Evergrande’s Surprisingly Quiet Collapse

By Richard Frost, Bloomberg Markets Live reporter and analyst

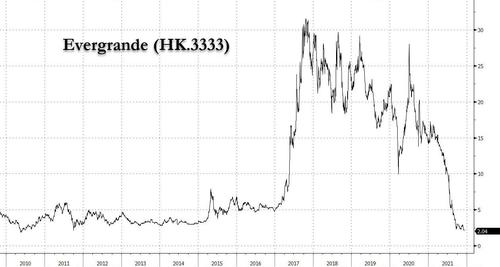

After months of anticipation, Evergrande finally failed to meet obligations on time – and it wasn’t the Lehman moment that some had predicted.

On the day that bondholders didn’t receive interest payments at the end of a grace period, a gauge of Chinese stocks in Hong Kong jumped the most in two months, with developers among the best performers. Sunac, which last month had to borrow money from its founder to help pay debts, surged 17%. Chinese junk dollar bonds climbed at least 3 cents on the dollar, the biggest gain in almost a month, according to traders.

The credit for the lack of contagion must go to Beijing. A reserve-ratio cut announced on Monday and signaling from the Politburo that more easing was on the way injected much-needed confidence into China’s beaten down offshore assets. As Macquarie’s Larry Hu put it, the Politburo meeting shows that the Communist Party is shifting to supporting growth from regulatory tightening.

Signs that the state is taking a bigger role in Evergrande’s future, including a potential debt restructuring, may also have eased investor concerns of a disorderly collapse. The company on Monday said state representatives have taken the majority of seats on a new risk management committee.

There is much that can go wrong from here. What happens next for Evergrande is unclear. Kaisa, which has $11.6 billion in outstanding dollar debt, may have failed to repay a $400 million dollar bond that was due Tuesday. (Kaisa halted trading in its shares on Wednesday, without giving a reason.) How such companies will pay suppliers or finish apartment projects remains a key question. The yield on junk dollar bonds remains brutally high, making it near-impossible for cash-strapped developers to refinance. S&P Global Ratings says more developers are at risk of defaulting.

Yet for now it seems authorities have accomplished their goal of teaching wayward companies (and the foolhardy foreign investors who bankrolled them) a tough lesson without crashing the nation’s financial markets. As with Huarong earlier in the year, Beijing has challenged the assumption that some companies are too big to fail, forcing creditors to take a closer look at corporate finances. Moral hazard has been successfully reduced and another billionaire humbled.

Tyler Durden

Tue, 12/07/2021 – 22:26

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com