JPMorgan Prime Advises Institutions To Keep Shorting Even As The Bank Hikes Its S&P Price Target

One wouldn’t know it from reading the “house view” research distributed for broad retail and media consumption, and to a large extent for political motives, but behind the cheerful and bullish facade spun by JPMorgan’s equity strategists, the bank is quietly telling a subset of its top clients that they should keep shorting the market.

This should come as a surprise – after all just a few weeks ago, with many Wall Street firms scaling back their stock market outlooks for the rest of the year, JPMorgan was adamantly bullish and in a recent note, the bank’s chief US equity strategist Dubravko Lakos-Bujas said the bank is confident that strong growth lies ahead despite concerns that the recent downshift in economic and business cycle momentum will weigh on stocks. He also raised his year-end S&P 500 price target to 4,700 from 4,600, representing a 6% gain from current levels, and predicted that the index would hit 5,000 at some time in 2022.

So in light of this euphoric optimism, we found it strange that JPM’s “positioning intelligence” team, a group which operates under the umbrella of the bank’s Prime Brokerage team which in turn directly interfaces with institutional investor clients and provides them with ideas and insights from “top-ranked analysts, to high-touch sales and trading services, to world-class algorithmic and electronic trading capabilities” is far less enthused about the market’s near-term perspective. In fact, in its latest note, the team of JPM wonder traders whose views rarely if ever make it to the broader public is advising clients on “5 Reasons Why Shorts Can Continue to Work in the Medium Term.“

Seems a bit strange to pitch shorts when your chief strategist sees stocks surging over 300 points in under three months? Or perhaps, JPM is playing both sides of the trade: getting its retail clients and less privileged institutions to keep buying, helping a handful of select top accounts to short into a rising tide. Then again, JPMorgan would never do something that duplicitous, would it?

Rhetorical questions aside, here is the thesis presented by the JPM prime folks; needless to say this would never make its way into a bullish “house view” research report:

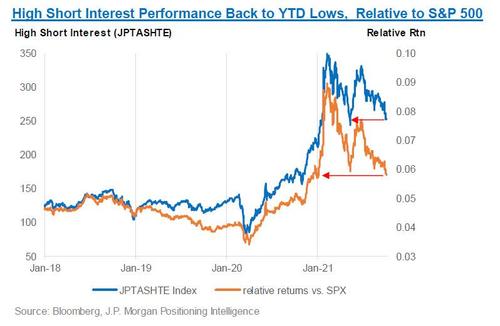

During the recent drawdown, one element that’s helped HF performance is that shorts have generally worked. When compared to what we saw early this year, this is a welcome development and potentially a sign that HFs relative returns could appear better if the markets were to continue to correct. However, with the recent declines, the US High Short Interest stocks (JPTASHTE basket) are back to the mid-May lows in absolute terms and are back to relative lows on a YTD basis… So a key question as we approach year-end could be will these rip higher once again? In general, we think shorts are not set up for a sharp reversal higher (i.e. they can continue to work), unless we see a very strong “risk on” market come back into vogue.

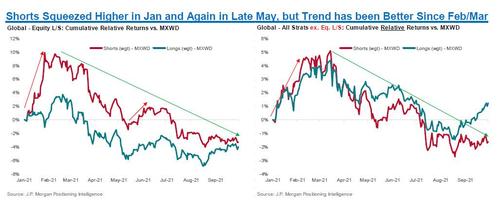

Digging deeper into this argument, and before getting into the main reasons for why JPM Prime thinks shorts can continue to perform better relative to the market going forward, it’s worth taking a quick step back to look at what’s happened this year on the short side. First, when we look at short “alpha” (i.e. the performance of shorts relative to the market), it suggests that shorts rallied much faster than the market and faster than longs at the start of this year, particularly among Equity L/S funds (left chart).

Everyone remembers the reason: the hedge fund inspired squeeze of “meme stonks” by millions of retail investors, who made hedge fund like Senvest which was long Gamestop well ahead of the short squeeze frenzy and which leaked its GME squeeze thesis to the reddit message boards, the best performing hedge fund of the year.

And yet WallStreetBets still thinks it is somehow “socking” it to the billionaire hedge funds, little do they know that they were merely pawns in a far bigger game which made one of said hedge funds, the one that precipitated the squeeze, fabulously wealthy as we explained in “The Curious Case Of The Hedge Fund That Made $700 Million On GameStop.” But we digress.

Again in late May to early June, we saw another period of fairly strong outperformance (i.e. negative alpha). Both of these periods were tied to greater activity among the retail community, especially among so-called “meme” stocks, with the timing coinciding with Joe Biden’s stimmies hitting bank accounts. However, and this did surprise us, JPM notes that since the peaks in Feb/Mar of this year, shorts have been underperforming the broader market and are actually underperforming on a YTD basis.

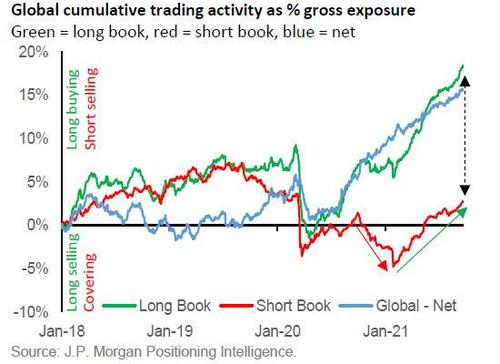

Second, looking at short activity (i.e. short additions vs. covering), we had seen sharp covering in 4Q20 as markets rallied into year-end and this persisted into Jan of this year, but the trend since then has been mostly one of shorts being added back. That said, the short additions on a cumulative basis still lag the long additions by a wide margin on a YTD, 2-year, or 4-year basis.

Third, High Short Interest stocks (e.g. the “tip of the spear”) clearly rallied very sharply — both in absolute and relative terms — in both Jan and late May. However, with the recent declines, these stocks are back to the mid-May lows in absolute terms and are back to relative lows on a YTD basis…so a key question according to JPM prime – again, these are the guys that institutions listen to, not the generic tripe distributed by “chief equity strategists” which is just fodder for CNBC talking heads, as we approach year-end is will these rip higher once again?

Below we get into some of the multiple reasons why JPM Prime thinks it’s less likely that we experience another Jan or late May “squeeze” – for what it’s worth we disagree completely and are confident that accumulating some of the most shorted names will soon pay off in droves, more on that in a subsequent post – however, one key factor (pun intended) that JPM wanted to emphasize up front is that it seems far less likely that “risky” factors will drive shorts higher going forward.

Thus, this suggests that the worst for High SI stocks (and the short book more generally) is likely behind us, given the regime backdrop could remain more favorable going forward. Put simply, a rally in “risky” factors drove a lot of the outperformance of High SI stocks from the Covid lows to this past Feb. Importantly, the magnitude and duration of the factor moves is already in line with what we saw coming out of the low in the early 2000s and the 2009 low. Thus, JPM’s crack in house traders believe that “there’s a much lower likelihood that we get a repeat of what we saw from last March to mid-Feb of this year.” And again, we believe JPM is dead wrong… again.

With that in mind, here is what JPMorgan really thinks: 5 reasons why shorts can continue to work in the medium term:

- ETFs still make up relatively high % of the short book; thus, there’s room for a continued shift back to single-names

- Short Leverage is still low; it’s at a 1-year low for the All Strategies composite and only the 24th %-tile since 2017

- Lack of evidence that HFs are strongly pressing shorts in High SI stocks; there has been some increase recently, which may lead to some near term risk of a bounce higher due to covering, but this is quite different from the build-up into mid-May

- Distribution of shorts suggests fewer extreme names; there are still many fewer stocks that have SI/float at elevated levels (e.g. 0 stocks in the Russell 3000 with SI/float > 50% vs. 10 of these at the start of the year),

- Factors have mattered a lot, but they shouldn’t nearly as much going forward; from a regime perspective, “risky” factors – i.e. high trading activity, high vol, high earnings variability, high leverage – tend to outperform over the 12-18 months from a market low. Given the move we saw from the COVID lows was similar in both magnitude and duration to what we saw post other major market lows, it suggests that the risk of a persistent outperformance on the short side is less likely to occur

We drill down into these starting at the top:

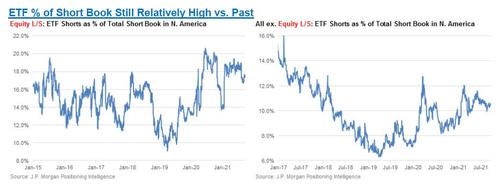

1. ETFs as % of Short Book in N. America – Still Elevated

Among Equity L/S funds, the % of shorts in ETFs is down from the highs earlier this year (17-18% recently vs. high of 19% at end of Jan 2021). That said, the recent level is still elevated on a longer lookback and well above the ~14% it was pre-COVID and early 2021. Among non-ELS funds, ETF shorts have been trending lower to 10-11% of the book, from a high of 12% in 1Q21. However, the level is still higher than it was in early Jan 2021 or early 2020.

2. Short Leverage – Still Low

Among All Strategies, short leverage (i.e. short exposure as a % of equity) remains near ~1yr lows and is only at the 24th %-tile since 2017. Among ELS funds, it has been trending higher lately, but is still well below pre-COVID levels — it’s at the 52nd %-tile. One thing to note is that short leverage changes due to multiple factors including the relative performance of shorts, how it relates to HF performance (i.e. equity changes), and also includes derivative exposures. Thus, some of the decline among All Strategies is likely due to a) shorts performing better, b) performance holding up reasonably well lately, and c) some derivative exposures declining after quadruple witching in Sep. This is why it appears to be at odds with the recent flows that show a continuation of shorts being actively added.

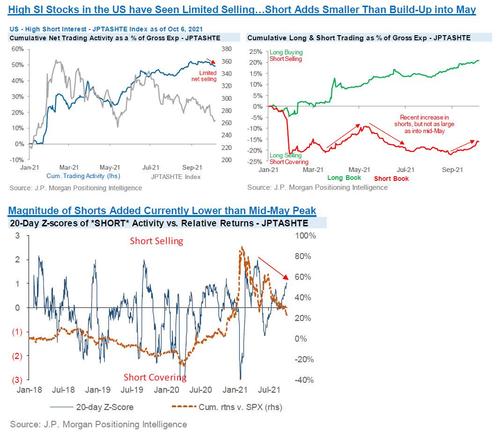

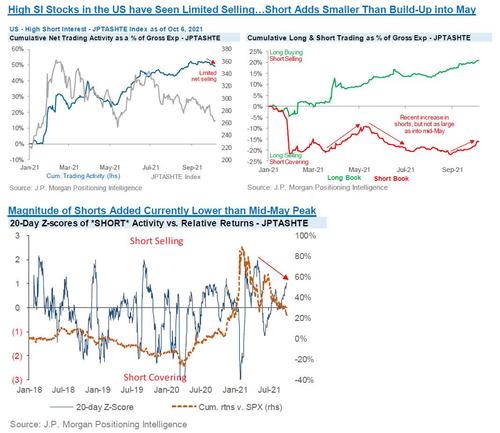

3. High SI Stock Flows vs. Performance – Not pressing High SI Shorts

High SI stocks saw material outperformance at the start of 2021 amidst retail squeeze behavior and very large covering. In Mar to mid-May, we saw HFs re-engage and add shorts among these stocks as they underperformed, but ultimately this was reversed again as the names squeezed in 2H May into early June. More recently, JPM has seen relatively less shorting of the High SI stocks despite their relative performance dropping back to mid-May lows. On a related point, JPM notes that since the flows are for the stocks that already have High SI, i.e. these stocks were likely shorted prior to getting into the basket, it’s not too unusual to see a lack of further short adds, but the recent flows also suggest that there’s not a strong pressing into these names.

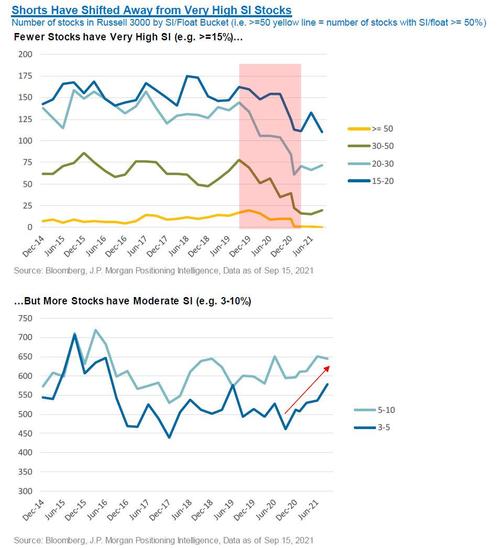

4. Distribution of shorts suggests fewer extreme names

In Jan 2021, the large covering of High Short Interest names caused a material reduction in the # of stocks in the Russell 3000 that had very high SI. In particular, the number of stocks with >50% SI/float went from 10 to 1, and was down from 19 at the end of 2019. However, the “belly” of the distribution has been rising as the number of stocks with 3-10% SI/float has been rising in the past few quarters. Given there are still relatively fewer stocks with 15%+ SI/float, the risk of a short squeeze having much broader market impacts seems relatively low. This is exemplified by the fact that in recent months, retail still seems to occasionally cause squeezes in one-off names, but a) they often come back down and b) there haven’t been broader impacts as the High SI stocks have generally underperformed the

market.

4. Distribution of shorts suggests fewer extreme names

According to JPM, in Jan 2021, the large covering of High Short Interest names caused a material reduction in the # of stocks in the Russell 3000 that had very high SI. In particular, the number of stocks with >50% SI/float went from 10 to 1, and was down from 19 at the end of 2019. However, the “belly” of the distribution has been rising as the number of stocks with 3-10% SI/float has been rising in the past few quarters. As such the bank believes Given there are still relatively fewer stocks with 15%+ SI/float, the risk of a short squeeze having much broader market impacts seems relatively low. This is exemplified by the fact that in recent months, retail still seems to occasionally cause squeezes in one-off names, but a) they often come back down and b) there haven’t been broader impacts as the High SI stocks have generally underperformed the market. Again, we disagree with JPM here, and remain confident it’s just a matter of time before hedge funds – not retail – orchestrate the next squeeze wave.

5. Factor Matters (or to put it more clearly, Factors HAVE Mattered a lot, but they shouldn’t nearly as much going forward)

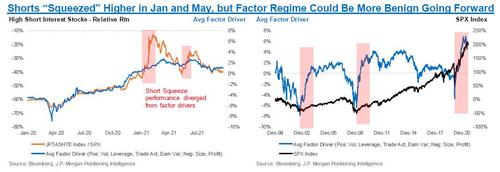

The performance of High SI stocks broadly correlates with the broader short book JPM Prime sees (although it generally hasn’t performed as well). However, understanding what caused the massive outperformance from the March 2020 lows to mid-Feb 2021 can help understand what’s likely going forward.

So what’s the main takeaway?

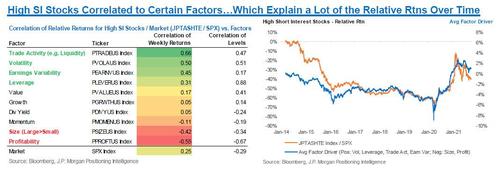

From a factor standpoint, the High SI stocks’ relative returns tend to be very positively correlated to a number of “risky” factors – i.e. stocks with high trading activity, high vol, high earnings variability, high leverage – and negatively correlated to stocks with lower risk – i.e. large caps, highly profitable stocks. Put simply, HFs are often shorting lower quality, highly volatile (and liquid), smaller cap stocks. When JPM takes the average return across these factors, it sees a very strong relationship to the relative returns of the High SI stocks. Looking at the chart since the start of 2020 (right chart below), the average factor driver line has been extremely correlated to the High SI stocks relative returns, except for Jan 2021 and then late May 2021, arguably as large HF covering drove these stocks to diverge from the factor drivers for a period of time.

So what is JPM’s the view going forward, and why does it differ so much from the “house view”?

As the Prime folks explain, the magnitude and duration of the factor moves, which have tended to drive the High SI stocks to outperform post a market low, are already in line with what we saw coming out of the low in the early 2000s and the 2009 low. Thus, the bank believes that there’s a much lower likelihood that we get a repeat of what we saw from last March to mid-Feb of this year.

For those curious about more details, the charts below on the left show the relative returns of the High SI stocks since 2014 against the various factors that seem to influence them. The right charts show these various factors vs. the SPX since 2000.

Finally, JPM takes a brief look at some other questions on this topic.

First, how does retail’s role figure into this? Here the House of Morgan is confident that there is less potential for retail to drive broader risk propagation due to 1) more awareness among HFs of what retail is trading, 2) less concentrated shorts (see prior reasons 3 & 4 in particular), 3) retail trading shifting more towards ETFs lately.

Second, how does this look in other regions? Short performance has generally been less extreme in other regions, compared to what we saw in the US in 2H20 to early 2021. While there was some outperformance of top shorts in Europe in 4Q20 to Jan 2021, the volatility of the relative returns has generally been much lower. Additionally, in Japan and China there has not been as strong a move in the last year towards shorts outperforming.

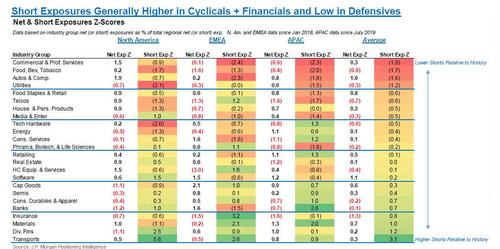

Finally, where does JPM see shorts relatively low or high vs. history? On a global basis, it’s mostly Defensive sectors that appear to have relatively low short exposure vs. history (e.g. FBT, Utilities, Food Retail, Telcos, Household & Pers. Products). On the flip side, a number of Cyclicals and Financials generally have higher short exposure vs. history.

And while we thank JPM’s elite trading forces for this stern defense of institutional shorting, we wonder just how all of this jives with the bank’s overarching bullishness which has maintained JPM’s equity strategists such as Lakos-Bujas and Kolanovic at or near the top of the highest S&P price targets. As for who will be right in their “medium-term” outlook on the market, whether it is the bullish JPMorgan urging smaller retail investors and less important institutions to buy or the bearish JPMorgan telling its high margin prime brokerage clients to press their shorts here, we eagerly look forward to getting the answer over the next few weeks.

Tyler Durden

Sun, 10/10/2021 – 07:35![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com