Rally Fizzles As Banks And Energy Dump While FANGs Hit All-Time High; Cryptos Soar

For the second day in a row, stocks rushed out of the gate only to stumble late in the day.

On the first day of the month, following a stellar Aug which saw 12 all time highs in the S&P – the most since 1987, September started off with a whimper as a broad divergence emerged beneath the market surface as energy and banks slumped while duration-sensitive and small cap stocks traded in the green.

As a result, the S&P failed to hold on to gains and closed broadly unchanged.

The slumping reflation trade was once again offset by strength in gigacaps, as the NYSE FANG+ Index climbed about 1.5% to reach a new all time high….

… with utilities and real-estate sectors also rising. The benchmark gauge of American equities traded near its all-time high, while the Dow Jones Industrial Average fluctuated.

Helping the FANGs was an upgrade by Wolfe Research of Apple to peer perform from underperform on the back of strong demand trends for the iPhone. The stock hit an all time high briefly before fading much of its gains.

Tech outperformance was also driven by another day of declining rates, with the 10Y yield sliding as soon as the ugly ADP print showed a huge miss to expectations, sparking concerns about Friday’s payrolls report…

… which in turn dragged the broader curve lower.

“The private payrolls numbers have been all over the map during the pandemic, and often not the strongest indicator of how the rest of the jobs report will play out,” said Mike Loewengart, managing director of investment strategy at E*Trade Financial. “With so much pressure on improvement on the labor-market front coming from the Fed, this could send a signal that jobs growth is stagnating. That’s likely a good thing for the markets though, as it means easy-money policy continues.”

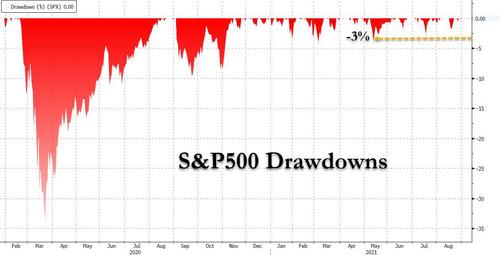

In short, good news is good but bad news is better, leading to a relentless meltup but while the market hasn’t had a 5% drawdown since November, it also hasn’t had a 3% drop since May as stocks become a one-way diagonal line higher.

There is debate on what happens next, with bulls and bears once again torn: For Linda Duessel, senior equity strategist at Federated Hermes, it’s still too early to get bearish on the market. While more Wall Street voices are predicting a pullback soon, she told Bloomberg TV Wednesday that the “unbelievable” landscape of strong earnings and fiscal stimulus means stocks can run higher for longer.

Meantime, Citigroup Inc.’s Tobias Levkovich is sticking to his bearish call. The bank’s chief U.S. equity strategist predicts the index will end the year at 4,000 before reaching 4,350 by June 2022. Both levels sit below its last close of 4,522.68. Underpinning his view are stretched valuations and a planned tax rise that will hurt corporate profits.

One thing which however appears quite likely is even more gains for cryptos: with the prospect of even more monetary easing on deck, and as the NFT craze finds a second and far more powerful wind, cryptos jumped with Ethereum surging to the highest level since May, with many expecting ETH to take out its May all time highs in the coming weeks.

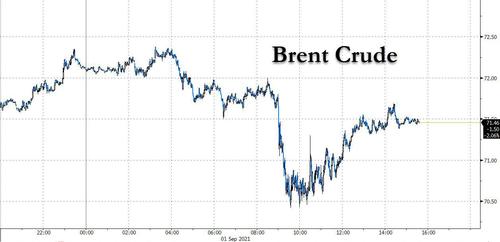

Away from cryptos, commodities were flat with gold flatlining and oil paring steep earlier losses as traders found comfort from a bullish U.S. government oil inventory report which saw a more than 7mm bbl inventory draw. Nerves were also soothed by the speed with which OPEC and its partners agreed – with hardly any discussion – to continue with a plan to add about 400,000 barrels a day of supply the group had shut last year when the pandemic destroyed demand.

But if today was boring, expect even more muted volumes tomorrow when traders will refrain from taking any major positions ahead of Friday’s NFP which, however, as noted above will be bullish if it beats, and more bullish if it misses.

Tyler Durden

Wed, 09/01/2021 – 16:02![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com