Japan Emerges As Biggest Driver Behind Recent Plunge In Yields

As frequent readers will recall, one of the catalysts behind the forceful emergence of the reflation trade in the first quarter was the powerful move higher in yields which many interpreted as markets pricing in higher long-term inflation. In reality, we have since learned that this move – which coincided perfectly with the end of Japan’s fiscal year on March 31 – was largely, if not exclusively, a byproduct of Japan’s giant pension fund, the GPIF, drastically shifting out of treasuries as it slashed its US Treasury exposure by a record amount.

Furthermore, as Morgan Stanley said earlier this month when news of the GPIF’s asset reallocation first emerged, “it is important to avoid the trap of forcibly goalseeking a narrative to lower yields, a trap investors dealt with merely four months ago“:

Treasury yields rose sharply in March, largely due to selling from Japanese investors, based on their fiscal year-end considerations.

Yet, most investors mistook the rise in yields as validation for a super-hot economy, and the consensus bought into the idea that 10-year yields were headed above 2%. We cautioned investors that yields had overshot relative to the economic reality. Over the coming weeks, economic data in the US couldn’t keep up with unrealistic expectations, and 10-year yields started grinding lower.

In other words, GPIF’s decision to dump US Treasuries fooled the world into believing the recovery was accelerating, but now that yields are collapsing again, the asset gatherers and commission-rakers conveniently brush it off as “QE-driven distortion.”

Fast forward to today when we may be experiencing a remarkable reversal of events from the first quarter.

As most know, in recent weeks the market has been obsessed with the ongoing plunge in yields with most interpreting this development as spelling the end of any reflationary hopes and signaling perhaps outright deflation. Yet as Morgan Stanley again points out, it could very well be that the recent sharp move lower in yields is again merely the result of country-specific asset reallocation. The country in question? Again Japan.

As Morgan Stanley’s rates strategist Matthew Hornbach writes in his latest weekly Global Macro Strategist note, global macro markets continue to grapple with the fallout from rising Covid cases driven by the Delta variant, albeit to different extents. With higher vaccination rates, booster vaccines, and stronger fiscal support, most developed economies have some scope for mitigating the economic damage from the rise in cases. As Fed chair Powell noted earlier this week, he doesn’t see “important effects” for the US economy just yet.

Powell, on August 18: I would say it’s not yet clear whether the delta strain will have important effects on the economy. We’ll have to see about that.

But while Powell may not have changed his view for the economy based on rising Covid cases yet, markets are grappling with the risk case that the rise in the Delta variant will have a negative effect on the economy. Nowhere is this more obvious than in the recent plunge in 10Y nominal yields to 1.15% and the crash in real yields to all time lows.

Of course, there is nothing revolutionary in arguing that the move lower in yields is a direct result of economic slowdown fears arising from the wide spread of the covid Delta variant which has already prompted fresh lockdowns in various countries such as Australia, Japan and New Zealand… but how much is too much? According to Morgan Stanley, “the decline in Treasury yields in the last two months, coincident with a rise of the Delta variant globally, already prices in that downside risk to a sizeable degree.”

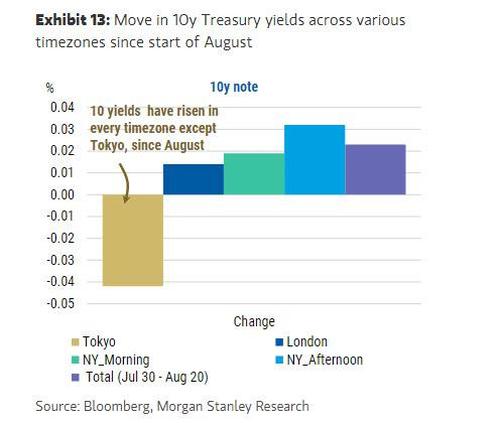

But a far more actionable observation courtesy of Morgan Stanley’s Matthew Horbnach, is that the buying of Treasurys (i.e., reducing yields) is hardly a uniform event. In fact, as shown in the chart below, the decline in yields has been coming exclusively from overnight buyers, particularly from Asian buyers – i.e., Japan, the same Japan which in Q1 was busy dumping Treasurys – while US investors as well as European investors seem relatively bullish.

As shown in the chart below, yields have declined in August only in the Tokyo session, while rising in London and NY sessions.

Furthermore, as Hornbach notes, the lack of follow-through in Treasury yields after the sharp decline in the University of Michigan consumer sentiment – which curiously saw yields rise despite the most bearish economic signal in the survey’s recent history – “is encouraging in that regard.”

Paradoxically, this bizarre dump out of Japan may also explain a strange observation in equities: as we noted last week, in the past month the S&P is down 4% in the overnight session and it is up 3.5% from 930am to 4pm. This is a stark reversal of the familiar “overnight futures ramp” which has led to most of the market’s gains in the past decade.

So is the recent slide in yields the result of aggressive Japanese hedging and/or outright buying of Treasurys? After GPIF’s Q1 stunner, when yields blew out as the pension fund was dumping its Treasury exposure, it certainly is conceivable that Japan’s skittish bond managers have once again taken the entire bond market for the proverbial ride. Throw in the fact that Japan would be wrongfooting the entire market for the second time in six months, and the irony of all those rates experts being confounded by one nation’s bond flow would be complete.

There’s more: even if the move in rates is more than just “Japan”, the bond market has now taken its downbeat view of the Delta variant too far. Just yesterday, we reported that according to the CDC, the Delta wave has “likely peaked across the Northeast.” This confirms what Morgan Stanley said 10 days ago when it predicted that the Delta wave “will peak in 1-2 weeks.” It’s now almost two weeks later.

Also two weeks ago JPMorgan’s Marko Kolanovic said that Delta cases are about to turn lower, an inflection point which prompted the quant to call for a bottom in yields and cyclicals.

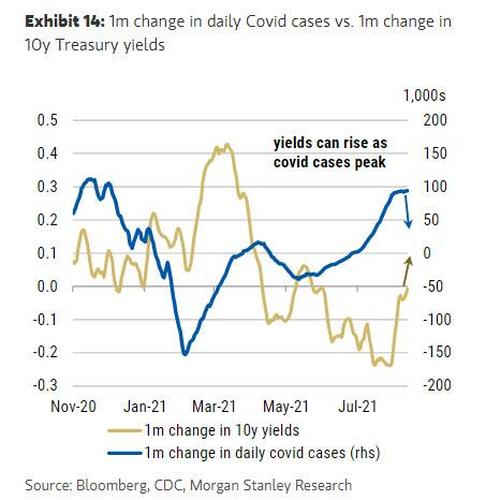

Picking up on this, Hornbach writes that the “second derivative of daily cases in the US is peaking, which is in line with our biotechnology analysts’ view that daily Covid case in the US could be peaking in late August/early September.” As shown in the next chart, the rise and fall in Treasury yields over the last few months has a degree of inverse relationship with the rate of change of daily Covid cases (2nd derivative of total cases). In other words, “If Covid cases indeed peak, we would expect Treasury yields to rise.”

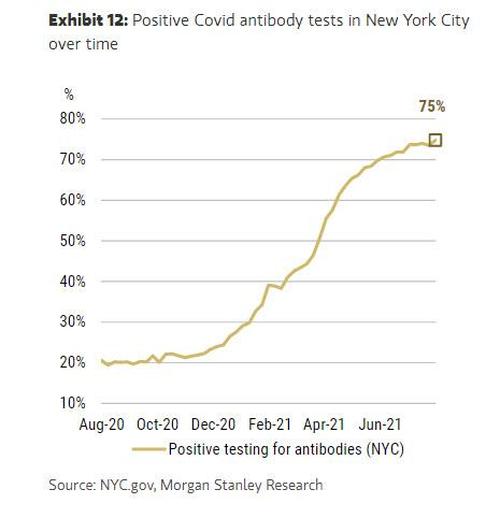

And finally, Hornbach who was broken with Wall Street’s dovish trend and expects 10Y yields to hit 1.80% by year end, notes that there may actually be long-term positive effects from the current wave of Covid cases in that it allows the US population to move faster toward herd immunity. This is because (1) more people have been vaccinated after the recent rise in cases, and (2) given the fast spread of the Delta variant in the unvaccinated population, more people gain immunity by developing antibodies after infection.

On that note, it is remarkable that the latest serological testing in New York City shows that 75% of the population has some form of antibody immunity vs. Covid – immunity whether due to vaccination or actually having defeated the virus – and thus the US is getting ever closer to “herd immunity”.

Tyler Durden

Sun, 08/22/2021 – 20:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com