Evergrande’s Impact On The Broader Junk Bond Market

Ahead of China’s reopening on Wednesday after a two-day holiday which has seen property stocks traded in Hong Kong tumble on fears that the Evergrande default will spark contagion both domestically and internationally, investors are closely watching what – if anything – Beijing will announce to ease investor nerves (they are also watching the first People’s Bank of China policy operation since the country’s holiday break). Meanwhile, international investors are just as closely tracking developments in China bond markets, not just the High Yield market where yields have soared to the highest level in 10 years, but also the investment grade sector, which is where the country’s banks reside. The good news here is that so far China’s IG market has barely budged, and as Deutsche Bank’s Jim Reid notes, “if Chinese IG doesn’t care, the world shouldn’t. However, if that starts to widen we know the impact is starting to spread. Definitely one to watch.”

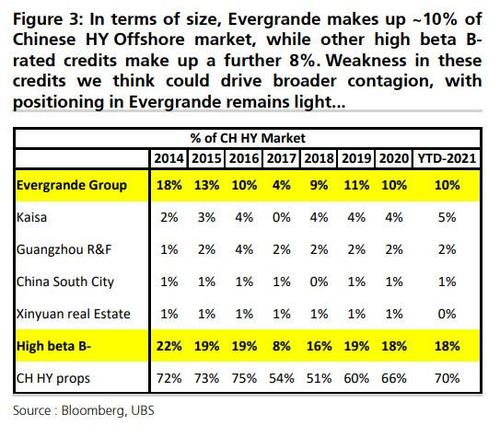

And while traders wait to see if new developments impact China’s IG market, Deutsche Bank has released a detailed look at how Evergrande could impact the broader high yield market, where it is a dominant player, with estimates of Evergrande’s bonds ranging anywhere between 10% and 16% of total market size…

Or, as Deutsche Bank puts it, “Evergrande is the largest corporate in the largest sector of the second-largest economy in the world” and as such the fact that this crisis has become a much wider global macro story shouldn’t be a surprise. To this end, in his note published this morning DB’s Craig Nicol seeks to answer some of the questions posed by investors in recent days, including scale and scope of contagion within HY, exposure to China risk within indices, and the ultimate end game.

Starting with the topic of contagion, the first question to ask is why have we not seen any wider scale contagion within HY or even China $IG?

As detailed in the chart below, which shows cumulative year-to-date total returns across HY markets as well as China $HY and $IG markets, the obvious point to make is that, while we’ve seen a significant decline in performance in China $HY, the wider impact on credit markets has been negligible. China $HY has seen YTD performance of nearly -18% which compares to returns of +3% to +5% across

broader HY markets and +1% for China $IG.

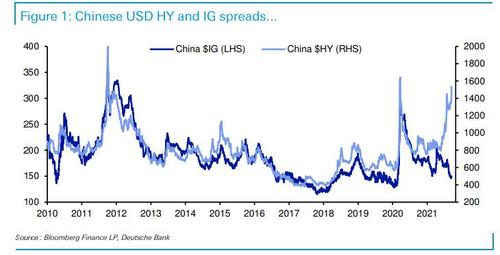

The next two charts show the scale of the spread moves for context. The first two charts focus on the China $ markets only.

As we have observed recently, China’s dollar HY market has seen spreads widen back to the pandemic wides of last year at ~1600bps – and clearly very distressed levels – and recently even rose to decade wides from 2011. Spreads are 326bps wider MTD alone. In contrast, and as noted above although yesterday was the first real weak day for China $IG, spreads are only 7bps wider MTD and 10bps tighter versus the end of Q2. The chart with spreads tracked back to 2010 on the right hand side shows that there has been a clear dislocation between China $ IG and HY risk in recent weeks as the Evergrande situation has developed compared to what has historically been a tight correlation between the two markets.

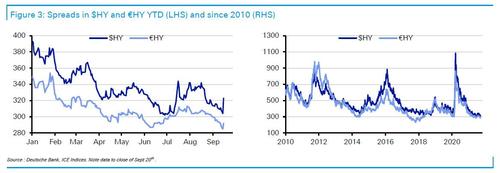

Chart 3 shows spreads for $HY and €HY only. Spreads were notably wider yesterday, particularly in $HY, however in the context of YTD spread performance we are still near the tights not only this year but also historically over the last decade. Most importantly, China $HY spreads have been widening for the best part of 4 months now but in that time we’ve seen $HY and €HY trade in a narrow range at historically tight levels with all-time low volatility. So, as Nicol notes, “whilst yesterday’s price action was eye-catching the broader spread moves since China $HY started widening aggressively has been anything but that. So, contagion has been incredibly limited and virtually non-existent so far at least.”

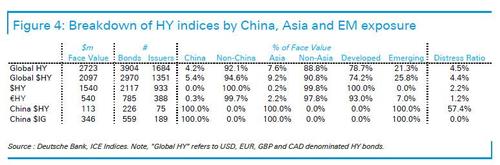

One reason for the lack of contagion within the bond market is the relatively low exposure: according to DB, global HY has only 5% exposure to China, while €HY less than 1% and $HY no exposure, and as Nicol notes, “the fact that we’ve seen spreads remain so resolute in $HY and €HY in the face of China weakness is supported by the lack of direct China risk. In Figure 4, we show the breakdown of the main ICE HY indices with a focus on China country of risk and also Asia and broader EM exposure.”

As shown above, given that $HY is a DM-only index, there is no exposure to corporates with a China country of risk whatsoever whilst €HY has minimal exposure at just 0.3% of the index notional spread across 2 issuers. Where there is greater exposure is within global HY funds where around ~5% of the index is directly China country of risk (excluded here are issuers that don’t have a China country of risk but may have significant revenue, earnings or even asset exposure to China. This will be more significant but requires more of a subjective overlay.)

DB has also included distress ratios as an additional information point across all markets. Distress ratios are at historically low levels across HY markets (to be expected in a world that has injected $40 trillion in liquidity since Covid); however, unsurprisingly for China $HY, the distress ratio is alarmingly high at over 57%, although one should highlight that this is very much a real estate story.

According to DB calculations, China’s real estate sector comprises over 80% of China $HY and has a distress ratio of 69%. In contrast, all other sectors combined have a distress ratio of just 6% and only just above that of the wider global HY market. This is further evidence that the contagion has been incredibly limited so far with China HY real estate really the only sector under any kind of distress, although when one considers the outsized impact of China real estate on China’s economy – 30% of GDP and 70% of household wealth are tied up in property – this should not be discounted.

Uncertainty is high, contagion risks should not be discounted.

While one could be tempted to discount the risk of contagion, Deutsche Bank cautions that “the sheer scale and complexity of Evergrande and the potential for contagion in a sector like real estate that provides core collateral for financial intermediation and complex webs and interlinkages between institutions rightly means markets are sensitive about the potential fallout.” Indeed, in recent days, the scale of concern has even ignited debate about Evergrande being “China’s Lehman” moment.

That said, to counter some of the more extreme concerns, DB notes that the first important point to make is that the Evergrande situation has not happened overnight and it is a story that has been developing for some time now. Indeed, the $ bonds have been in what is a relatively steady decline since the end of May now as opposed to crashing in a matter of days (as was the case with Lehman, although there the stock did collapse heading into Sept 15, 2008). So, as Deutsche notes, “investors have had some time to digest the potential knock-on risks, price the risks and consider the wider ramifications for more domestic markets and sectors. That is considerably different to the global financial crisis over a decade ago where broader markets ultimately were unable to reprice quickly enough” (or rather they simply refused to accept the Lehman bankruptcy as a viable outcome until the actual bankruptcy filing itself).

The second point is that we have seen little to no fallout beyond the real estate sector in China HY. As stated earlier, the non-real estate distress ratio in China $HY is just 6% and only slightly above broader global HY while there is no stress at all in China $IG. The latter is the next market to watch especially given exposure to banks, however here DB argues that a combination of stronger balance sheets and a level of state or local government backing does somewhat mitigate the risks.

The third point and, where there appears to be some level of consensus, is that a wide-scale systemic issue is unlikely. Historically, there has been some level of belief that China’s government would not let a financial shock event unfold especially before contagion. However, as many have noted in recent weeks, it is not nearly as clear how much of a China “policy put” exists to support sectors, unless contagion gets much worse. This is especially the case given policy makers’ greater focus on reducing moral hazard. Ultimately, authorities have the tools to contain this, are incentivised to prevent this becoming a wider systemic issue and will likely prevent this being systemic, especially if market turmoil gets worse. If nothing else, the argument goes, problems have been too obvious for too long and the Evergrande shock is mostly policy-induced so all things equal policy makers should be more in control than a decade ago. While this may come via a managed restructuring of Evergrande’s debt as opposed to a direct bailout, the bigger unknown is how much longer are authorities willing to tolerate and the likelihood of a policy error going up.

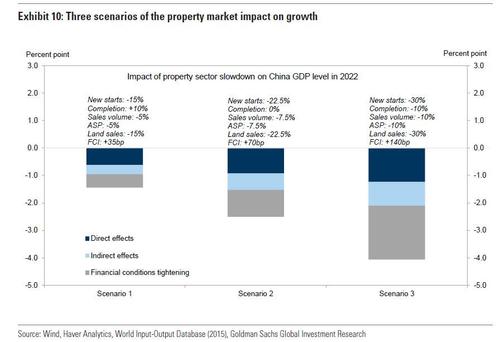

That all being said, Deutsche ultimately agrees with Goldman that whatever the ultimate timeline is on some level of policy support to prevent this becoming more widespread, it’s hard to argue against there being a further shift lower in growth expectations in China, especially when it comes to the slowdown in the property sector adversely impacting GDP (for those who missed it yesterday, the chart below shows Goldman’s three cases how significantly the property market slowdown will impact China’s GDP).

Here DB’s China economists have also noted that the property sector is now in a cyclical downturn and that if the downturn this time were to follow historical patterns, the trough for property sales will likely be in end-2021 or early 2022. The bank also notes, similarly to Goldman, that previous downturns resulted in a negative impact on real GDP of ~1-2% and closer to ~5% during the GFC.

As Deutsche Bank concludes, “much depends on contagion knock-on risks to other sectors; however, we should note that this is all coming as China also shifts to living with COVID and potential further waves, and smoothing trade relations with the US.”

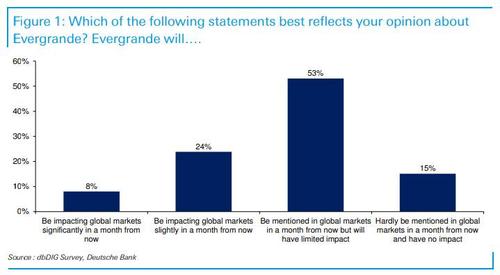

One final point: DB’s chief credit strategist Jim Reid held a flash poll asking clients’ opinion of what Evergrande will mean for global markets in a month had over 700 response in two hours. The result: only 8% felt it would be significantly impacting global financial markets by then with a combined 68% expecting limited or no impact.

Bottom line: markets are fully of the view that contagion is virtually unlikely. Or as Jim Cramer would say, “Evergrande is fine.“

Tyler Durden

Tue, 09/21/2021 – 21:05![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com