What Chip Shortage: Inventory At Leading Chipmakers Hits Record $65 Billion

Something odd emerged as automaker after automaker – most notably Toyota last week – announced they would throttle auto production in coming months due to a historic chip shortage: according to calculations from Financial Times parent, Nikkei, total inventory at the world’s nine leading chipmakers hit a record high of $64.7 billion as of the end of June as “companies quickly moved to ramp up production to alleviate a protracted shortage that has disrupted supply chains in the auto industry and beyond.”

When demand for chips used in high-performance computers and automobiles outpaced projections due to the coronavirus pandemic which forced many chipmakers to suspend production in Southeast Asia, Taiwan Semiconductor – the world’s largest chipmaker – optimized production lines in January-June, expanding production of automotive chips during the period by 30% from a year earlier.

Others followed, and according to Nikkei, total inventory at TSMC, Intel, Samsung Electronics, Micron Technology, SK Hynix, Western Digital, Texas Instruments, Infineon Technologies and STMicroelectronics are now at historic highs, as chipmakers expand their stockpile of raw materials to drive production. The share of raw materials in total inventory has steadily been increasing since March 2019 at the seven companies that provide comparable data, and topped 24% as of the end of March.

At the same time, finished chips are flying off the shelves: while turnover usually falls when total inventory increases, due to the backlog of persistent demand, sales have been growing faster than inventory, and the April-June quarter saw a turnover rate of 7.8, the highest in 18 months.

Still, as the Japanese publication notes, there is concern that growing inventories are not necessarily an accurate reflection of actual chip demand. For example, many automakers are now shifting away from the just-in-time strategy — or holding as little parts inventory for as short a time as possible — to holding spare inventory in case of supply chain disruptions.

“We may need to change the way we approach inventory, like by cultivating more chip suppliers,” Honda Motor Executive Vice President Seiji Kuraishi said

Electronic equipment maker Fujitsu General had also increased its inventory of chips and other components and materials by about 20% in three months as of the end of June. “We are securing more components even if it means a larger inventory in case the semiconductor shortage drags on,” said Vice President Hiroshi Niwayama.

Of course, while demand is solid there is little risk of excess inventory; but chipmakers worry that these developments could lead to a glut down the line.

“We have an order book that represents approximately two years of revenue,” said Helmut Gassel, chief marketing officer at Infineon Technologies. “We expect there to be some double ordering, which is, as always, impossible to quantify.”

But signs of a slowdown are already emerging in memory chips, where three key producers including Micron Technology and SK Hynix reported a steady decline in inventory. The bulk price of 4GB DDRs, which serve as a benchmark for dynamic random-access memory used in computers, roughly stayed flat for the second straight month in July at around $3.20 per chip. Global shipments of smartphones, which require memory chips, also fell markedly in April-June.

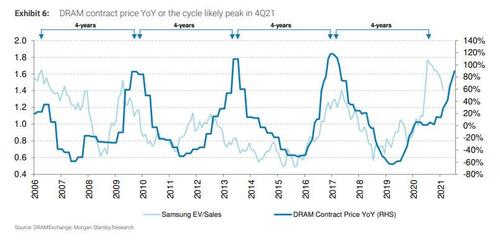

At the start of August, the SOX semi index slumped after Morgan Stanley issued a rare downgrade of core semiconductor names including SK Hynix, Samsung and Micron, warning that “winter is coming” for the DRAM sector, which is expected to peak in Q4 2021.

“The supply of memory chips will likely surpass demand in the first half of 2022, bringing prices down,” said Akira Minamikawa at research company Omdia, echoing Morgan Stanley’s concerns.

As a result, Samsung and Micron’s stock prices plunged this month as investors brace for an eventual correction in the chip market.

Still, leading chipmakers continue to rake in big bucks. The top 10 players by market capitalization booked $276 million in net profit in April-June, an increase of about 60% on the year and their sixth straight quarter of gains. They are also pursuing major expansions, largely in logic chips. TSMC plans to make $100 billion in capital investments over three years, while Intel has announced plans for a new $20 billion plant in Arizona.

But the chip industry has experienced major fluctuations in the past, saddling manufacturers with excess capacity built up during boom years once the market cools down. Expansions currently underway will go online in two to three years, meaning they may end up dragging companies down.

Tyler Durden

Mon, 08/23/2021 – 02:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com