Dovish Powell Sparks “Most Painful” Meltup To 52nd Record High In 2021

All that angst and jitters heading into today’s Jerome Powell speech, with so many fearing that the Fed Chair would finally make good on urgent warnings from a growing number of Fed speakers that the Fed’s easing is causing bubbles across all asset classes – including housing and certainly stocks – and warns traders that the big, bad taper is coming, and… nothing.

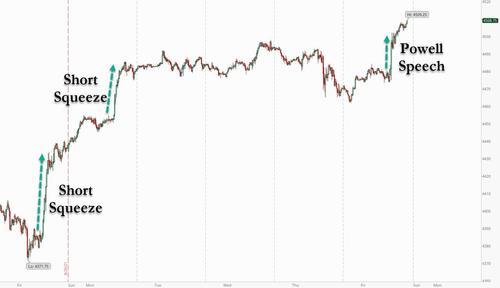

Instead, Powell was far more dovish than almost anyone had expected, barely mentioning the upcoming taper (and only in the context of what the Fed said in the recent Minutes), while reserving the bulk of his speech to discuss why inflation is transitory. The result was a nearly 1% surge in the S&P, with spoos rising above 4,500 for the first time up some 50 points from session lows…

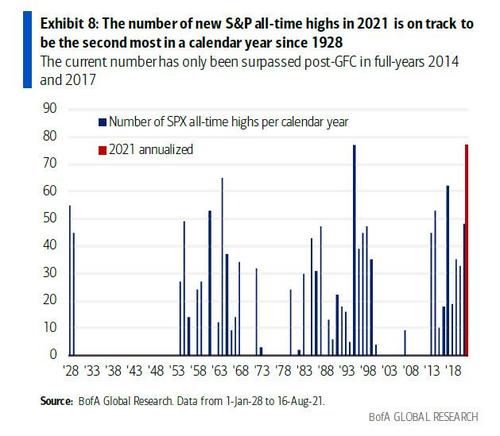

… and leading to the 52nd all time high for 2021, which means that at this pace 2021 will be a year with a record number of records!

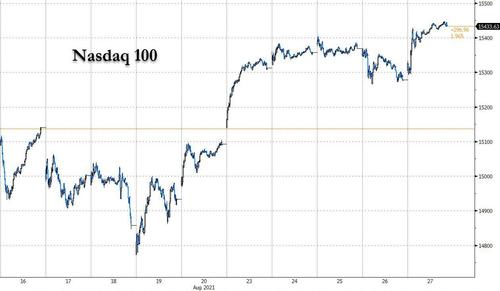

So “concerned” is Powell about wealth inequality that he made the world’s richest tech billionaires even richer again, thanks to another new all time high in the Nasdaq, which has continued its merry meltup, and just days after it rose above 15,000 for the first time, it was trading just shy of 15,500.

Predictably, Powell’s dovishness sparked a waterfall in the dollar and yields, with the 10Y and the Bloomberg Dollar index both sliding.

With the dollar freefalling, gold and silver surged…

… as did oil…

… as did cryptos.

After pushing higher earlier in the week, yields promptly collapsed after Powell’s dovish commentary…

… and just one day after 30Y yields finally caught up to stocks, today we observed a sharp divergence again in yet another manifestation of the QE trade where everything – except the dollar – was bought.

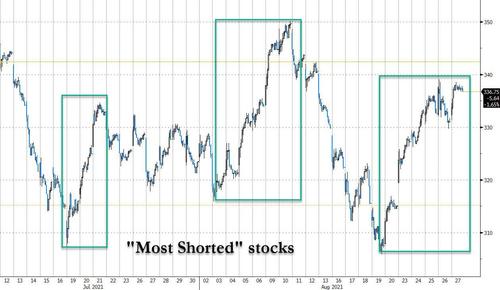

In a way, Powell was only a secondary catalyst to today’s move. The key driver behind the current meltup: a continue short squeeze, the third in the past month…

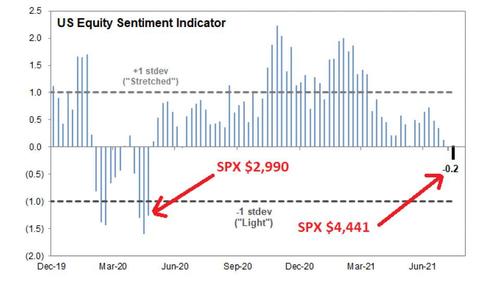

… and one which was triggered by wrong positioning by hedge funds, which as we noted earlier, appear to have an extremely bearish bias as revealed by Goldman’s sentiment indicator which just hit the lowest level in 63 weeks.

This upside meltup, which Goldman trader Scott Rubner said “would be the most painful“, may also explain why CNN’s fear and greed index is barely above the midline after spending much of the past month in “extreme fear” territory.

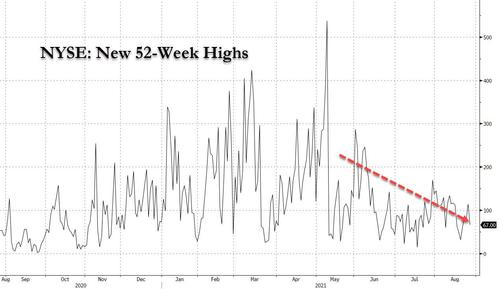

Finally, not only is breadth ugly, but trading volumes are slumping as stonks rally to the moon. While there was just 67 new 52-week highs on the NYSE…

The 50-day average daily trading volume across all members of the S&P 500 Index has declined to just shy of 2 billion shares, the lowest since the coronavirus pandemic first began to roil markets in late February 2020.

While August has historically been one of the quietest periods for trading, the equity benchmark’s average volume this year is still below its 10-year average for the month and is set to be the lowest since 2018… so who’s buying?

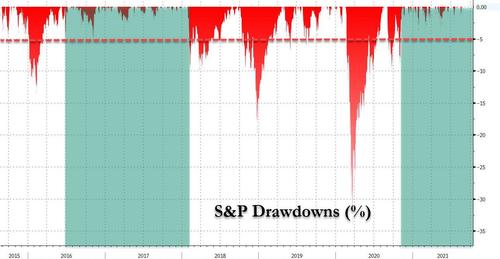

Whoever it is, they aren’t stopping – it has now been 10 months since the S&P suffered a 5% drawdown or greater…

Tyler Durden

Fri, 08/27/2021 – 16:11![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com