Goldman: It Is Now Too Late To Hike The Debt Limit “Before The Last Minute And Maybe Not Until After”

There is a reason why top Senate republican Mitch McConnell may be about to cave and offer democrats a short-term debt limit increase through November – aka lifting the limit until December – in order to give Dems enough time to begin a debt ceiling hike via a reconciliation process (which Dems won’t do and instead will punt on the Republicans again). That reason, as a just released note from Goldman calculates, is that “a debt limit hike now looks unlikely before the last minute… and maybe not until after” by which they refer to the “drop-dead date” which Janet Yellen recently said was October 18.

As Goldman’s political economist Alec Philips writes, “it looks unlikely that Congress will raise or suspend the debt limit” until just before the Oct. 18 deadline because “Neither side has a reason to compromise earlier than that and both appear to be waiting for the other party to change course.”

And while not Goldman’s base case yet, the bank also believes there is a real risk that Congress will miss the deadline. Here’s why:

If Democrats believe that Republicans will cooperate absent any other option, they might delay the other option—the reconciliation process—long enough to take that option off the table. Even at that late stage, Republicans might not cooperate if they still believe the reconciliation process is an option or doubt the credibility of the Treasury’s projected Oct. 18 deadline. In such a scenario, Congress could fail to raise the debt limit by the deadline even if neither side prefers that outcome.

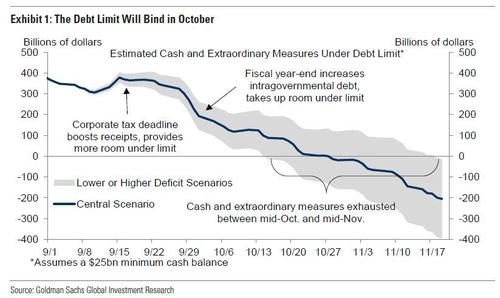

Goldman then notes that the effect of missing the deadline would depend on how long the lapse lasts. On Oct. 18, the Treasury is likely—but not certain—to still have a small amount of cash on hand and might still be able to make scheduled payments even if Congress has not acted. Then, with each day that passes after the 18th, the probability that the Treasury exhausts all of its cash would increase. If that happens, the Treasury would likely delay payments to households, businesses, and state governments and pay those obligations in arrears, while continuing to pay debt obligations. That said, Goldman would expect a lapse in borrowing authority to be brief, “as the public and financial market response would likely force a quick political resolution.”

The good news is that even absent a short-term debt limit punt, Goldman does not believe that a lapse would affect payments related to Treasury securities. To wit, ahead of prior debt limit deadlines, the Treasury made plans to pay principal and interest (P&I) on Treasury securities while stopping other payments, and the same would occur if Congress misses the deadline. That said, as we have noted before repeatedly, there is already clear evidence demand for Treasury bills maturing just after the Oct. 18 deadline have cheapened relative to maturities farther from the deadline.

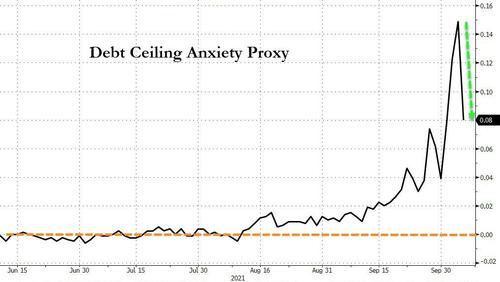

So if Democrats accept McConnell’s short-term extension proposal, all that will happen is the kink will move from October to November, something which we are seeing already, as the debt ceiling anxiety proxy is easing rapidly.

Tyler Durden

Wed, 10/06/2021 – 13:52![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com