Bitcoin’s Futures ETF To Launch Tuesday

Confirming speculation from Friday, the NYT reports this morning that on Tuesday morning, ProShares will launch the long-awaiting ETF on the New York Stock Exchange linked to Bitcoin futures, the firm and the exchange told DealBook. The E.T.F. will give investors exposure to Bitcoin without having to hold the cryptocurrency directly, via any ordinary brokerage account.

“2021 will be remembered for this milestone,” said Michael Sapir, the C.E.O. of ProShares. Investors who are curious about crypto but hesitant to engage with unregulated crypto exchanges want “convenient access to Bitcoin in a wrapper that has market integrity,” he said.

The ETF launch comes after seven years of crypto entrepreneurs and traditional finance firms seeking permission to launch a Bitcoin E.T.F. in the U.S., whose applications had been persistently delayed or denied by the S.E.C. Many remain pending.

To be sure, a Bitcoin futures E.T.F. falls short of what some purists want: a fund that holds crypto directly. Gary Gensler, the S.E.C. chair, recently suggested that the agency might allow crypto ETF.s based on futures — bets on Bitcoin’s price fluctuations rather than the underlying crypto itself — that trade on a highly regulated exchange. Approval for the ProShares ETF, which is based on Bitcoin futures that trade on the Chicago Mercantile Exchange, won’t be announced by the SEC, but the firm’s final prospectus met with no opposition ahead of its effective deadline, and the N.Y.S.E. is readying for launch tomorrow, the NYT reported.

Commenting on the futures ETF, One River CIO Eric Peters said that the new ETFs will provide exposure to bitcoin that is almost as costly and inefficient as could be imagined, including because of the futures-related risks the SEC cites. And relative to the underlying digital asset markets, which trade 24x7x365, these ETFs will trade just 252-days per year on exchanges whose primary trading hours are only 6.5-hours per day.

As Green concludes, “such a vast chasm between the digital asset markets and our legacy exchanges will drive more investors away from archaic financial intermediaries to the new digital ecosystem.”

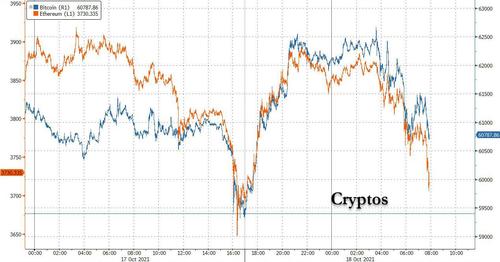

Meanwhile the question is what the ETF news does for crypto: following the NYT report, the crypto space has drifted modestly lower but that’s from near all-time high levels; a similar drop on Sunday which was triggered by an algo stop hunt, fizzled after a powerful buying spree emerged late in the day, sending bitcoin back to near all time highs.

Looking ahead Jim Cramer expects that the ETF news will have top-ticked the market, but since that’s Cramer who is always wrong about everything, we would take the other side of the bet, where Mike Novogratz can be found and who sees m uch more upside from here.

Tyler Durden

Mon, 10/18/2021 – 07:54![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com