Furious Europeans Protest Electricity Hyperinflation: Christine Lagarde Are You Watching?

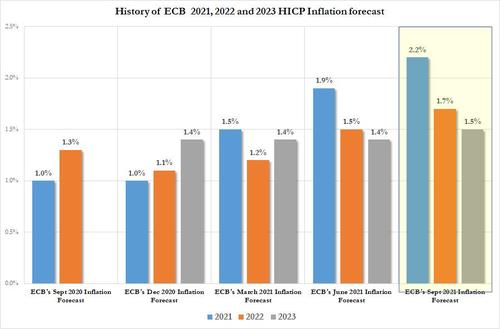

While a faint glimpse of reality did sneak through into the ECB’s latest set of economic projections, with the central bank now projecting that for the first time in over a decade, Europe’s 2021 inflation will surpass the ECB’s stated target of 2.0%, rising to 2.2% from the June projection of 1.9%, the balance of the outlook remained troubling, with the ECB now predicting inflation drops to 1.7% in 2022 and then again to 1.5% in 2023.

As Bloomberg’s Ven Ram put it, “the key number in all of ECB President Christine Lagarde’s projections is the HICP inflation number of 1.5%, which shows a modest revision that was expected by the markets. In other words, there’s still no sight of 2% inflation over the medium term. So after all these years of negative rates, APP and PEPP, there will be no end to yet-more accommodation and the ECB is saying its inflation target is still very much work-in-progress. And that against a backdrop where the ECB’s own estimates show growth this year and next will be better than it has been in a long, long time. Little wonder that BTPs and bunds are bid.”

Meanwhile, as Lagarde stakes the ECB’s reputation on the current burst of inflation once again being merely “transitory”, the reality on the ground is far uglier, and as the NYT writes overnight, soaring natural gas prices threaten to become a drag on the economies of Europe and elsewhere. Wholesale prices for the fuel are at their highest in years — nearly five times where they were at this time in 2019, before people started falling ill with the virus.

“The high costs feed into electric power prices and have begun showing up in utility bills, weighing on consumers whose personal finances have already been strained by the pandemic. The price jumps are unusual because demand is typically relatively low in the warmer summer months, raising alarms about the prospects for further increases when demand jumps in the winter.”

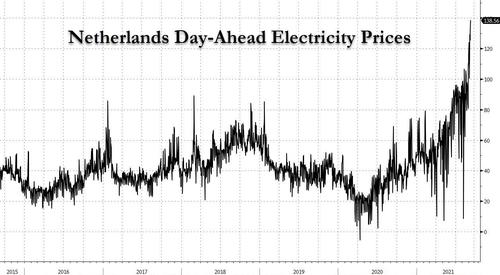

The explosive move – which has pushed European gas prices to fresh all-time highs today, also dragging electricity prices to fresh records highs in some countries – is shown below. Take Spain, with one-day ahead power prices at €152.32 per MWh.

Or Germany, where prices also hit a record…

… and in the Netherlands too.

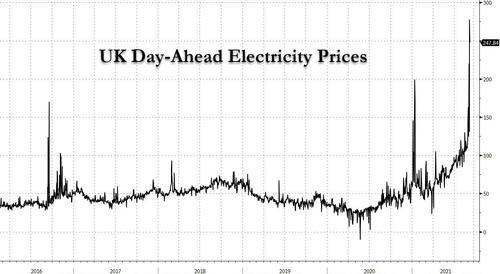

Meanwhile, one-day ahead electricity prices in the UK just going hyperbolic:

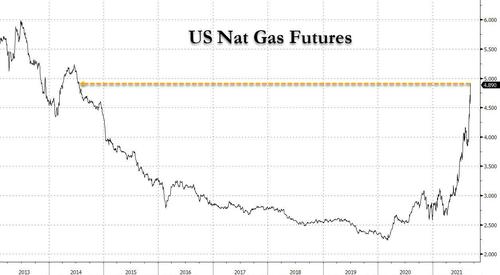

Needless to say, in the “green” continent, all of these explosive moves are the direct result of nat gas prices which have similarly hit all time highs.

Putting the recent price surge in context, Spanish households are paying roughly 40% more than what they paid for electricity a year ago as the wholesale price has more than doubled, prompting angry protests against utility companies. Indeed, as Bloomberg’s Javier Blas writes, Spanish day-ahead electricity prices have hit a fresh record high of €141.71 per MWh, which means that “power prices are now front-page story in Spain. A huge political problem.”

And because it’s my home country, and minister @Teresaribera started to follow me this week on Twitter, here we go with Spanish day-ahead electricity prices, hitting a fresh record high of €141.71 per MWh. Power prices are now front-page story in Spain. A huge political problem. pic.twitter.com/OmdDLk44FW

— Javier Blas (@JavierBlas) September 8, 2021

“The electricity price hike has created a lot of indignation, and this is of course moving onto the streets,” said María Campuzano, spokeswoman for the Alliance against Energy Poverty, a Spanish association that helps people struggling to pay energy bills.

The pain is being felt across Europe, where gas is used for home heating and cooking as well as electric power generation. Citing record natural gas prices, Britain’s energy regulatory agency, Ofgem, recently gave utilities a green light to increase the ceiling on energy bills for millions of households paying standard rates by about 12 percent, to 1,277 pounds, or $1,763, a year.

Several trends are to blame for soaring prices, including a resurgence of global demand after pandemic lockdowns, led by China, and a European cold snap in the latter part of winter this year that drained storage levels. The higher-than-expected demand and crimped supply are “a perfect storm,” said Marco Alverà, chief executive of Snam, the large gas company in Milan.

The worry is that if Europe has a cold winter, prices could climb further, possibly forcing some factories to temporarily shut down.

“If it is cold, then we’re in trouble,” Mr. Alverà said.

It also means that Europe will be begging Putin’s Russia to accelerate the launch of its controversial Nord Stream pipeline; clearly without it European gas prices will go even more parabolic.

Amusingly, the jump has prompted some to call for an acceleration of the shift from fossil fuels to clean domestic energy sources like wind and solar power to free consumers from being at the mercy of global commodity markets. This, of course, is dead wrong because with the ongoing “green” shift across the developed world, existing utilities are mothballing capacity expansions in baseload facilities, meaning that prices will soar much higher until the new “green” regime is established. That could take place in 5 years… or 50.

Even the NYT admits as much noting that “the turbulence in prices may also be a harbinger of volatility if energy companies begin to give up on fossil fuel production before renewable sources are ready to pick up the slack, analysts say. In addition, the closure of coal-fired generating plants in Britain and other countries has reduced flexibility in the system, Mr. Alverà said.”

Meanwhile, in the US gas prices have also risen as well, and while Henry Hub briefly rose above $5/mBtu on Wednesday, the highest since 2014…

… US prices are only around a quarter of those being paid in Europe. The United States has a big price advantage over Europe because of its large domestic supply of relatively cheap gas from shale drilling and other activities, while Europe must import most of its gas.

The immediate worry for markets in Europe is that suppliers failed to follow their usual practice and used the summer months to fill storage chambers with cheap gas that will be used during the winter, when cold weather more than doubles the consumption of gas in countries like Britain and Germany. A sharp drop in Russian gas supplies via the Yama-Europe pipeline did not help.

Instead, suppliers responded to the cold weather late last winter by draining gas storage facilities. Subsequently, they have been reluctant to top them up with high-priced gas. As a result, and as we warned one month ago, European storage facilities are at the depleted levels usual in winter rather than the peaks of fall.

“The market is very nervous as we move into the winter season,” said Laura Page, an analyst at Kpler, a research firm. “We have very low storage levels for the time of year.”

Europe imports around 60 percent of its gas, with supplies coming by pipeline from Russia and to a lesser extent Algeria and Libya. In other words, how much more Europeans will spend on gas this winter, literally depends on Vladimir Putin.

And while liquefied natural gas, arriving by ship from the United States, Qatar and elsewhere, usually helps balance the market, this year, L.N.G. carriers have been drawn to higher prices in China, South Korea and Brazil, where a drought has caused a drop in power generated by dams. As a result, Italy, Spain and northwest Europe have seen a sharp decline in liquefied natural gas infusions, according to data from Wood Mackenzie, a market research firm.

Adding to the tight situation in Europe, Groningen, the giant gas field in the Netherlands that long served as a safety valve for both its home country and western Germany, is being gradually shut down because of earthquakes and environmental concerns. Over the last year European gas prices have risen from around $4 per million British thermal units to about $18.

Russia, the largest gas supplier to Europe, and Algeria have substantially increased their exports but not enough to ease market concerns. Some analysts question whether Gazprom, Russia’s gas company, is pursuing a high-price strategy or trying to persuade the West to allow the completion of its Nord Stream 2 pipeline project, which will deliver gas from Russia to Germany.

“On the face of it, it looks as though some sort of game is being played here,” said Graham Freedman, an analyst at Wood Mackenzie. On the other hand, Mr. Freedman said, it could be that Gazprom doesn’t have any more gas to export. A spokeswoman for Gazprom said: “Our mission is to fulfill contractual obligations to our clients, not to ‘reduce the concerns’ of an abstract market.” She added that Gazprom had increased supplies to near-record levels this year.

Construction of the 746-mile pipeline, which runs under the Baltic Sea, was halted last year just short of completion off Germany’s shores by the threat of sanctions from the United States. But in a deal with Germany in July, the Biden administration agreed to drop its threat to stop the pipeline. On Monday, the management company for the project said it aimed to have the pipeline operating this year.

In any case, whatever the reason behind the electricity hyperinflation, we suggest that the ECB and Christine Lagarde pay close attention to staple electricity prices which – more than anything – threaten to send inflation expectations sharply higher at a time when the ECB is also injecting roughly €100BN in liquidity into the market, and if protests accelerate – and/or turn ugly especially if they reach Frankfurt – the ECB will suddenly find itself in a very unpleasant situation.

Tyler Durden

Thu, 09/09/2021 – 10:25![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com