The “Same Old” No Longer Works In This Market

By Ven Ram, Bloomberg Markets Live analyst and commentator

What used to work in the markets for ages is being challenged with a vengeance these days. Just look at the reaction of currencies to hawkish policy shifts.

Earlier this year, New Zealand’s central bank changed tack to go from being extremely dovish (remember the talk of taking rates negative not so long ago?) to being uber hawkish (it stopped its large-scale asset purchase program abruptly and began signaling higher rates). You would be logically inclined to think that should have given the kiwi enough flight. Except that the New Zealand dollar hasn’t budged meaningfully since the RBNZ raised rates, a posit MLIV made well before the central bank began its hiking cycle. And on the year, it’s declined about 3% against the U.S. dollar.

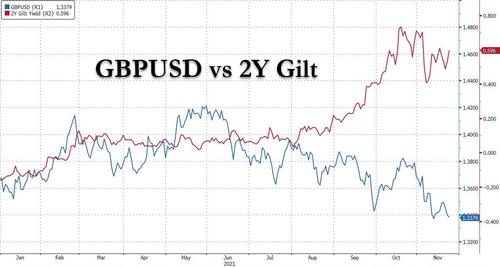

Yet, that’s not an exception. For months now, the Bank of England has been shouting from rooftops that it means to quell inflation with supreme urgency. That has meant that gilt yields have surged, with the front end already signaling that it’s more than comfortable with the monetary authority raising rates.

But did you take a look at the pound? Sterling has declined almost 4% in value against the dollar since the end of July, around when front-end gilts started to brace themselves for a rate increase.

Yes, yes, let me hasten to add that the BOE’s communication — using the best understatement that I can muster — has been all over the place, meaning it hasn’t nearly got down to raising rates as promised. (If anything, Governor Andrew Bailey suggested over the weekend that even a December rate increase isn’t a slam dunk.) Even allowing for an epic failure of communication, the point is that gilts and the pound have been singing from different hymn sheets.

There are more examples of what you would have expected to work using age-old paradigms that quite haven’t done so. With record amounts of global savings chasing yields and fund managers chasing after alpha, investing time scales seem to have undergone a veritable shift: by the time you are thinking of sowing the seeds of a new trade, smart money has already begun to reap the harvest.

That’s only made our world ever-more interesting and keeps us on our toes on every day. Some of us, like Warren Buffett, may even want to tap dance to work, thanks to sprightly markets.

Tyler Durden

Tue, 11/23/2021 – 17:40

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com