrow, but that hasn’t traditionally been a forum for market communications.

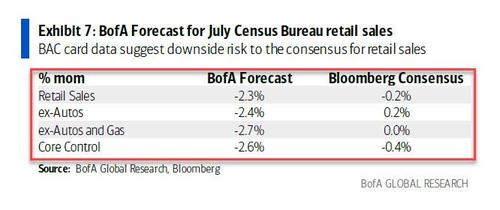

Staying on the US, this week’s data releases will feature an increasing amount of hard data for July, including retail sales, industrial production, housing starts and building permits. On the retail sales release, economists expect that auto sales will weigh on the headline number, and see a -0.6% decline this month. But they’re expecting a more mixed view on the factory and housing data mixed, with the manufacturing releases still pointing to strong production, whilst the housing sector continues to normalise around pre-covid levels of activity. As we noted on Friday, the latest card data from BofA showed a marked slowdown in recent spending, suggesting a big miss to expectations is on deck.

Turning to inflation, the coming week’s data should also add some further details on global price pressures after the US headline CPI print remained at +5.4% in July. The UK’s CPI reading for July will be in focus on Wednesday, particularly after the last couple of releases surprised to the upside and the Bank of England said at their latest meeting that “some modest tightening of monetary policy … is likely to be necessary” in order to meet their inflation target. Our UK economist projects that CPI will fall to +2.4% in July (vs. +2.5% in June), but still sees it peaking at closer to 4% before settling back down to target later next year. Separately in the Euro Area, there’s the final CPI print for July on Wednesday as well, and on Friday we’ll get the German PPI release for July, where the Bloomberg consensus is looking for a further increase after June’s +8.5% reading that marked the fastest rise in producer prices since January 1982.

On the earnings front, it’s nearly the end of the current season now, with over 90% of the S&P 500 having reported. Nevertheless, we’ve still got a few highlights over the week ahead, with tomorrow seeing reports from Walmart, Home Depot, BHP, and Agilent Technologies, before Wednesday sees releases from Tencent, Nvidia, Cisco, Lowe’s, and Target. Towards the end of the week, there’s also Applied Materials, Estee Lauder, Ross Stores, and Adyen on Thursday, before Friday sees Deere & Co release.

The pandemic will remain in focus over the week ahead, particularly given that cases have been rising at the global level for 8 consecutive weeks now, according to John Hopkins University data. In the US, the New York Times reported over the weekend that the Biden administration was drawing up a plan to offer booster shots as early as the autumn, with the story saying that priority would be given to care home residents, healthcare workers and the elderly. Meanwhile from today in England, those who’ve been fully vaccinated for two weeks won’t be required to self-isolate if they’ve been in contact with someone who’s tested positive for Covid.

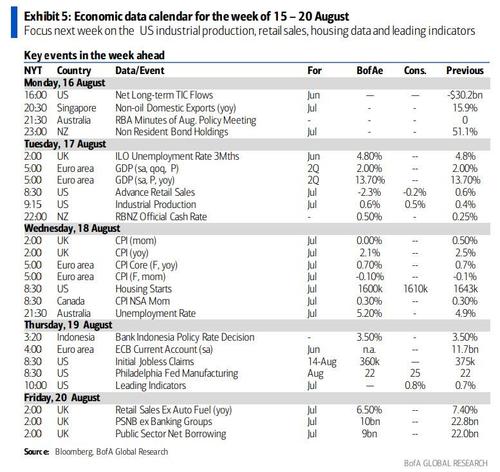

Day-by-day calendar of events, courtesy of Deutsche Bank

Monday August 16

-

Data: Japan final June industrial production, China July industrial production and retail sales, US August Empire manufacturing index

-

Earnings: Roblox

Tuesday August 17

-

Data: Japan Tertiary June industry index, UK July jobless claims and ILO unemployment rate, Euro Area preliminary 2Q GDP, US July retail sales, industrial production, and NAHB Housing market index

-

Central Banks: Fed Chair Powell and Fed’s Kashkari speak

-

Earnings: Walmart, Home Depot, BHP, Agilent Technologies

-

Other: China’s National People’s Congress Standing Committee begins a four-day meeting in Beijing

Wednesday August 18

-

Data: Japan July trade balance and July core machine orders, UK July CPI, PPI and retail price index, Euro Area July CPI, US weekly MBA mortgage applications, July building permits and housing starts

-

Central Banks: July FOMC meeting minutes, Fed Kaplan speaks, Reserve Bank of New Zealand policy decision

-

Earnings: Tencent, Nvidia, Cisco, Lowe’s, Target, TJX companies

Thursday August 19

-

Data: US weekly initial jobless claims and continuing claims, August Philadelphia Fed Business outlook, and July leading index

-

Central Banks: Bank of Indonesia rate decision, Norges Bank policy decision

-

Earnings: Applied Materials, Estee Lauder, Ross Stores, Adyen

Friday August 20

-

Data: Japan July national CPI, Germany July PPI, UK August GfK consumer confidence, July retail sales and public sector net borrowing

-

Central Banks: Fed’s Kaplan speaks

-

Earnings: Deere & Co

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the retail sales report on Tuesday and the Philadelphia Fed manufacturing index on Thursday. There are a couple scheduled speaking engagements from Fed officials this week, including a town hall between Chair Powell and educators on Tuesday.

Monday, August 16

-

08:30 AM Empire State manufacturing survey, August (consensus +28.5, last +43.0)

Tuesday, August 17

-

08:30 AM Retail sales, July (GS -0.6%, consensus -0.2%, last +0.6%); Retail sales ex-auto, July (GS -0.4%, consensus +0.2%, last +1.3%); Retail sales ex-auto & gas, July (GS -0.5%, consensus flat, last +1.1%); Core retail sales, July (GS -0.6%, consensus -0.2%, last +1.1%): We estimate a 0.6% pullback in core retail sales (ex-autos, gasoline, and building materials) in July (mom sa). High-frequency data suggest some softening in consumer goods spending, perhaps related to the expiration of federal income support programs in some states. We also expect a waning contribution from reopening in categories such as restaurants, clothing, and department stores, and we are assuming a decline in the non-store category following the Amazon Prime Day boost to June. We estimate a 0.6% decline in headline retail sales, reflecting fewer auto sales but higher auto and gas prices.

-

09:15 AM Industrial production, July (GS +0.3%, consensus +0.5%, last +0.4%); Manufacturing production, July (GS +0.9%, consensus +0.6%, last -0.1%); Capacity utilization, July (GS 75.6%, consensus 75.7%, last 75.4%): We estimate industrial production rose by 0.3% in July, reflecting strength in mining production and motor vehicle output as production recovers from supply chain constraints and weakness in utilities. We estimate capacity utilization rose by 0.2pp to 75.6%.

-

10:00 AM Business inventories, June (consensus +0.8%, last +0.5%)

-

10:00 AM NAHB housing market index, August (consensus 80, last 80)

-

01:30 PM Fed Chair Powell (FOMC voter) speaks: Fed Chair Jerome Powell will participate in a virtual town hall with educators. Audience Q&A is expected.

-

03:45 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will participate in a town hall during the Pacific Northwest Economic Regional Annual Summit. Audience Q&A is expected.

Wednesday, August 18

-

08:30 AM Housing starts, July (GS -3.0%, consensus -2.6%, last +6.3%); Building permits, July (consensus +1.0%, last -5.1%); We estimate housing starts declined by 3.0% in July, reflecting lower permits in June

-

02:00 PM Minutes from the July 27–28 FOMC meeting: At its July meeting, the FOMC left the funds rate target range unchanged at 0–0.25%, as widely expected. The post-meeting statement noted that the economy had continued to strengthen and upgraded the assessment of sectors most adversely affected by the pandemic. The statement placed less emphasis on downside risks from virus spread and was updated to acknowledge that the economy had made progress toward the FOMC’s dual mandate goals since December.

Thursday, August 19

-

08:30 AM Initial jobless claims, week ended August 14 (GS 375k, consensus 365k, last 375k); Continuing jobless claims, week ended August 7 (consensus 2,800k, last 2,866k); We estimate initial jobless claims were unchanged at 375k in the week ended August 14.

-

08:30 AM Philadelphia Fed manufacturing index, August (GS 21.9, consensus 24.0, last 21.9): We estimate that the Philadelphia Fed manufacturing index remained unchanged at 21.9 in August, reflecting continued production constraints from labor shortages and supply chain bottlenecks.

Friday, August 20

-

There are no major economic data releases scheduled.

Source: DB, Goldman, BofA

Tyler Durden

Mon, 08/16/2021 – 10:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com