“The End Of Abenomics” – Japan’s Struggling Prime Minister Suga Unexpectedly Steps Down

Japan’s original doom loop – rotating prime ministers who stay on the job for about a year only to resign and leave the country in even worse shape – is back.

Less than a year after he was appointed to replace Shinzo Abe, Japanese Prime Minister Yoshihide Suga said in a surprise move on Friday he would step down, setting the stage for a new premier after a one-year tenure marred by an dismal and unpopular Covid response and sinking public support. Suga, who took over after Shinzo Abe – who resigned last September for the second time as prime minister citing ill health although this time it wasn’t diarrhea, unlike the reason cited for his first departure – had seen his approval ratings drop below 30% as the nation struggled with its worst wave of covid infections ahead of a general election this year (despite mandatory masks).

“I want to focus on coronavirus response, so I told the LDP executive meeting that I’ve decided not to run in the party leadership race,” Suga told reporters. “I judged that I cannot juggle both and I should concentrate on either of them.”

Suga did not capitalize on his last major “achievement” – hosting the Olympics, which were postponed months before he took office as coronavirus cases surged, and which proved to be highly unpopular with the population, merely saddling Japan with even more debt.

His decision not to seek reelection as ruling Liberal Democratic Party (LDP) president this month means the party will choose a new leader, who will become prime minister.

While there was no clear frontrunner, the popular minister in charge of Japan’s vaccination rollout, Taro Kono, intends to run, broadcaster TBS said on Friday without citing sources. Former foreign minister Fumio Kishida has already thrown his hat in the ring. Before Abe’s record eight-year tenure, the country had gone through six prime ministers in as many years, including Abe’s own troubled first one-year term.

Succession

Declaring himself a contender for Japan’s next leader, Kishida, a soft-spoken Hiroshima lawmaker, on Thursday criticised Suga’s coronavirus response and urged a stimulus package to combat the pandemic.

“Kishida is the top runner for the time being but that doesn’t mean his victory is assured,” said Koichi Nakano, political science professor at Sophia University. Nakano said Kono, Suga’s administrative reform minister, could run if he gets the backing of his faction leader in the party, Finance Minister Taro Aso.

Former defense minister Shigeru Ishiba, also popular with the public as a potential premier, said he was ready to run if the conditions and environment are right. He was a rare LDP critic of Abe during his time as prime minister.

Kono has led Japan’s rocky inoculation drive but remains high on the list of lawmakers voters want to see succeed Suga. Kono did not deny media reports but stopped short of declaring his candidacy, telling reporters he wanted to carefully consult with party colleagues first.

A former foreign and defense minister, Kono, 58, is popular with younger voters after building support through Twitter, where he has 2.3 million followers – a rarity in Japanese politics dominated by men who are older and less social media-savvy.

Abe’s stance will also be closely watched given his influence inside the two largest factions of the LDP and among conservative MPs, experts say.

LDP Fate

The LDP-led coalition is not expected to lose its majority in the lower house, but forecasts suggest the party could lose the majority that it holds on its own, an outcome that would weaken whoever leads the party next. “Stock prices are rising based on a view that the chance of LDP’s defeat in the general election has diminished because anyone other than Suga will be able to regain popularity,” said senior economist at Daiwa Securities Toru Suehiro.

Suga’s image as a shrewd political operator capable of pushing through reforms and taking on the stodgy bureaucracy propelled his support to 74% when he took office.

He initially won applause for populist promises such as lower mobile phone rates and insurance for fertility treatments. But removing scholars critical of the government from an advisory panel and compromising with a junior coalition partner on policy for healthcare costs for the elderly drew criticism.

His delay in halting a domestic travel program – which experts say may have helped spread coronavirus around Japan – hit hard, while the public grew weary of states of emergency that hurt businesses.

Market Reaction

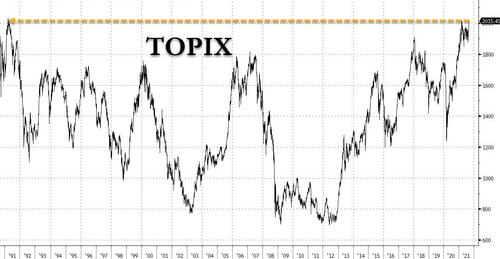

Tokyo stocks jumped on news of Suga’s decision, a move that investors say could serve as an inflection point for local stocks, with the benchmark Nikkei rising 2% and the broader Topix hitting its highest levels since 1991. The nation’s equities have been largely range-bound for months amid uncertainty over the upcoming election and concern over the latest wave of coronavirus cases, as Japan’s vaccination campaign and reopening lagged those of the U.S. and Europe. While it’s not unclear who will replace Suga, many said that regardless of who becomes the next prime minister, a large economic stimulus is likely. Others cheered the possibility of political stability, as prospects for a more comprehensive victory for the ruling Liberal Democratic Party in the upcoming election increase.

At the same time, Japanese government bonds fell, led by super-long maturities, as traders weighed the risk of more stimulus spending with a change in the nation’s leadership. The yen weakened after stocks rallied. JGB futures ended day session down 0.08 at 151.98 with the benchmark 10- year yield rising 0.5bp to 0.035, the highest since Aug. 11. Yields on maturities above 10 years also climbed, with that on 20-year notes up 1bp to 0.415%

The market reaction to Suga reflects wariness about more debt issuance next year as his successor is likely to resort to fiscal stimulus to limit the damage from the outbreak, said Naoya Oshikubo, a senior economist at Sumitomo Mitsui Trust Asset Management in Tokyo

Suga’s abrupt resignation ended a rollercoaster week in which Suga pulled out all the stops to save his job, including suggestions he would sack his long-term party ally, as well as plans to dissolve parliament and reshuffle party executive and his cabinet. He is expected to stay on until his successor is chosen in the party election slated for Sept. 29. The winner, assured of being premier due to the LDP’s majority in the lower house of parliament, must call the general election by Nov. 28.

In response to the resignation news, views differed from the bullish, as this one from BBG’s Yoshiaki Nohara…

Japanese Prime Minister Suga’s decision to step aside is only going to intensify calls for a big stimulus package. Whoever comes to power next will want to woo a pandemic-frustrated public, and the promise for extra dollops of cash will be welcome news for Tokyo’s equity bulls. The economy has managed to avoid a double-dip recession, there are signs that companies are looking past the virus and there was plenty left over from last year’s stimulus spending plan. But a national election is due soon, and so politics, not economics, will require another round of spending

… to the skeptical as this one from Bloomberg’s Gearoid Reidy:

The shock effective resignation of PM Yoshihide Suga, who most expected to lead the ruling LDP into a general election this fall, is pleasing equity investors –but caution is warranted. While Suga was deeply unpopular and widely criticized for his handling of the pandemic, there are dangers here for markets. Suga, whose premiership represented a continuation of Shinzo Abe’s exit, could effectively mark the end of nearly a decade of Abenomics. And while the lure of Fumio Kishida’s promise of “tens of trillions of yen” of spending to control the pandemic may sound appealing to investors, don’t forget what Japanese politics was like before the Abe-Suga era. The biggest fear of many analysts is that a premature Suga exit could represent a return to the revolving-door premierships of the late 2000s, when successive prime ministers, each with only fractional control of the ruling party, lasted only a year. That wasn’t enough time to put any of their pet economic projects into action, and contributed to leaving Japan’s economy and market languishing. While the Topix is rallying today, a return to that era would not be good news for stocks.

Here’s what other analysts across asset classes are saying:

Mitsubishi UFJ Morgan Stanley Securities (Norihiro Fujito)

- “If the LDP were to win the general election soundly, the rally in Japanese stocks could continue. Foreign investors could revisit Japanese equities as valuations have been very cheap to begin with. The Nikkei 225 could climb back up to 30,000.”

- “Investors and consumers will expect policies under a fresh new leadership, and people assume that the LDP won’t lose so badly in the upcoming general election.”

- “Investors and consumers are expecting some ground-breaking stimulus, regardless of who might take over.”

Shinkin Asset (Naoki Fujiwara)

- “This is a plus for equities — with a new person leading, there will be expectations over policy steps.” Suga’s decision to resign might be a “turning point” for local equities.

- “The cloud may be gradually lifting for Japanese equities in terms of the overall environment.”

- “The virus situation is calming down, while we could see political risks easing from here, compared to before.”

T&D Asset (Hiroshi Namioka)

- Suga’s decision could help Japanese stocks “get out of a range.”

- His low approval rating has weighed on Japanese equities, and “for the stock market, it could be important to see the LDP regain its approval rating and not lose a majority during the general election.”

JP Morgan Asset (Shogo Maekawa)

- With Suga’s resignation, the LDP can head for the general election with a “slightly better support rate.”

- The risk that the ruling party might see a big loss of seats in the election, which would destabilize the administration, has been reduced. “Lowering those risks is something that local stocks would welcome.”

- The move will also boost expectations over economy- boosting measures, as well as progress on steps to get more people vaccinated and gradually prepping for “normalization” of the economy.

Asymmetric Advisors (Amir Anvarzadeh)

- “Logic prevails as LDP was bound to lose many seats in the Lower House if Suga continued after his monumental failure on betting on Olympics and acting too slow on vaccines.”

- “Suga’s departure will be viewed as positively, at least for now given his shortcomings. Question is will LDP yield to the will of the nation and allow” the popular Taro Kono to become prime minister

Gaitame.com Research Institute (Takuya Kanda)

- Yen may stay pressured despite the news; regardless of who becomes LDP leader and thus next premier, there won’t likely be a major shift in Japan’s economic and monetary policy

- Markets have seen Suga as a reason for falling support rating for the government and the ruling Liberal Democratic Party, so his departure probably could give a sense of relief; this may add to global risk-on

- Currency market players aren’t likely to use Japanese politics to make bets on yen

- As long as stocks are rising, expectations for united and stable LDP will be a yen weakness factor

Mitsubishi UFJ Morgan Stanley Securities (Naomi Muguruma)

- “The risk of a bigger economic stimulus package may be weighing on Japan’s bonds.”

- “A new leader for the ruling Liberal Democratic Party would face a lower house election soon and that may pressure the new leader to boost stimulus, which is positive for stocks but a source of concern for bonds.”

Oanda (Jeffrey Halley)

- Given Nikkei 225’s rally, “it is clear that domestically they feel that Suga’s resignation will add more political stability ahead of the October election, and will prompt more stimulus from either the government or the BOJ, or both.”

- “Given the complete debacle of Japan’s Covid-19 response, it seemed inevitable that he had become a political liability, although I expected him to go after, and not before the election.”

- “Of course, who PM Suga will be replaced by will be the critical development. Will the LDP go back to the future and insert another ‘aged establishment’ leader, or will they seize the opportunity to reinvigorate the leadership.”

- “I know which my money is on, and on that basis, I do not see the rally of today continuing with the same momentum, although I would love to be pleasantly surprised and proven wrong.”

Tyler Durden

Fri, 09/03/2021 – 06:59![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com